How long does something stay on credit report?

This falls in line with the way all negative information, including late payments, are dealt with when it comes to your credit reports. Generally speaking, negative marks like late payments and accounts in collections will stay on your credit reports for seven years before falling off automatically.

How long do hard inquiries stay on a credit report?

Is there a percentage of hard inquiries left pending your credit score drops? The number of inquiries you have to answer cannot exceed six and can severely impact how long you can ... these inquiries will stay on your credit report for over five years ...

How long does negative information stay on a credit report?

Under the terms of the Fair Credit Reporting Act, negative information can stay on your credit report for seven to ten years—or even longer—as Bankrate reports. Let's look at how that breaks down. Hard inquiries appear on your report for two years.

How long can bankruptcy stay on a credit report?

- Ability to catch up on past missed payments such as mortgages, lien, or car payments.

- Non-discharged debts such as alimony or child support can be paid off in three to five years.

- If an account was delinquent during the bankruptcy, it will be deleted seven years from its original delinquency date.

Does a credit report expire?

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, accounts not being paid as agreed, or bankruptcies stays on credit reports for approximately seven years.

How long can a credit report be used?

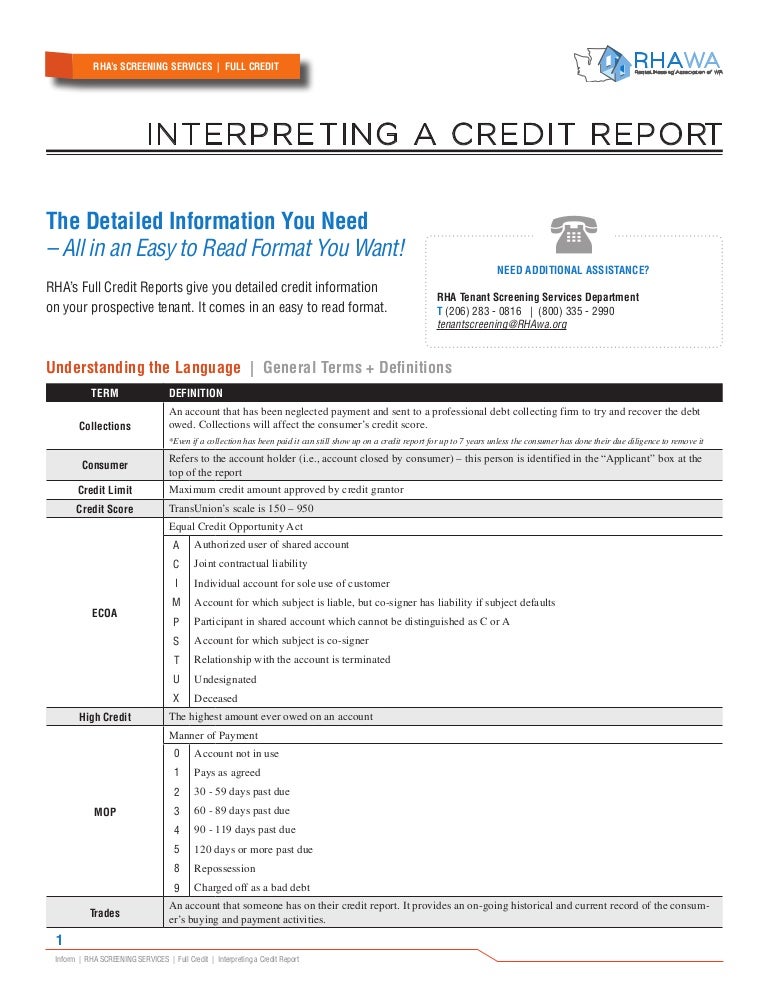

How long does debt stay on your credit report?Hard inquiries2 yearsCollection accounts7 yearsChapter 13 bankruptcies7 yearsJudgments7 years or until the state statute of limitations expires, whichever is longerUnpaid taxesIndefinitely, or 7 years from the last date paid6 more rows•Sep 15, 2022

How long is a credit report valid for a mortgage application?

