An inventory accounting method, cost flow assumption uses the real value of the products from the beginning inventory period and the expenses done in purchasing the new inventory in that period to calculate COGS

Cost of goods sold

Cost of goods sold (COGS) refer to the carrying value of goods sold during a particular period. Costs are associated with particular goods using one of several formulas, including specific identification, first-in first-out (FIFO), or average cost. Costs include all costs of purchase, costs of conversion and other costs incurred in bringing the inventories to their present location and condition.

What is average cost flow assumption?

How is cost flow assumption calculated? Under average cost flow assumption, all of the costs are added together, then divided by the total number of units that were purchased. The number of units sold can be multiplied by the average price per unit to establish the cost of goods sold and the ending inventory. Click to see full answer.

When is the cost flow assumption a minor item?

Jul 16, 2021 · To compute the total COGS, Wexel utilizes the average cost flow assumption method. It calculates the cost of each widget as follows: [ (25x$25) + (27x$27) + (30x$30)] / (25+27+30). Average Cost...

What is the difference between FIFO and LIFO cost flow assumptions?

May 04, 2020 · How do you calculate cost flow assumption? The purchase price differentials are attributed to external factors, including inflation, supply, or demand. Under the average cost flow assumption, all of the costs are added together, then divided by the total number of units that were purchased.

What are the assumptions of first in first out method?

The term cost flow assumptions refers to the manner in which costs are removed from a company's inventory and are reported as the cost of goods sold. In the U.S. the cost flow assumptions include FIFO, LIFO, and average. (If specific identification is used, there is no need to make an assumption.)

How does a company determine what cost flow assumption they should use?

A company can choose to use specific identification, first-in, first-out (FIFO), last-in, first-out (LIFO), or averaging. Each of these assumptions determines the cost moved from inventory to cost of goods sold to reflect the sale of merchandise in a different manner.

What is cost flow assumption in accounting?

An assumption that determines the order in which costs should flow out of a balance sheet account (e.g. Inventory, Investments, Treasury Stock) when the item is sold. For an illustration of the cost flow assumption, see Explanation of Inventory and Cost of Goods Sold.

What is the cost flow equation?

Free Cash Flow = Net income + Depreciation/Amortization – Change in Working Capital – Capital Expenditure. Operating Cash Flow = Operating Income + Depreciation – Taxes + Change in Working Capital.Jan 2, 2022

What is the average cost flow assumption?

The weighted-average cost flow assumption is a costing method that is used to assign costs to inventory and the cost of goods sold. Under this approach, the cost of goods available for sale is divided by the number of units produced in the period to arrive at an average cost per unit.Dec 24, 2021

Which inventory cost flow assumption generally results?

Which inventory cost flow assumption generally results in the lowest reported amount for inventory when inventory costs are rising? Last-in, first-out (LIFO).

What are the two assumptions in cost estimation?

The two assumptions are: 1) Variations in the level of a single activity the variations in the related total costs. 2) Cost behavior is approximated by a linear function within the relevant range.

How are costs assumed to flow through the manufacturing process?

The process of the flow of costs begins with valuing the raw materials used in manufacturing. The flow of costs then moves to the work-in-process inventory. The cost of the machinery and labor involved in production are added as well as any overhead costs.

How do costs flow through a process costing system?

Cost Flow in Process Costing The typical manner in which costs flow in process costing is that direct material costs are added at the beginning of the process, while all other costs (both direct labor and overhead) are gradually added over the course of the production process.May 14, 2017

How is cash flow calculated?

With the indirect method, cash flow is calculated by adjusting net income by adding or subtracting differences resulting from non-cash transactions. Non-cash items show up in the changes to a company's assets and liabilities on the balance sheet from one period to the next.

How is average cost calculated?

Accounting. In accounting, to find the average cost, divide the sum of variable costs and fixed costs by the quantity of units produced.

How is WAC inventory calculated?

