Do Mortgage Rates Change Daily? Short answer: yes. Long answer: Every morning, Monday through Friday, banks get a fresh rate sheet that has pricing for that day. Mortgage rates don’t change over the weekend, but the rate you’re quoted on Friday can differ from Monday’s numbers.

Why do mortgage interest rates change so often?

Why do Mortgage Interest Rates Change so Often?

- The Economy Plays a Role. The economy plays a large role in interest rates at any given time. ...

- The Federal Reserve Plays a Role. The Federal Reserve doesn’t directly impact interest rates, unless they need to. ...

- World Events. Sometimes even world events can cause interest rates to rise or fall. ...

- Always Lock in Your Interest Rate. ...

Are mortgage rates going up or down?

The pandemic housing rally is heating up again ... year rates to climb above 4% this year. “Many potential first-time homebuyers will get locked out of homeownership, at least until house prices come back to earth or mortgage rates turn back down, ...

Do mortgage rates change daily?

You’ll be able to get a better idea of monthly payments and hone in on the rent vs buy question. Anyway, to answer the initial question, yes, mortgage rates can change daily, but only during the five-day workweek.

What are current mortgage rates?

When shopping around for home mortgage rates, consider your goals and current finances. Things that affect what the interest rate you might get on your mortgage include: your credit score, down payment, loan-to-value ratio and your debt-to-income ratio.

Do Mortgage Rates fluctuate daily?

Mortgage interest rates are in constant flux, changing every day. That's because there are a lot of different factors that influence mortgage rates, including economic conditions, inflation and U.S. Treasury bonds.

Can interest rates change daily?

Frequency Of Interest Rate Changes Every day, banks receive rate sheets. This doesn't mean rates change daily, but they can. In fact, they can change multiple times a day. If you have your eye on an interest rate, it's best to talk to your lender about locking in a lower interest rate before it rises.

Do mortgage rates change over the weekend?

Mortgage rates do not change during the weekend, though pricing can definitely change between Friday and Monday.

How quickly can mortgage rates rise?

