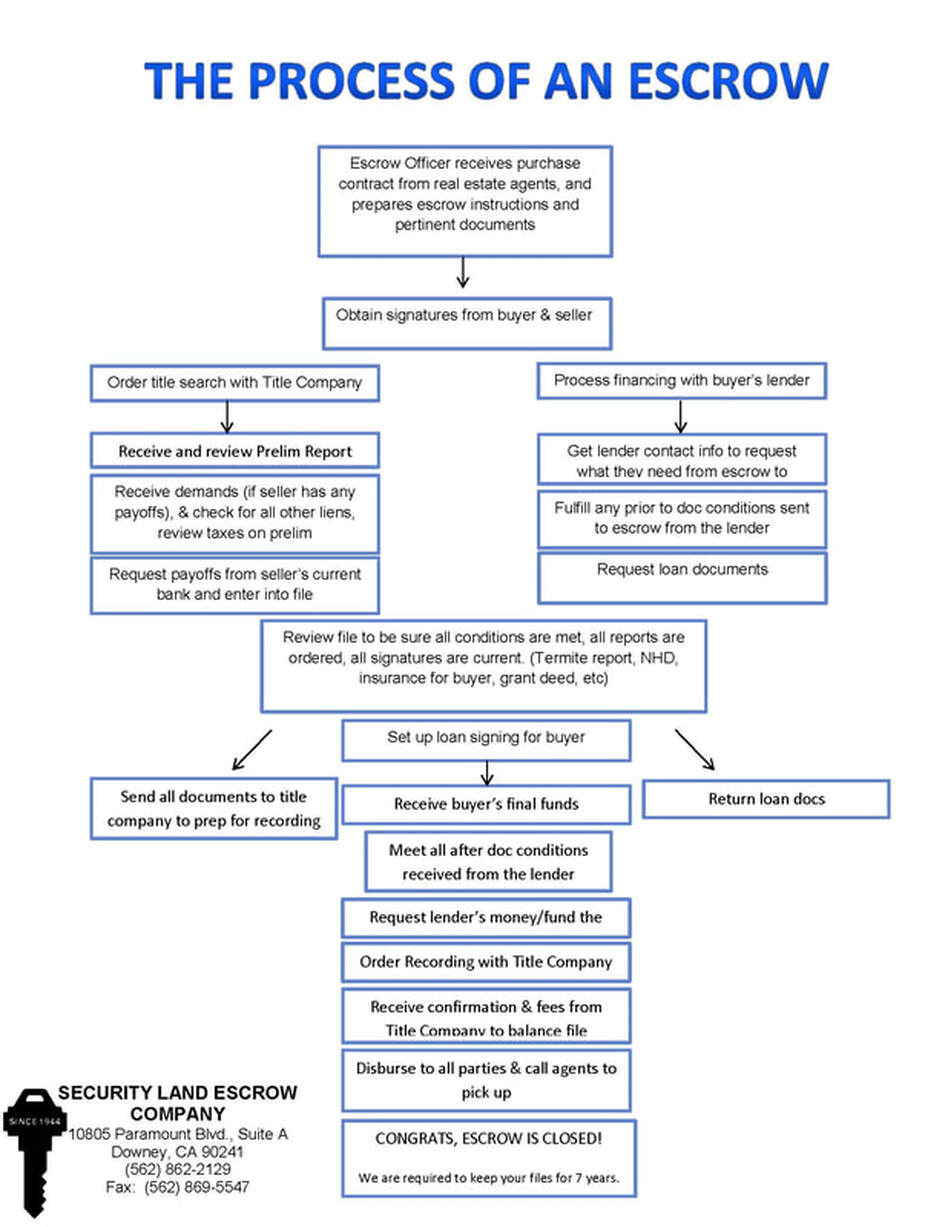

The escrow process generally goes as follows:

- You and the seller appoint an escrow agent.

- You or the seller bring a signed agreement to the escrow agent.

- You open escrow by making a deposit. ...

- The escrow agent determines if the sale is subject to bulk sales laws. ...

- The escrow agent obtains clearances on behalf of the buyer. ...

How does escrow work for dummies?

An escrow account is a separate account managed by a lender to collect advance insurance payments and tax payments from a homeowner. Usually, a lender will add up the total amount due for these payments in a year, divide it by 12, and tack on that extra amount to each mortgage payment.

What happens when money goes into escrow?

After you purchase a home, your lender will establish an escrow account to pay for your taxes and insurance. After closing, your mortgage servicer takes a portion of your monthly mortgage payment and holds it in the escrow account until your tax and insurance payments are due.

Who holds the money in escrow?

Escrow refers to a neutral third party holding assets or funds before they are transferred from one party in a transaction to another. The third party holds the funds until both buyer and seller have fulfilled their contractual requirements.

What does escrow mean on a house payment?