How to calculate inventory weighted average cost. To calculate the weighted average cost, divide the total cost of goods purchased by the number of units available for sale. To find the cost of goods available for sale, you'll need the total amount of beginning inventory and recent purchases.Jul 31, 2020

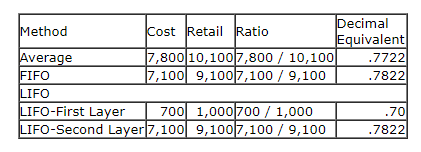

What are the three primary inventory cost flow assumptions?

The term cost flow assumptions refers to the manner in which costs are removed from a company's inventory and are reported as the COGS. In the U.S., the common cost flow assumptions are First-in, First-out (FIFO), Last-in, First-out (LIFO), and average.

What is cost flow assumption?

The term cost flow assumptions refers to the manner in which costs are removed from a company's inventory and are reported as the cost of goods sold. In the U.S. the cost flow assumptions include FIFO, LIFO, and average. (If specific identification is used, there is no need to make an assumption.)

Why are FIFO and LIFO assumptions?

FIFO, LIFO, average are assumptions because the flow of costs out of inventory does not have to match the way the items were physically removed from inventory.

Who is Harold Averkamp?

Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. Read more about the author.

What is the inventory cost flow assumption?

The inventory cost flow assumption states that the cost of an inventory item changes from when it is acquired or built and when it is sold. Because of this cost differential, management needs a formal system for assigning costs to inventory as they transition to sellable goods.

What is the LIFO method?

In periods of rising materials prices, the LIFO method results in a higher cost of goods sold, lower profits, and therefore lower income taxes. In periods of declining materials prices, the FIFO method yields the same results.

What is specific identification method?

Under the specific identification method, you can physically identify which specific items are purchased and then sold, so the cost flow moves with the actual item sold. This is a rare situation, since most items are not individually identifiable. Weighted average cost flow assumption.

Is LIFO allowed under IFRS?

Note that the LIFO method is not allowed under IFRS. If this stance is adopted by other accounting frameworks in the future, it is possible that the LIFO method may not be available as a cost flow assumption.

Does cost flow assumption match actual flow?

The cost flow assumption does not necessarily match the actual flow of goods (if that were the case, most companies would use the FIFO method). Instead, it is allowable to use a cost flow assumption that varies from actual usage. For this reason, companies tend to select a cost flow assumption that either minimizes profits ...

Definition of Cost Flow Assumptions

- When it comes time to calculate cost of goods sold, should the company average its costs across all inventory? Or maybe it should use the latest inventory for its calculations. This decision is critical and will affect a company’s gross margin, net income, and taxes, as well as future inventory valuations. The average cost inventory method assigns the same cost to each item. R…

Rising Costs

- For example, the COGS for an automaker would include the material costs for the parts that go into making the car plus the labor costs used to put the car together. The cost of sending the cars to dealerships and the cost of the labor used to sell the car would be excluded. LIFO is the opposite of the FIFO method and it assumes that the most recent items added to a company’s i…

Requirement For Cost Flow Assumptions

- Items previously in inventory that are sold off are recorded on a company’s income statement as cost of goods sold (COGS).

- The COGS is an important figure for businesses, investors, and analysts as it is subtracted from sales revenue to determine gross margin on the income statement.

- Businesses that sell products to customers have to deal with inventory, which is either bough…

- Items previously in inventory that are sold off are recorded on a company’s income statement as cost of goods sold (COGS).

- The COGS is an important figure for businesses, investors, and analysts as it is subtracted from sales revenue to determine gross margin on the income statement.

- Businesses that sell products to customers have to deal with inventory, which is either bought from a separate manufacturer or produced by the company itself.

Free Financial Statements Cheat Sheet

- The costs paid for those oldest products are the ones used in the calculation. Additional costs may include freight paid to acquire the goods, customs duties, sales or use taxes not recoverable paid on materials used, and fees paid for acquisition. For financial reporting purposes such period costs as purchasing department, warehouse, and other operating expenses are usually not treat…