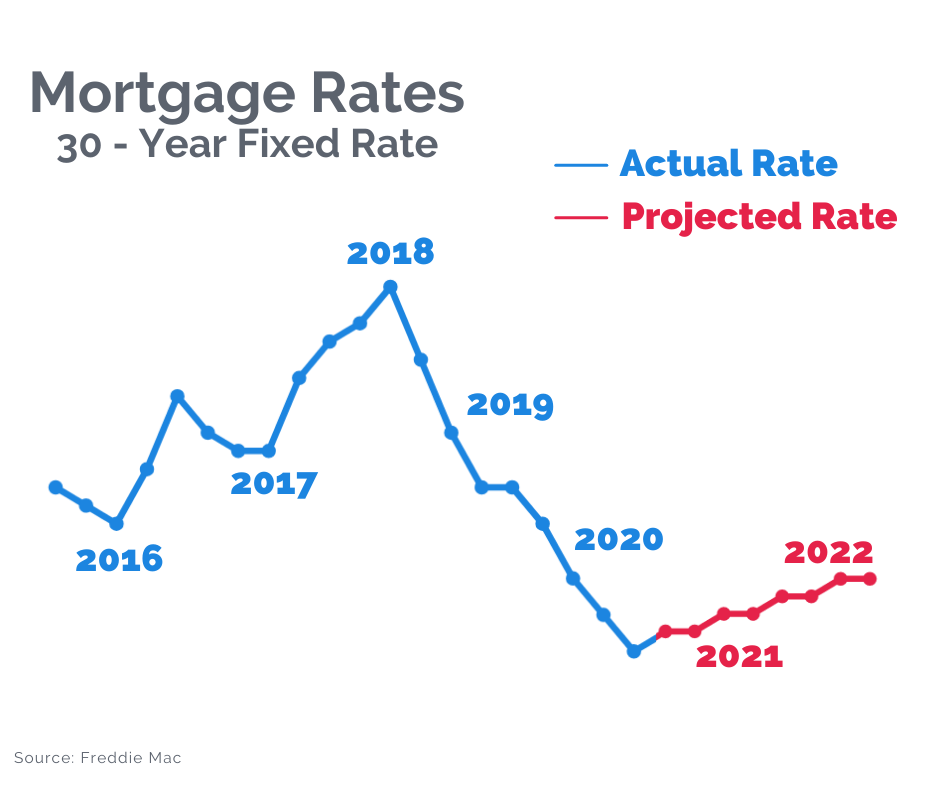

Mortgage Interest Rates Forecast for June 2022 As inflation increases, the Fed reacts by applying more aggressive monetary policy, which invariably leads to higher mortgage rates. Experts are forecasting that the 30-year, fixed-mortgage rate will vary from 4.8% to 5.5% by the end of 2022.

What is the best day to lock in a mortgage rate?

The best day of the week to lock in a mortgage rate is Monday. This is because the history of mortgage rates shows it's the least volatile day of the week when it comes to the mortgage market. Potential homebuyers will want to avoid volatility.

Should I lock in a mortgage rate today?

As long as you close before your rate lock expires, any increase in rates won't affect you. The ideal time to lock your mortgage rate is when interest rates are at their lowest, but this is hard to predict — even for the experts. It's worth noting that interest rates could decrease during your lock period.

What is the lowest ever mortgage rate?

Mortgage rates dropped to a record low of 3.35% in November 2012. To put it into perspective, the monthly payment for a $100,000 loan at the historical peak rate of 18.45% in 1981 was $1,544, compared to $441 at a much lower rate of 3.35% in 2012.

What if rates drop after I lock?

Most lenders measure this cost as a percentage of your loan amount (0.25 percent for example). What happens if you lock in a rate, and it goes down? If interest rates go down after you rate lock, you are still committed to your initial, agreed-upon rate, unless your loan includes a float-down provision.

Can mortgage rate changes once locked?

Once locked, the loan's interest rate won't change — barring any changes to your application details. You're protected from higher rates, but you won't get a lower rate, either, unless you have the option for a one-time "float down."

What is the highest mortgage rate ever?

Interest rates reached their highest point in modern history in 1981 when the annual average was 16.63%, according to the Freddie Mac data.

Will mortgage rates stay low in 2022?

Mortgage rates are likely to continue to rise in 2022. Many factors influence mortgage rates, including inflation, world events, economic crises, personal factors, the Federal Reserve and even bond prices. Even though mortgage interest rates increase, they will still be lower than historical mortgage rates.

Will mortgage interest rates go up in 2022?

In 2022, mortgage rates rose nearly to levels not seen since before the pandemic, after nearly two years of record-low rates. The refinance or purchase of your home doesn't have to be put on hold. Although rates are higher than they were in 2021, 30-year fixed rates are still close to rates from a few years ago.

What are mortgage rates?

Mortgage rates are the costs associated with taking out a loan to finance a home purchase. Because properties cost so much, most people can’t pay f...

When will mortgage rates go up?

Mortgage rates have surged since the start of 2022, which reflects investors’ views that the economy is heating up and that the Federal Reserve is...

What is a mortgage rate lock?

A mortgage rate lock is a guarantee that the rate you’re offered in your mortgage application acceptance is the one you will eventually pay, assumi...

When should I lock my mortgage rate?

It can be tricky to time any market, and mortgage rates are no exception. If conditions are choppy, and interest rates are likely to at least stay...

Average Mortgage Interest Rate By Credit Score

National rates aren’t the only thing that can sway your mortgage rates personal information like your credit history also can affect the price you’ll pay to borrow.

What That Forecast Got Correct

I look at that year-ago prediction in two ways. The forecasters were wrong in their aggregated prediction that mortgage rates would stay about the same. But they were right about something more important: that rates, when averaged for the year, wouldn’t be higher in 2021 than in 2020.

How Much Is The Apr

The terms interest rate and APR are often used interchangeably, but theyre not the same thing.

Our Mortgage Rate Methodology

Moneys daily mortgage rates show the average rate offered by over 8,000 lenders across the United States the most recent business day rates are available for. Today, we are showing rates for Thursday, January 20, 2022. Our rates reflect what a typical borrower with a 700 credit score might expect to pay for a home loan right now.