When you close on a mortgage, your lender may set up a mortgage escrow account where part of your monthly loan payment is deposited to cover some of the costs associated with home ownership. The costs may include but are not limited to real estate taxes, insurance premiums and private mortgage insurance.

What should you not do during escrow?

What Should I Not do During Escrow?Do not make large purchases which could be viewed as debt.Do not apply to or open any new lines of credit.Do not make finance related changes, like a new job or bank.

How long is money held in escrow?

So, while a "typical" escrow is 30 days, they can go from one week to many weeks. A: The length of an escrow can vary widely depending upon the terms agreed upon by the parties.

How do I get my money out of escrow?

You must withdraw from escrow in writing. In California, buyers must usually provide written notice to the seller before canceling via a Notice to Seller to Perform. The written cancellation of contract and escrow that follows must then be signed by the seller to officially withdraw from escrow.

How do you get your money held in escrow?

Here's how to hold money in escrow:The buyer and seller agree to the terms of the transaction.Payment is sent to the escrow company.Seller ships the goods or provides the service to the buyer.Buyer accepts the goods or services.More items...

Is it better to have escrow or not?

Pros of an escrow account Having your mortgage lender or servicer hold your property tax and homeowners insurance payments in escrow ensures that those bills are paid on time, automatically. In turn, you avoid penalties such as late fees or potential liens against your home.

Can you remove escrow from your mortgage?

Lenders also generally agree to delete an escrow account once you have sufficient equity in the house because it's in your self-interest to pay the taxes and insurance premiums. But if you don't pay the taxes and insurance, the lender can revoke its waiver.

Why does escrow increase?

Why Did My Escrow Payment Go Up? As we previously mentioned, if your escrow payment goes up, it's typically due to an increase in insurance costs or taxes. However, if you don't already have an escrow account, adding one will come with some new costs.

What happens to escrow when you pay off mortgage?

Paid off mortgage completely: If you have a remaining balance in your escrow account after you pay off your mortgage, you will be eligible for an escrow refund of the remaining balance. Servicers should return the remaining balance of your escrow account within 20 days after you pay off your mortgage in full.

Do you get leftover escrow money back?

Paid off mortgage completely: If you have a remaining balance in your escrow account after you pay off your mortgage, you will be eligible for an escrow refund of the remaining balance. Servicers should return the remaining balance of your escrow account within 20 days after you pay off your mortgage in full.

Can you withdraw money from your escrow account?

Escrow accounts offer the benefit of security. No party may withdraw money from the account. One party makes payment into the account while another party receives payments form the account. Neither may withdraw money from the account at any time, meaning the money held in the escrow account is completely secure.

Is it better to pay into principal or escrow?

Which Is More Important? Both the principal and your escrow account are important. It's a good idea to pay money into your escrow account each month, but if you want to pay down your mortgage, you will need to pay extra money on your principal. The more you pay on the principal, the faster your loan will be paid off.

How long does it take to get escrow refund?

Escrow Refund Period Mortgage lenders can take up to 30 days to refund escrow account balances to borrowers whose mortgage loans have been paid off. For several reasons, mortgage lenders tend to take their time refunding their borrowers' escrow accounts.

What is an escrow account?

An escrow account is a contractual arrangement in which a neutral third party, known as an escrow agent, receives and disburses funds for transacti...

How does escrow work?

When you make an offer on a home, the seller may require you to pay earnest money that will be held in an escrow account until you and the seller n...

What does in escrow mean?

When you hear the phrase in escrow, it means that all items placed in the escrow account (e.g., earnest money, property deed, loan funds) are held...

What does it mean to close escrow?

To close escrow means that all of the escrow conditions have been met. You’ve received a home loan, and the title has legally passed from the selle...

What is an escrow payment?

After you purchase a home, you’ll be responsible for maintaining insurance on the property and paying state and local property taxes. The property...

Is an escrow account required?

An escrow account for paying property tax and homeowners insurance is generally required by lenders who originate VA, FHA and conventional loans. I...

What is the escrow process?

The escrow process occurs between the time a seller accepts an offer to purchase and the buyer takes possession of the home. The first part of the escrow process is the opening of an account in which deposits and any other payments can be held. The buyer must wait for bank approval, secure financing, get inspections completed, ...

When does escrow occur?

The escrow process occurs between the time a seller accepts an offer to purchase and the buyer takes possession of the home.

Why do banks do their own appraisals?

The bank or other lender providing your mortgage will do its own appraisal of the property—which you, the buyer, usually pays for—to protect its financial interests in case it ever needs to foreclose on the property. If the appraisal comes in lower than the offered price, the lender will not give you financing unless you are willing to come up with cash for the difference or the seller lowers the price to the appraised amount.

What is an escrow company?

The escrow company acts as a neutral third party to collect the required funds and documents involved in the closing process, including the initial earnest money check , the loan documents, and the signed deed .

Who oversees escrow?

