To calculate the total manufacturing cost, add up the direct material costs, direct labor costs, and manufacturing overhead costs:

- 1. Begin with direct material costs. Direct material costs directly relate to the finished products manufactured by a company. ...

- 2. Add direct labor costs. Direct labor costs include payroll taxes and wages for workers in the production process. ...

- 3. Add cost of manufacturing overhead. The overhead expenses is everything else necessary to keep the business running. ...

How do you calculate the total manufacturing cost?

- Direct materials. Add the total cost of materials purchases in the period to the cost of beginning inventory, and subtract the cost of ending inventory.

- Direct labor.

- Overhead.

- Add together the totals derived from the first three steps to arrive at total manufacturing cost.

How to calculate the total manufacturing cost of a product?

Total Manufacturing Cost Formula

- Where MC is the total manufacturing cost

- RM is the raw material cost

- DL is the direct labor cost

- OH is the manufacturing overhead cost

How to determine manufacturing costs properly?

You can use total manufacturing cost calculators when doing operational analysis, including:

- Seeing where expenses are too high or where to invest more

- Reducing direct material costs

- Streamlining operations to save time and labor costs

- Determining inventory totals at the end of a period and their carrying costs to store

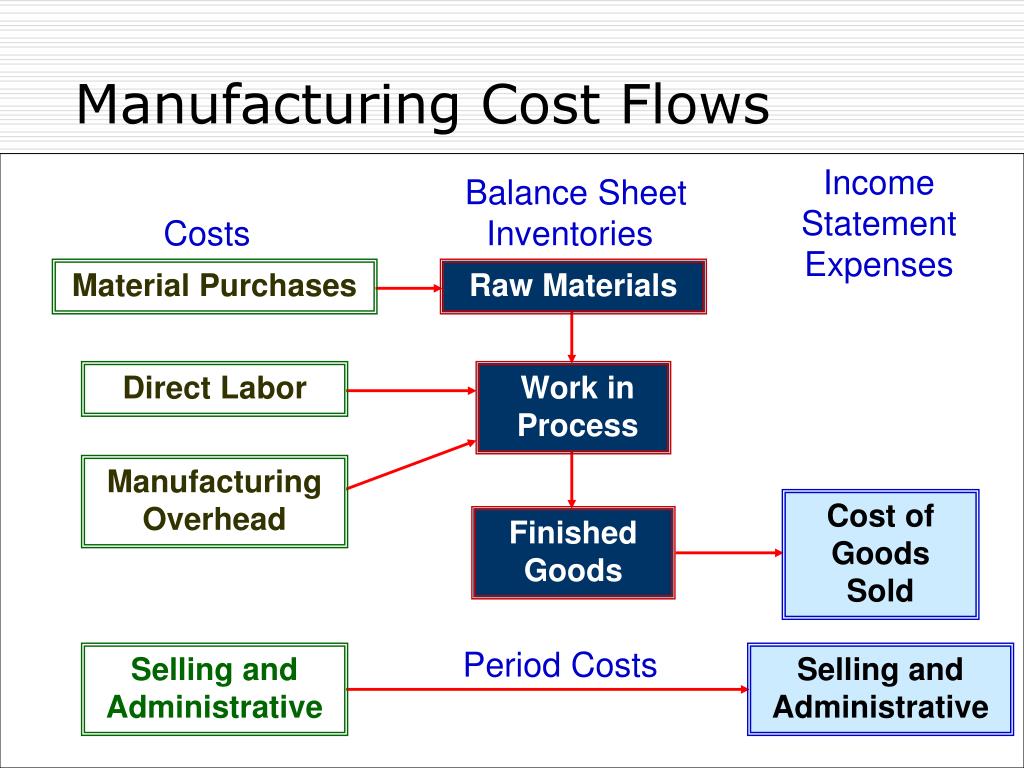

- Accounting for balance sheet inventory and cost of goods sold on income statements

How to find total manufacturing cost formula?

How to calculate manufacturing cost. The formula that you use to calculate manufacturing cost is: Manufacturing cost = raw materials + labor costs + allocated manufacturing overhead. Here are the basic steps you should use to calculate manufacturing cost: 1. Determine the cost of raw materials. Start by determining the cost of all your raw materials.

