- 192 publicly traded REITs (although there are some that aren't in Nareit's directory),

- 26 public non-listed REITs (REITs that are open to all investors but don't list their shares on major stock exchanges like the NYSE), and

- 14 private REITs.

Are REITs worth buying?

The main reason REITs remain so popular with investors year after year is the reliable strength of their dividends. Remember: REITs are required to pay out at least 90% of their taxable profits as dividends (in return for some generous tax breaks).

Should you invest in REITs?

The advantages of REITs

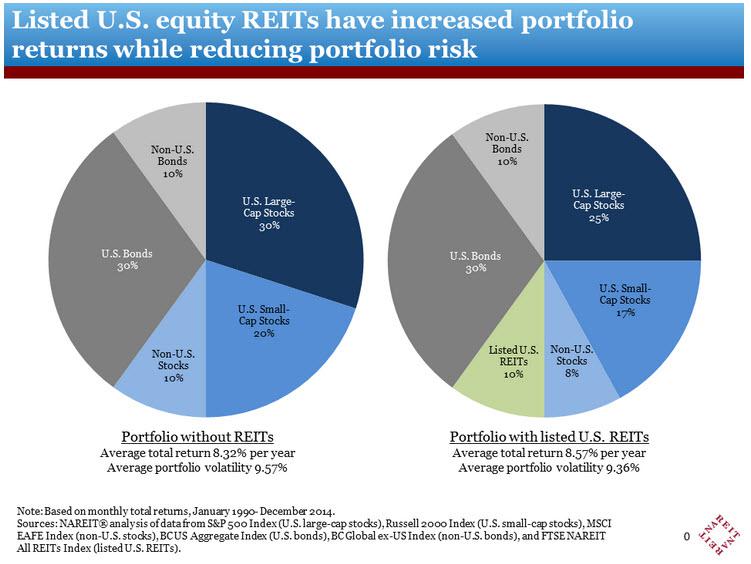

- Portfolio diversification. REITs offer a great way to invest independently of the stock market. ...

- Guaranteed distributions. Another benefit of investing in REITs is the payouts. ...

- Solid long-term performance. The nice thing about REITs is that they’re something you can invest in and hold for a long period of time.

- Low barrier to entry. ...

- Liquidity. ...

Are REITs better than property funds?

REITs have an average gearing of 20% while the average gearing for property funds remains below 5%, well below the 10% regulatory limit. While REITs with higher market capitalisation and trading liquidity tend to trade better, they typically do so at tighter yields than funds, adjusting for size.

Are REITs included in total stock market?

REITs are included in broad “total stock market” index funds in proportion to their market weight — just like stocks from every other market sector. REITs are included in many other stock index funds as well. For instance, as of last year, the S&P 500 included 15 different REITs. REITs as a Diversifier

How many REITs are on the stock market?

There are currently 170 U.S. real estate investment trusts or REITs in our database. REITs are unique because they are organized as pass-thru entities - they must distribute their income to stockholders to avoid taxation at a corporate level.

How many REITs are on the NYSE?

174 REITs trade on the New York Stock Exchange.

Are most REITs publicly traded?

Equity REITs – The majority of REITs are publicly traded equity REITs. Equity REITs own or operate income-producing real estate.

What is the largest publicly traded REIT?

The Top 10 by Market CapREITMarket CapDividend YieldSimon Property Group (NYSE: SPG)$48.9B5.07%Welltower (NYSE: WELL)$43.0B2.58%Digital Realty (NYSE: DLR)$40.1B3.55%Realty Income (NYSE: O)$40.1B4.44%6 more rows•Apr 7, 2022

What is the largest REIT in the US?

American Tower 1AMTLargest Real-Estate-Investment-Trusts by market cap#NameM. Cap1American Tower 1AMT$129.64 B2Prologis 2PLD$101.51 B3Crown Castle 3CCI$78.94 B4Equinix 4EQIX$64.84 B56 more rows

How big is the US REIT market?

REITs own approximately $3.5 trillion in gross real estate assets, with more than $2.5 trillion of that total from public listed and non-listed REITs and the remainder from privately held REITs. The economic and investment reach of those assets are felt by millions of Americans all across the country.

Does Warren Buffett Own REITs?

Warren almost certainly thinks so, as Berkshire has held fast to its position in the company since plowing $377 million into its equity in 2017. These days, Berkshire holds a more than 5% stake in the REIT.

Are all REITs publicly traded?

Many REITs are registered with the SEC and are publicly traded on a stock exchange. These are known as publicly traded REITs. Others may be registered with the SEC but are not publicly traded. These are known as non- traded REITs (also known as non-exchange traded REITs).

Which REITs pay the highest dividend?

Table of ContentsHigh-Yield REIT No. ... High-Yield REIT No. ... High-Yield REIT No. ... High-Yield REIT No. ... High-Yield REIT No. 4: Annaly Capital Management (NLY)High-Yield REIT No. 3: Two Harbors Investment Corp. ... High-Yield REIT No. 2: ARMOUR Residential REIT (ARR)High-Yield REIT No. 1: Orchid Island Capital (ORC)More items...•

What publicly traded company owns the most real estate?

