When should I buy homeowners insurance before closing?

Prior to closing on a home mortgage, your lender will require that you purchase homeowners insurance It is generally recommended that you start shopping around for homeowners insurance and comparing policies anywhere from three weeks to a month in advance of the closing date

When should I start looking for home insurance?

Most mortgage lenders require proof of homeowners insurance before they’ll let you close on a home. Start looking for home insurance three weeks to a month before your actual closing date. This gives you plenty of time to compare coverage options and rates.

When do mortgage lenders want proof of homeowners insurance?

Generally, mortgage lenders want you to have proof of homeowners insurance at least three business days before the closing date of your new home. Some insurers demand proof of coverage weeks before closing to allow the lender to review the policy.

How far in advance should I compare homeowners insurance policies?

It is generally recommended that you start shopping around for homeowners insurance and comparing policies anywhere from three weeks to a month in advance of the closing date Most lenders will require that you provide proof of homeowners insurance a minimum of three business days out from the closing date

What is the effective date for homeowners insurance?

An effective date is the time, day, month, and year when your insurance coverage becomes active. It also marks when you'll have to pay your monthly premium for the first time.

What is the first step to consider when buying homeowners insurance?

The first step in selecting a homeowners policy is figuring out how much insurance you actually need. There are several individual costs you'll need to break down to get an accurate estimate. The most important figure to consider is how much money it would take to rebuild your home if it was completely destroyed.

Why do you prepay homeowners insurance?

Why do you prepay for homeowners insurance? Some mortgage lenders may require you to prepay for homeowners insurance. Lenders do this for the same reason they require you to purchase homeowners insurance in the first place — to protect their financial investment in your home.

Is homeowners insurance paid through escrow?

Homeowners insurance can be paid through an escrow account or directly by you to your insurance company. An escrow account is a type of savings account managed by your lender that sets aside money for things like home insurance and property tax payments.

What are the four packages of homeowners insurance?

In short, homeowners insurance helps protect you, your home and your belongings from a variety of unexpected events. A standard policy includes four key types of coverage: dwelling, other structures, personal property and liability.

What is usually not covered by homeowners insurance?

Standard homeowners insurance policies typically do not include coverage for valuable jewelry, artwork, other collectibles, identity theft protection, or damage caused by an earthquake or a flood.

Do closing costs include homeowners insurance?

Is homeowners insurance included in closing costs? Your lender will require the first term of your homeowners insurance to be paid at closing.

Is homeowner insurance included in mortgage payment?

Some homeowners may think their home insurance is included in their mortgage because they make a single monthly payment that covers both their homeowners insurance premium and their monthly mortgage payment. However, homeowners insurance is not included in your mortgage.

What is the final step in the closing process?

The last step of the closing process is the actual legal transfer of the home from the seller to you. The mortgage and other documents are signed, payments are exchanged, and finally, the waiting is over: you get the keys.

How do I get rid of my PMI?

The only way to cancel PMI is to refinance your mortgage. If you refinance your current loan's interest rate or refinance into a different loan type, you may be able to cancel your mortgage insurance.

Can you pay home insurance with credit card?

Read our editorial standards. Escrow accounts are common alongside of a mortgage, but you can pay property taxes and insurance on your own. Most insurance companies accept credit cards for payments, as do counties for property taxes.

Should I pay off my escrow balance?

Padding your escrow account is a good idea if you have an adjustable-rate mortgage that will allow your interest rate to go up. On the other hand, paying on your principal will pay off your loan much quicker and build equity in your home. Both have advantages.

What should I look for when getting home insurance?

What to consider when buying your home insuranceBuildings insurance. ... Contents insurance for tenants. ... Contents insurance for students. ... Accidental damage. ... Specify your high-value items. ... Set your excess. ... Away-from-home cover. ... Think about your keys, gardens, and frozen food.More items...•

What is the most important part of homeowners insurance?

The most important part of homeowners insurance is the level of coverage. Avoid paying for more than you need. Here are the most common levels of coverage: HO-2 – Broad policy that protects against 16 perils that are named in the policy.

