What banks are part of the Federal Reserve System?

Which banks make up the Federal Reserve?

- Bank of America - $1,082B or about 20%

- JP Morgan - $1013B or about 20%

- Citigroup - $706B or about 15%

- wachovia - $472B or about 8%

- Wells Fargo - $403B or about 8%

What are 12 Federal Reserve Banks?

List of Federal Reserve branches

- Boston

- New York Federal Reserve Bank of New York Buffalo Branch (closed)

- Philadelphia

- Cleveland Federal Reserve Bank of Cleveland Cincinnati Branch Federal Reserve Bank of Cleveland Pittsburgh Branch

- Richmond Federal Reserve Bank of Richmond Baltimore Branch Federal Reserve Bank of Richmond Charlotte Branch

How many Federal Reserve Banks are there in the US?

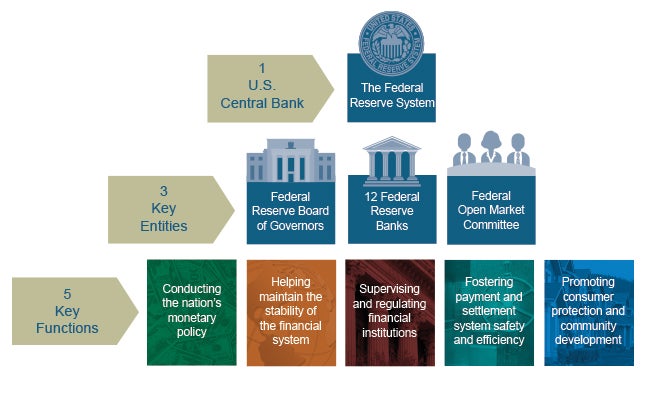

The 12 Federal Reserve Banks and their 24 Branches are the operating arms of the Federal Reserve System. Each Reserve Bank operates within its own particular geographic area, or district, of the United States. Each Reserve Bank gathers data and other information about the businesses and the needs of local communities in its region.

What are the locations of the Federal Reserve Banks?

- Federal Reserve Bank of San Francisco Los Angeles Branch

- Federal Reserve Bank of San Francisco Portland Branch

- Federal Reserve Bank of San Francisco Salt Lake City Branch

- Federal Reserve Bank of San Francisco Seattle Branch

See more

How many Reserve regional banks are there?

12 Federal Reserve BanksThe 12 Federal Reserve Banks and their 24 Branches are the operating arms of the Federal Reserve System. Each Reserve Bank operates within its own particular geographic area, or district, of the United States.

What are the 12 district banks of the Federal Reserve?

The Twelve Federal Reserve Districts01-Boston.02-New York.03-Philadelphia.04-Cleveland.05-Richmond.06-Atlanta.07-Chicago.08-St. Louis.More items...•

How many regional Federal Reserve banks are there and where are they?

The 12 regional Reserve Banks are the operating arms of the Fed and work to ensure a sound financial system and healthy economy. The Reserve Banks are decentralized by design and are located in Boston, New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, St.

Who owns the 12 regional reserve banks?

Under the Federal Reserve Act of 1913, each of the 12 regional reserve banks of the Federal Reserve System is owned by its member banks, who originally ponied up the capital to keep them running. The number of capital shares they subscribe to is based upon a percentage of each member bank's capital and surplus.

Which Federal Reserve District is the largest?

the Twelfth DistrictOf the twelve Federal Reserve Districts, the Twelfth District is the largest by geography and the size of its economy.

Who owns the US Federal Reserve Bank?

The Federal Reserve System is not "owned" by anyone. The Federal Reserve was created in 1913 by the Federal Reserve Act to serve as the nation's central bank. The Board of Governors in Washington, D.C., is an agency of the federal government and reports to and is directly accountable to the Congress.

What do regional Federal Reserve Banks do?

Regional banks enforce the monetary policies that the Board of Directors sets by ensuring that all depository institutions—commercial and mutual savings banks, savings and loan associations and credit unions—can access cash at the current discount rate.

Why are there multiple Federal Reserve Banks?

Based on the Commission's findings and other proposals, Congress established the Federal Reserve System in which several Federal Reserve Banks would provide liquidity to banks in different regions of the country.

How much money is in the Federal Reserve Bank?

