Here are three steps for how to calculate variable cost per unit:

- Find the per-unit cost of output A per-unit cost includes the expense required to produce, store and ship a single unit of a product. ...

- Find the total quantity of units of output Determine how many units of product or output the company is producing at a given time. ...

- Use the variable cost formula

What is the formula for calculating variable cost?

Sep 24, 2019 · Formula for Variable Costs Total Variable Cost = Total Quantity of Output x Variable Cost Per Unit of Output Variable vs Fixed Costs in Decision-Making Costs incurred by businesses consist of fixed and variable costs. As mentioned above, variable expenses do not remain constant when production levels change.

How is the formula for total variable cost determined?

The formula used to calculate the variable cost is: Total variable cost = Total quantity of output x Variable cost per unit of output Also Read: What is the Average Fixed Cost? Where is it mostly used? In a business, the variable cost is mostly used and is an integral part while analysing the company’s break-even point. The break-even analysis is applied to scan the revenue or the unit …

How to estimate fixed cost and variable cost?

Feb 09, 2019 · Variable Cost Per Unit is calculated as: Variable Cost Per Unit = Labor Cost Per Unit + Direct Material Per Unit + Direct Overhead per Unit

How to determine variable and marginal cost?

Mar 09, 2021 · Total variable cost = Total quantity of output x Variable cost per unit of output A per-unit cost includes the expense required to produce, store and ship a single unit of a product or service. These costs can include material, overhead and labor. A company's unit cost is important in understanding how well its overall operations perform.

What is a Variable Cost?

A variable cost is the expense that changes with the decrease and increase of the production output of a company. Variable costs differ with the volume of the output produced. Most of the basic variable costs are:

Where is it mostly used?

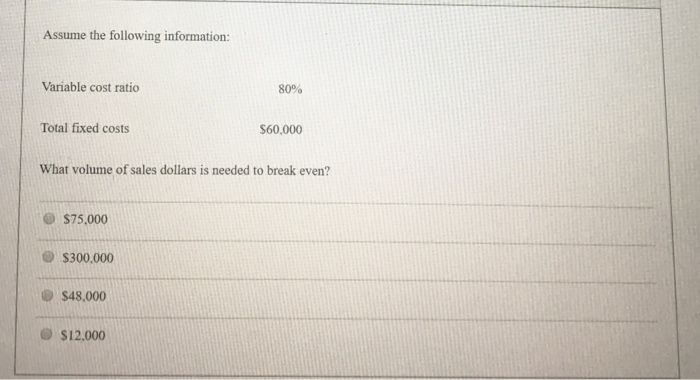

In a business, the variable cost is mostly used and is an integral part while analysing the company’s break-even point. The break-even analysis is applied to scan the revenue or the unit that has to be sold to cover the total cost.

What is variable costing?

Variable costing is the expense that changes in proportion with production output. We can say that expenses depend on the output with a change in the output of production input expense change. If variable cost increases, production output also increases and if variable cost decreases, product output also decreases.

What is break even analysis?

The break-even analysis is a vital application of variable costing. It helps to find the amount of revenue or the units required to cover the total costs of the product. Break-even points in units are fixed cost divided by sales price per unit minus variable cost per unit. The formula can be written as:-

Why is variable cost important?

Understanding variable costs is an important asset to determining potential profit margins for a company. Variable costs earned their name due to their ability to fluctuate. Businesses can calculate variable costs to adjust where necessary as these fluctuations occur.

Do variable and fixed costs change?

Both variable and fixed costs make up total expenses. Fixed costs do not change in tandem with production. Even if production halts, fixed costs continue. Common examples include rent, depreciation, salaries and property taxes. Alternatively, variable costs change with the flow of production.

What is direct materials cost?

Direct materials cost. This type of cost refers to any raw materials necessary to create a product. To designate a material into this category, it should be identifiable, quantifiable and tangible. Examples include grains, meat, steel and wood.

