How does a bank measure interest rate exposure?

There are many methods used for measuring exposure to interest rates. Three of the more widely used methods used are 1) gap analysis models, 2) economic value of equity / net economic value models and 3) net interest income simulation models.

Is a measure of interest rate sensitivity of a bond?

Bond duration is a measure of the degree to which a bond investment is likely to change in value if interest rates were to rise or fall. The higher the number, the more sensitive your bond investment will be to changes in interest rates.

What are measures of interest rate?

The interest rate is the amount a lender charges a borrower and is a percentage of the principal—the amount loaned. The interest rate on a loan is typically noted on an annual basis known as the annual percentage rate (APR).

What is considered interest sensitive?

An interest sensitive stock is a stock that is especially influenced by changes in interest rates. Financial institutions, highly leveraged businesses, and companies that pay high dividends are all examples of interest sensitive stocks.

What is the most accurate measure of interest rates?

yield to maturity (YTM)The concept known as yield to maturity (YTM) is the most accurate measure of interest rates.

Can sensitivity be measured?

Sensitivity is an absolute quantity, the smallest absolute amount of change that can be detected by a measurement. Consider a measurement device that has a ±1.0 volt input range and ±4 counts of noise, if the A/D converter resolution is 212 the peak-to-peak sensitivity will be ±4 counts × (2 ÷ 4096) or ±1.9 mV p-p.

What are the 3 factors that determine your interest rate?

Here are seven key factors that affect your interest rate that you should knowCredit scores. Your credit score is one factor that can affect your interest rate. ... Home location. ... Home price and loan amount. ... Down payment. ... Loan term. ... Interest rate type. ... Loan type.

Which is the most common measure of interest rate risk?

The most common model to measure long-term IRR is an economic value of equity (EVE) analysis.

What are the 4 factors that influence interest rates?

Interest rate levels are a factor in the supply and demand of credit. The interest rate for each different type of loan depends on the credit risk, time, tax considerations, and convertibility of the particular loan.

How can I lower my interest rate sensitivity?

Interest rate risk can be reduced by buying bonds with different durations, or by hedging fixed-income investments with interest rate swaps, options, or other interest rate derivatives.

What are examples of interest sensitive assets?

Rate sensitive assets are bank assets, mainly bonds, loans and leases, and the value of these assets is sensitive to changes in interest rates; these assets are either repriced or revalued as interest rates change.

What is an unreasonable interest rate?

The term usury rate refers to a rate of interest that is considered to be excessive as compared to prevailing market interest rates. They are often associated with unsecured consumer loans, particularly those relating to subprime borrowers.

What is the sensitivity of a bond?

Sensitivity refers to the impact on a security given a change in some relevant factor. A bond, for instance is measured by its price sensitivity to interest rate changes (its duration), as well as the duration's sensitivity itself to changes in rates (its convexity).

What measures the interest rate risk of a bond?

Interest rate risk is measured by a fixed income security's duration, with longer-term bonds having a greater price sensitivity to rate changes. Interest rate risk can be reduced through diversification of bond maturities or hedged using interest rate derivatives.

How do you measure the sensitivity of a measurement?

Find the percentage change in the output and the percentage change in the input. The sensitivity is calculated by dividing the percentage change in output by the percentage change in input.

Is Delta same as DV01?

The DV01 is analogous to the delta in derivative pricing (one of the "Greeks") – it is the ratio of a price change in output (dollars) to unit change in input (a basis point of yield). Dollar duration or DV01 is the change in price in dollars, not in percentage.

What Is Interest Rate Sensitivity?

Interest rate sensitivity is a measure of how much the price of a fixed-income asset will fluctuate as a result of changes in the interest rate environment. Securities that are more sensitive have greater price fluctuations than those with less sensitivity.

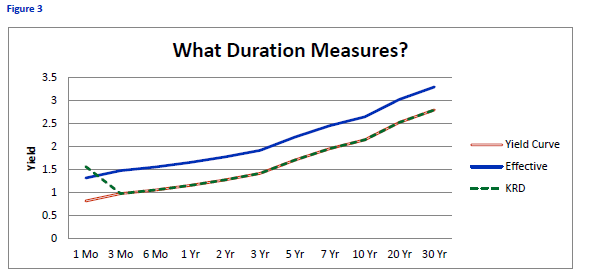

What is effective duration?

