How much did Enron pay out to its shareholders?

Enron settlement: $7.2 billion to shareholders. Eligible shareholders whose Enron holdings became worthless when the company crumbled in scandal will receive $7.2 billion in settlements under a distribution plan approved in federal court.

What was the impact of the Enron collapse?

The collapse of Enron, which held more than $60 billion in assets, involved one of the biggest bankruptcy filings in the history of the United States, and it generated much debate as well as legislation designed to improve accounting standards and practices, with long-lasting repercussions in the financial world.

How much did Enron lose in 2000?

Enron had losses of $591 million and had $690 million in debt by the end of 2000. The final blow was dealt when Dynegy (NYSE: DYN), a company that had previously announced it would merge with Enron, backed out of the deal on Nov. 28. By Dec. 2, 2001, Enron had filed for bankruptcy. 16 $74 billion

What happened to Enron's 401k?

The Enron Corporation has been associated with many scandals. In 401 (k) plans, employees experienced steep losses due to more than 60% of assets being invested in Enron stock at one point, whose price has now dropped to 50 cents from a high of $90. What was the cause of Enron's downfall?

How does Enron write off its assets?

How Did Enron Hide Its Debt?

What is an Enron to SPV transaction?

What was the Enron trading business in 2000?

How much debt did Enron have in 2000?

What is the story of Enron 2021?

When was Enron formed?

See 4 more

About this website

Did Enron investors get paid back?

Enron had more than $68 billion in market value before its December 2001 bankruptcy filing. Investors who claim they lost $40 billion in the company's collapse have recovered $7.3 billion so far in settlements with the company's former lenders.

What happened to people who invested in Enron?

Many of those workers were also Enron shareholders. As stock in the company dropped from more than $80 per share to mere pennies, tens of thousands of people saw their pension and investment accounts depleted or destroyed.

How did Enron scandal affect its stakeholders?

Stockholders lost a total of eleven billion dollars. However, they were affected more mentally than financially. They no longer trusted the financial reports they were reading because if it was so easy for Enron to forge them, then how were they supposed to believe other companies were not doing the same.

Who lost money in the Enron scandal?

Enron shareholders filed a $40 billion lawsuit after the company's stock price, which achieved a high of US$90.75 per share in mid-2000, plummeted to less than $1 by the end of November 2001.

Did Enron employees lose their 401k?

But around the time Enron disclosed serious financial problems last month, the company froze the assets in the plan because of an administrative change. For several weeks, as the stock lost much of its value, workers stood by helplessly as their retirement savings evaporated.

Is Andy Fastow still rich?

Fastow's wife Lea who was a former Enron assistant treasurer was sentenced to one year in a federal prison in Houston in 2004. In addition she also severed one additional year of a supervised released after pleading guilty to a misdemeanor tax charge....Andrew Fastow Net Worth.Net Worth:$500 ThousandNationality:United States of America3 more rows

Who were affected in Enron scandal?

Enron scandal, series of events that resulted in the bankruptcy of the U.S. energy, commodities, and services company Enron Corporation and the dissolution of Arthur Andersen LLP, which had been one of the largest auditing and accounting companies in the world.

What was the impact of the Enron scandal?

Immediate Consequences Not only did 5,000 of them lose their jobs, but all those who had accounts in the Enron 401K retirement scheme found that their holdings were not worth the paper they were printed on.

What caused Enron's downfall?

Overall, poor corporate governance and a dishonest culture that nurtured serious conflicts of interests and unethical behaviour in Enron are identified as significant findings in this paper.

How did most of the employees of Enron lose money?

Some longtime Enron employees lost hundreds of thousands of dollars as the value of stock they accumulated in Enron's boom times tumbled in a period when they were not allowed to sell it.

Who went to jail for Enron?

Jeffrey Keith SkillingJeffrey Keith Skilling (born November 25, 1953) is a convicted American felon best known as the CEO of Enron Corporation during the Enron scandal. In 2006, he was convicted of federal felony charges relating to Enron's collapse and eventually sentenced to 24 years in prison.

Does Enron still exist today?

Enron filed for bankruptcy on December 2, 2001. In addition, the scandal caused the dissolution of Arthur Andersen, which at the time was one of the Big Five of the world's accounting firms. The company was found guilty of obstruction of justice during 2002 for destroying documents related to the Enron audit.

Who went to jail for Enron?

Jeffrey Keith SkillingJeffrey Keith Skilling (born November 25, 1953) is a convicted American felon best known as the CEO of Enron Corporation during the Enron scandal. In 2006, he was convicted of federal felony charges relating to Enron's collapse and eventually sentenced to 24 years in prison.

Did Enron employees get their pensions?