Do Rates Vary With Different Lenders

Its common for rates to vary slightly across multiple banks and financial institutions. Each bank may have its own process for assessing risk. Some banks may offer promotional interest rates for well-qualified customers . Other financial institutions give customers who already have a relationship with them a slight discount on the interest rate

Consider Different Types Of Home Loans

The 30-year fixed rate mortgage is the most common type of home loan, but there are additional mortgage options that may be more beneficial depending on your situation.

Mortgage Rates: Looking Forward

Looking forward, housing experts predict a continuation of the same trend rates will continue increasing through the end of the year and into 2022 citing inflation as a key factor. Federal Reserve Gov.

Why Do Interest Rates Matter?

Mortgage lending is a business just like any other. Their goal is to make a profit and charging interest on your loan is how they do it. Interest rates are always calculated as a percentage of the loan amount you borrow.

How do Rates Fluctuate?

Mortgage rates can change daily depending on the state of the economy. Numerous factors influence this such as consumer demand for housing and unemployment levels. During a slow economic period, the Federal Reserve will provide more funding which allows rates to go down.

How do You Lock in a Rate?

The term “rate lock” refers to when a lender offers a guaranteed interest rate. This rate lock will last about 30 days and usually starts once you’ve been preapproved. If you can close on a home within that time, the rate is yours.

How to Get the Best Rate

Your interest rate will depend on your personal finances. To get the best rate you can focus on the following factors:

How much will refinancing be in 2021?

The MBA predicts that refinancing volume will fall from $2.149 trillion in 2020 to $1.191 trillion in 2021, mainly due to rising rates. There will be an even sharper decline of refinancing volume in 2022 to $573 billion, according to MBA’s latest forecast. The refinance share of all mortgage originations is predicted to drop to 41% in 2021 ...

What is the average mortgage rate for 2021?

The Mortgage Bankers Association (MBA) says it believes the average rate for a 30-year mortgage will start at 2.9% in the first quarter of 2021 and gradually increase to 3.2% by the end of 2021. Looking even further down the road, the MBA has 2022 rates peaking at 3.6%.

Will home prices increase in 2021?

Higher rates can reduce buying power, especially as home price appreciation is on track to increase in 2021. The MBA forecast for home price appreciation in 2021 is 5.1%, which is a small dip from 5.3% in 2020. In the following scenarios, you can see how even a small jump in interest rates can substantially increase the cost of a mortgage.

Why is it so hard to shop for mortgage rates?

Shopping for a mortgage rate can be difficult — especially because it’s not always clear where mortgage rates come from, or how they’re made. The good news is that mortgage rates are simple to understand once you understand a few basic facts.

How long is a mortgage lock good for?

The standard mortgage rate lock is good for 30 days. This means that when you lock a loan, the lender will agree to honor your locked rate for a period of 30 days no matter what. If the mortgage market suddenly worsens, ...

What is mortgage backed securities?

Mortgage-backed securities are bonds, which are traded similar to stocks. Also like stocks, mortgage-backed security prices change all day, every day. In this context, we see that mortgage rates — just like stocks — are driven by “the market”.

How long does it take for a mortgage to increase?

In general, mortgage rates increase 12.5 basis points (0.125%) for every 15 days you add to your rate lock, up to 90 days. Beyond 90 days, expect to pay higher rates and a non-refundable, upfront fee. This fee is why very few people execute rate locks for longer than 90 days.

What does it mean to lock your rate at the right time?

Locking your rate at the precise right time can mean the difference between saving big bucks and paying higher costs.

How long does it take to close on a mortgage?

Thankfully, rate locks are available for time frames longer than just 30 days. Mortgage rates can be locked in 15-day increments, all the way up to 90 days. Beyond 90 days, the increment shifts to 30-day periods, up to 360 days total.

Can MBS prices be affected?

MBS prices can be affected by the policies of a government halfway around the globe ( see: China ); and, by the policies of the government here at home. MBS prices — and, by extension, mortgage rates — are always on the move. This is why it’s recommend to do your mortgage rate shopping all in one day, when possible.

