What is commercial bank?

What is a savings and loan institution?

How are S&Ls owned?

How much of a loan can an S&L lend?

Why are S&Ls created?

Do commercial banks offer residential loans?

Can commercial banks be chartered?

See 4 more

About this website

What is the difference between a commercial banks and a savings and loan associations?

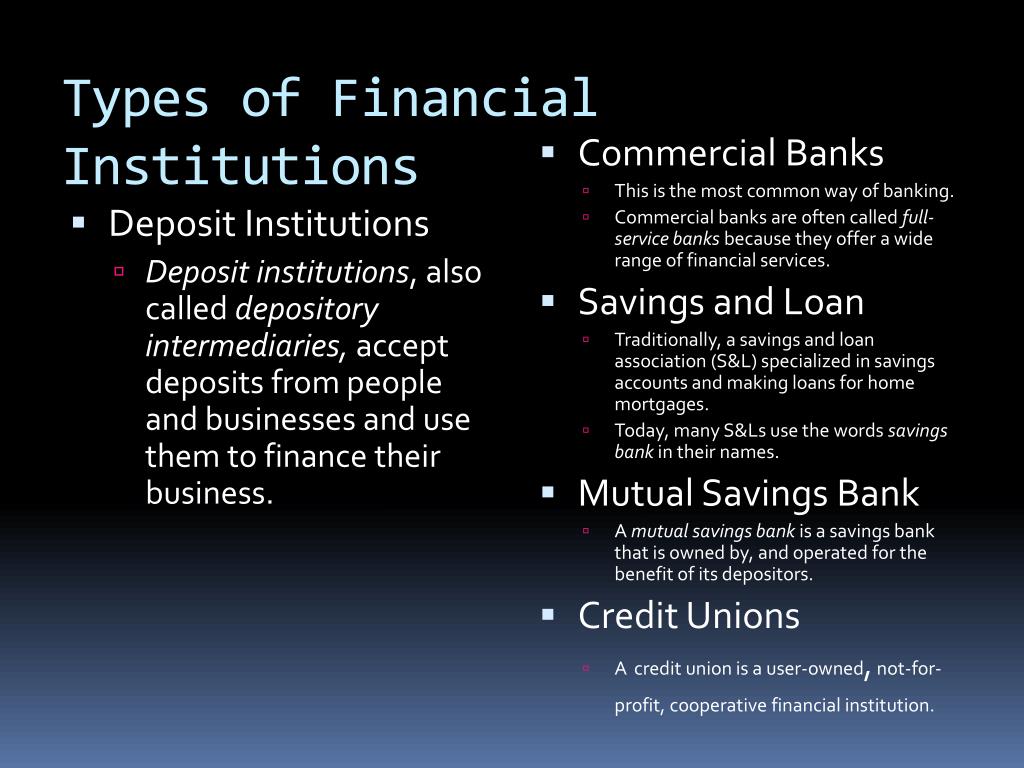

Savings and loan associations operate similarly to banks and credit unions in that they offer many of the same services, such as banking and home lending. However, savings and loan associations focus more so on mortgages and savings, whereas banks work with businesses in addition to individuals.

What is the difference between commercial banks and savings banks?

Commercial banks are intermediaries between the central bank (FED) and the ultimate money borrowers. However, savings banks are financial institution whose primary purpose consists of accepting savings deposits and paying interest on those deposits.

How is savings and loan different than bank?

Unlike commercial banks, they are owned and controlled by their customers—not by shareholders. As noted above, they focus on providing residential mortgages, loans, and basic banking and savings vehicles—checking and savings accounts, certificates of deposit (CDs), and others—to customers.

What is the difference between loan from financial institutions and loan from commercial banks?

The main difference between other financial institutions and banks is that other financial institutions cannot accept deposits into savings and demand deposit accounts, while the same is the core business for banks.

What are the basic differences between commercial banks and savings and loans quizlet?

What are the basic differences between commercial banks and savings and loans? Although both institutions offer checking accounts, savings accounts, and make loans, commercial banks loan mainly to individuals and businesses, and savings and loans primarily make mortgage loans.

What is the role of savings and loan association?

savings and loan association, a savings and home-financing institution that makes loans for the purchase of private housing, home improvements, and new construction.

What are commercial banks examples?

Few examples of commercial banks in India are as follows:State Bank of India (SBI)Housing Development Finance Corporation (HDFC) Bank.Industrial Credit and Investment Corporation of India (ICICI) Bank.Dena Bank.Corporation Bank.

What is the savings and loan association crisis?

The savings and loan crisis was the build-up and extended deflation of a real-estate lending bubble in the United States from the early 1980s to the early 1990s.

