See more

How much are property taxes in Fulton County?

Georgia Property Tax RatesCountyMedian Home ValueAverage Effective Property Tax RateFulton County$290,4001.00%Gilmer County$171,0000.51%Glascock County$63,8001.12%Glynn County$168,7000.73%62 more rows

What is the tax in Fulton County?

Georgia has a 4% sales tax and Fulton County collects an additional 2.6%, so the minimum sales tax rate in Fulton County is 6.6% (not including any city or special district taxes)....Tax Rates By City in Fulton County, Georgia.CitySales Tax RateTax JurisdictionAtlanta7.75%Fulton Co Tsplost Sp17 more rows

How much are property taxes in Atlanta?

Effective property tax rate: 0.94 percent. Median home value: $173,700 (21st lowest) Per capita property taxes: $1,124.80 (19th lowest)

What county pays the highest taxes in Georgia?

Residents of Fulton County pay highest average property taxes in Georgia. (The Center Square) – Fulton County residents on average paid $2,901 annually in property taxes, the highest such tax levies among all regions of Georgia, according to a new Tax Foundation analysis.

How much are property taxes in Alpharetta GA?

The tax is levied on the assessed value of the property which is established at 40% of the fair market value (unless otherwise specified by law).

How much is tax in GA?

Georgia's income tax rates range from 1.00 percent to 5.75 percent. Taxpayers reach their highest tax bracket once they reach an income of $7,000 for single filers and $10,000 for married taxpayers filing jointly.

How much is property taxes in Buckhead?

You may file an appeal online at this link If you feel that the valuation of your home is too high. This process can be complicated, so consider hiring one of the professionals below to handle it for you....The 2021 appeals deadline for appeals is August 5, 2021.AreaBuckheadAtlantaCity Tax1.24%Total Tax %1.63%3 more columns•Jul 14, 2021

Why are Georgia property taxes so high?

Because the value of commercial and industrial property, from shopping centers to factories, is always higher, the counties can collect more taxes from them. In areas with little development, homeowners assume more of the tax burden, she said.

How is property tax calculated in Georgia?

How to Figure Tax: The assessed value (40 percent of the fair market value) of a house that is worth $100,000 is $40,000. In a county where the millage rate is 25 mills the property tax on that house would be $1,000; $25 for every $1,000 of assessed value or $25 multiplied by 40 is $1,000.

Which county in Georgia has the cheapest taxes?

Towns CountyThe lowest rates are in: Towns County (0.45 percent) Fannin County (0.45 percent)...And then there are the middle-of-the-road areas:Decatur County (0.92 percent)Chattahoochee County (0.93 percent)Elbert County (0.93 percent )Jeff Davis County (0.93 percent)Grady County (0.94 percent)Oglethorpe County (0.94 percent)

What is the best county to live in in Georgia?

#1 Best Counties to Live in Georgia. Oconee County. ... #2 Best Counties to Live in Georgia. Forsyth County. ... #3 Best Counties to Live in Georgia. Cobb County. ... High Meadows School. ... #4 Best Counties to Live in Georgia. ... #5 Best Counties to Live in Georgia. ... #6 Best Counties to Live in Georgia. ... #7 Best Counties to Live in Georgia.More items...

Does Atlanta have high taxes?

While Georgia has one of the lowest statewide sales taxes in the country (among states that have a sales tax), Atlanta has its own city sales tax of 1.15%, and counties can assess their own sales taxes of up to 4.9%.

What is the average property tax in Fulton County?

Fulton County collects, on average, 1.08% of a property's assessed fair market value as property tax. Fulton County has one of the highest median property taxes in the United States, and is ranked 220th of the 3143 counties in order of median property taxes.

Who is responsible for determining the fair market value of a property in Fulton County?

The Fulton County Tax Assessor is responsible for assessing the fair market value of properties within Fulton County and determining the property tax rate that will apply. The Tax Assessor's office can also provide property tax history or property tax records for a property. These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal.

Which county in Georgia has the highest property tax?

You can use the Georgia property tax map to the left to compare Fulton County's property tax to other counties in Georgia. Fulton County collects the highest property tax in Georgia, levying an average of $2,733.00 (1.08% of median home value) yearly in property taxes, while Warren County has the lowest property tax in the state, ...

Does Fulton County property tax go to the state budget?

Property tax income is almost always used for local projects and services, and does not go to the federal or state budget. Unlike other taxes which are restricted to an individual, the Fulton County Property Tax is levied directly on the property. Unpaid property tax can lead to a property tax lien, which remains attached to ...

Does Fulton County have a homestead exemption?

For properties considered the primary residence of the taxpayer, a homestead exemption may exist. The Fulton County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes.

Fulton County Georgia Sales Tax Exemptions

In most states, essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate. Many municipalities exempt or charge special sales tax rates to certain types of transactions. Groceries is subject to special sales tax rates under Georgia law.

Fulton County Sales Tax Calculator

All merchants operating in Fulton County must automatically calculate the sales tax due on each purchase made and include it in separately in the receipt. Goods bought for resale or other business use may be exempted from the sales tax.

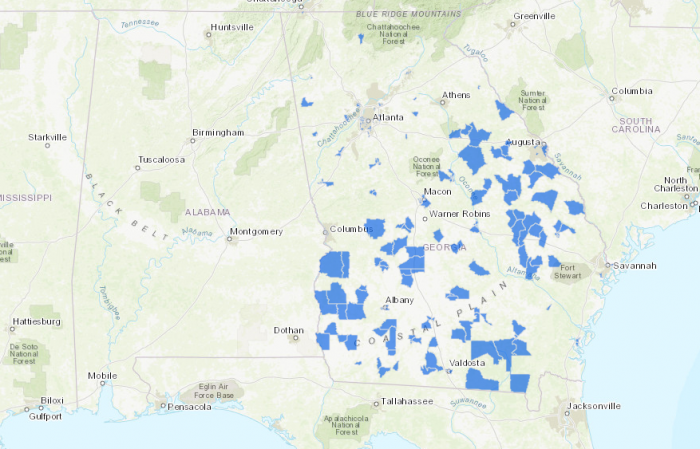

Fulton County Sales Tax Region ZIP Codes

The Fulton County sales tax region partially or fully covers 53 zip codes in Georgia. Remember that ZIP codes do not necessarily match up with municipal and tax region borders, so some of these zip codes may overlap with other nearby tax districts. You can find sales taxes by zip code in Georgia here

Additional Resources & Disclaimer - Fulton County Sales Tax

While we make every effort to ensure that our information on the Fulton County sales tax is up to date, we can offer no warranty as to the accuracy of the data provided. Please let us know if any of our data is incorrect, and we will update our database as soon as possible.

Vehicle Tags

Vehicle registrations are handled through the Office of the Fulton County Tax Commissioner.

Vehicle Tags

Vehicle registrations are handled through the Office of the Fulton County Tax Commissioner.