How long do Pre-Authorized Debits take to process?

Depending on your processor, Pre-Authorized Debits can take anywhere from 1-4 business days from the process date. It may seem like a while, but the settlement delay ensures that the funds are actually cleared before arriving in the account.

How long does it take to reverse a pre authorized debit?

Check with your financial institution for details on its pre-authorized debit policy. You usually have 90 calendar days from the date the funds came out of your account to: Your financial institution does not have to reimburse you if more than 90 days have passed. You’ll have to sign a declaration confirming the reason for reversing the debit.

How long do I have to cancel a pre-authorized debit agreement?

The biller must cancel the agreement within 30 days of the notice. Cancelling a pre-authorized debit agreement doesn't cancel your contract for goods or services with the biller, or any amount owed. The cancellation applies to the payment method.

How do I get my money back from a pre authorized debit?

inform your financial institution of incorrect or unauthorized debits within 90 days of the withdrawal If you find a pre-authorized debit that you didn’t approve on your account, contact the biller directly, and ask for your money back. You have a right to get your money back, if:

What is a pre-authorized debit?

A pre-authorized debit allows the biller to withdraw money from your bank account when a payment is due. Pre-authorized debits may be useful when you want to make payments from your account on a regular basis. For example, you may want to use pre-authorized debit for the following: mortgage payments. utility payments. RRSP contributions.

What is the difference between pre-authorized debits and automatic payments?

Difference between pre-authorized debits and automatic payments. An automatic payment, or pre-authorized payment doesn’t give the biller permission to withdraw money from your account. Instead, you arrange an automatic payment or series of recurring payments from your account to the biller.

How long do you have to give a biller before you can withdraw money?

If the amount is variable, the biller must give you written notice of the amount at least 10 days before they withdraw the funds, unless you agree to waive or shorten this period. Your pre-authorized debit agreement should include the frequency of the pre-authorized debit.

What should a pre-authorized debit agreement include?

What your agreement should include. Your pre-authorized debit agreement should include the amount of the pre-authorized debit. The amount may be: fixed, that is, the same amount every month. variable, that is, a different amount every month. If the amount is variable, the biller must give you written notice of the amount at least 10 days ...

How long does it take for a bank to send a confirmation?

If you set up your agreement electronically or over the telephone, the bank should send you a written confirmation. It must be sent at least 3 days before the first withdrawal from your account and include the details of the agreement. You must provide your banking information as part of the pre-authorized debit agreement.

How long does it take to notify a bank of an incorrect debit?

inform your financial institution of incorrect or unauthorized debits within 90 days of the withdrawal

Who must get your approval for each pre-authorized debit?

The biller must get your approval for each pre-authorized debit if one of the following occurs:

How long does a preauthorization hold last?

This hold typically lasts about five days, though this depends on your MCC (merchant classification code).

When do you have to capture fully authorized payments?

Be sure to capture the fully authorized payments before the fifth day, while the funds are still being held in the customer’s account. After expiry, the pre authorized funds will be released back to the cardholder, and will be available to be withdrawn or spent. Be sure to avoid this, as you would then have to contact the cardholder to process a new payment in order to hold funds again.

Why is pre authorization important?

Credit card pre authorization is an important and useful practice for merchants accepting payments in person or online, and offers many benefits. With pre-authorization of payments, merchants ensure their customers pay for the products and services they use. Merchants also save time and money by eliminating the instance of fees for refunds, MDRs, and the hassle of processing chargebacks. But, how do they work?

What is a pre authorization for a bike?

Tour operators and activity providers also utilize pre authorizations. For those lending customers expensive pieces of equipment, such as a bicycle or surfboard, the funds protect them from being stuck with the costs associated with loss, damage, or theft. In these cases, the hold is also referred to as a “security deposit”.

Why do hotels require preauthorization?

