You can calculate credit utilization yourself using this formula:

- Add up the balances on all your credit cards.

- Add up the credit limits on all your cards.

- Divide the total balance by the total credit limit.

- Multiply by 100 to see your credit utilization ratio as a percentage.

What is the ideal credit utilization ratio?

While many experts recommend keeping your credit utilization rate below 30%, “there is no hard and fast rule,” says Liran Amrany, founder and CEO of personal finance app Debitize. “In general, you want to be as low as possible, though not 0%, as then it looks like you are not using any credit at all.” Amrany is on the right track.

How do you calculate credit card utilization?

You can calculate credit utilization yourself using this formula:

- Add up the balances on all your credit cards.

- Add up the credit limits on all your cards.

- Divide the total balance by the total credit limit.

- Multiply by 100 to see your credit utilization ratio as a percentage.

What is the best credit utilization?

What Is a Good Credit Card Utilization Ratio?

- The credit utilization ratio is a value used to express the percentage of your credit card limits that you have used. ...

- What is the best credit utilization ratio? ...

- Typically, a good credit utilization ratio is below 30%— the lower, the better. ...

How to reduce your credit utilization rate?

Tips to Manage Your Credit Utilization Percentage

- Spread Out Your Charges Over Different Cards. This way you’ll have lower balances on several cards instead of a balance that uses more than 30% of your limit on one ...

- Time Your Payments Right. ...

- Ask Your Creditor to Increase Your Card Limit. ...

- Pay Your Credit Cards Twice Each Month. ...

Is credit utilization calculated daily or monthly?

Pay your bill twice per month: As explained above, the credit bureaus only calculate your credit utilization ratio once per month, so if you make a payment halfway through the month and again at the end, you can spend more than 30% of your credit limit and still show a low credit utilization ratio.

What is good credit utilization percentage?

Most credit experts advise keeping your credit utilization below 30 percent, especially if you want to maintain a good credit score. This means if you have $10,000 in available credit, your outstanding balances should never exceed $3,000.

Is 27% credit utilization good?

A good credit utilization ratio is anything below 30%. These percentages reflect a credit card user's statement balance divided by the account's credit limit, with the product multiplied by 100. On a credit card with a $1,000 limit, for example, it would be best to use $10 to $100 each month, and no more than $300.

What date is credit utilization calculated?

Balance Reporting and Credit Utilization Typically, credit card companies update this information every 30 days at the end of your billing cycle.

Should I pay off my credit card in full or leave a small balance?

It's Best to Pay Your Credit Card Balance in Full Each Month Leaving a balance will not help your credit scores—it will just cost you money in the form of interest. Carrying a high balance on your credit cards has a negative impact on scores because it increases your credit utilization ratio.

Is it better to pay off your credit card or keep a balance?

It's better to pay off your credit card than to keep a balance. It's best to pay a credit card balance in full because credit card companies charge interest when you don't pay your bill in full every month.

What happens if you go over 30% utilization?

“It could hurt your score if you max out on one card even if the others have a low utilization rate,” said Rod Griffin, director of consumer education and awareness for Experian. He also said that when you cross the 30% utilization ratio, your score begins dropping faster if your debt continues to climb.

How do you get a 850 credit score?

According to FICO, about 98% of “FICO High Achievers” have zero missed payments. And for the small 2% who do, the missed payment happened, on average, approximately four years ago. So while missing a credit card payment can be easy to do, staying on top of your payments is the only way you will one day reach 850.

Does credit Utilization matter if you pay in full?

Credit Utilization Matters Even If You Pay Your Cards in Full Each Month. If you pay your bill on time every month, you might think you'd have a 0% credit utilization. Not true. The amount owed is based on what your credit card issuers report to each credit agency.

Does credit utilization reset every month?

Every month, your card issuers report the balances on your credit cards to one or more of the three major credit bureaus — Experian, Equifax and TransUnion. This data then lands on your credit reports. When a new credit card balance is reported, the new level of credit utilization is what counts for your score.

How Much Will lowering my credit utilization raise my score?

Credit scoring models such as FICO and VantageScore analyze your debt-to-limit ratio when calculating your credit score. With FICO scoring models, credit utilization accounts for 30% of your credit score. So, when you lower your credit card utilization, your credit score might increase.

Is credit utilization based on statements?

“Whatever balance shows up on your credit report is what's used in the utilization calculation,” says John Ulzheimer, credit expert at CreditSesame.com. That figure is generally the previous month's balance that appears on your statement, even if you pay the bill in full by the due date.

Will lowering my credit utilization raise my score?

With FICO scoring models, credit utilization accounts for 30% of your credit score. So, when you lower your credit card utilization, your credit score might increase.

How can I raise my credit score 200 points?

How to Raise Your Credit Score by 200 PointsGet More Credit Accounts.Pay Down High Credit Card Balances.Always Make On-Time Payments.Keep the Accounts that You Already Have.Dispute Incorrect Items on Your Credit Report.