120 daysBut when a lot of time passes between being prepproved and closing on a home, then mortgage lenders may pull a second copy of your credit report. Credit reports are typically only valid for 120 days. So if yours has expired, then the lender will re-pull your credit.

What is the 7 year credit rule?

Late payments remain on the credit report for seven years. The seven-year rule is based on when the delinquency occurred. Whether the entire account will be deleted is determined by whether you brought the account current after the missed payment.

How long are you blacklisted for?

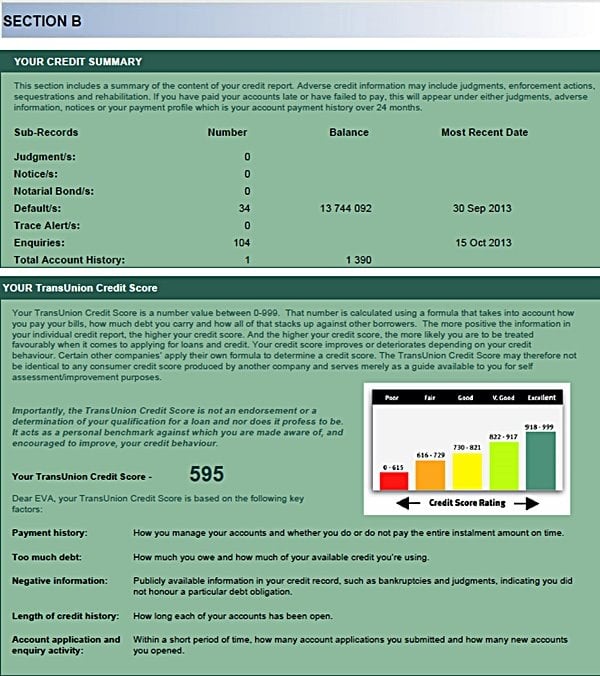

Your credit report is a record of your payment behaviour. It tracks all your accounts and indicates where, over a period of two years, you have missed payments or gone into arrears on an account. Then after two years, this adverse information simply disappears.

Can a creditor report an old debt as new?

Collection agencies cannot report old debt as new. If a debt is sold or put into collections, that is legally considered a continuation of the original date. It may show up multiple times on your credit report with different open dates, but they must all retain the same delinquency date.

How many credit inquiries is too many?

Six or more inquiries are considered too many and can seriously impact your credit score. If you have multiple inquiries on your credit report, some may be unauthorized and can be disputed. The fastest way to identify and dispute these errors (& boost your score) is with help from a credit expert like Credit Glory.

How many times is credit pulled when buying a house?

And of course, they will require a credit check. A question many buyers have is whether a lender pulls your credit more than once during the purchase process. The answer is yes. Lenders pull borrowers' credit at the beginning of the approval process, and then again just prior to closing.

Do multiple credit inquiries count as one?

If you're shopping for a new auto or mortgage loan or a new utility provider, the multiple inquiries are generally counted as one inquiry for a given period of time. The period of time may vary depending on the credit scoring model used, but it's typically from 14 to 45 days.

Can a debt collector take you to court after 7 years?

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

How long can a debt be chased?

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

How long before a debt becomes uncollectible?

four yearsIn California, the statute of limitations for consumer debt is four years. This means a creditor can't prevail in court after four years have passed, making the debt essentially uncollectable.

How do I find my credit history from 20 years ago?

How to Retrieve an Old Credit ReportCall a credit bureau. The three largest bureaus are Experian, Equifax and TransUnion. ... Make a list of your reasons for needing an old credit report. ... Request a copy of your current credit report. ... Request information from the credit bureau.

How do I know if I am blacklisted on CMAP?

How Do You Know if You Are Blacklisted?Check your credit report. The easiest way to see if you are blacklisted is to get a copy of your credit report from the accredited credit bureaus4 or your bank5. ... Check the members of CIC, CMAP, and BAP-DX.

Should I pay off closed accounts?