Hotels are one of the primary industries where pre-authorizations are commonly used. Pre-authorized payments for hotels enable funds to be held either at the booking stage, or during check in. This helps to guarantee that, when the time of check out comes, there are funds available to cover additional charges incurred during the guest’s stay. Room service, spa visits, or damage to the room can be covered by these reserved funds. By placing a hold on extra funds, hotel managers can rest assured that a guest cannot leave without paying.

What are the benefits of pre-authorization?

There are many benefits to pre authorization. Merchants can reduce their fees, while also providing customers with a positive experience. Here are some of the main benefits to both you and your customers:

What happens when a guest checks out of a hotel?

When a guest checks out of your hotel, the hold is converted into a charge. If the guest prefers to pay with a different card or payment method, the pre authorization is cancelled and the funds on hold will be released within a few days.

How to offer pre-authorized debits?

To offer pre-authorized debits to their customers, an organization needs to have a contract in place (called a Payee Letter of Undertaking in Rule H1) with your financial institution. In that agreement, your financial institution agrees to issue PADs on behalf of the biller and they, in turn, agree to follow rules that apply to PADs. There are mandatory elements that must be contained in that Payee Letter of Undertaking. Detailed information is available in Rule H1.

How much notice do you need to give before a payment?

Note: if the amount varies, the biller must give at least 10 days' notice of the amount before the payment, unless the biller and the payor mutually agree to waive or shorten this period, or if the payor asks to change the amount. the timing. set intervals (i.e. weekly, monthly, annually, on set dates, etc.)

How long do you have to give notice of assignment?

If the existing agreements don’t contain an assignment clause, the new owner will need to give a written notice of the full details of the assignment (including the name and contact information for the new owner) at least 10 days before withdrawing funds from their accounts. The new payee can also set up a new agreement with each customer.

How long does an organization have to send a written confirmation of the terms of the agreement?

The organization must also send the customer a written confirmation of the terms of the agreement at least 3 days before the first payment (email is acceptable). The confirmation must include all of the mandatory elements found in Appendix IV of Rule H1.

Can a business continue PADs?

If the agreements with the business’ current customers contain an assignment clause, the new owner can continue the PADs, if the business’ financial institution “signs off” on the existing agreements (as well as any new ones). A written notice giving full details of the transfer must also be sent to the customers (including the name and contact information of the new owner).

The shocking side of pre-authorized payments

When you set up a pre-authorized payment for a company, you’re letting them withdraw any amount they want, whenever they want. You’re putting a lot more trust in them than you think.

Bank policies on stopping pre-authorized payments

Each bank works a bit differently, with varying fees and time frames involved.

The only real permanent solution

Incredibly, the only real permanent solution is closing your bank account and opening a new one.

4 things to remember before setting up a pre-authorized debit

Stopping a pre-authorized payment can be tricky, so there are a few things you should keep in mind before signing up.

So why do people use pre-authorized debits at all?

Pre-authorized debits are convenient for you and the business you’re paying.