What are 4 factors that are used to determine the cost of insurance premiums?

Some factors that may affect your auto insurance premiums are your car, your driving habits, demographic factors and the coverages, limits and deductibles you choose. These factors may include things such as your age, anti-theft features in your car and your driving record.

What are the 3 basic levels of coverage that exist for homeowners insurance?

Homeowners insurance policies generally cover destruction and damage to a residence's interior and exterior, the loss or theft of possessions, and personal liability for harm to others. Three basic levels of coverage exist: actual cash value, replacement cost, and extended replacement cost/value.

When should I get homeowners insurance before closing?

You should try to have a home insurance policy in place a couple of weeks before closing. That way, the coverage will be set and if there are any issues with the policy, you can clear them up before your closing date.

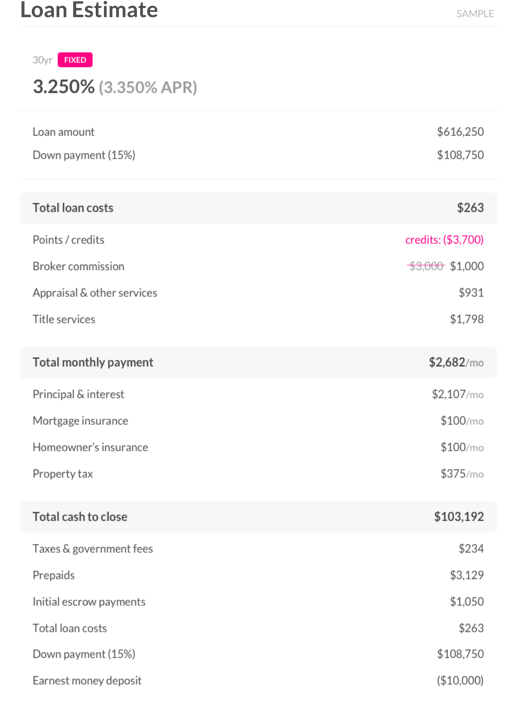

How much does a closing cost?

Closing costs usually range from 3% to 5% of your mortgage. Lenders give a loan estimate after you submit a mortgage application. The estimate shows you the expected closing costs. You’ll also receive a closing disclosure just before closing that will provide the final closing costs.

Is homeowners insurance worth it after the mortgage is paid off?

You don’t need homeowners insurance if you don’t have a mortgage, but should you keep coverage once you pay off the mortgage?

How much does home insurance cover?

Property damage -- Covers you if you damage someone else’s property. Homeowners insurance often provides between $100,000 and $500,000 of liability coverage. It’s wise to get at least $300,000. Liability coverage protects your assets, so think about what you own and could be at risk if you’re sued.

How much personal property coverage is required for a home?

A homeowners insurance policy generally sets a personal property coverage limit at 50% to 70% of the dwelling coverage. So, if you have $400,000 dwelling coverage, you’ll likely be able to get at least $200,000 in personal property coverage. Make sure to keep an inventory of your belongings in a safe place.

What is deductible on home insurance?

The deductible is what you pay after you file a home insurance policy claim. Here’s an example: Let’s say you have a $1,000 deductible. Your home suffers $5,000 worth of damage and you file a claim. The insurance company investigates and approves the claim.

What is dwelling coverage?

Dwelling coverage is the part of a homeowners policy covering your home and other buildings on your property if they’re attached to the home. A policy’s Other Structures coverage covers buildings not connected to the home, such as a detached garage or a shed.

When do you need proof of insurance for closing?

Typically lenders will require proof of homeowners insurance at least three business days prior to the end of the closing process. Additionally, they’ll typically require a year of homeowner’s insurance to be purchased upfront and will typically include those costs in the closing fees.

How long does it take to close on a house?