The effective duration is used to calculate the duration of bonds with embedded options. It determines the approximate price decline for a bond if interest rates rise instantaneously by 1%. The key rate duration determines a fixed-income security's or fixed-income portfolio's duration at a specific maturity on the yield curve.

How do interest rates affect fixed income?

Fixed-income securities and interest rates are inversely correlated. Therefore, as interest rates rise, prices of fixed-income securities tend to fall . When applied to calculate fixed income securities, interest rate sensitivity is known as the asset's duration. This is one way to determine how interest rates affect a fixed-income security portfolio. The higher a bond or bond fund's duration, the more sensitive the bond or bond fund to changes in interest rates.

How does maturity affect interest rates?

Generally, the longer the maturity of the asset, the more sensitive the asset to changes in interest rates. Changes in interest rates are watched closely by bond and fixed-income traders, as the resulting price fluctuations affect the overall yield of the securities. Investors who understand the concept of duration can immunize their fixed-income portfolios to changes in short-term interest rates.

Why is the duration of a bond important?

The higher a bond or bond fund's duration, the more sensitive the bond or bond fund to changes in interest rates. The duration of fixed-income securities gives investors an idea of the sensitivity to potential interest rate changes. Duration is a good measure of interest rate sensitivity because the calculation includes multiple bond ...

What is more sensitive, a bond or a fixed income instrument?

Securities that are more sensitive have greater price fluctuations than those with less sensitivity. This type of sensitivity must be taken into account when selecting a bond or other fixed-income instrument the investor may sell in the secondary market. Interest rate sensitivity affects buying as well as selling.

What is modified duration?

The modified duration is a modified calculation of the Macaulay duration that incorporates yield to maturity (YTM). It determines how much the duration would change for each percentage point change in the yield.

Why are callable bonds unpredictable?

But the bottom line is, the future cash flows from a callable bond are unpredictable, because they depend on what happens with interest rates. So bond wizards developed a more complicated measure of interest-rate sensitivity for callable bonds called effective duration.

What is bond duration?

Duration, measured in years, is the amount of time it will take for a bond investor to receive half of the present value of all future cash flows (coupon payments and principal repayment) from the bond.

What is TSC fixed income forum?

TSC Fixed-Income Forum aims to provide general bond information. Under no circumstances does the information in this column represent a recommendation to buy or sell bonds, funds or other securities.

How much will a bond increase in price?

A bond with a duration of 6 years will increase in price by about 6% if its yield sheds 100 basis points, and decrease in price by about 6% if its yield rises by 100 basis points.

What is effective duration?

Effective duration takes into account the fact that as interest rates change, cash flows will change as well. Obviously, it involves assumptions about how much a given change in interest rates will affect cash flows, and as such, it's part science, part art. Average life, the subject of your question, is a predecessor of effective duration ...

How long does a mortgage last?

A pool of 30-year mortgages can have an average life ranging from less than five years to more than 20, depending on how fast a rate of prepayments is assumed.

Is a mortgage payment a principal or interest?

That makes them some of the most complicated income securities to analyze. In addition, because every mortgage payment a homeowner makes is part interest, part principal, mortgage investors receive payments that are part interest, part principal.

How does interest rate affect bond prices?

To understand rate sensitivity, you first must understand how interest rates affect bond prices. A typical bond pays a fixed amount of interest each year, called the annual coupon, until maturity. If prevailing interest rates rise after the bond is issued, newer bonds will pay higher coupons than the older one. Since the older bond is now less desirable than the new ones, its price falls. This is the general rule: When interest rates go in one direction, bond prices go in the other. Interest rate sensitivity tells you how much the bond price will change.

How to calculate the current yield on a bond?

One other important term to understand is yield. The current yield on a bond is its annual coupon divided by its current price. If the current price is equal to the face value, which is often the case for newly issued bonds, then the yield is equal to the fixed interest rate of the bond. A 6 percent bond with a face value of $1,000 and a price of $1,000 will have a current yield of 6 percent. A higher price would lower the yield; a lower price would raise the yield. For example, if the price fell to $960, the yield would rise to $60/$960, or 6.25 percent.

How does a bond work?