What is included in manufacturing costs?

Manufacturing costs fall into three broad categories of expenses: materials, labor, and overhead. All are direct costs. That is, the salary of the company accountant or the accountant's office supplies are not included, but the salary and supplies of the foreman are.

How do you calculate manufacturing cost per unit?

Determining the unit cost of production is a simple matter of addition and division, using this formula: Cost per Unit = (Fixed Costs + Variable Costs) / Number of Units. Add the costs together and divide this amount by the number of units you produce: Add up the fixed costs for a specific period of time.

How do you calculate manufacturing cost on a balance sheet?

How to Calculate Total Manufacturing CostDirect materials. Add the total cost of materials purchases in the period to the cost of beginning inventory, and subtract the cost of ending inventory. ... Direct labor. ... Overhead. ... Add together the totals derived from the first three steps to arrive at total manufacturing cost.

How do you find total manufacturing costs added to work in the process?

To calculate total manufacturing cost you add together three different cost categories: the costs of direct materials, direct labour and manufacturing overheads. Expressed as a formula, that's: Total manufacturing cost = Direct materials + Direct labour + Manufacturing overheads.

How do we calculate cost?

Economics 101: How To Calculate Average CostAverage Total Cost = Total Cost of Production / Quantity of Units Produced.Average Total Cost = Average Fixed Cost + Average Variable Cost.Average Total Cost = Total Cost of Production / Quantity of Units Produced.More items...

What are the 3 types of manufacturing?

There are three types of manufacturing production process; make to stock (MTS), make to order (MTO) and make to assemble (MTA).

How do you calculate fixed manufacturing costs?

Take your total cost of production and subtract your variable costs multiplied by the number of units you produced. This will give you your total fixed cost.

How does a manufacturing company calculate cost of goods sold?

Calculation of the Cost of Goods Sold for a Manufacturer Equals: Finished Goods Available for Sale. Subtract: Ending Inventory of Finished Goods. Equals: Cost of Goods Sold.

How do you calculate labor cost in manufacturing?

For example, one simple formula for calculating labor costs in the manufacturing and construction industries involves multiplying a workers' hourly rate by the time that worker takes to complete production of a single unit of work (a manufacturer's product or a construction task, for instance), resulting in a per-unit ...

Which of these is not included in the total manufacturing cost?

Manufacturing overhead does not include administration wages, sales, marketing, office rent, or other staff salaries. The Total Manufacturing Cost is also used to calculate the Cost of Goods Manufactured (COGM) and the Cost of Goods Sold (COGS).

How do you calculate total variable manufacturing cost?

To calculate variable costs, multiply what it costs to make one unit of your product by the total number of products you've created. This formula looks like this: Total Variable Costs = Cost Per Unit x Total Number of Units.

How do you calculate manufacturing cost per unit in Excel?

Production Cost per Unit = Product Cost / Production VolumeProduction Cost per Unit = $10.5 million / 3.50 million.Production Cost per Unit = $3 per piece.

How do you calculate cost per unit example?

How to calculate cost per unit?Cost per unit = (Total fixed costs + Total variable costs) / Total units produced.Total fixed cost = Building rent + Direct labor costs + Other fixed costs.Total variable cost = Production costs + Customer acquisition costs + Packaging costs + Shipping costs + Other variable costs.More items...•

How do you calculate manufacturing cost per unit in Excel?

Production Cost per Unit = Product Cost / Production VolumeProduction Cost per Unit = $10.5 million / 3.50 million.Production Cost per Unit = $3 per piece.

How do you calculate manufacturing overhead cost per unit?

In order to know the manufacturing overhead cost to make one unit, divide the total manufacturing overhead by the number of units produced. The total manufacturing overhead of $50,000 divided by 10,000 units produced is $5.

How do you calculate average fixed manufacturing cost per unit?

Obtain the total quantity of products produced within the chosen period: The total quantity of goods produced should be within the same period for which the costs were accrued. Divide the total fixed cost by the quantity produced: This will give you the average fixed cost per unit.

What are total manufacturing costs?