As of the most recent fiscal year, Walmart comes out on top with $116.9 billion worth of real estate, more than doubling Amazon's second-place total of $57.3 billion. Alphabet — Google's parent company — ranks third at $49.7 billion, followed by Microsoft and AT&T.

How can you tell if a REIT is publicly traded?

You can review publicly traded REIT's disclosure filings, including annual reports and quarterly reports and any offerings prospectus using the SEC's EDGAR database. There are also REIT-focused mutual funds and exchange-traded funds to consider.

Are REITs a good investment in 2022?

Revenue and funds from operations (FFO) have actually increased for many of these REITs while real estate values have remained relatively stable for the year, indicating that the net asset value (NAV) of these companies has likely improved in 2022.

How many REITs are in the United States?

How many REITs are there? The Internal Revenue Service shows that there are about 1,100 U.S. REITs that have filed tax returns. There are more than 225 REITs in the U.S. registered with the SEC that trade on one of the major stock exchanges—the majority on the NYSE.

How big is the global REIT market?

approximately $2.5 trillionA total of 865 listed REITs with a combined equity market capitalization of approximately $2.5 trillion (as of December 2021) are in operation around the world.

Are REITs publicly traded companies?

Real estate investment trusts (REITs) are publicly traded companies that allow individual investors to buy shares in real estate portfolios that receive income from a variety of properties.

What are public REITs?

A REIT, or real estate investment trust, is a company that owns – and typically operates – income-producing real estate or real estate-related assets. The income-producing real estate assets owned by a REIT may include real assets (e.g., apartment or commercial buildings) or real estate-related debt (e.g., mortgages).

When were REITs created?

The economic and investment reach of those assets are felt by millions of Americans all across the country. Since their creation in 1960, REITs have grown in size, impact and market acceptance.

Why are REITs important?

REITs are an important part of the economy, investors’ portfolio and local communities. Taken individually, a single REIT-owned property can change the entire complexion of a neighborhood. When viewed as an entire industry, REITs significantly contribute to the tax base, job market and community.

Do REITs have a track record?

REITs have historically produced a track record of strong performance. The industry’s track record has resulted in a broader acceptance among institutional investors, financial advisors and retail investors. Data as of March 2021 unless otherwise noted.

What is REIT investment?

A REIT, or real estate investment trust, is a company that owns – and typically operates – income-producing real estate or real estate-related assets. The income-producing real estate assets owned by a REIT may include real assets ( e.g., apartment or commercial buildings) or real estate-related debt ( e.g., mortgages). Most REITs specialize in a single type of real estate – for example, apartment communities. There are retail REITs, office REITs, residential REITs, healthcare REITs and industrial REITs, to name a few.

Why are REITs so sensitive to interest rates?

Interest rate sensitivity. REIT investments may be sensitive to a changing interest rate environment. Different REITs may be affected differently. When interest rates increase, some REITs may experience an increase in rent rates or mortgage rates. Other REITs, however, may experience higher acquisition costs, similar to when a homebuyer is affected by higher mortgage rates when buying a home. Because some investors find REITs attractive for their dividend yields, REITs may become less attractive for those investors as investment alternatives such as savings accounts and certificates of deposit increase their rates.

What are the conflicts of interest in a REIT?

Conflicts of interest . Publicly traded REITs are often managed by their own employees. However, as typically found in nontraded REITs, some publicly traded REITs may hire external managers to manage their investments and operations. The external manager may be paid significant transaction fees by the REIT for services that may not necessarily align with the interests of shareholders, such as fees based on the amount of property acquisitions and assets under management. In addition, the external manager may manage or be affiliated with other companies that may compete with the REIT in which you are invested or that are paid by the REIT for services provided, such as property management or leasing fees.

Is a non-traded REIT publicly traded?

Because non-traded REITs are not publicly traded, there is no readily available market price for the stock of a non-traded REIT. An investment in a non-traded REIT poses risks different than an investment in a publicly traded REIT. REITs that file with the SEC and whose shares trade on national stock exchanges.

What percentage of investment fees are charged by broker?

Typically, fees of 10-15 percent of the investment are charged for broker-dealer commissions and other up-front costs. Ongoing management fees and expenses also are typical. Back-end fees may be charged.

Can you buy a publicly traded REIT?

Publicly traded REITs (also called exchange-traded REITs) have their securities registered with the SEC, file regular reports with the SEC and their securities are listed for trading on an exchange such as the NYSE or NASDAQ. As with any stock listed on an exchange, you can buy and sell the stock of a publicly traded REIT with relative ease.

Do REITs have double taxation?