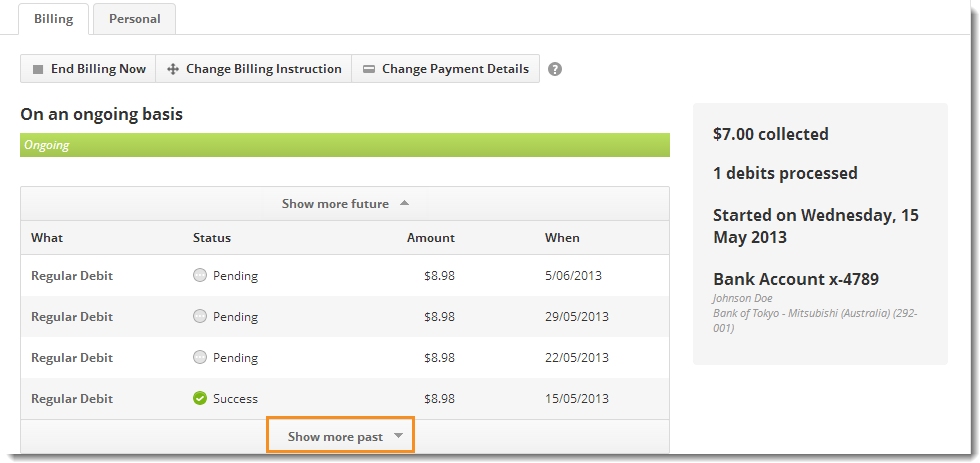

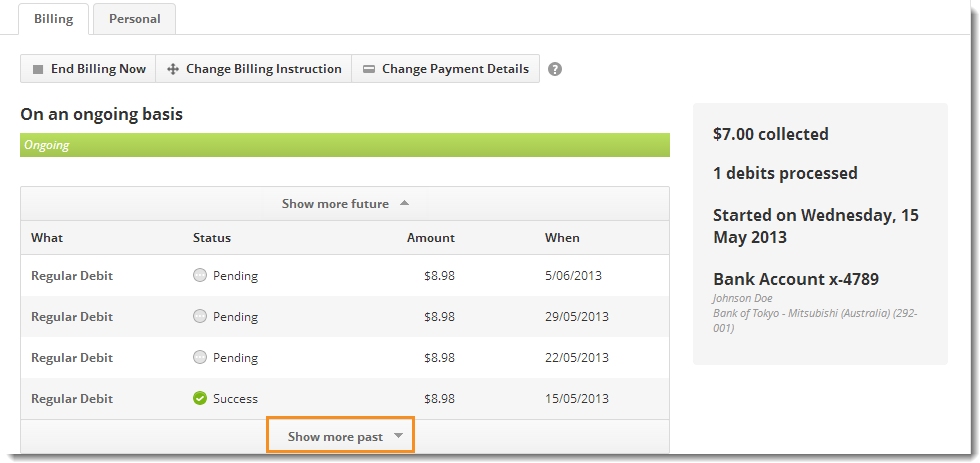

How to set up pre-authorized debit payments

Here’s a link to the big five banks and their how-to’s on pre-authorized debits:

Be careful what you authorize

With all that said, be careful, read the fine print, and make sure to go through your finances with a fine-tooth comb.

What is debit card preauthorization?

This is called debit card preauthorization, and it takes place electronically, in an instant. Depending on the transaction, preauthorization may place a temporary hold on money in your bank account. Advertisement.

How long does it take for a debit card to clear?

The money will still come out of your account, but it might take a couple days for the transaction to clear through the credit card system. Advertisement.

What happens when a bank receives a preauthorization request?

When banks receive a debit card preauthorization request from a merchant, it's common for them to place a "hold" on money in the account — especially when the merchant is handling it like a credit card purchase.

What does a debit card do?

With a debit card, though, the card issuer takes money directly out of your bank account. That affects what your bank does with a preauthorization involving a debit card. Advertisement.

What is the difference between a credit card and a debit card?

A key difference between credit card and debit card preauthorizations stems from how the cards work. When you use a credit card, the card issuer pays the merchant, and then you pay the issuer back later. So a credit card purchase essentially involves a short-term loan. With a debit card, though, the card issuer takes money directly out ...

What happens when you pay with a debit card?

During preauthorization, the merchant's card terminal or computer asks the bank that issued the card whether the card is valid for the sale. If the bank's computer responds that it is, the transaction moves forward. If the bank's computer says no, the merchant declines the card.

How to process a debit card transaction?

There are two ways a merchant can process a debit card transaction. One is to require you to enter your PIN. When you do this, it's the same as getting cash at an ATM: The money comes out of your account immediately. The second way for a merchant to handle a purchase with a debit card is to submit it like a credit card transaction through a network such as Visa or MasterCard. The money will still come out of your account, but it might take a couple days for the transaction to clear through the credit card system.