Your real estate agent will oversee this entire escrow process, so don't be too concerned if you don't understand every detail. However, in any transaction where you're putting so much on the line financially, it's a good idea to have at least a basic idea of what's going on so you won't get taken advantage of—or inadvertently lose your home.

Can a buyer walk away from a purchase agreement?

The buyer may walk away from the agreement if conditions are not met or there is a problem with the property.

What is escrow in real estate?

What is escrow? In real estate, it has several meanings, but they all boil down to your house and your money being in a kind of limbo.

What does in escrow mean?

When you hear the phrase “in escrow”, it means that all items placed in the escrow account (e.g., earnest money, property deed, loan funds) are held with an escrow agent until all conditions of the escrow arrangement have been met. The conditions usually involve receiving an appraisal, title search and approved financing.

What does it mean to close escrow?

To close escrow means that all of the escrow conditions have been met. You’ve received a home loan, and the title has legally passed from the seller to you. During the closing of escrow process, a closing or escrow agent (who may be an attorney, depending on the state in which the property is located) will disburse transaction funds to the appropriate parties, ensure all documents are signed and prepare a new deed naming you the homeowner.

Why do lenders collect taxes?

That’s because your lender has a vested interest in making sure those payments are made.

Why is it important to put earnest money in escrow?

It’s in escrow. That’s important because it protects both parties. Say you put down earnest money that went directly to the seller and then couldn’t reach a final purchase and sale agreement. You don’t want the seller holding your earnest money hostage as a negotiating ploy.

What is closing of escrow?

A closing or “escrow officer” will oversee the final paperwork and handle the exchange of funds and recording of deeds. This person, sometimes an attorney, will ensure that all the money is properly disbursed, that the documents are signed and recorded, and that all necessary conditions are met before closing the escrow.

Do you need a closing statement when escrow is closed?

Once escrow is closed and all funds have been disbursed, you and the seller will receive a final closing statement and other documents in the mail. Check the statement carefully and call the closing agent immediately if you spot an error. File the statement with your most important papers. You’ll need it when you file your next income tax return.

What happens after escrow is complete?

After the closing is complete, the escrow holder will distribute all funds as detailed in the real estate contract and mortgage agreement. These payments include real estate agent commissions, title and insurance fees, HOA dues, the purchase funds from your mortgage loan, and any other closing costs as detailed in your final Closing Disclosure.

What Is Escrow in Real Estate?

When you sign a purchase contract, there may be an earnest money deposit involved. This is an up-front amount that comes from your down payment and shows the seller you’re committed to buying the home.

What is escrow account?

Escrow is an account that holds your funds for earnest money, down payment, and closing costs, as well as the purchase funds from your mortgage lender. At closing, all funds will be distributed to the applicable parties for a stress-free closing on your home.

What is mortgage escrow?

Mortgage escrows help the buyer manage their taxes and insurance payments. They are free of charge and provide easy budgeting for home buyers.

Why is escrow important in online shopping?

The growth of online shopping over the past two decades has led to increased use of the escrow process for the protection of buyers and sellers. In this situation, the buyer puts the purchase price into an escrow account where it is held until the shipped item is received. Once the item is in hand, the funds can be released to the seller.

What is escrow fee?

The real estate escrow fee is a one-time charge that you pay as part of your closing costs.

Why do you need an escrow account for a mortgage?

Finally, the mortgage escrow account provides you with a stress-free process. Paying a predictable amount each month makes it easier to budget and you don’t have to worry about tracking the due dates for your taxes and insurance policies.

What is escrow instructions?

Escrow instructions. Escrow instructions define the events that must take place prior to an escrow closing. The escrow instructions are your written instructions to the escrow holder acknowledging the terms and conditions of the sale. An itemized statement is included with your instructions, reflecting all agreed upon debits and credits.

What happens next when you pay escrow?

What happens next? Unless you are paying cash, the next step will be for you, the buyer, to apply for a mortgage loan. During the escrow process, you are still required to make your payments on existing loans so that you don’t incur late fees or damage your credit rating. Escrow instructions.

How long does it take for an escrow officer to review a loan?

Following the review, which usually occurs within a few days, the lender is ready to fund the buyer’s loan, and advises the escrow officer.

What does an escrow officer do?

The escrow officer can hold inspection reports and bills for work performed as required by the purchase agreement. Other elements of the escrow include hazard insurance, and the grand deed from the seller.

How long does it take to get escrow signed?

Please expect the process to take approximately one hour. There are several acceptable forms of identification which may be used during the escrow process. These include: One of these forms of identification must be presented at the signing of escrow in order for the signature to be notarized.

Can a real estate agent open escrow?

Escrow can’t be completed until these items have been satisfied and all parties have signed escrow documents. Either your real estate agent or the seller’s agent may open escrow. As soon as you execute the Purchase Agreement, your agent will place your initial deposit into an escrow account at the Title Company.

Do you need to present identification at escrow?

One of these forms of identification must be presented at the signing of escrow in order for the signature to be notarized.