Imposing a tax on the supplier or the buyer has the same effect on prices and quantity. The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. A tax increases the price a buyer pays by less than the tax.

How does tax affect price and quantity?

The imposition of the tax causes the market price to increase and the quantity demanded to decrease. Because consumption is elastic, the price consumers pay doesn't change very much. Because production is inelastic, the amount sold changes significantly.

How does a tax effect equilibrium price?

As sales tax causes the supply curve to shift inward, it has a secondary effect on the equilibrium price for a product. Equilibrium price is the price at which the producer's supply matches consumer demand at a stable price. Since sales tax increases the price of goods, it causes the equilibrium price to fall.

Does tax reduce equilibrium quantity?

Taxes do not greatly affect the equilibrium quantity. The tax burden in this case is on the sellers.

Do taxes cause the equilibrium quantity to increase?

A tax on suppliers will cause the equilibrium price paid by the consumer to increase and the equilibrium quantity to decrease. This reduces the quantity supplied at any given price, because the after-tax price is lower. The new supply curve intersects the demand curve at a higher price and a lower quantity.

What happens when taxes increase?

By increasing or decreasing taxes, the government affects households' level of disposable income (after-tax income). A tax increase will decrease disposable income, because it takes money out of households. A tax decrease will increase disposable income, because it leaves households with more money.

What is the effect of tax?

Taxes affect household behavior via income and substitution effects. The income effect is straightforward: as taxes go up, households are poorer and behave that way. For ex- ample, if leisure is a normal good, then higher taxes will induce consumers to consume less leisure.

How do you find the new equilibrium price and quantity after tax?

Hence, the new equilibrium quantity after tax can be found from equating P = Q/3 + 4 and P = 20 – Q, so Q/3 + 4 = 20 – Q, which gives QT = 12. Price producers receive is from pre-tax supply equation Pnet = QT/3 = 12/3 = 4.

What effect will a decrease in taxes have on supply?

Supply-side tax cuts are aimed to stimulate capital formation. If successful, the cuts will shift both aggregate demand and aggregate supply because the price level for a supply of goods will be reduced, which often leads to an increase in demand for those goods.

What quantities decrease in response to a tax on a good?

A tax on a good raises the price buyers pay, lowers the price sellers receive, and reduces the quantity sold. 7. The burden of a tax is divided between buyers and sellers depending on the elasticity of demand and supply.

What increases equilibrium quantity?

An increase in demand will cause an increase in the equilibrium price and quantity of a good.

Why does a tax shift the supply curve?

When there is an increase in unit tax on the production of goods by the government, the unit cost of production will rise and consequently, the firm would supply less than before at the given price. The supply would decrease implying that the supply curve would shift to the left.

Do taxes shift the demand curve?

Since the demand curve represents the consumers' willingness to pay, the demand curve will shift down as a result of the tax.

What are the effects of tax and subsidy on market equilibrium?

How does tax and subsidy affects market equilibrium? Tax decreases supply and shifts the market equilibrium to a higher price and lower quantity. A subsidy increases supply and shifts the market equilibrium to a lower price and higher quantity.

Does a tax shift the demand curve?

Since the demand curve represents the consumers' willingness to pay, the demand curve will shift down as a result of the tax.

Why does a tax shift the supply curve?

When there is an increase in unit tax on the production of goods by the government, the unit cost of production will rise and consequently, the firm would supply less than before at the given price. The supply would decrease implying that the supply curve would shift to the left.

How do taxes affect the economy?

They also largely indicate that tax increases can generate increased revenue for government but often at the expense of economic growth and mobility for taxpayers. Conversely, tax cuts tend to produce short-lived revenue decreases while promoting long-term economic growth.

What happens to the quantity demand after taxation?

After taxation, it can be observed that the quantity demand changes from Q 0 to Q 1, as the equilibrium moves from B to A. It implies that the application of taxation will lead to a decrease in quantity demanded. Excise taxes lead to either consumers paying more or producers receiving less.

What is economic equilibrium?

Economic Equilibrium Economic equilibrium is a state in a market-based economy in which economic forces – such as supply and demand – are balanced. Economic

What is the Incidence of Excise Tax?