As you've probably gathered, it's a good idea to pay off closed accounts with active debts if you possibly can. Doing so won't remove the account from your credit report and it doesn't have direct or immediate benefits for your credit score, but it can protect your credit from damage further down the line.

How do I remove closed accounts from my credit report?

Send a written request to remove the account from your credit report directly to the creditor that reported the information to the credit bureau, McClary says. Ask politely if the creditor will remove the account now that it is no longer active.

What can my Credit Report show me?from checkmyfile.com

It shows lenders what type of borrower you’ve been in the past, how you’re managing current credit facilities, and based on that, what you’re likely to do in the future. Other key information includes your Electoral Roll status (which can differ at each Credit Reference Agency), Financial Associations and Aliases, linked addresses, searches, fraud warnings, Court Records and more besides.

How long does credit history stay on credit report?from registerednursern.com

Information remains on annual credit reports as follows: inquiries – 2 years, late payments – 7 years, paid tax liens – 7 years, unpaid tax liens – 15 years, collection accounts – 7 years, judgments – 7 years, and bankruptcies – 7 to 10 years. The information may surprise many people, but it’s true. Depending on the creditor, information may remain on credit reports for less than the specified time. Some creditors remove the information after the accounts are paid in full so that their customers can begin rebuilding their credit.

How to dispute an item on your credit report?from thecreditpros.com

To dispute an item on your credit report, you will need to call up each credit bureau and file a dispute. This may take some time, but with some help and a little bit of time, you can remove fraudulent or unfair items on your credit report.

How to improve credit?from registerednursern.com

Ways to Improve Credit. Pay bills on or before the scheduled payment date. Lenders do not always hold payment history issues against potential customers. They may consider your current payment history. For example, paying all bills on time for 2 or 3 years may make it possible to receive credit and improve credit.

What is a last minute bankruptcy check?from checkmyfile.com

A last-minute bankruptcy check is carried out on you shortly before you complete a house purchase, which checks to see if you have been declared bankrupt. The Bankruptcy and Insolvency Register is checked against your name and anyone matching your name that has an insolvency will be shown. You are welcome to check this information for yourself at any time, which could be useful if you need to find the exact dates of a bankruptcy being issued.

Why do people apply for credit with small amounts?from registerednursern.com

Apply for credit with a small credit line. Part of the reason for past credit issues may have been the misuse of credit. Applying for credit in small amounts may help rebuild credit and helps consumers use credit responsibly.

How long do cancelled credit cards stay on your credit report?from thecreditpros.com

Cancelled credit cards will remain on your credit report 10 years after they’re closed, assuming they’re in good standing. If they’re not in good standing, or are charged off, they’ll be removed after 7 years. Cancelled credit cards in good standing will be on your credit report with a zero balance and will not affect you negatively.

What is the highest rating for S&P?

Each of the rating agencies has its own rating scheme, though the schemes are very similar. Ratings are most often assigned letter ratings. For example, S&P's rating scheme starts at AAA, the highest rating, indicating the best credit quality, and ends at D, the lowest rating, indicating the poorest quality credit. 1

How to determine how risky a bond is?

To determine how risky a bond investment is, investors look at the credit ratings of corporations, government agencies, or other entities issuing bonds. The three main entities that conduct analyses and provide credit ratings are Standard and Poor's (S&P), Moody's, and Fitch Ratings. Credit ratings are usually updated quarterly with an assessment ...

What happens after a rating is issued?

After the initial rating, the assigned analyst keeps in contact with the issuing company's finance team and reviews its rating periodically . Ratings are often reviewed each quarter—in which upgrades or downgrades are possible—after a company releases quarterly earnings information .

How often is a credit rating reviewed?

There are several credit rating agencies that provide a thorough analysis of an issuer's finances and assign a rating according to their findings. The rating is typically reviewed and restated quarterly, with a full analysis provided annually for higher volume issuers.

What is the difference between investment grade and non investment grade?