Is 10 percent credit utilization good?

To maintain a healthy credit score, it's important to keep your credit utilization rate (CUR) low. The general rule of thumb has been that you don't want your CUR to exceed 30%, but increasingly financial experts are recommending that you don't want to go above 10% if you really want an excellent credit score.

How much should I spend on a $300 credit limit?

A good guideline is the 30% rule: Use no more than 30% of your credit limit to keep your debt-to-credit ratio strong. Staying under 10% is even better. In a real-life budget, the 30% rule works like this: If you have a card with a $1,000 credit limit, it's best not to have more than a $300 balance at any time.

What is credit utilization ratio?

Your credit utilization ratio is how much you owe on all your revolving accounts, such as credit cards, compared with your total available credit — expressed as a percentage. It's important because it's one of the biggest factors in your credit score. Experts suggest using no more than 30% of your limits, and less is better.

What is per card utilization?

Per-card utilization measures how much of each card’s credit limit you’re using, while overall utilization takes all your cards and their limits into account.

How close are you to your credit limits?

Most experts recommend using no more than 30% of available credit on any card. Our calculator shows you where you stand.

How to lower credit score by running up credit cards?

That’s why running up your cards will lower your score. Add up the balances on all your credit cards. Add up the credit limits on all your cards. Divide the total balance by the total credit limit. Multiply by 100 to see your credit utilization ratio as a percentage.

How to lower credit score if you charge too much?

That’s why running up your cards will lower your score. Add up the balances on all your credit cards. Add up the credit limits on all your cards. Divide the total balance by the total credit limit.

What happens if you avoid using more than 30% of your credit limit?

If you avoid using more than 30% of the credit limit on any one card, the overall usage takes care of itself.

Why is it important to have a good credit score?

Working toward a good credit score will make it easier for you to qualify for the best rates on loans, insurance policies and other financial products.

How Do You Calculate Credit Utilization Ratio?

Credit utilization is based on revolving credit: credit cards and other short-term lines of credit that are not paid on a set schedule. It does not include mortgages, student loans, or auto loans which are considered long-term installment loans. Revolving credit carries over month to month without a predetermined payment date.

What is credit utilization?

Credit utilization is the percentage of your total available revolving credit that you are actually using at any given time. It is an important number to understand because it is a key factor in calculating your credit score. Improving your credit utilization ratio is one way to improve your credit score.

How long does it take for a revolving credit card to show up on your credit report?

Payments made or changes to total credit are reflected in 30 to 60 days. If you have paid off a significant portion of debt on revolving credit, expect to see it in your credit score in about a month, depending on when the institution reports and when the credit score is updated.

What percentage of credit score is a credit utilization ratio?

Your credit utilization ratio makes up around 30% of your total credit score. Even with perfect payment history, long credit history, and a good credit mix, your credit score could be reduced by a high ratio.

How to keep credit card rates low?

You can do this by paying off debt, opening a new credit card, asking for a higher credit limit, or making a balance transfer. Keeping credit cards open, even if you are not using them, can help you maintain a low rate.

How often do credit card companies report to credit bureaus?

Credit card companies usually report to credit bureaus once a month, or once during every 30-day billing cycle. This usually happens about 7 to 15 days after the statement closing date, but that varies with the card issuer.

How long does it take to get 0% interest on a credit card?

Second, many credit cards offer 0% interest for a set period of time after opening. This is typically three months to a year. This gives you an opportunity to make a balance transfer, improve your credit utilization rate, and avoid interest while paying off debt.

How is credit utilization calculated?

Credit utilization ratios are calculated in two ways: per card and overall. 2 To see the percentage per card, simply divide the total balance of a credit card by its credit limit, then multiply that number by 100. For example:

What is a credit utilization?

Credit utilization is the percentage of total credit used in comparison to the total credit you have available. 1 This percentage is a factor used by top credit scoring models like FICO® and VantageScore ® in calculating your credit score. It can have a big influence on your score, and a general rule of thumb is the lower your percentage, the better.

What is a good credit utilization ratio?

While there’s no universal standard for a “good” credit utilization ratio, 30% or below is the general guideline per card and overall. This shows the scoring models you don’t need to rely on credit and may have less difficulty repaying new debt. The less of a risk you present, the higher your credit score can go.

Why is it important to understand credit utilization?

Understanding how credit utilization works can give you a better sense of how credit is measure d and the impact it can have on your financial goals. And for younger adults, it’s especially important to get a firm understanding of credit utilization now so you can make more informed decisions about managing your spending, debt and credit in the future.

How long is the Onemain credit course?

Learn why maintaining strong credit is important to your financial health — and 7 actions you can take today to improve your credit score — with this free 5-minute online course from OneMain.

Is credit utilization a foreign language?