What is a savings bank definition?

savings bank, financial institution that gathers savings, paying interest or dividends to savers. It channels the savings of individuals who wish to consume less than their incomes to borrowers who wish to spend more.

What is an example of a savings and loan association?

For example, a bank grants loans for credit cards, mortgages where the homes are spread across the state, and commercial loans for hotels, restaurants, retail stores, and factories.

What is one difference between commercial banks and finance companies?

Finance companies make a profit by borrowing money at a rate lower than the rate at which they lend. This is similar to a commercial bank, with the primary difference being the source of funds, principally deposits for a bank and money and capital market borrowing for a finance company.

What is role of commercial bank?

Primary functions Commercial banks provide loans and advances of various forms, Such as [overdraft] facility, cash credit, bill discounting, money at call, etc. They also give demand and term loans to all types of clients against proper security. They also act as trustees for wills of their customers etc.

What do savings banks do?

A savings bank is a financial institution whose primary purpose is accepting savings deposits and paying interest on those deposits. They originated in Europe during the 18th century with the aim of providing access to savings products to all levels in the population.

What are commercial banks examples?

Few examples of commercial banks in India are as follows:State Bank of India (SBI)Housing Development Finance Corporation (HDFC) Bank.Industrial Credit and Investment Corporation of India (ICICI) Bank.Dena Bank.Corporation Bank.

How do savings banks work?

You open a savings account at the bank. The bank pays you interest on the money that you deposit and leave in that account. The bank then loans that money out to other people, only they charge a slightly higher interest rate on the loan than what they pay you for your account.

What are saving institutions?

Savings institutions also have a board of directors, but they can be corporations or mutuals (a type of business where making a deposit is like purchasing stock in the organization). Savings and loans and savings banks are the two different types of savings institutions.

5 Big Differences between Commercial Banks vs. Credit Unions

We asked Professor David Kass, Clinical Professor of Finance at the Robert H. Smith School of Business at the University of Maryland, for his advice on choosing between the two and he said “my advice for people choosing a bank for a loan, checking account, savings account, etc. would be to visit several banks near their home or office to compare the terms (interest rates, etc.) to find the ...

What Is the Difference Between a Commercial Bank and a Savings & Loan Bank?

The differences between a savings bank vs commercial bank may not seem obvious at first, but the differences are key to their missions. A commercial bank focuses on businesses, while savings and loans focus on mortgages and other types of consumer loans, not commercial lines of credit.

Commercial Banks vs. Savings & Loans | Pocketsense

Commercial banks and savings and loan associations are most similar in terms of the basic banking services they provide. Both types of institutions accept deposits from investors in exchange for a promise of safekeeping and, usually, an interest payment.

Differences Between a Commercial Bank & a Savings & Loan

A commercial bank and a savings and loan institution are similar in that they both accept deposits and make loans. Each type of institutions has its own regulator, however, and generally issues loans to different types of lenders.

What Is the Difference Between a Commercial Bank and a Savings & Loan ...

Different Histories. Savings and loans were founded to underwrite mortgage loans and provide consumer savings accounts. Scandal threatened the industry in the 1980s and 1990s, when 747 thrifts ...

What is the difference between a savings bank and a commercial bank?

There are commercial banks and savings banks. The primary difference is the way each is regulated, which determines the type of banking products they offer. The term "bank" seems interchangeable today given that there are commercial banks and savings banks, which are also called savings & loans.

What is a savings and loan?

Commercial banks and savings and loans issue loans to consumers for mortgages, cars, personal loans and credit cards.

What is S&L loan?

An S&L focuses mainly on mortgages and other kinds of consumer loans. A question often asked is, saving and loan institutions put about 70 percent of their money into which of the following: Stocks? Bonds? Actually, it's residential mortgages or mortgage-backed securities, which are assets backed by residential mortgages. You can still deposit your money in an S&L, but you would not be able to apply for a business loan such as a commercial line of credit.

Where to store cash?

Banks are highly regulated and your deposits are insured, which means you generally don't have to worry about ending up penniless if your bank goes under.

Is a commercial bank FDIC insured?

A federally-chartered commercial bank must belong to the Federal Reserve System, placing it under the regulation and supervision of the Federal Reserve. All commercial banks are FDIC-insured. Like an S&L, a commercial bank is also regulated and supervised by state banking authority where it accepts deposits. 00:00.

What is the difference between a commercial bank and a savings bank?

Savings and loan institutions are typically regional in focus, serving local customers, whereas commercial banks are often multinational and capable of serving an international clientele.

What is savings loan?