U.S. Reserve Assets (Table 3.12)Asset20191Total129,4792Gold stock111,0413Special drawing rights2 350,7494Reserve position in International Monetary Fund2 526,1532 more rows

Which banks do Rothschilds own?

The Rothschilds control the Bank of England, the Federal Reserve, the European Central Bank, the IMF, the World Bank and the Bank for International Settlements. They also own most of the world's gold, as well as the London Gold Exchange, which sets the price of gold every day.

Who prints money in the US?

Bureau of Engraving and PrintingThe Bureau of Engraving and Printing produces United States currency notes, operates as the nation's central bank, and serves to ensure that adequate amounts of currency and coin are in circulation.

Why does Missouri have 2 Federal Reserve Banks?

Why does Missouri have two Reserve Banks – Kansas City and St. Louis? Locations of Reserve Banks were selected based on population distribution and where financial centers were in 1914. Government officials traveled the country early that year to visit potential Reserve Bank sites, including Kansas City and St.

How many Federal Reserve Bank branches are in District 12 of the Federal Reserve System?

The Federal Reserve System has adapted to changing population patterns by adding branch offices in the Districts. For example, the Twelfth District is very large geographically and includes Hawaii and Alaska. This District has four branches in addition to its headquarters in San Francisco.

Who owns Swiss bank?

Swiss National BankLogoHeadquartersBern and ZurichOwnershipMixed ownership. Around 78% owned by Swiss public entities, the rest are publicly traded in SIX.ChairmanThomas JordanCentral bank ofSwitzerland4 more rows

What are the roles of the district banks?

These Fed Banks provide banking services to commercial banks, regulate commercial banking activity, process checks and other payments, provide banking services for government agencies, collect and analyze economic data, and undertake a host of other activities.

Why does Missouri have 2 Federal Reserve Banks?

Why does Missouri have two Reserve Banks – Kansas City and St. Louis? Locations of Reserve Banks were selected based on population distribution and where financial centers were in 1914. Government officials traveled the country early that year to visit potential Reserve Bank sites, including Kansas City and St.

How many Federal Reserve banks are there?from en.wikipedia.org

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve Act of 1913. The banks are jointly responsible for implementing the monetary policy set forth by ...

How are the Reserve Banks organized?from en.wikipedia.org

The Reserve Banks are organized as self-financing corporations and empowered by Congress to distribute currency and regulate its value under policies set by the Federal Open Market Committee and the Board of Governors. Their corporate structure reflects the concurrent interests of the government and the member banks, but neither of these interests amounts to outright ownership.

How is the Federal Reserve funded?from federalreserve.gov

Its operations are financed primarily from the interest earned on the securities it owns--securities acquired in the course of the Federal Reserve's open market operations. The fees received for priced services provided to depository institutions, such as check clearing, funds transfers, and automated clearinghouse operations, are another source of income; this income is used to cover the cost of those services. After payment of expenses and transfers to surplus (limited to an aggregate of $10 billion), all the net earnings of the Federal Reserve Banks are transferred to the U.S. Treasury.

What is the role of FedWire?from federalreserve.gov

providing key financial services that undergird the nation's payment system, including distributing the nation's currency and coin to depository institutions, clearing checks, operating the FedWire and automated clearinghouse (ACH) systems, and serving as a bank for the U.S. Treasury; and

What is the Federal Reserve's internal audit?from en.wikipedia.org

The Federal Reserve Banks conduct ongoing internal audits of their operations to ensure that their accounts are accurate and comply with the Federal Reserve System's accounting principles. The banks are also subject to two types of external auditing. Since 1978 the Government Accountability Office (GAO) has conducted regular audits of the banks' operations. The GAO audits are reported to the public, but they may not review a bank's monetary policy decisions or disclose them to the public. Since 1999 each bank has also been required to submit to an annual audit by an external accounting firm, which produces a confidential report to the bank and a summary statement for the bank's annual report. Some members of Congress continue to advocate a more public and intrusive GAO audit of the Federal Reserve System, but Federal Reserve representatives support the existing restrictions to prevent political influence over long-range economic decisions.

What happens after the Federal Reserve pays out its surplus?from federalreserve.gov

After payment of expenses and transfers to surplus (limited to an aggregate of $10 billion), all the net earnings of the Federal Reserve Banks are transferred to the U.S. Treasury.