Credit terms can sound like a foreign language sometimes. Credit utilization is one important financial term you may have heard of but aren’t sure exactly what it is or how important it is to your credit score.

What is credit utilization ratio?

Your credit utilization ratio, or credit utilization rate, is the amount of your revolving credit balance divided by your total available credit.

What is the utilization rate for a credit card?

Credit companies commonly recommend keeping your utilization rate to 30% or below. If you have a credit card with a $5,000 balance, that means you should try not to exceed a balance $1,500.

How to increase credit limit?

Request a credit limit increase. Call your credit card issuer or go online to see if you can get approved for a higher limit on your account. This will lower your credit utilization ratio as long as your account remains at or below its current balance. Pay down your outstanding balances.

What happens to your credit when you pay off a revolving loan?

Unlike a loan, revolving credit renews when you pay it off. Think of credit cards, gas cards, and home equity lines of credit (HELOCs). If you have a $500 balance on a card with a $5,000 limit, then your available credit is $4,500. But when you pay off the $500 balance, that amount “renews,” and your available credit becomes $5,000.

How to improve credit score?

Pay down your outstanding balances. Paying your balances in full every month is ideal. If you’re not able to do that, then aim to keep them as low as possible. Paying more toward your balance than you spend every month will help you chip away at your debt and improve your credit standing. Open new credit accounts.

How to increase credit score when paying off credit card?

Keep old accounts open. As you pay off your credit card balances, keep your accounts open, even if you don’t use them. Closing old accounts that are no longer in use can increase your credit utilization ratio and adversely affect your length of credit history, another factor used to determine your credit score.

What is the optimal credit score ratio?

The optimal ratio always will be as close to zero percent as possible, but it’s still possible to have elite credit scores with higher ratios.”. Generally speaking, the lower your credit utilization, the more responsible and creditworthy you appear to potential lenders.

How to calculate credit utilization ratio?

To calculate your credit utilization ratio, simply divide your credit card balance by your credit limit, then multiply by 100. 3 The lower your credit utilization percentage, the better. A low credit utilization shows that you're only using a small amount of the credit that's been extended to you.

What is credit utilization?

Credit utilization is the ratio of your outstanding credit card balances to your credit card limits. It measures the amount of available credit you are using. 2 1 For example, if your balance is $300 and your credit limit is $1,000, then your credit utilization for that credit card is 30%. If you’re adding $500 per month of new charges on your card and your limit is $1,000, you’ll have a utilization rate of 50%.

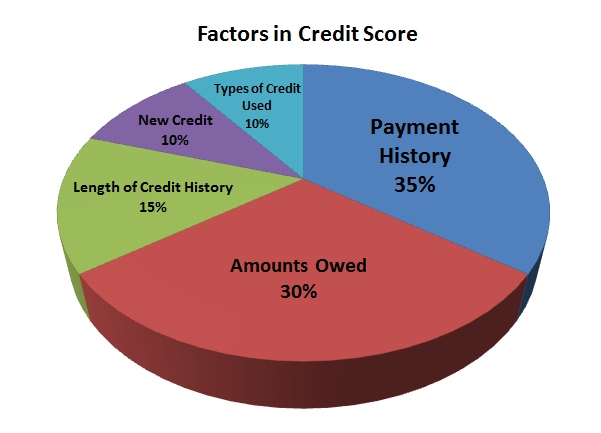

What are the factors that affect your credit score?

Five major factors have an influence on your FICO credit score, the most commonly used credit scoring model: 1 Payment history (35%) 2 Level of debt/credit utilization (30%) 3 The age of credit (15%) 4 Mix of credit (10%) 5 Credit inquiries (10%) 4

Why is my credit score not reflecting the most recent changes to my credit card balance?

Because credit card information is updated on your credit report based on billing cycles and not in real time , your credit score may not reflect the most recent changes to your credit card balance and credit limit. 1 . The balance and credit limit as of your credit card account statement closing date is what's used to calculate your credit score.

Why do people have credit cards?

Credit cards provide the ability to build a credit record and receive a credit score, along with many other benefits. If you have a high credit utilization on your cards, however, you might find yourself with lower credit scores, a more difficult time making larger monthly payments, and a higher interest rate on your cards if you make any payments late.

What is the balance and credit limit on a credit card statement?

The balance and credit limit as of your credit card account statement closing date is what's used to calculate your credit score.

How to manage credit card utilization?

To manage your credit utilization, especially if your credit cards get a good workout each month, one of the easiest things to do is to set up balance alerts that notify you if your balance exceeds a certain preset limit. Besides keeping an eye on your balances, you can take a number of other steps:

How to calculate credit utilization ratio?

To calculate your credit utilization ratio use this simple formula: Divide your total debt on revolving credit by your total available credit limit on your revolving accounts.

How many credit lines can you add to your credit score?

You can add up to five credit lines, their balances and credit limits to calculate your total credit utilization. Your credit utilization ratio is an important factor in determining your credit score.