What is the FASB?

What is the purpose of a financial reporting organization?

Are FASB members paid?

They have to pay for their own lunches - but the F.A.S.B. gives them ample cash to do so. Board members earn $215,000 a year. Despite the hefty salary, the Financial Accounting Foundation, the private-sector trust that appoints board members for five-year terms, is in a constant struggle to recruit new members.

How are FASB members chosen?

FASB members are appointed by the FAF Trustees generally for 5-year terms; they may serve up to 10 years.

How many FASB board members are there?

seven membersThe seven members of the FASB serve full time and, to foster their independence, are required to sever connections with the firms or institutions they served before joining the Board.

How does FASB make money?

The work of the Financial Accounting Foundation (FAF), the Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB) is funded by a combination of publishing revenue, accounting support fees, and investment income.

Who runs the FASB?

nonprofit Financial Accounting FoundationThe FASB is run by the nonprofit Financial Accounting Foundation. FASB accounting standards are accepted as authoritative by many organizations, including state Boards of Accountancy and the American Institute of CPAs (AICPA).

What is the job of FASB?

The FASB and GASB establish and improve financial accounting and reporting standards—known as Generally Accepted Accounting Principles, or GAAP—for public and private companies, not-for-profit organizations, and state and local governments in the United States.

How many people work for the FASB?

The Board is assisted by a staff of more than 60 professionals.

Is FASB and GAAP the same?

GAAP is a set of procedures and guidelines used by companies to prepare their financial statements and other accounting disclosures. The standards are prepared by the Financial Accounting Standards Board (FASB), which is an independent non-profit organization.

What is the difference between FASB and SEC?

The SEC has the authority to both set and enforce accounting standards. The FASB can set standards, which it does via the Accounting Standards Codification. GAAP is not law, though violating GAAP can have costly ramifications.

Who selects members of the FASB?

The FASB is governed by seven full-time board members, who are required to sever their ties to the companies or organizations they work for before joining the board. Board members are appointed by the FAF's board of trustees for five-year terms and may serve for up to 10 years.

What is the difference between FASB and IASB?

Firstly, the FASB focuses mainly on setting standards and rules for accounting firms and individual certified public accountants practising in the United States. In contrast, the IASB focuses on international accounting standards.

Do governments follow FASB?

FASAB standards are GAAP for federal governmental entities only. FASAB issues the following types of pronouncements: Statements of Federal Financial Accounting Concepts (provide general guidance to the FASAB as it deliberates on the creation or amendment of Statements of Federal Financial Accounting Standards)

Who sets accounting standards for private companies?

Responsibility for enforcement and shaping of generally accepted accounting principles (GAAP) falls to two organizations: The Financial Accounting Standards Board (FASB) and Securities and Exchange Commission (SEC). The SEC has the authority to both set and enforce accounting standards.

Is FASB a government entity?

The Federal Accounting Standards Board (FASAB) is an advisory committee that develops accounting standards for government agencies.

Which are attributes of FASB?

FASB (Financial Accounting Standards Board) lists six qualitative characteristics that determine the quality of financial information: Relevance, Faithful Representation, Comparability, Verifiability, Timeliness, and Understandability.

How does FASB set accounting standards?

The FASB decides whether to add a project to the technical agenda based on a staff-prepared analysis of the issues. The Board deliberates at one or more public meetings the various reporting issues identified and analyzed by the staff. The Board issues an Exposure Draft to solicit broad stakeholder input.

What is the FASB?

