The ABC calculation is as follows:

- Identify all the activities required to create the product.

- Divide the activities into cost pools, which includes all the individual costs related to an activity—such as...

- Assign each cost pool activity cost drivers, such as hours or units.

- Calculate the cost driver rate by dividing the total overhead in each cost pool by the total cost...

How to calculate the activity rate of each unit?

Calculating the activity rate of each unit. Application of the various cost identified and appropriating it to various cost in the service line of the production process. Activity-based costing can be computed by assigning all the indirect cost which is incurred to the identified various types of cost umbrella,

How do you calculate ABC cost?

The ABC calculation is as follows: 1 Identify all the activities required to create the product. 2 Divide the activities into cost pools, which includes all the individual costs related to an activity—such as manufacturing. ... 3 Assign each cost pool activity cost drivers, such as hours or units. More items...

How do you explain the ABC formula?

The ABC formula can be explained with the following core concepts. Cost Pool: This is an item for which measurement of the cost would require, e.g., a product Cost Driver: It is a factor that will cause a change in the cost of that activity.

What is activity based costing (ABC)?

Activity Based Costing (ABC) is a costing approach, that allocates manufacturing overheads into per unit cost in a more rational manner compared to the traditional costing approaches.

How is activity rate calculated under ABC?

The ABC calculation is as follows:Identify all the activities required to create the product.Divide the activities into cost pools, which includes all the individual costs related to an activity—such as manufacturing. ... Assign each cost pool activity cost drivers, such as hours or units.More items...

How do you calculate the activity rate?

An activity-based costing rate is calculated by assigning indirect costs to a cost pool, adding the costs included in that cost pool together, then dividing the cost pool total by the cost driver.

How is ABC overhead calculated?

To calculate the per unit overhead costs under ABC, the costs assigned to each product are divided by the number of units produced.

How do you calculate overhead rate using activity-based costing?

Divide the setup cost per batch of goods produced by the number of units in a batch to figure out the manufacturing overhead for setup per unit. Divide the overhead cost per machine hour by the number of units produced per machine hour to get the overhead cost for production of each unit.

What is ABC method?

Activity-based costing (ABC) is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each. Therefore this model assigns more indirect costs (overhead) into direct costs compared to conventional costing.

What is meant by activity rate?

The activity rate is the ratio between the number of active persons (occupied labour force and the unemployed) and the corresponding total population.

What is ABC costing with examples?

Activity-based costing (also known as ABC costing) refers to the allocation of costs (charges and expenses) to different heads or activities or divisions according to their actual use or on account of some basis for allocation, i.e. (cost driver rate, which is calculated by total cost divided by total no.

How do you solve activity-based costing problems?

1:3413:29Activity Based Costing Examples - Managerial Accounting videoYouTubeStart of suggested clipEnd of suggested clipAnd the total number of setups is 100. So we're going to divide. This 107,000 by 100 setups thatMoreAnd the total number of setups is 100. So we're going to divide. This 107,000 by 100 setups that will give us 1070 dollars per setup.

Activity Based Costing Formula

You are free to use this image on your website, templates etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked For eg: Source: Activity Based Costing (wallstreetmojo.com)

Relevance and Uses

It is a type of cost allocation process Cost Allocation Process Cost Allocation is the procedure of recognizing & assigning costs to different cost objects like a product, department, program, customer, etc., as per the cost driver serving as the base for this process.

Recommended Articles

This article has been a guide to what is Activity Based Costing (ABC) & its definition. Here we discuss the formula of activity-based costing along with its calculation & practical examples. You may learn more about excel from the following articles –

Examples of Activity Based Costing Formula (With Excel Template)

Let’s take an example to understand the calculation of Activity Based Costing formula in a better manner.

Explanation

The activity-based formula simply gives us the dollar value of amount per activity which is then can be multiplied to determine the cost of the total products assigned or produced in that particular cost pool.

Relevance and Uses of Activity Based Costing Formula

Because activity-based costing breaks down the costs that go into creating a product, it has many uses in business.

Recommended Articles

This has been a guide to Activity Based Costing Formula. Here we discuss how to calculate Activity Based Costing along with practical examples. We also provide an Activity Based Costing calculator with downloadable excel template. You may also look at the following articles to learn more –

What is ABC accounting?