What is the Federal Reserve Act?from federalreserve.gov

Federal Reserve Act. Section 2. Federal Reserve Districts. 1. Establishment of reserve cities and districts. As soon as practicable, the Secretary of the Treasury, the Secretary of Agriculture and the Comptroller of the Currency, acting as "The Reserve Bank Organization Committee," shall designate not less than eight nor more than twelve cities ...

How many branches are there in the Federal Reserve?from federalreserve.gov

The 12 Federal Reserve Banks and their 24 Branches are the operating arms of the Federal Reserve System. Each Reserve Bank operates within its own particular geographic area, or district, of the United States.

How is the Federal Reserve funded?from federalreserve.gov

Its operations are financed primarily from the interest earned on the securities it owns--securities acquired in the course of the Federal Reserve's open market operations. The fees received for priced services provided to depository institutions, such as check clearing, funds transfers, and automated clearinghouse operations, are another source of income; this income is used to cover the cost of those services. After payment of expenses and transfers to surplus (limited to an aggregate of $10 billion), all the net earnings of the Federal Reserve Banks are transferred to the U.S. Treasury.

How long are Reserve Bank presidents?from federalreserve.gov

Presidents are nominated by a Bank's Class B and C directors and approved by the Board of Governors for five-year terms. Reserve Bank Branches also have boards of directors.

What happens after the Federal Reserve pays out its surplus?from federalreserve.gov

After payment of expenses and transfers to surplus (limited to an aggregate of $10 billion), all the net earnings of the Federal Reserve Banks are transferred to the U.S. Treasury.

How many directors are there in a commercial bank?from federalreserve.gov

Commercial banks that are members of the Federal Reserve System hold stock in their District's Reserve Bank and elect six of the Reserve Bank's directors; three remaining directors are appointed by the Board of Governors. Most Reserve Banks have at least one Branch, and each Branch has its own board of directors.

What is the purpose of the Reserve Bank?from federalreserve.gov

Each Reserve Bank gathers data and other information about the businesses and the needs of local communities in its region. That information is then factored into monetary policy decisions by the FOMC and other decisions made by the Board of Governors.

What is the role of a director in the Federal Reserve?from federalreserve.gov

Directors serve as a link between the Federal Reserve and the private sector. As a group, directors bring to their duties a wide variety of experiences in the private sector , which gives them invaluable insight into the economic conditions of their respective Federal Reserve Districts. Reserve Bank head-office and Branch directors contribute to the System's overall understanding of the economy.

Which banking organization is supervised by the Federal Reserve?

Regional and community banking organizations constitute the largest number of banking organizations supervised by the Federal Reserve. In supervising community banks, the Federal Reserve follows a risk-focused approach that aims to target examination resources to higher-risk areas of each bank's operations and to ensure ...

What is a community bank?

Community banks serve businesses and consumers throughout the country. The Federal Reserve defines community banking organizations as those with less than $10 billion in assets , and regional banking organizations as those with total assets between $10 billion and $100 billion. Regional and community banking organizations constitute the largest number of banking organizations supervised by the Federal Reserve. In supervising community banks, the Federal Reserve follows a risk-focused approach that aims to target examination resources to higher-risk areas of each bank's operations and to ensure that banks maintain risk-management capabilities appropriate to their size and complexity.

What is community banking in the 21st century?

The annual Community Banking in the 21st Century research and policy conference--sponsored by the Federal Reserve System, the Conference of State Bank Supervisors and the Federal Deposit Insurance Corporation--brings together community bankers, academics, policymakers, and bank regulators to discuss the latest research on community banking.

How many branches are there in the Federal Reserve?from federalreserve.gov

The 12 Federal Reserve Banks and their 24 Branches are the operating arms of the Federal Reserve System. Each Reserve Bank operates within its own particular geographic area, or district, of the United States.

How is the Federal Reserve funded?from federalreserve.gov

Its operations are financed primarily from the interest earned on the securities it owns--securities acquired in the course of the Federal Reserve's open market operations. The fees received for priced services provided to depository institutions, such as check clearing, funds transfers, and automated clearinghouse operations, are another source of income; this income is used to cover the cost of those services. After payment of expenses and transfers to surplus (limited to an aggregate of $10 billion), all the net earnings of the Federal Reserve Banks are transferred to the U.S. Treasury.