FINANCIAL ACCOUNTING STANDARDS BOARD (FASB)FINANCIAL ACCOUNTING STANDARDS ADVISORY COUNCIL (FASAC)ESTABLISHED IN 1973, THE FASB IS THE INDEPENDENT, PRIVATE-SECTOR ORGANIZATION, BASED IN NORWALK, CONNECTICUT, THAT ESTABLISHES FINANCIAL ACCOUNTING AND REPORTING STANDARDS FOR PUBLIC AND PRIVATE COMPANIES AND NOT-FOR-PROFIT ORGANIZATIONS THAT FOLLOW GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAP). THE FASB IS RECOGNIZED BY THE SECURITIES AND EXCHANGE COMMISSION AS THE DESIGNATED ACCOUNTING STANDARD SETTER FOR PUBLIC COMPANIES. FASB STANDARDS ARE RECOGNIZED AS AUTHORITATIVE BY MANY OTHER ORGANIZATIONS, INCLUDING STATE BOARDS OF ACCOUNTANCY AND THE AMERICAN INSTITUTE OF CPAS (AICPA). THE FASB DEVELOPS AND ISSUES FINANCIAL ACCOUNTING STANDARDS THROUGH A TRANSPARENT AND INCLUSIVE PROCESS INTENDED TO PROMOTE FINANCIAL REPORTING THAT PROVIDES USEFUL INFORMATION TO INVESTORS AND OTHERS WHO USE FINANCIAL REPORTS. THE FINANCIAL ACCOUNTING FOUNDATION (FAF) SUPPORTS AND OVERSEES THE FASB. THE FOLLOWING ARE SOME SPECIFIC ACCOMPLISHMENTS AND INITIATIVES IN 2018 RELATED TO THESE AGENDA ITEMS AND IMPROVING GAAP IN GENERAL. HOWEVER, FOR A COMPLETE AND DETAILED PICTURE OF THE WORK OF THE FASB, CURRENT AND COMPLETED PROJECTS, TIMETABLES AND OTHER INFORMATION, PLEASE VISIT FASB.ORG. IN ADDITION, THE FAF ANNUAL REPORT PROVIDES A HIGHLIGHT OF FASB'S 2018 ACCOMPLISHMENTS AND CAN BE FOUND AT ACCOUNTINGFOUNDATION.ORG.THE FASB COMPLETED A VARIETY OF PROJECTS TO IMPROVE ASPECTS OF GAAP, ISSUING 20 FINAL ACCOUNTING STANDARDS UPDATES (ASUS) IN 2018. AMONG THE MOST SIGNIFICANT OF THESE WERE ASUS ON ACCOUNTING FOR LONG-DURATION INSURANCE CONTRACTS AND ON GRANTS AND CONTRACTS, PRIMARILY TO NOT-FOR-PROFIT ENTITIES. THE FASB ALSO ISSUED 12 PROPOSED ASUS, SEVERAL OF WHICH RELATED TO IMPLEMENTATION MATTERS CONCERNING RECENTLY ISSUED STANDARDS ON REVENUE RECOGNITION, LEASES, AND CREDIT LOSSES. MOST OF THESE WERE SUBSEQUENTLY ISSUED AS FINAL ASUS IN 2018.THE PRIVATE COMPANY COUNCIL (PCC), CONTINUED ITS WORK WITH IMPROVEMENTS THAT ADDRESS THE NEEDS OF PRIVATE COMPANY USERS OF FINANCIAL STATEMENTS IN THE STANDARDS DEVELOPMENT PROCESS AND WERE INSTRUMENTAL IN ADVISING THE FASB ON A NUMBER OF ASUS. THE FASB CONTINUED WITH THE CONTINUED DEVELOPMENT OF THE GAAP FINANCIAL REPORTING TAXONOMY (TAXONOMY) FOR EXTENSIBLE BUSINESS REPORTING LANGUAGE (XBRL). OUTREACH AND OTHER STAKEHOLDER COMMUNICATIONS CONTINUED TO BE EXTENSIVE WITH NUMEROUS MEETINGS WITH LIAISON GROUPS, REPRESENTATIVES OF USERS, PREPARERS, AND AUDITORS, AND OTHER STAKEHOLDERS. OUTREACH ACTIVITIES ALSO INCLUDES VARIOUS COMMUNICATIONS, EDUCATIONAL MATERIALS AND OTHER ACTIVITIES INCLUDING: * FASB MEMBERS AND STAFF DELIVERED SPEECHES AT 156 DIFFERENT CONFERENCES DURING THE YEAR * 79 PRESS RELEASES, MEDIA ADVISORIES AND TWEETS WERE SENT ON A VARIETY OF FASB STANDARD SETTING ACTIVITIES * 21 EDUCATIONAL WEBCASTS AND VIDEOS WERE PROVIDED.THE FASAC, WHICH COMPRISES 35 MEMBERS WHO REPRESENT A BROAD CROSS-SECTION OF THE FASB'S STAKEHOLDERS, MET FOUR TIMES IN 2018. THE PRIMARY FUNCTION OF FASAC IS TO ADVISE THE FASB ON ISSUES RELATED TO PROJECTS ON THE FASB'S AGENDA, POSSIBLE NEW AGENDA ITEMS, PROJECT PRIORITIES, PROCEDURAL MATTERS THAT MAY REQUIRE THE ATTENTION OF THE FASB, AND OTHER MATTERS AS REQUESTED.FASB'S OTHER ADVISORY GROUPS, INCLUDING THE INVESTOR ADVISORY COMMITTEE, THE NOT-FOR-PROFIT ADVISORY COMMITTEE, AND THE SMALL BUSINESS ADVISORY COMMITTEE, AND THE EMERGING ISSUES TASK FORCE ALL HELD MEETINGS IN 2018 TO SUPPORT THE EFFORTS OF THE FASB.