Total manufacturing costs are how much a company spends to make a finished product and inventory during a set time. Often reviewed quarterly or annually, the total manufacturing cost is an accounting calculation that examines each department or operational phase and their cost of operation.

How to calculate materials cost?

To calculate the costs of materials, figure out how much was on hand to start, how much extra was bought and how much remains after production with this formula: Beginning inventory + added purchases – ending inventory = direct materials cost. 2.

What are some examples of overhead costs in manufacturing?

Manufacturing overhead: Overhead costs include everything else needed to keep production running aside from direct materials. Utilities like water and electricity, maintenance or repair parts, depreciation of machinery and equipment, quality inspection of products, rent and insurance are examples of overhead items.

How does manufacturing affect the selling price of an item?

Consider how total manufacturing costs affect the selling price of an item, often called the manufacturer's suggested retail price, and ultimately a company's profit margins. Depending on the total manufacturing cost amount, managers and business owners can cut operational costs, improve profitability or lower a suggested price for consumers.

What are the stages of manufacturing?

March 23, 2021. There are three stages of the manufacturing process: raw materials, work in progress and finished products . The total manufacturing cost looks at how much each of those phases costs to calculate the complete cost of making a product. Monitoring the total manufacturing cost simplifies expenses for better understanding ...

How to figure out overhead costs?

To figure out overhead costs, add together all factors that keep production going, both direct and indirect. Some examples of direct overhead costs include facility rent, mortgage and property taxes. Indirect overhead costs might be special oil for equipment and machinery, label printing or factory supplies.

How to measure cost of labor?

To measure the cost of labor, compile the expense of all labor wages for the set period, including related payroll taxes and benefits compensation. Cost of labor covers both variable hourly wages and fixed salaried wages, though only for employees who work directly with production.

What is total manufacturing cost?

Total manufacturing cost is the total expenses related to all resources used in the process of creating a finished product. Calculating total manufacturing cost requires an accurate analysis of your company’s different departments to identify how they contribute to the manufacturing process and the associated costs. This involves detailed accounting of the cost of all materials, overhead and labour, to identify the manufacturing costs of finished goods in their entirety.

How to calculate manufacturing overhead?

To do this, divide the monthly manufacturing overhead by the value of your monthly sales, multiplying that by 100.

What are indirect costs in manufacturing?

Manufacturing overhead is an indirect cost and includes: 1 Taxes and depreciation on the manufacturing facilities 2 Depreciation on manufacturing plant and equipment 3 Salaries of employees such as managers, supervisors, quality control staff and maintenance teams 4 The material cost of repairs and maintenance 5 Utility costs such as electricity and gas used in the manufacturing facility

What does low manufacturing overhead mean?

A low manufacturing overhead rate indicates that your manufacturing operations are utilising resources efficiently and effectively.

What is the difference between direct and indirect costs?

The key difference between direct costs and indirect costs is that direct costs can be tracked to specific item, and tend to be variable. Examples of direct costs include direct labour, materials, wages, commissions, and manufacturing supplies. Indirect costs are likely to be fixed costs that include rent, insurance, quality control costs, ...

Why is there waste in manufacturing?

Reduce waste. A primary cause of waste in manufacturing is overproduction. Producing too much stock in advance means you are spending a lot more on direct material costs. Equally, you will also incur the costs of holding excess inventory stock or risk being left with stock you cannot sell.

How does tracking manufacturing cost help a business?

By reducing total manufacturing costs, businesses become more productive. In short, tracking total manufacturing cost can reveal how well a business is operating.

What is materials cost?

Materials costs. This is the cost of all of the raw materials used to create your finished product. These can be direct, such as prefabricated pipes that will be used to fabricate finished equipment. These can also be indirect, such as the palettes and bands used to safely store the pipes. Labor costs.

What happens if you don't know your manufacturing costs?

Any manufacturing executive will tell you that if you don’t have adequate data on your manufacturing costs, there’s no way to know whether you will hit your revenue targets. If you don’t know how to calculate the cost of production, you also won’t know whether your production process is as efficient as it could be.

What is manufacturing overhead?

Manufacturing overhead. This is the broader category of costs that are neither direct materials or workers, and is more difficult to accurately project. It can include utility costs, tariffs, leased properties and equipment, as well as service costs.