At maximum, it can take up to 50 days to close on a property, whereas the average is 35-47 days. Closing fees tend to typically trend with the property’s asking price and you can expect to pay 3-5% of the home’s assessed value in closing fees. The median estimate for closing fees in 2020 was $3,312. Delivery costs can be included in the mortgage amount (called a no-delivery cost mortgage) or paid in advance to avoid paying additional interest.

Why do I need homeowners insurance?

Homeowners insurance helps to protect your house against named perils and natural disasters. It helps to protect your asset against liability and also provides coverage in case someone steals property from your home. As part of your new home closing process, you’ll need to provide proof of a homeowners insurance policy covering your home. Why is this necessary? Although you will most likely put a down payment on your new home, your lender is putting up most of the money to purchase the home. Homeowners insurance helps to secure that purchase in the event of a loss or a natural disaster. If your home was lost in a fire or natural disaster and you didn’t have homeowners insurance, your lender would lose out just like you would.

What does a house closing look like?

When you purchase or refinance a home, the last step in that process is called the closing. Closing is typically the time when you finalize the details of your transaction and is typically held at an attorney’s office, your lender, or other location. Ultimately, it is the last step in the process of home ownership. You can expect to pay different closing fees including:

What is personal property insurance?

Personal Property: Your personal property is typically anything that is owned by you. In addition to providing protection for your personal items (such as computers, phones etc.), it also includes protection when those items aren’t at your house. For example if your phone is stolen from your car, your personal property coverage will cover it. There are limits to this however for valuable items, such as jewelry and artwork, and it’s important to make sure any higher value items have additional coverage!

Is homeowners insurance mandatory?

While there’s no law that states that homeowners insurance is mandatory, it allows those with an invested interest to protect their investment. In most cases, these entities include your mortgage holder or home equity loan holder who often require proof of homeowners insurance. Not only does it protect their investment, but it also protects yours. Imagine if your home was robbed and you lost a majority of your personal belongings. Homeowners insurance helps to protect your personal property. Ultimately, homeowners insurance is a good idea to protect your and your lender’s investment.

Can you make a cash deposit during a closing?

In fact, many lenders also recommend against making large undocument ed cash deposits or opening new lines of credit during the closing process.

When to purchase insurance before closing?

After determining that your desired policy meets your lender’s requirements, you can purchase the insurance. This should be done sometime before you go to the meeting to officially close on your home. The insurance company will normally pre-approve the policy and then wait for your escrow/title company to send a request for Proof of Insurance when the final closing date is near. The insurance company will then email or fax the confirmation of coverage before the closing date.

When Do I Need to Get Homeowners Insurance?

In general, you purchase homeowners insurance before closing on the home. By securing the coverage you need before you even move into your new home, you safeguard your purchase from disaster. It is important to research various insurance policy options as they may offer different levels of coverage. Once you have found a policy that is best for you, check that it meets the requirements of your lender. Most financial institutions won’t fund a mortgage, or home equity lines of credit, without the home being insured. In fact, some lenders may require that you purchase extra coverage in addition to a basic homeowners policy.

What is the phone number for Wawanesa homeowners insurance?

If you have any questions about what is covered in your policy, speak with a trusted Wawanesa homeowners insurance agent by calling 1-877-WAWANESA (929-2637) .

Why do you need to buy insurance for a new house?

Purchasing an insurance policy is a smart move in protecting the incredible investment of a new house. In addition to covering repairs to your home, many policies offer some coverage for you and your family’s belongings. Basic homeowners policies usually include liability coverage to protect you against legal action if someone is hurt on your property. These lesser-known benefits of homeowners insurance increase the value of purchasing a policy.

What to do before buying a home?

Often overlooked in the long list of things to do before buying and moving into your new home is getting home insurance. Getting homeowners insurance before closing is an important step in the homebuying process and should be a priority.

What is personal home insurance?

It is important to protect your home with a personal homeowners insurance policy. A personal policy covers the physical structure of your home. Coverage may also be available for your family’s belongings inside the home and outbuildings such as garden sheds.

Do you have to pay HOA fees?