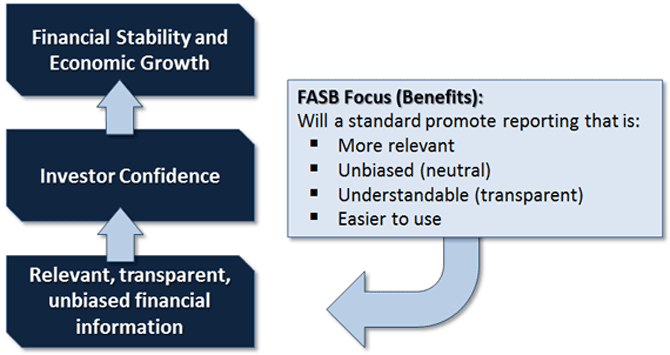

What is the purpose of a financial reporting organization?

Organizations Filed Purposes: ESTABLISH AND IMPROVE FINANCIAL ACCOUNTING AND REPORTING STANDARDS TO PROVIDE USEFUL INFORMATION TO INVESTORS AND OTHER USERS OF FINANCIAL REPORTS AND TO EDUCATE STAKEHOLDERS ON HOW TO MOST EFFECTIVELY UNDERSTAND AND IMPLEMENT THOSE STANDARDS.

How much does a senator make?

Senators and House of Representative members receive the same salary: $174,000, according to a report by the Congressional Research Service. That number is $50,000 less than what the Vice President makes, which is $230,700. (The president, on the other hand, receives a $400,000 salary.)

How much does the Speaker of the House make?

However, there are exceptions to some congressional salaries. According to the Congressional Research Service, the Speaker of the House receives $223,500, while the President pro tempore of the Senate, as well as majority and minority leaders of the House and Senate receive a salary of $193,400. These salaries also haven’t changed since 2009. Like the President of the United States, congressional salaries have changed a lot since the first United States election was held in 1789. (For comparison, George Washington made $25,000 per year as president, which equals to about $600,000 today after factoring in inflation.) Congress members, on the other hand, received a $50 per annum sum in 1989. Now congress members’ salaries are in the six figures.

When was the last time the Congress salary was changed?

The last time the congressional salary was changed was in 2009, when it was raised from $169,300 to $174,000. Since 2010, the congress has voted not to increase the salary, which is why it’s stayed unchanged for more than a decade.