The company coordinated their pension plan and their employee stock ownership plan, so that the value of their ESOP accounts permanently erased benefits in their pensions. That is because Enron had a "floor-offset" arrangement, which has been used by many companies, including Hewlett-Packard Co.

Who were affected by the Enron scandal?

Further, thousands and thousands of workers have lost their jobs. Some 4,000 Enron employees were let go after the company declared bankruptcy. The AFL-CIO estimates that 28,500 workers have lost their jobs from Enron, WorldCom and accounting firm Arthur Andersen alone.

Where is Jeffrey Skilling now?

The famed “golden boy” of Enron, Jeffrey Skilling is back on the Houston energy scene with a new startup. After serving 12 years in federal prison on fraud and insider trading charges, the former Enron CEO launched Veld Applied Analytics, billed as a sophisticated online platform to invest in oil and gas assets.

Enron scandal | Summary, Explained, History, & Facts

Enron scandal, series of events that resulted in the bankruptcy of the U.S. energy, commodities, and services company Enron Corporation and the dissolution of Arthur Andersen LLP, which had been one of the largest auditing and accounting companies in the world. The collapse of Enron, which held more than $60 billion in assets, involved one of the biggest bankruptcy filings in the history of ...

Enron Accounting Fraud: The Scandal That Ended a Company

How did the bad Enron accounting fraud lead to the company’s failure? Enron accounting fraud were questionable, but not necessarily illegal. But Enron accounting fraud was focused exclusively on stock price, and as a results, faced pressure to demonstrate profits when there were none.

What happened to Enron? The Enron Scandal Explained

The so-called “Enron scandal” describes a series of events resulting in one of the largest bankruptcy filings in United States history. The scandal consisted of a mixture of bad culture, aggressive sales incentives, and serious accounting manipulations, resulting in one of the greatest American scandals of history. ContentsBackgroundProblems with cultureProblems with leadershipBull markets ...

Enron Scandal - Overview, Role of MTM, Agency Conflicts

What is the Enron Scandal? The Enron scandal is likely the largest, most complicated, and most notorious accounting scandal of all time. Through deceiving accounting tricks, Enron Corporation – the US-based energy, commodities, and services company – was able to trick its investors into thinking that the firm was doing much better than it actually was.

How much money did Enron receive in settlement?

Eligible shareholders whose Enron holdings became worthless when the company crumbled in scandal will receive $7.2 billion in settlements under a distribution plan approved in federal court.

What happened to Enron in 2001?

Facing a bankrupt company when the litigation was filed weeks before Enron failed in 2001, the plaintiffs pursued deep-pocketed banks that did business with Enron. Specifically, plaintiffs said the banks played as major a role in fraud as Enron by crafting and financing dubious deals.

Why are the three remaining banks liable?

The Supreme Court refused to review the case, so plaintiffs argued to Harmon that the three remaining banks are liable because they were so active in conducting deals with Enron and selling its securities that they had a duty to disclose what they knew about fraudulent practices.

How much did the Enron settlements cost?

The bulk of the settlements, $6.6 billion, came from JP Morgan Chase, Citigroup and the Canadian Imperial Bank of Commerce. Smaller amounts came from Bank of America; Lehman Brothers; former Big Five auditing firm Arthur Andersen and its defunct global umbrella organization, Andersen Worldwide; LJM2, a former partnership once run by ex-Enron finance chief Andrew Fastow to conduct deals with Enron; and law firm Kirkland & Ellis. The only individuals to have settled for a collective $168 million were former Enron directors.

When did WorldCom go bankrupt?

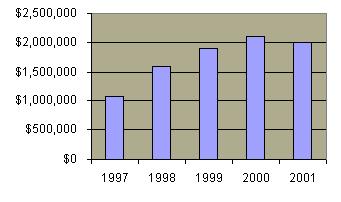

Shareholders eligible for a payout must have purchased Enron stock between Sept. 9, 1997 and Dec. 2, 2001, the day the company went bankrupt.

When did Enron stock stop trading?

January 15, 2002 - The New York Stock Exchange suspends trading of Enron shares.

When did Enron announce its third quarter loss?

October 16, 2001 - Enron announces a third-quarter loss of $618 million. The company later reveals that it overstated earnings dating back to 1997. October 31, 2001 - The company discloses that it is under formal investigation by the Securities and Exchange Commission.

What year did Enron file for bankruptcy?

Facts. Enron was ranked as America’s fifth largest company by Fortune magazine in 2002, despite its 2001 bankruptcy filing. An independent review published in 2002 detailed how executives pocketed millions of dollars from complex, off-the-books partnerships while reporting inflated profits to shareholders. Executives including Kenneth Lay and ...

What happened to Enron in 2001?