2 All credit ratings are commonly known to be broken into investment grade and non-investment grade ratings. Investment-grade ratings are those with a good credit quality with a low risk of default whereas non-investment grade ratings are those with poor credit quality and a high risk of default.

What is bond issuance?

Bond issuances are debt securities issued by a corporation, or other agency, and sold to an investor. The company receives payment upfront from the bond purchaser and makes regular interest payments to the bondholder and a return of the principal amount at the time of the bond's maturity .

When a company, government agency, or municipality issues any debt security, a credit rating is usually sought by an?

When a company, government agency, or municipality issues any debt security, a credit rating is usually sought by an investor. The rating is published so investors can judge the creditworthiness of the issuer and gauge the risks associated with buying its debt.

What percentage of FICO is used for new credit accounts?

VantageScore describes recent credit behavior and inquiries as “less influential.” Applications for new credit account for 10% of FICO scores.

How long does a hard inquiry stay on your credit report?

How Long Do Hard Inquiries Stay on Your Credit Report? A hard inquiry stays on your credit report for about two years, but it won’t affect your score for longer than a year. Bev O'Shea Apr 4, 2019.

How long does it take for a hard inquiry to affect your credit score?

However, a hard inquiry won’t affect your score after 12 months, if it affects your score at all. Applying for credit can knock a few points off your credit scores. But making multiple inquiries in a short window counts as a single inquiry when you shop for a mortgage, student loan or auto loan.

Is it better to pay credit card balances on time or every time?

Paying on time, every time. Keeping credit card balances no higher than 30% of your credit limit, and lower is better. Those habits account for more than half of your score. NerdWallet can help you track your progress and offer tips for improving the other factors.

When you need credit, it's a good idea to check to see if you are likely to qualify before?

When you need credit, it’s a good idea to check to see if you are likely to qualify before you actually apply, because a hard inquiry will be recorded whether you are approved or not. In the meantime, focus on the two things that have the most powerful effect on your scores: Paying on time, every time.

Does NerdWallet track your progress?

Those habits account for more than half of your score. NerdWallet can help you track your progress and offer tips for improving the other factors.

Can multiple inquiries affect your credit?

Multiple hard inquiries can put a serious dent in your credit, particularly if you are new to credit, and it’s an easy mistake to make. Say you’ve just rented an apartment. The leasing agent may check your credit. And then you may apply for financing for furniture.

How long does a debt stay on your credit report?

A debt stays on your credit 10 years from the date of final payoff. How long does payment history stay on your credit report? Positive payment history (i.e. payments you make on time) can remain indefinitely; however, the credit bureaus typically only show payments going back 10 years on your credit report. Share 1.

How long do tax liens stay on credit?

How long does a tax lien stay on your credit report? In the past, tax liens could remain on your credit report for up to 15 years if they went unpaid. However, as of April 2018, all three credit bureaus stopped reporting tax liens on consumer credit reports.

How to follow up after the clock runs out?

You basically need to follow up by reviewing your credit after the item should expire. Then you check to make sure it no longer appears.

Why do negative items appear on my credit report?

Negative items appear on your credit report for two reasons: You did something that creditors consider bad, like miss a payment or declare bankruptcy. There was a mistake in reporting, either by the original creditor, collector or credit bureau.

How long does nothing last on credit?

Nothing in credit lasts forever, so here’s how long you need to worry about negative items on a credit report.

When is the last time missed payment is reported on credit report?

As such, the last month it should appear on your credit report is August 2018. Thus, you should check your credit report in September 2018 to make sure the missed payment item is gone.

Can a positive credit report be removed?

In fact, neutral or positive credit report information can remain indefinitely. However, to keep credit reports manageable, the credit bureaus remove information after a certain amount of time. Type of Positive Action. Amount of Time It’s Reported.

2 attorney answers

Typically, if the lender checked your credit, they can not check it again a second time. If you just got notification that your credit report was run today, call the dealer and ask them why (if the credit check was not needed at this time)? Then, you can dispute the credit check with your credit bureaus, depending upon the answer you receive.