What are the benefits of being a congressman?

The site also reports that if a congress member dies while in office, their families will receive a payout of $174,000 or a year’s salary. BI also reports that each congress member receives an allowance of $944,671 called the “Members’ Representational Allowance,” which can be used for official expenses, such as personnel, official mailings and office furnishings. Other perks include access to the Senate Hair Care Services, and on-site Capitol amenities , such as the House and Senate dining rooms and gym.

How Much Do YouTubers Make With 100K Subscribers?

You don't need 1 million subscribers to be successful on YouTube. Creators with 100,000 subscribers can still make decent money.

How Much Do YouTubers Make Per View?

Advertising money is split between Google (which owns YouTube) and the content creator. YouTubers keep about 68% of the ad revenue.

Who Are the Richest YouTubers?

Big YouTubers can make a lot of money just on the platform. But the top-paid YouTubers have also started lucrative side businesses in addition to being a full-time content creators.

Abstract

This study provides descriptive evidence on how the Financial Accounting Standards Board (FASB) sets Generally Accepted Accounting Principles (GAAP).

JEL Classification

The current paper is a substantial revision of our 2014 working paper titled “Saying No in Standard Settings: An Examination of FASB Board Members' Voting Decisions.” We thank Charry Boris of the Financial Accounting Foundation for her generous help on data collection.

What is the FASB?