Why are commissions considered variable costs?

The primary reason they would do so is an increase in production. Therefore, commissions should be considered variable costs.

Why is piece rate labor considered variable?

It's considered a variable cost because pay varies depending on employee performance. Piece rate labor is often seen in circumstances where quality significantly outweighs quantity.

What happens to variable costs when production increases?

If production halts, there are no variable costs. When production increases, fixed costs reduce per-unit costs. This is commonly referred to as diminishing marginal cost.

What is a per unit cost?

A per-unit cost includes the expense required to produce, store and ship a single unit of a product or service. These costs can include material, overhead and labor. A company's unit cost is important in understanding how well its overall operations perform. It can help determine if a product can be produced more efficiently.

What is variable cost?

Variable cost is a production expense that increases or decreases depending on changes in a company’s manufacturing activity. For example, the raw materials used as components of a product are considered variable costs because this type of expense typically fluctuates based on the number of units produced.

Why are packaging materials variable costs?

The materials that are used for packaging goods may be considered variable costs because the amount used may vary depending on the volume of sales and production. Some companies opt to reduce the number of packaging materials used for a product when the production volume or sales volume decreases.

Is freight out a variable cost?

Freight out is therefore considered a variable cost. Shipping costs are the expenses that a company incurs when transporting raw materials or delivering finished products from one location to another. These materials and products may be transported by land, sea or by air.

What is shipping cost?

Shipping costs are the expenses that a company incurs when transporting raw materials or delivering finished products from one location to another. These materials and products may be transported by land, sea or by air. Shipping costs tend to vary depending on the company’s sales and production volumes.

What is direct materials?

Direct materials are the inventory of raw materials purchased by a manufacturing or retail company to create finished goods or merchandise. Direct materials cost is, therefore, the cost of all the items used in the manufacture of a product. These tangible materials should all be measurable and identifiable as contributing to the product.

What is piece rate labor?

Piece-rate labor. This is the amount that workers get paid for every unit they complete or sell. Employee input typically determines the cost of piece-rate labor. This cost also increases or decreases along with the rate of production.

What is production supply?

Production supplies are the indirect raw materials needed during the manufacturing or assembly process. One example is machine oil, which is difficult to measure based on how much or how often the machines are used. Because the cost of machine oil varies with production volume, it can be considered a variable cost.

What is variable cost?

Key Takeaways. A variable cost is an expense that changes in proportion to production output or sales. When production or sales increase, variable costs increase; when production or sales decrease, variable costs decrease. Variable costs stand in contrast to fixed costs, which do not change in proportion to production or sales volume.

What are some examples of variable costs?

Examples of variable costs include a manufacturing company's costs of raw materials and packaging—or a retail company's credit card transaction fees or shipping expenses, which rise or fall with sales. A variable cost can be contrasted with a fixed cost .

What is variable cost of production?

The variable cost of production is a constant amount per unit produced. As the volume of production and output increases, variable costs will also increase. Conversely, when fewer products are produced, the variable costs associated with production will consequently decrease. 1. Examples of variable costs are sales commissions, direct labor costs, ...

What is fixed cost?

Fixed costs are expenses that remain the same regardless of production output. Whether a firm makes sales or not, it must pay its fixed costs, as these costs are independent of output. 1

How can a company increase its profits?

A company can increase its profits by decreasing its total costs. Since fixed costs are more challenging to bring down (for example, reducing rent may entail the company moving to a cheaper location), most businesses seek to reduce their variable costs. Decreasing costs usually means decreasing variable costs. 2.

Will Kenton be an investor?

Will Kenton has 10 years of experience as a writer and editor. He developed Investopedia's Anxiety Index and its performance marketing initiative. He is an expert on the economy and investing laws and regulations. Will holds a Bachelor of Arts in literature and political science from Ohio University. He received his Master of Arts in economics at The New School for Social Research. He earned his Master of Arts and his Doctor of Philosophy in English literature at New York University.