The incidence of excise tax is the measure of how much of the tax the producer and consumer are responsible for. It is important to note that it often does not matter who officially pays the tax, as the equilibrium outcome is the same.

What is the primary factor in the incidence of excise tax?

The primary factor in the incidence of excise tax is the price elasticity . Price Elasticity Price Elasticity measures how the quantity demanded or supplied of a good changes when its price changes.

What happens when excise tax is imposed on the producer?

If excise tax is imposed on the producer, the supplier will provide less quantity of Good A. It is illustrated as the supply curve shifts from S 0 to S 1. Quantity shifts from Q 0 to Q 1 after the excise tax is imposed on the production of Good A.

What happens to the demand curve when excise tax is imposed on consumers?

If excise tax is imposed on consumers, the consumer’s demand for Good A will decrease. It is illustrated as the demand curve shifts from position D 0 to D 1. Quantity shifts from Q 0 to Q 1 after the excise tax has been imposed on consumers of each unit of Good A.

What is excise tax?

Excise tax refers to a tax on the sale of an individual unit of a good or service. The vast majority of tax revenue in the United States is generated from excise taxes. The incidence of an excise tax depends on the price elasticity of demand and the price elasticity of supply.

How does tax affect equilibrium?

In both cases, the effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. This is illustrated in Figure 5.3 "Effect of a tax on equilibrium". The quantity traded before a tax was imposed was qB*. When the tax is imposed, the price that the buyer pays must exceed the price that the seller receives, by the amount equal to the tax. This pins down a unique quantity, denoted by qA *. The price the buyer pays is denoted by pD * and the seller receives that amount minus the tax, which is noted as pS *. The relevant quantities and prices are illustrated in Figure 5.3 "Effect of a tax on equilibrium".

How does tax affect supply and demand equilibrium?

The effect of the tax on the supply-demand equilibrium is to shift the quantity toward a point where the before-tax demand minus the before-tax supply is the amount of the tax. A tax increases the price a buyer pays by less than the tax. Similarly, the price the seller obtains falls, but by less than the tax.

How does taxation affect revenue?

First, a small tax raises revenue approximately equal to the tax level times the quantity, or tq. Second, the drop in quantity is also approximately proportional to the size of the tax. Third, this means the size of the deadweight loss is approximately proportional to the tax squared. Thus, small taxes have an almost zero deadweight loss per dollar of revenue raised, and the overhead of taxation, as a percentage of the taxes raised, grows when the tax level is increased. Consequently, the cost of taxation tends to rise in the tax level.

What is a 20 cent tax?

Consider first a fixed, per-unit tax such as a 20-cent tax on gasoline. The tax could either be imposed on the buyer or the supplier. It is imposed on the buyer if the buyer pays a price for the good and then also pays the tax on top of that. Similarly, if the tax is imposed on the seller, the price charged to the buyer includes the tax.

What are the effects of tax on buyers and sellers?

There are two main economic effects of a tax: a fall in the quantity traded and a diversion of revenue to the government. A tax causes consumer surplus and producer surplus (profit) to fall..

What are the effects of taxes?

There are two main effects of a tax: a fall in the quantity traded and a diversion of revenue to the government. These are illustrated in Figure 5.4 "Revenue and deadweight loss". First, the revenue is just the amount of the tax times the quantity traded, which is the area of the shaded rectangle. The tax raised, of course, uses the after-tax quantity qA * because this is the quantity traded once the tax is imposed.

What is the tax on $2.00?

Thus, with a a 20-cent tax, a price of $2.00 to the buyer is a price of $1.80 to the seller. Whether the buyer pays $1.80 to the seller and an additional 20 cents in tax, or pays $2.00, produces the same outcome to both the buyer and the seller.

How does VAT affect supply curve?

The VAT on the suppliers will shift the supply curve to the left , symbolizing a reduction in supply (similar to firms facing higher input costs). While supply for the product has not changed (all of the determinants of supply are the same), producers incur higher cost, which is why we will see a new equilibrium point further up the demand curve at a higher price and lower quantity. Once again, the magnitude of the shift in the supply curve will be equal to the amount of the tax introduced by the government. Essentially, the firms are passing on the tax to the consumers in the same way they would pass on higher input costs.