FINANCIAL ACCOUNTING STANDARDS BOARD (FASB)FINANCIAL ACCOUNTING STANDARDS ADVISORY COUNCIL (FASAC)ESTABLISHED IN 1973, THE FASB IS THE INDEPENDENT, PRIVATE-SECTOR ORGANIZATION, BASED IN NORWALK, CONNECTICUT, THAT ESTABLISHES FINANCIAL ACCOUNTING AND REPORTING STANDARDS FOR PUBLIC AND PRIVATE COMPANIES AND NOT-FOR-PROFIT ORGANIZATIONS THAT FOLLOW GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAP). THE FASB IS RECOGNIZED BY THE SECURITIES AND EXCHANGE COMMISSION AS THE DESIGNATED ACCOUNTING STANDARD SETTER FOR PUBLIC COMPANIES. FASB STANDARDS ARE RECOGNIZED AS AUTHORITATIVE BY MANY OTHER ORGANIZATIONS, INCLUDING STATE BOARDS OF ACCOUNTANCY AND THE AMERICAN INSTITUTE OF CPAS (AICPA). THE FASB DEVELOPS AND ISSUES FINANCIAL ACCOUNTING STANDARDS THROUGH A TRANSPARENT AND INCLUSIVE PROCESS INTENDED TO PROMOTE FINANCIAL REPORTING THAT PROVIDES USEFUL INFORMATION TO INVESTORS AND OTHERS WHO USE FINANCIAL REPORTS. THE FINANCIAL ACCOUNTING FOUNDATION (FAF) SUPPORTS AND OVERSEES THE FASB. THE FOLLOWING ARE SOME SPECIFIC ACCOMPLISHMENTS AND INITIATIVES IN 2018 RELATED TO THESE AGENDA ITEMS AND IMPROVING GAAP IN GENERAL. HOWEVER, FOR A COMPLETE AND DETAILED PICTURE OF THE WORK OF THE FASB, CURRENT AND COMPLETED PROJECTS, TIMETABLES AND OTHER INFORMATION, PLEASE VISIT FASB.ORG. IN ADDITION, THE FAF ANNUAL REPORT PROVIDES A HIGHLIGHT OF FASB'S 2018 ACCOMPLISHMENTS AND CAN BE FOUND AT ACCOUNTINGFOUNDATION.ORG.THE FASB COMPLETED A VARIETY OF PROJECTS TO IMPROVE ASPECTS OF GAAP, ISSUING 20 FINAL ACCOUNTING STANDARDS UPDATES (ASUS) IN 2018. AMONG THE MOST SIGNIFICANT OF THESE WERE ASUS ON ACCOUNTING FOR LONG-DURATION INSURANCE CONTRACTS AND ON GRANTS AND CONTRACTS, PRIMARILY TO NOT-FOR-PROFIT ENTITIES. THE FASB ALSO ISSUED 12 PROPOSED ASUS, SEVERAL OF WHICH RELATED TO IMPLEMENTATION MATTERS CONCERNING RECENTLY ISSUED STANDARDS ON REVENUE RECOGNITION, LEASES, AND CREDIT LOSSES. MOST OF THESE WERE SUBSEQUENTLY ISSUED AS FINAL ASUS IN 2018.THE PRIVATE COMPANY COUNCIL (PCC), CONTINUED ITS WORK WITH IMPROVEMENTS THAT ADDRESS THE NEEDS OF PRIVATE COMPANY USERS OF FINANCIAL STATEMENTS IN THE STANDARDS DEVELOPMENT PROCESS AND WERE INSTRUMENTAL IN ADVISING THE FASB ON A NUMBER OF ASUS. THE FASB CONTINUED WITH THE CONTINUED DEVELOPMENT OF THE GAAP FINANCIAL REPORTING TAXONOMY (TAXONOMY) FOR EXTENSIBLE BUSINESS REPORTING LANGUAGE (XBRL). OUTREACH AND OTHER STAKEHOLDER COMMUNICATIONS CONTINUED TO BE EXTENSIVE WITH NUMEROUS MEETINGS WITH LIAISON GROUPS, REPRESENTATIVES OF USERS, PREPARERS, AND AUDITORS, AND OTHER STAKEHOLDERS. OUTREACH ACTIVITIES ALSO INCLUDES VARIOUS COMMUNICATIONS, EDUCATIONAL MATERIALS AND OTHER ACTIVITIES INCLUDING: * FASB MEMBERS AND STAFF DELIVERED SPEECHES AT 156 DIFFERENT CONFERENCES DURING THE YEAR * 79 PRESS RELEASES, MEDIA ADVISORIES AND TWEETS WERE SENT ON A VARIETY OF FASB STANDARD SETTING ACTIVITIES * 21 EDUCATIONAL WEBCASTS AND VIDEOS WERE PROVIDED.THE FASAC, WHICH COMPRISES 35 MEMBERS WHO REPRESENT A BROAD CROSS-SECTION OF THE FASB'S STAKEHOLDERS, MET FOUR TIMES IN 2018. THE PRIMARY FUNCTION OF FASAC IS TO ADVISE THE FASB ON ISSUES RELATED TO PROJECTS ON THE FASB'S AGENDA, POSSIBLE NEW AGENDA ITEMS, PROJECT PRIORITIES, PROCEDURAL MATTERS THAT MAY REQUIRE THE ATTENTION OF THE FASB, AND OTHER MATTERS AS REQUESTED.FASB'S OTHER ADVISORY GROUPS, INCLUDING THE INVESTOR ADVISORY COMMITTEE, THE NOT-FOR-PROFIT ADVISORY COMMITTEE, AND THE SMALL BUSINESS ADVISORY COMMITTEE, AND THE EMERGING ISSUES TASK FORCE ALL HELD MEETINGS IN 2018 TO SUPPORT THE EFFORTS OF THE FASB.

What is the purpose of a financial reporting organization?

Organizations Filed Purposes: ESTABLISH AND IMPROVE FINANCIAL ACCOUNTING AND REPORTING STANDARDS TO PROVIDE USEFUL INFORMATION TO INVESTORS AND OTHER USERS OF FINANCIAL REPORTS AND TO EDUCATE STAKEHOLDERS ON HOW TO MOST EFFECTIVELY UNDERSTAND AND IMPLEMENT THOSE STANDARDS.