Ginger Bayles Kelly

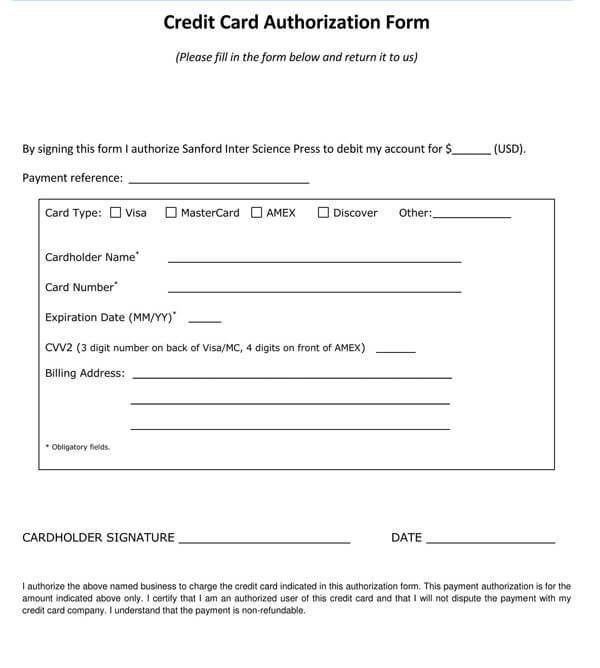

You need to look at the form you signed. If you don't have a copy, you will need to call the entity you gave the authorization to, and ask for a copy.

How long does a judgment stay on your credit report in Texas?

In Texas, judgments are valid (“active”) for at least 10 years and they can be renewed for another 10 years after that, and then another 10 year after that, and so on, indefinitely. So, legally, the judgment could remain on your credit report forever, or until you settle it or pay it.

How to contact a debt relief attorney in Dallas?

Give our Dallas debt relief attorney a call at 844.334.4566 or fill out the contact form. We will review your judgment with you and tell you where you stand and what your options are. The consultation is free, and there is no obligation.

What can cloud the title to your home?

File an “Abstract of Judgment” which can cloud the title to your home

Can you still collect judgments off your credit report?

Even if the judgment drops off your credit report, you still owe it and they can still collect on it

What are the types of changes that are unacceptable?

The following types of changes are unacceptable: deleting tradelines that pertain to a borrower’s bankruptcy, adding a payment amount to a creditor’s tradeline when the creditor does not require a payment, or. restricting information collection to a shorter time period than Fannie Mae requires.

How long does it take for a credit report to be reviewed by Fannie Mae?

Although the Fair Credit Reporting Act currently specifies that credit information is not considered obsolete until after seven years, and bankruptcy information after ten years, Fannie Mae requires only a seven-year history to be reviewed for all credit and public record information.

What is a nontraditional mortgage credit report?

For credit report requirements in DU see below. A nontraditional mortgage credit report or other form of alternative credit verification may be used if the borrower. does not have sufficient credit to enable the development of a credit score, or. does not use the type of credit that is reported to credit repositories.

What happens if your credit report does not include a reference for each significant open debt?

If the credit report does not include a reference for each significant open debt on the application, the lender must obtain a separate written verification for each unreported debt. The lender also needs to verify separately accounts listed as “will rate by mail only” or “need written authorization.”.

How long does it take for a credit report to show a debt?

Each account with a balance must have been checked with the creditor within 90 days of the date of the credit report.

What is an automated credit report?

An automated credit report or one that is transmitted by fax is considered to be an “original” report. The report must include the full name, address, and telephone number of the credit reporting agency, as well as the names of the national repositories that the agency used to provide information for the report.

How to assess credit management skills?

The borrower’s credit management skills can be assessed by analyzing repayment patterns, credit utilization, and level of experience in using credit.

Highlights

Your credit scores are not fixed numbers and will likely change over time based on your financial behavior.

How often are credit scores updated?

Your credit scores typically update at least once a month. However, this may vary depending on your unique financial situation.