If your new home is in a subdivision or planned community, you are likely required to pay a homeowners association fee. Also known as HOA fees, this money helps cover the upkeep and maintenance costs of the community where your home is located. Often included in HOA fees are your home’s portion of an insurance policy for the community and/or complex.

How long does it take to get a homeowners insurance quote?

Most major homeowners insurance companies provide free and instant quotes online. After getting your quote, it can take a few days for the insurance company to process your application.

What is the most time consuming part of buying home insurance?

When buying homeowners insurance, one of the most time consuming parts of the whole process is learning the basics about homeowners coverage and determining how much coverage you need.

Do insurance companies require inspections?

Some insurers may also require a home inspection, however most inspections happen after your policy has already gone into effect. During a home inspection, your home insurance company will send an inspector to your house to make sure everything in your application is accurate.

Can insurance adjust rates?

The insurance company may adjust your coverage and rates based on the results of the inspection. If your lender requires proof of insurance before you can close on your mortgage, you should be able to provide them with an insurance binder or copy of your policy’s declarations page ahead of the closing date.

How often does escrow insurance renew?

The company managing your escrow account will likely renew your policy each year. As the homeowner, you will be able to choose your deductible amount.

Do you need to purchase home insurance before closing?

The full amount of coverage is typically decided by the lender, based on their assessment (appraisal) of the home’s value. So yes, in most cases you will need to purchase a basic home insurance policy before closing day comes around. There may be exceptions to this rule, but I’ve never encountered one.

Do you need a binder for home insurance?

The common practice is that you have to bring a homeowners insurance binder with you to the closing procedures. This binder is provided by the insurer and is proof that you have a policy in place that covers the property. In some cases, a letter from the insurer will suffice, or a photocopy of the coverage document (s).

Do you need insurance for a home loan?

In most cases, yes, you will need to purchase a homeowners insurance policy before the lender will allow the closing to proceed. Otherwise, the loan won’t be finalized and funded — and nobody wants that.

Does Wells Fargo require proof of insurance?

It also protects our interest as your mortgage servicer.”. This is why most lenders require proof of coverage before closing.

Do you need to buy insurance before closing on a home loan?

There is some variation. But generally speaking, borrowers need to buy homeowners insurance before they can close on a home loan.

How long before closing should I get homeowners insurance?

Start looking for home insurance three weeks to a month before your actual closing date. This gives you plenty of time to compare coverage options and rates. Most mortgage lenders require proof of homeowners insurance a minimum of three business days before your closing date.

Do you have to prepay homeowners insurance at closing?

Paying your homeowner's insurance policy at closing is necessary when mortgage financing is involved. Your lender requires that you secure and prepay a premium that fits its minimum standards for coverage. The exact amount owed at closing depends on your specific loan.

What happens if you don't buy home insurance?

When you don't have homeowner's insurance that equals the amount you owe on your home, you're in violation of your mortgage contract. Your mortgage lender might find a new insurance provider for you that could have even higher premiums or not provide the coverage you need for your possessions.

Can I have two home insurance policies?

It is not illegal to buy more than one insurance policy for your home, but doing so is unlikely to increase the amount you collect in a settlement. ... Because homeowner's insurance is a standard package policy, the second policy is unlikely to offer benefits beyond those covered by the first policy.

What is home insurance?

Damage to your home can be an expensive emergency, costing money to repair and replace lost goods, and your family may have to live elsewhere for a while. Homeowner's insurance, sometimes called home insurance or hazard insurance, can provide financial protection and peace of mind.

Why do insurance companies require inspections?

The insurance company may require a home insurance inspection to accurately assess its risk. An inspection can slow the process by a few days -- inspector needs permission to view the inside of the home -- so it's best to inquire about insurance sooner rather than later.

Does a mortgage require homeowners insurance?

Mortgage lenders often require some form of homeowner's insurance as a condition of the loan, and many insurance companies can offer insurance for your purchase on short notice. With an eclectic background, Ian Johnston has written on diverse topics including literature, real estate, executive leadership and mental health.