Activity-based costing ( ABC) is a method of assigning overhead and indirect costs—such as salaries and utilities—to products and services. The ABC system of cost accounting is based on activities, which are considered any event, unit of work, or task with a specific goal. An activity is a cost driver, such as purchase orders or machine setups.

What is activity based costing?

Activity-based costing (ABC) is mostly used in the manufacturing industry since it enhances the reliability of cost data, hence producing nearly true costs and better classifying the costs incurred by the company during its production process.

Identify activities and cost pools

To use the ABC method, you will first have to understand how to assign costs to activities.

Allocate overhead to the cost pools

Once you have created a list of your cost pools and how you will measure them, you will need to spread the £1 million between them. This is an estimate of how much of the £1 million is used for each cost pool. To identify this estimate, you will need to interview employees to get an idea of how much time (and money) is spent on each activity.

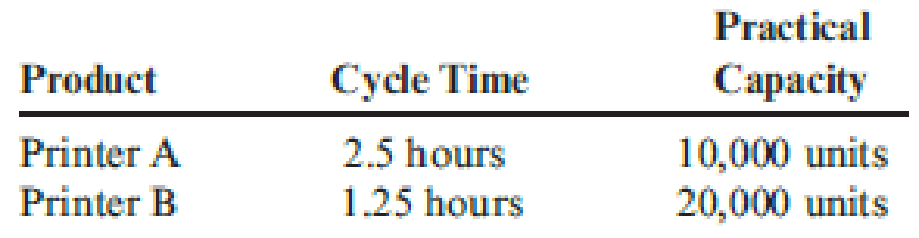

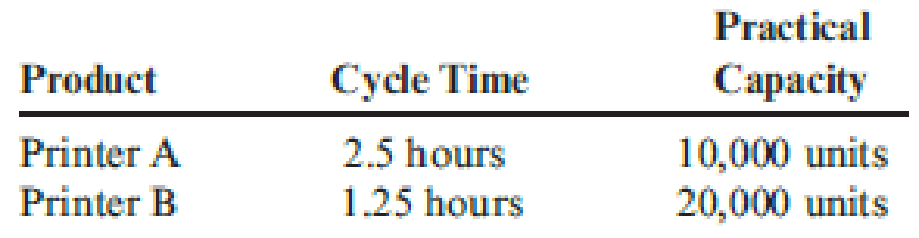

Calculate the activity (cost pool) rate

Once you have the estimated percentages and costs associated with each cost pool, you will need to calculate the activity rate. The activity rate is calculated by the cost divided by the measurement, as seen in the chart below.

Use the activity rates to assign overhead to cost products

Now that you have calculated the activity rate for each cost pool, you can divide it up between the products you sell. In this example, we have a company that sells backpacks and purses.

What is activity based costing?

Activity-based costing is a method of assigning indirect costs to products and services by identifying cost of each activity involved in the production process and assigning these costs to each product based on its consumption of each activity.

What is unit level activity?

Unit level activities are activities that are performed on each unit of product. Batch level activities are activities that are performed whenever a batch of the product is produced. Product level activities are activities that are conducted separately for each product.

Calculation control check

The total allocated cost amounts to $ 73,000 ($36,250+$36,750). Our allocations are correct as the total overhead cost in the first column amounts to $73,000. Hence, we have accurately allocated overhead costs based on usage of OVH’s significant activities.

Advantages of using ABC system of costing

Following are some of the advantages associated with the ABC system of cost allocation.

Disadvantages of ABC system of costing

Following are some of the disadvantages associated with the ABC system.

Bottom line

An activity-based costing system helps allocate the company’s overhead cost to different products/services more accurately. The results/cost of the products/services obtained is more accurate because ABC does not use the same overhead Absorption Rate. On the other hand, it makes use of the specific cost driver for the specific cost pool.

Frequently asked questions

What is the difference between the traditional system and the ABC system?

What is ABC cost?

ABC is a modern tool of charging overhead costs in which costs are first identified with activities and then allocated to products or services based on appropriate cost drivers. Cost drivers reflect the cause and effect relationship between activity consumption and cost incurrence.