How long are Reserve Bank presidents?from federalreserve.gov

Presidents are nominated by a Bank's Class B and C directors and approved by the Board of Governors for five-year terms. Reserve Bank Branches also have boards of directors.

What happens after the Federal Reserve pays out its surplus?from federalreserve.gov

After payment of expenses and transfers to surplus (limited to an aggregate of $10 billion), all the net earnings of the Federal Reserve Banks are transferred to the U.S. Treasury.

How many directors are there in a commercial bank?from federalreserve.gov

Commercial banks that are members of the Federal Reserve System hold stock in their District's Reserve Bank and elect six of the Reserve Bank's directors; three remaining directors are appointed by the Board of Governors. Most Reserve Banks have at least one Branch, and each Branch has its own board of directors.

What is the purpose of the Reserve Bank?from federalreserve.gov

Each Reserve Bank gathers data and other information about the businesses and the needs of local communities in its region. That information is then factored into monetary policy decisions by the FOMC and other decisions made by the Board of Governors.

What is the role of a director in the Federal Reserve?from federalreserve.gov

Directors serve as a link between the Federal Reserve and the private sector. As a group, directors bring to their duties a wide variety of experiences in the private sector , which gives them invaluable insight into the economic conditions of their respective Federal Reserve Districts. Reserve Bank head-office and Branch directors contribute to the System's overall understanding of the economy.

How many branches are there in the Federal Reserve?from federalreserve.gov

The 12 Federal Reserve Banks and their 24 Branches are the operating arms of the Federal Reserve System. Each Reserve Bank operates within its own particular geographic area, or district, of the United States.

How is the Federal Reserve funded?from federalreserve.gov

Its operations are financed primarily from the interest earned on the securities it owns--securities acquired in the course of the Federal Reserve's open market operations. The fees received for priced services provided to depository institutions, such as check clearing, funds transfers, and automated clearinghouse operations, are another source of income; this income is used to cover the cost of those services. After payment of expenses and transfers to surplus (limited to an aggregate of $10 billion), all the net earnings of the Federal Reserve Banks are transferred to the U.S. Treasury.

How long are Reserve Bank presidents?from federalreserve.gov

Presidents are nominated by a Bank's Class B and C directors and approved by the Board of Governors for five-year terms. Reserve Bank Branches also have boards of directors.

What happens after the Federal Reserve pays out its surplus?from federalreserve.gov

After payment of expenses and transfers to surplus (limited to an aggregate of $10 billion), all the net earnings of the Federal Reserve Banks are transferred to the U.S. Treasury.

How many directors are there in a commercial bank?from federalreserve.gov

Commercial banks that are members of the Federal Reserve System hold stock in their District's Reserve Bank and elect six of the Reserve Bank's directors; three remaining directors are appointed by the Board of Governors. Most Reserve Banks have at least one Branch, and each Branch has its own board of directors.

What is the purpose of the Reserve Bank?from federalreserve.gov

Each Reserve Bank gathers data and other information about the businesses and the needs of local communities in its region. That information is then factored into monetary policy decisions by the FOMC and other decisions made by the Board of Governors.

What is the role of a director in the Federal Reserve?from federalreserve.gov

Directors serve as a link between the Federal Reserve and the private sector. As a group, directors bring to their duties a wide variety of experiences in the private sector , which gives them invaluable insight into the economic conditions of their respective Federal Reserve Districts. Reserve Bank head-office and Branch directors contribute to the System's overall understanding of the economy.

Who is the president of the Federal Reserve Bank of New York?

John C. Williams (Off-site) took office as the president of the Federal Reserve Bank of New York on June 18, 2018. He was previously the president and chief executive officer of the Federal Reserve Bank of San Francisco. Prior to that, he was the executive vice president and director of research for the San Francisco Fed.

What is the role of the President of the Federal Reserve?

In addition, the president serves on the Federal Reserve’s chief monetary policymaking body, the Federal Open Market Committee (FOMC).

How many members are on the FOMC?

The FOMC (Off-site) is made up of 12 voting members (the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York and four of the 11 other Reserve Bank presidents).

When did James Bullard join the Fed?

He joined the Chicago Fed in 1991 after serving as an assistant professor of economics at the University of South Carolina. James Bullard (Off-site) took office as the president of the Federal Reserve Bank of St. Louis on April 1, 2008.