No double taxation. REIT investments do not incur the double taxation that can often affect an investor’s return in a typical operating company. For REITs, the income that is distributed to investors is not taxed at the entity level. Rather, that income is only subject to tax when investors receive the REIT distribution and report the income personally. A typical operating company, on the other hand, has its profits taxed at the corporate level and then at the investor level when these profits are distributed as dividends to investors. Of course, tax on any investment income whether from a REIT or other investment may be deferred if the investments are held by the investor in a tax-deferred account such as an individual retirement account.

Why Invest in REITs?

REITs are, by design, a fantastic asset class for investors looking to generate income. Thus, one of the primary benefits of investing in these securities is their high dividend yields.

Why are REITs paying dividends?

The high dividend yields of REITs are due to the regulatory implications of doing business as a real estate investment trust. In exchange for listing as a REIT, these trusts must pay out at least 90% of their net income as dividend payments to their unitholders (REITs trade as units, not shares).

What is FFO in REIT?

Just like earnings, FFO can be reported on a per-unit basis, giving FFO/unit – the rough equivalent of earnings-per-share for a REIT.

What is the net income of real estate investment trusts in 2020?

In 2020, net income was $395 million while FFO available to stockholders was above $1.1 billion, a sizable difference between the two metrics. This shows the profound effect that depreciation and amortization can have on the GAAP financial performance of real estate investment trusts.

What is real estate income?

This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment. Realty Income is a large-cap stock with a market capitalization above $24 billion.

What is Alpine Income Property Trust?

Alpine Income Property Trust is a real estate trust that owns and operates a high-quality portfolio of commercial net lease properties. Its portfolio consists of 71 net leased retail and office properties located in 49 markets in 22 states.

What types of REITs are there?

Many REITs are registered with the SEC and are publicly traded on a stock exchange. These are known as publicly traded REITs . Others may be registered with the SEC but are not publicly traded. These are known as non- traded REITs (also known as non-exchange traded REITs). This is one of the most important distinctions among the various kinds of REITs. Before investing in a REIT, you should understand whether or not it is publicly traded, and how this could affect the benefits and risks to you.

Why would somebody invest in REITs?

REITs provide a way for individual investors to earn a share of the income produced through commercial real estate ownership – without actually having to go out and buy commercial real estate.

What are the benefits and risks of REITs?

REITs offer a way to include real estate in one’s investment portfolio. Additionally, some REITs may offer higher dividend yields than some other investments.

How to verify a REIT registration?

You can verify the registration of both publicly traded and non-traded REITs through the SEC’s EDGAR system. You can also use EDGAR to review a REIT’s annual and quarterly reports as well as any offering prospectus. For more on how to use EDGAR, please visit Research Public Companies.

How to buy and sell a REIT?

How to buy and sell REITs. You can invest in a publicly traded REIT, which is listed on a major stock exchange, by purchasing shares through a broker. You can purchase shares of a non-traded REIT through a broker that participates in the non-traded REIT’s offering. You can also purchase shares in a REIT mutual fund or REIT exchange-traded fund.

What are the conflicts of interest in REITs?

Conflicts of Interest: Non-traded REITs typically have an external manager instead of their own employees. This can lead to potential conflicts of interests with shareholders. For example, the REIT may pay the external manager significant fees based on the amount of property acquisitions and assets under management. These fee incentives may not necessarily align with the interests of shareholders.

How long does it take to determine the value of a non-traded REIT?

Non-traded REITs typically do not provide an estimate of their value per share until 18 months after their offering closes. This may be years after you have made your investment. As a result, for a significant time period you may be unable to assess the value of your non-traded REIT investment and its volatility.

What is the biggest threat to retail REITs?

The biggest threat to retail REITs is the growth of online competition. Industrial: Industrial REITs earn rental and management income from industrial facilities. Many types of specialization are possible.

How long do REITs have to be held?

Normally, private REIT shares must be held for one year before they can be resold to the general public. The following table contrasts the details concerning each of these REIT types:

What is equity REIT?

Equity REIT – owns properties that provide lease income to unitholders. When an equity REIT sells a property, the unitholders receive a prorated portion of the gain or loss. Equity REITS may also return capital to unitholders, which reduces the cost basis of the REIT.

What are REITs specialties?

Specialty: These REITs own and collect rent from a mixed bag of properties, such as movie theaters, billboards, and other properties that don’t conform to major sectors.

What are lodging REITs?

Lodging: The properties owned by lodging REITs include hotels, motels and resorts. These REITs earn income from operating these facilities and by leasing space in the properties to retailers and long-term tenants. The revenue per available room (RevPAR) is a key determinant of success for lodging properties.

What is mortgage REIT?

Mortgage REIT – hold mortgage notes on properties, allowing them to collect principal and interest payments from the mortgage holders. The mortgage notes act as liens, meaning the REIT can foreclose and seize a property when the mortgage holder defaults on the loan.

Which properties are more resistant to economic cycles?

Industrial properties are somewhat more resistant to economic cycles, because their size and complexity are usually key to the functioning of large companies that can withstand downturns that destroy many small retailers. Lodging: The properties owned by lodging REITs include hotels, motels and resorts.