What is ABC in accounting?

1. Meaning of Activity-Based Costing (ABC): Activity-based costing (also popularly known as ABC) is a new and scientific approach developed by Rabin Cooper and Roberk Kaplan (1988) of the Harvard University for assigning overhead costs to end-products, jobs and processes. It refines a costing system by focusing on individual activities as ...

What is ABC distribution?

Under ABC distribution of overhead costs is done on the basis of activities which is considered to be more realistic. It is said to be an objective approach. The traditional costing uses more arbitrary bases for apportionment of overhead costs and is a subjective approach.

What is cost pool?

Cost pool is like a cost centre or activity centre around which costs are accumulated. For example, the total of machine set-up might constitute are cost pool for all set-up related costs.

What is the next step in the application of activity-based costing?

The next step in the application of activity-based costing is the ascertainment of the factors that influence the cost of each major activity. The factors or the forces that cause costs are known as cost drivers. A cost driver not merely causes cost but also explains its behaviour.

What is ABC in business?

ABC gives better understanding of cost behaviour and a more rational approach to fixed and variable costs. It enables management to control many fixed overheads by exercising more control over those activities which cause these fixed overheads.

What is ABC management?

ABC which is now being called Activity-Based Management (ABM) used cost information generated by ABC about an activity for controlling the activity itself rather than just using cost information of the final product.

How to calculate activity based costing?

Following steps need to be followed in the calculation of activity based costing: 1 Recording and classification of all costs 2 Identification of the activities producing the overhead cost 3 Identification of cost drivers 4 Apportionment of related to overheads to the cost drivers 5 Calculating the rate of cost drivers 6 Absorbing both direct and indirect cost into the product

What are the limitations of ABC costing?

For example, it cannot allocate certain expenditures to any cost pool. In addition, the process of ABC is complex in understanding and costly as well in comparison to absorption costing.

Examples of Activity Based Costing Formula

Explanation

- The activity-based formula simply gives us the dollar value of amount per activity which is then can be multiplied to determine the cost of the total products assigned or produced in that particular cost pool. By computing and using this method of activity-based costing the manufacturing company can successfully and more accurately determine the va...

Relevance and Uses of Activity Based Costing Formula

- Because activity-based costing breaks down the costs that go into creating a product, it has many uses in business.

- For small businesses, activity-based costing is great for making overhead decisions and pricing products.

- Using specific product allocation, you can very well determine the exact cost which is being u…

- Because activity-based costing breaks down the costs that go into creating a product, it has many uses in business.

- For small businesses, activity-based costing is great for making overhead decisions and pricing products.

- Using specific product allocation, you can very well determine the exact cost which is being used for the product type and can also be used for detailed cost analysis. A company can analyze its his...

- Activity Based Costing method creates new bases for assigning overhead costs to items such that costs are allocated based on the activities that generate costs instead of on volume measures, such a...

Recommended Articles

- This has been a guide to Activity Based Costing Formula. Here we discuss how to calculate Activity Based Costing along with practical examples. We also provide an Activity Based Costing calculator with downloadable excel template. You may also look at the following articles to learn more – 1. Guide To High Low Method 2. Examples of Variable Costing Formula 3. Calculator Fo…

What Is Activity-Based Costing (ABC)?

How Activity-Based Costing (ABC) Works

- Activity-based costing (ABC) is mostly used in the manufacturing industry since it enhances the reliability of cost data, hence producing nearly true costs and better classifying the costs incurred by the company during its production process. This costing system is used in target costing, product costing, product lineprofitability analysis, customer profitability analysis, and service pri…

Requirements For Activity-Based Costing

- The ABC system of cost accounting is based on activities, which are any events, units of work, or tasks with a specific goal, such as setting up machines for production, designing products, distributing finished goods, or operating machines. Activities consume overhead resources and are considered cost objects. Under the ABC system, an activity can...

Benefits of Activity-Based Costing

- Activity-based costing (ABC) enhances the costing process in three ways. First, it expands the number of cost pools that can be used to assemble overhead costs. Instead of accumulating all costs in one company-wide pool, it pools costs by activity. Second, it creates new bases for assigning overhead costs to items such that costs are allocated based on the activities that gen…