Here’s a look at Enron, an energy trading company that collapsed after a massive accounting fraud scheme was revealed. Its 2001 bankruptcy filing was the largest in American history at the time. Estimated losses totaled $74 billion.

What happened to Skilling in 2015?

December 8, 2015 - The SEC announces that it has obtained a summary judgment against Skilling, permanently barring him from serving as an officer or director of a publicly held company . The judgment settles a long-running civil suit by the SEC.

What did the lower level employees do before the company collapsed?

Lower-level employees were encouraged to invest in company stock for their retirement savings just before the company collapsed. The workers later filed a class action lawsuit and won an $85 million settlement.

Who bought Enron?

November 9, 2001 - Enron confirms that it has agreed to be purchased by a rival company, Dynegy for $9 billion.

When did Enron go bankrupt?

Enron plummeted into bankruptcy proceedings in December 2001 amid revelations of hidden debt, inflated profits and accounting tricks. Jurors determined after a 16-week trial that both Lay and Skilling repeatedly lied to investors and employees about the company’s health when they knew their optimism masked fraud.

What are the potential fines Lake could impose?

The potential fines Lake could impose are tied to the crimes of which both men were convicted. The potential asset seizures involve a separate proceeding intended to make Lay and Skilling forfeit what they gained while running what was, in the jury’s eyes, a massive fraud, Frenkel said.

Why did Jamie Olis go to jail?

finance executive Jamie Olis to 24 years in prison for his role in pushing through a 2001 scheme to disguise debt as cash flow.

How long was Alton Dane Hudnall in jail?

In October 1999 he sentenced former day trader Alton Dane Hudnall to 25 years in prison for conspiring with five others to defraud 500 European investors of $53 million in a money laundering scheme. Hudnall was convicted of 26 counts of money laundering, 17 counts of wire fraud and one count of conspiracy.

Is Enron sentence tied to investor losses?

Enron sentences will be tied to investor losses. Just how much time former Enron Corp. chiefs Kenneth Lay and Jeffrey Skilling spend in prison could hinge on how much of the more than $60 billion lost in the company’s crash is deemed their responsibility.

Who represents the University of California in the shareholder lawsuit?

In addition, both remain named as defendants in shareholder litigation in Houston. But William Lerach, who represents the University of California, the lead plaintiff in the litigation, said he doesn’t expect to see any cash from them.

Did Lake resentence Olis?

Lake had intended to resentence Olis before the Lay-Skilling trial began Jan. 30. But the judge decided to hold off until experts hash out how long Olis remains behind bars based on the loss amount. Lake indicated he won’t side with Olis’ contention that no specific amount can be attributed to his crime.

What was the damage to Enron's reputation?

The damage to its reputation was so severe that it was forced to dissolve itself. In addition to federal lawsuits, hundreds of civil suits were filed by shareholders against both Enron and Andersen. Joseph Berardino, then CEO of Arthur Andersen, testifying during a congressional hearing on the Enron scandal, 2002.

What is the Enron scandal?

Enron scandal. Former Enron employees sitting with their belongings after layoffs by the bankrupt energy-trading company. David J. Phillip/AP. Enron was founded in 1985 by Kenneth Lay in the merger of two natural-gas -transmission companies, Houston Natural Gas Corporation and InterNorth, Inc.; the merged company, HNG InterNorth, ...

What did Enron do under Skilling?

Under Skilling’s leadership, Enron soon dominated the market for natural-gas contracts, and the company started to generate huge profits on its trades. Skilling also gradually changed the culture of the company to emphasize aggressive trading.

What does it mean to transfer assets to SPEs?

Transferring those assets to SPEs meant that they were kept off Enron’s books, making its losses look less severe than they really were. Ironically, some of those SPEs were run by Fastow himself. Throughout these years, Arthur Andersen served not only as Enron’s auditor but also as a consultant for the company.

When did Enron file for bankruptcy?

On December 2, 2001, Enron filed for Chapter 11 bankruptcy protection. Many Enron executives were indicted on a variety of charges and were later sentenced to prison. Arthur Andersen came under intense scrutiny and eventually lost a majority of its clients.

Who is the chief financial officer of Enron?

One of his brightest recruits was Andrew Fastow, who quickly rose through the ranks to become Enron’s chief financial officer. Fastow oversaw the financing of the company through investments in increasingly complex instruments, while Skilling oversaw the building of its vast trading operation.

Who was the CEO of Arthur Andersen?

Joseph Berardino, then CEO of Arthur Andersen, testifying during a congressional hearing on the Enron scandal, 2002. Scott J. Ferrell/Congressional Quarterly/Alamy. The scandal resulted in a wave of new regulations and legislation designed to increase the accuracy of financial reporting for publicly traded companies.