Is labor cost direct or indirect?

Labor costs. These costs can be direct, such as the salaries of those workers who are on the production line. But they can also be indirect, such as the costs of those who deliver raw goods to your factory.

Identifying your manufacturing costs

Before you're able to dive into specific numbers, it’s essential to know which areas of the business impact your balance sheet. Some of these items directly influence production costs, whereas others do so indirectly.

How to calculate manufacturing costs

Although slightly complex, calculating manufacturing costs follows some basic mathematical principles. It requires you to sum up the cost of materials as well as labor. Furthermore, you need to work out the more convoluted overhead costs.

Five effective ways to reduce manufacturing costs

Reducing manufacturing costs plays a central role in moving your books further into the black.

How to reduce your cost of quality

We've written about reducing cost of quality ad nauseam in previous blog posts and webinars. Since the advent of Industry 4.0 (and subsequently, Quality 4.0), the market has been flooded with solutions designed to help manufacturers better track production, streamline quality management, and increase efficiency.

How to calculate total manufacturing cost per unit?

To determine the total manufacturing cost per unit, you need to divide your total manifesting costs by the total number of units produced during a given period. For instance, if your business made 2 million units in 2017 and incurred total production costs of $10 million in the said year, then the total manufacturing cost per unit of the year is $5.

How to calculate per unit cost?

To determine per unit cost of a product, you first have to calculate the total manufacturing cost of all the items manufactured during the given period. Then, divide the estimated value by the number of items. The end figure you obtain is one unit’s manufacturing cost. Understanding and calculating the total manufacturing cost is necessary as you can compare it to the total revenue generated, and you use it to determine your company’s profitability. This is especially crucial for small businesses lacking the privilege of a financial safety net. The most basic formula for determining total manufacturing costs is to add up all costs of direct materials, direct labor, and manufacturing overhead consumed during a given period, as follows:

What are the utilities of manufacturing?

Utilities: Any utilities that mainly keep the entire manufacturing facility operational are simply part of the manufacturing overhead costs. Such costs typically include water, sewage, electricity, telephone, and internet services.

Why is it important to know how much it costs to make a unit of a commodity?

Knowing how much it costs your business to make a unit of a commodity helps you price them appropriately so that you can not only cover your costs but also make a potential profit. Thus, determining the value to set a fair price is as necessary as doing bookkeeping to preparing financial statements. However, raw materials cost is not the only ...

What is direct materials?

Direct materials are, typically, all the raw materials and elements that go into the finished product. If your company manufactures wooden furniture, expenses would include the wood in the furniture and the glues, nuts, bolts, and screws needed to hold the entire piece of furniture together.

Is depreciation considered manufacturing overhead?

Depreciation: The loss of value of assets due to their obsolesce or usage is depreciation. This also has to be considered for manufacturing overheads. Stolen Assets: The money lost through any stolen assets almost have to be accounted for manufacturing overhead.

Is raw material cost the only factor to consider when calculating the total manufacturing cost per unit?

However, raw materials cost is not the only element to consider when calculating the total manufacturing cost per unit. Direct labor and manufacturing overheads are also equally important.

How to get total manufacturing costs?

To get your total manufacturing costs, add your labor, material, outside services, and overhead. It’s not difficult if you have proper upstream processes, and tools in place to ensure all information is captured.

Why do companies want to know their manufacturing costs?

Not only do they want to know these costs, but they want to trust the numbers are accurate, and be able to make important business decisions with that knowledge. We talk to numerous companies that are profitable, yet don’t know their true manufacturing costs. They make money, but they struggle to identify areas where they could improve, quantify whether a product or customer is profitable, and make decisions about where they should focus attention to attain added improvement. Their data is like having a scoreboard, but no statistics to show the story of the game.

How to calculate manufacturing overhead?

That is your calculation of total manufacturing overhead costs, and it can be broken down by month, quarter, year, etc. To calculate your overhead rate, divide your monthly overhead costs by your total monthly sales, and multiply that number by 100.

How to capture material costs?

Capturing material costs is typically done in a couple ways. Many of our custom engineer and make-to-order customers often buy inventory directly to the job/project. The material arrives and goes directly into WIP at the purchase price. That’s easy and direct.