A savings and loan is focused more on lending to individuals for home purchases. Savings and loans are mandated by regulators to have at least 70 percent of assets in residential mortgages or mortgage securities.

Do commercial banks accept deposits?

Both commercial banks and savings and loans accept deposits, which they in turn lend out to both individuals and businesses.

What is the primary function of commercial banks?

The primary function of commercial banks is to make commercial and personal loans. On the asset side of their balance sheet, commercial banks, as their name implies, make most of their loans to consumers and businesses, typically short term, although they also make mortgage loans. Their liabilities include demand deposits (checking accounts), savings accounts, also withdrawable on demand, and longer-term certificates of deposits. Over time, the commercial banking sector has become the largest and most diversified of all financial institutions in the United States.

What was the impact of the savings and loan crisis of the 1980s?

The savings and loan crisis of the 1980s was precipitated in large part by the unique features of the S&Ls and the way they were regulated . When inflation reached double-digit levels in the late 1970s and early 1980s, newly formed money market funds paying market interest rates began siphoning off deposits from S&Ls that were limited to 3.75 percent interest. On the other side of the balance sheet, S&Ls were locked in to long-term mortgage portfolios that paid them below-market yields. Caught in a trap, S&Ls responded by offering newly deregulated high-yield deposits, while making riskier loans to raise the yields on their loan portfolios. When high-risk loans defaulted, many S&Ls became insolvent.

What is the core activity of commercial banks?

League of Savings Institutions, “The core expertise of savings institutions is home loans, while the core activity of commercial banks is business and commercial loans. ”.

Who can issue a commercial bank charter?

Different Charters. The federal government or a state government can issue a commercial bank charter. It’s up to the bank’s stockholders to decide which one is most appropriate for its needs and growth plans.

Where do national banks get their charters?

National banks receive charters from the Office of the Comptroller of the Currency, a division of the U.S. Treasury. If a commercial bank decides to trade a state charter for a federal one, it’s perfectly acceptable. Savings and loan charters also can originate at the national or state level.

Do thrifts operate under the same regulatory bodies?

Further, both now operate under the same regulatory bodies. Some of the nation’s largest thrifts are even owned by commercial bank holding companies.

Can borrowers own a commercial bank?

Thus depositors and borrowers can’t own a commercial bank.

Do thrift banks exist?

In the United States, commercial banks and “thrifts”-- savings banks or savings and loan associations—co-exist side by side. Over time, the lines have blurred dramatically. Bottom line: Savings and loans were instituted primarily to underwrite home loans and offer consumers a place to save. The purpose of commercial banks, according to Connecticut’s Department of Banking, is to act as “the traditional 'department store’ of the financial services world,” offering a smorgasbord of products to meet the needs of businesses and families.

What is commercial bank?

Commercial Banks. Commercial banks are owned and managed by a board of directors selected by stockholders. Many commercial banks are large, multinational corporations. There were 691 savings and loan companies insured by the FDIC as of the end of 2018 1 . In contrast to the S&L's narrower focus on residential mortgages, ...

What is a savings and loan institution?

Savings and loan institutions–also referred to as S&Ls, thrift banks, savings banks, or savings institutions–provide many of the same services to customers as commercial banks, including deposits, loans, mortgages, checks, and debit cards.

How are S&Ls owned?

S&Ls can be owned in either of two ways. Under what is known as the mutual ownership model, an S&L can be owned by its depositors and borrowers. Alternatively, an S&L can also be established by a consortium of shareholders that have controlling stock ownership (as issued in an S&L's charter).

How much of a loan can an S&L lend?

Prior to this ruling, S&Ls could only lend up to 20% of their assets for commercial loans, and only half of that can be used for small business loans. In addition, for Federal Home Loan Bank borrowing approvals, an S&L was required to show that 65% of its assets were invested in residential mortgages and other consumer-related assets.

Why are S&Ls created?

S&Ls were originally created to provide more economic opportunities, like home loans, available to more Americans (specifically, members of the middle-class). Many commercial banks conduct many of their operations exclusively online. Some rules for lending differ between S&Ls and commercial banks, although a ruling by the Office ...

Do commercial banks offer residential loans?

Although commercial banks provide residential mortgages, they tend to focus on loans targeting the construction and expansion needs of regional, national, and international businesses. In the electronic era, many customers utilize commercial bank services online. However, in the past, brick-and-mortar commercial banks often offered personalized ...

Can commercial banks be chartered?

Commercial banks can be chartered at either the state or federal level. The same is true for S&Ls. The Office of the Comptroller of the Currency (OCC) is in charge of monitoring all nationally-chartered commercial banks and S&Ls.