When you buy one, you pay the current price of the bond in return for periodic interest payments, or "coupon payments," and return of the bond's face value at a specified maturity. For example, a 10-year, 6 percent bond with a face value of $1,000 will pay you interest of $60 a year until maturity in 10 years, and then pay you the face value of $1,000. Rate sensitivity measures how much the price of the bond would change due to interest rate changes, which is important if you plan to sell the bond before maturity. On the day of maturity, the price will always equal the face value.

What is the current yield on a bond?

One other important term to understand is yield. The current yield on a bond is its annual coupon divided by its current price. If the current price is equal to the face value, which is often the case for newly issued bonds, then the yield is equal to the fixed interest rate of the bond.

What is bond loan?

A bond is a loan. When you buy one, you pay the current price of the bond in return for periodic interest payments, or "coupon payments," and return of the bond's face value at a specified maturity.

What is rate sensitivity?

Rate sensitivity measures how much the price of the bond would change due to interest rate changes, which is important if you plan to sell the bond before maturity. On the day of maturity, the price will always equal the face value. Advertisement.

How to measure interest rate sensitivity?

But you can get a good estimate of sensitivity by remembering that if interest rates change by 1 percentage point, a bond's price will change in the opposite direction by about 1 percent for each year until maturity.

How to Measure Muni Bond Interest Rate Sensitivity?

In particular, interest rate risks are a major concern for the fixed-income asset class, including muni bonds. Rising interest rates can put downward pressure on bond prices by forcing yields higher, while falling interest rates can have the opposite effects .

What does a duration of four mean?

A duration of four, for instance, means that a 1% change in interest rates would lead to a 4% drop in the bond’s price. Higher durations imply greater sensitivity to interest rates and lower durations imply lower sensitivity to interest rates.

What does duration mean in bond?

Duration is a number that represents a bond’s sensitivity to changes in short-term interest rates.

What are the short term risks of municipal bonds?

Short-Term Risks. Municipal bonds have a fixed face value that’s paid at the maturity date along with interest accrued over the holding period. However, the market price of a bond at any given point in time reflects a number of risks, including interest rate risk.

How does convexity work?

Positive convexity works in an investor’s favor since the price becomes less sensitive to interest rates when yields rise than when yields decline. On the other hand, negative convexity means that duration increases as yields rise, working against an investor’s best interests.

What are the risks of muni bonds?

In particular, interest rate risks are a major concern for the fixed-income asset class, including muni bonds. Rising interest rates can put downward pressure on bond prices by forcing yields higher, while falling interest rates can have the opposite effects.

Is municipal bond risky?

Municipal bonds are widely considered to be less risky than corporate bonds, but investors should keep in mind interest rate risks. Using the concepts of duration and convexity, investors can get an idea of how much risk they may see in the future based on expectations for interest rates. Muni bonds may be less exposed to this risk than many other types of bonds, however, making them an attractive asset class.

What Is Interest Rate Sensitivity?

- Interest rate sensitivity is a measure of how much the price of a fixed-income asset will fluctuat…

This type of sensitivity must be taken into account when selecting a bond or other fixed-income instrument the investor may sell in the secondary market. Interest rate sensitivity affects buying as well as selling. - Interest rate sensitivity is how much a fixed-income asset price moves with changes in interest r…

Interest rates and fixed-income asset prices are inversely correlated.

How Interest Rate Sensitivity Works

- Fixed-income securities and interest rates are inversely correlated. Therefore, as interest rates ri…

The duration of fixed-income securities gives investors an idea of the sensitivity to potential interest rate changes. Duration is a good measure of interest rate sensitivity because the calculation includes multiple bond characteristics, such as coupon payments and maturity.

Types of Interest Rate Sensitivity

- There are four widely used duration measurements to determine a fixed-income security's intere…

The modified duration is a modified calculation of the Macaulay duration that incorporates yield to maturity (YTM). It determines how much the duration would change for each percentage point change in the yield.

Example of Interest Rate Sensitivity

- One widely used measure to determine the interest rate sensitivity is the effective duration. For …

Likewise, a trader can look at a particular corporate bond with a maturity of six months and a duration of 2.5. If interest rates fall 0.5%, the trader can expect that the bond's price to rise by 1.25%.