What are the four categories of manufacturing costs?

You need to account for four categories to have accurate manufacturing costs: labor, materials, outside services, and overhead. You also need to have processes and mechanisms in place to capture or validate those costs, regardless of the costing method you choose. Typically, many of our “to order” manufacturers choose to use actual costs as their validation. However, we see other manufacturers choose standard or average costs. Whatever type of cost you choose, the goal is to establish standards to measure against, and we want to get the standards as close to reality as possible.

How to drive labor costing?

The labor component of costing should be driven by actual time involved on the production floor, captured as the in-process product moves from operation to operation. You may want to start with capturing data in a detailed manner, including setup time, operation time, inspection time, transfer time, and then repeat the process as products move through the production line. If you have no current labor collection processes, then you may want to start simpler. The Visual South team can guide you through the best practices and process for your situation.

What is marginal cost formula?

Marginal Cost Formulas Marginal Cost FormulaThe marginal cost formula represents the incremental costs incurred when producing additional units of a good or service. The marginal cost

Why is it important to have a schedule for cost of goods manufactured?

In general, having the schedule for Cost of Goods Manufactured is important because it gives companies and management a general idea of whether production costs are too high or too low relative to the sales they are making.

Why is COGM Important for Companies?

In general, having the schedule for Cost of Goods Manufactured is important because it gives companies and management a general idea of whether production costs are too high or too low relative to the sales they are making.

What is finished goods inventory?

Finished Goods Inventory, as the name suggests, contains any products, goods, or services that are fully ready to be delivered to customers in final form. The following T-account shows the Finished Goods Inventory. Beginning and ending balances must also be considered, similar to Raw materials and WIP Inventory.

What is COGM in accounting?

Just like the name implies, COGM is the total cost incurred to manufacture products and transfer them into finished goods inventory for retail sale. To learn more, launch CFI’s free accounting courses!

What is raw materials inventory?

Raw materials inventory refers to the inventory of materials that are waiting to be used in production. For example, if a company were to make a raw material purchase for use, these would be recorded in the debit side of the raw materials inventory T-Account.

Which side of WIP inventory is COGM?

With this information, we can solve for COGM, which is on the credit side of the WIP Inventory T-Account.

How to calculate unit cost?

It is calculated by adding fixed and variable expense and dividing it by the total number of units produced. read more.

What is the cost of goods manufactured?

Cost of goods manufactured is the total production cost of goods produced and completed by the company during an accounting period. Typically, businesses whose principal line of business is manufacturing create a separate schedule to calculate the cost of goods manufactured in order to determine their cost-effectiveness.

What is labor cost?

Here we are not given directly Material and Labor Cost Labor Cost Cost of labor is the remuneration paid in the form of wages and salaries to the employees. The allowances are sub-divided broadly into two categories- direct labor involved in the manufacturing process and indirect labor pertaining to all other processes. read more. We need to compute the same first.

What is the new weapon Starc Industries makes?

Starc industries have started to manufacture a new product called “Avenger Sword.” It will be used during war times and is designed in such a way that it can be used as a sword and as well as a shield. However, being a nonprofit organization, they are not worried about its pricing. But in order to continue production, they need to at least recover the cost. Hence the management of the starc industries has asked the production department to send over the cost incurred while producing the newly invented product “Avenger Sword.”

What Is The Total Manufacturing Cost?

How to Calculate Total Manufacturing Cost

- The formula used to calculate total manufacturing cost is: Total manufacturing cost = raw materials + labor costs + allocated manufacturing overhead. Here are the basic steps you should take to calculate the total manufacturing cost:

Total Manufacturing Cost Formula

- Simply add the aforementioned three key costs from the specified financial period to find the total manufacturing cost. As a result, the total manufacturing cost formula is as follows: The formula to calculate the total manufacturing cost is as follows:

Frequently Asked Questions

- Related Articles

1. PRODUCT COST: Definition Examples, Formula, and Calculation 2. CONVERSION COST: Definition, Formula, and Calculations 3. STANDARD COST: Definition, Benefits, and Limitations 4. INDIRECT LABOR: Definition, Examples, and Costs 5. What Is Prime Cost: Formula and How To …