What is the tax on a product?

A common form of tax is a sales tax, which is added on to the price of a product and paid by the consumer. Another common type of tax is a VAT (value added tax) which is paid by the producer along their production chain. The sales tax on the consumer shifts the demand curve to the left, symbolizing a reduction in demand for the product because ...

Why does the sales tax shift to the left?

The sales tax on the consumer shifts the demand curve to the left, symbolizing a reduction in demand for the product because of the higher price. While demand for the product has not changed (all of the determinants of demand are the same), consumers are required to pay a higher price, which is why we see the new equilibrium point occurring ...

What is the magnitude of the shift in the supply curve?

Once again, the magnitude of the shift in the supply curve will be equal to the amount of the tax introduced by the government. Essentially, the firms are passing on the tax to the consumers in the same way they would pass on higher input costs. Another type of tax is a labor tax.

What happens when the market is not at equilibrium?

However, if a market is not at equilibrium, then economic pressures arise to move the market toward the equilibrium price and equilibrium quantity. This happens either because there is more supply than what the market is demanding or because there is more demand than the market is supplying.

How to find equilibrium in a market?

We’ve just explained two ways of finding a market equilibrium: by looking at a table showing the quantity demanded and supplied at different prices, and by looking at a graph of demand and supply. We can also identify the equilibrium with a little algebra if we have equations for the supply and demand curves. Let’s practice solving a few equations that you will see later in the course. Right now, we are only going to focus on the math. Later you’ll learn why these models work the way they do, but let’s start by focusing on solving the equations. Suppose that the demand for soda is given by the following equation:

How to set demand and supply equations equal to each other?

we can set the demand and supply equations equal to each other: Step 1: Isolate the variable by adding 2P to both sides of the equation, and subtracting 2 from both sides. Step 2: Simplify the equation by dividing both sides by 7. The equilibrium price of soda, that is, the price where Qs = Qd will be $2.

How to find equilibrium with demand and supply schedules?

If you have only the demand and supply schedules, and no graph, you can find the equilibrium by looking for the price level on the tables where the quantity demanded and the quantity supplied are equal (again, the numbers in bold in Table 1 indicate this point).

Why is equilibrium important?

Equilibrium is important to create both a balanced market and an efficient market. If a market is at its equilibrium price and quantity, then it has no reason to move away from that point, because it’s balancing the quantity supplied and the quantity demanded.

Who is the author of Food Trucks and Changes in Equilibrium?

Food Trucks and Changes in Equilibrium. Authored by: Clark Aldrich for Lumen Learning. License: CC BY: Attribution

What is efficiency in demand and supply?

Efficiency in the demand and supply model has the same basic meaning: the economy is getting as much benefit as possible from its scarce resources, and all the possible gains from trade have been achieved. In other words, the optimal amount of each good and service is being produced and consumed.

When supply is perfectly elastic, does change in demand affect the equilibrium price of the commodity?

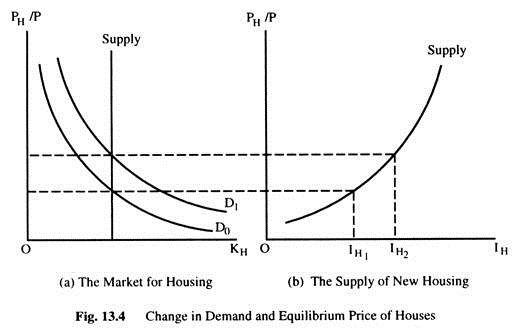

When supply is perfectly elastic, then change in demand does not affect the equilibrium price of the commodity. It only changes the equilibrium quantity. Original Equilibrium is determined at point E, when the original demand curve DD and the perfectly elastic supply curve SS intersect each other. OQ is the equilibrium quantity and OP is the equilibrium price. The change may be either an ‘Increase in Demand’ or ‘Decrease in Demand’.

When demand is perfectly inelastic, does change in supply affect the equilibrium quantity?

When demand is perfectly inelastic, then change in supply does not affect the equilibrium quantity. It only changes the equilibrium price. The change may be either an ‘Increase in Supply’ or ‘Decrease in Supply’.