How many homeowners are refinancing in 2021?

Mortgage rates fell further than anyone thought they would in summer 2021. Over 12 million homeowners are currently “in the money” to refinance, according to Black Knight. What’s more, the FHFA recently removed its Adverse Market Refinance Fee for all new conforming refinance loans.

What is the mortgage rate for 2020?

Any mortgage rate in the low- to mid-3 percent range is very good by historical standards. Looking back just one year, mortgage rates started 2020 at nearly 4 percent. And they were above 4.5 percent in early 2019. So today’s rates are excellent by comparison.

How much money does the Federal Reserve buy per month?

Keeping an eye on the Federal Reserve. Currently, the Federal Reserve is purchasing $40 billion per month in mortgage-backed securities (MBS) as part of its Covid stimulus program. This is one of the single biggest factors keeping mortgage rates as low as they are.

What is the interest rate for a 30 year mortgage?

But remember that rates vary a lot by borrower. Those with perfect credit and large down payments may see 30-year rates in the 2 percent range, while lower-credit borrowers and those with non-QM loans might see interest rates closer to 4 percent. You’ll need to get pre-approved for a mortgage to know your exact rate.

What is the best mortgage for you?

For instance, if you want to buy a high-priced home and you have great credit, a jumbo loan is your best bet. Jumbo mortgages allow loan amounts above conforming loan limits — which max out at $548,250 in most parts of the U.S.

What is the Fed's easy money policy?

Easy money policies by the Federal Reserve — By keeping its benchmark interest rate (the Federal Funds Rate) near 0% and continuing to purchase billions of dollars worth of mortgage-backed securities (MBS), the Fed is keeping mortgage rates artificially low.

Is there a refinance option for lower income borrowers?

There’s even a new refinance option for lower-income borrowers . Fannie Mae’s RefiNow loan (which launched in June) and Freddie Mac’s Refi Possible (starting in August) guarantee a payment reduction of at least $50 per month for qualified borrowers.

What is the Federal Funds Rate?

For example, the federal funds rate is the interest rate banks pay when they borrow from each other, usually overnight, to meet federally mandated reserves that must be stored in banks. The federal funds rate forms the basis on which banks determine their interest rates.

Why does the Federal Reserve buy Treasury bonds?

To prevent a costly drop in the purchasing power of money, the Federal Reserve buys a calculated amount of Treasury bonds on the open market to inject money into the economy. The effect of additional money helps decrease interest rates to more sustainable levels.

What is the role of the Federal Reserve in the economy?

Specifically, the Federal Reserve is a key component in controlling interest rates and reining inflation by adjusting the supply of money in the economy. If economic growth generates too much inflation, the risk to the economy is that purchasing power deteriorates.

Why do mortgage lenders study economic conditions?

To stay ahead of economic growth and decline , mortgage lenders often study economic conditions to gauge how the economy is likely to perform in the short- and long-term. Forecasting economic conditions lends insight into how interest rates are likely to behave. As a result, mortgage lenders can accommodate economic changes like inflation.

How does the Federal Reserve affect mortgage rates?

Specifically, the Federal Reserve is a key component in controlling interest rates and reining inflation by adjusting the supply of money in the economy. If economic growth generates too much inflation, the risk to the economy is that purchasing power deteriorates. To prevent a costly drop in the purchasing power of money, the Federal Reserve buys a calculated amount of Treasury bonds on the open market to inject money into the economy. The effect of additional money helps decrease interest rates to more sustainable levels.

What can change in interest rates?

Economy. Changes in economic growth can cause an increase or decrease in interest rates . This has implications for mortgage lenders who adjust their lending rates to meet their rates of return on mortgages to stay profitable. For example, an increase in economic growth commonly generates an increase in the general level ...

Why do mortgage rates fluctuate?

Mortgage rates fluctuate depending on changes in key economic factors that interact to determine a specific rate at a particular point on the economic cycle. Lenders routinely monitor economic activity related to the mortgage market to try to maximize returns from lending activity during periods of strong and weak economic growth.