How much did Enron lose in a year?

That is the inevitable consequence of a stock that lost 99.5 percent of its market value in a year. Carol M. Coale, an analyst at Prudential Securities, said that Enron had a market value of almost $68 billion at its peak but that number was about $344 million as of yesterday's close.

Who is the largest shareholder in Enron?

At the end of September, Alliance Capital was Enron's largest shareholder, with 43 million shares. Janus Capital, which topped the list for much of the year, was second, with 41.4 million shares.

Does Enron stock have dividends?

The market value of Enron's preferred stock has plummeted along with its ability to meet the dividends payable on the securities.

Does Enron owe money?

Enron also owes money to many lenders. The exact number may not be known for months, analysts say.

How much did Enron lose in 4 years?

During that period Enron reported its first quarterly loss in four years and took a charge of $1.2 billion against stockholders' equity as a result of off-balance-sheet deals that later came under investigation by U.S. regulators.

When did Enron block accounts?

Enron spokeswoman Karen Denne said employees' access to the accounts was blocked as part of a previously planned change in the administration of the retirement plan and that the measure was in effect from Oct. 26. to Nov. 19.

Why did Lacey invest in Enron?

Lacey declined to quantify his own losses but said he and many of his colleagues had invested most of their retirement funds in Enron stock because it had performed better in the past than the other investments available under the Enron plan.

How long can you hold Enron stock?

It also requires them to hold the stock they receive in matching contributions until they turn 50. Enron employees also were prevented from selling Enron stock held in retirement accounts for several weeks from mid-October due to a change in the retirement plan's administrator.

What was the price of Enron in 2000?

Enron's stock, which peaked at $90 in August 2000, closed at $4.74 Friday, after falling sharply in recent weeks amid a series of damaging financial disclosures.

What happens if you lose your retirement funds on a company's shares?

Employees who lost their retirement funds on company's shares fight back.

Who filed the Enron suit?

The suit, filed on behalf of Enron ( ENE: down $0.66 to $4.05, Research, Estimates) employees by Seattle-based law firm Hagens Berman, alleges that Enron breached its fiduciary duty by encouraging its employees to invest heavily in Enron stock without warning them of the risks in doing so.

How does Enron write off its assets?

In Enron's case, the company would build an asset, such as a power plant, and immediately claim the projected profit on its books, even though the company had not made one dime from the asset. If the revenue from the power plant was less than the projected amount, instead of taking the loss, the company would then transfer the asset to an off-the-books corporation where the loss would go unreported. This type of accounting enabled Enron to write off unprofitable activities without hurting its bottom line.

How Did Enron Hide Its Debt?

Fastow and others at Enron orchestrated a scheme to use off-balance-sheet special purpose vehicles (SPVs), also known as special purposes entities (SPEs ), to hide its mountains of debt and toxic assets from investors and creditors. 2 The primary aim of these SPVs was to hide accounting realities rather than operating results.

What is an Enron to SPV transaction?

The standard Enron-to-SPV transaction would be the following: Enron would transfer some of its rapidly rising stock to the SPV in exchange for cash or a note. The SPV would subsequently use the stock to hedge an asset listed on Enron's balance sheet. In turn, Enron would guarantee the SPV's value to reduce apparent counterparty risk.

What was the Enron trading business in 2000?

CEO Jeffrey Skilling hid the financial losses of the trading business and other operations of the company using mark-to-market accounting. 10 This technique measures the value of a security based on its current market value instead of its book value. This can work well when trading securities, but it can be disastrous for actual businesses.

How much debt did Enron have in 2000?

Enron had losses of $591 million and had $690 million in debt by the end of 2000. The final blow was dealt when Dynegy (NYSE: DYN), a company that had previously announced it would merge with Enron, backed out of the deal on Nov. 28. By Dec. 2, 2001, Enron had filed for bankruptcy. 16 .

What is the story of Enron 2021?

Updated Jun 1, 2021. The story of Enron Corporation depicts a company that reached dramatic heights only to face a dizzying fall. The fated company's collapse affected thousands of employees and shook Wall Street to its core.

When was Enron formed?

Enron was formed in 1985 following a merger between Houston Natural Gas Company and Omaha-based InterNorth Incorporated. Following the merger, Kenneth Lay, who had been the chief executive officer (CEO) of Houston Natural Gas, became Enron's CEO and chairman. Lay quickly rebranded Enron into an energy trader and supplier. Deregulation of the energy markets allowed companies to place bets on future prices, and Enron was poised to take advantage. In 1990, Lay created the Enron Finance Corporation and appointed Jeffrey Skilling, whose work as a McKinsey & Company consultant had impressed Lay, to head the new corporation. Skilling was then one of the youngest partners at McKinsey. 4