Full Answer

What is the minimum down payment for mortgage?

What is the minimum down payment for a house?

- Conventional loan minimum down payment: 3%

- FHA loan minimum down payment: 3.5%

- VA loan minimum down payment: 0%

- USDA loan minimum down payment: 0%

What down payment do I need for a mortgage?

How much is the down payment on a house?

- A conventional loan is the most popular loan option

- Conventional down payment requirements start at 3–5% down

- On a $250,000 house, that’s a $7,500–$12,500 down payment

How does the down payment affect a mortgage?

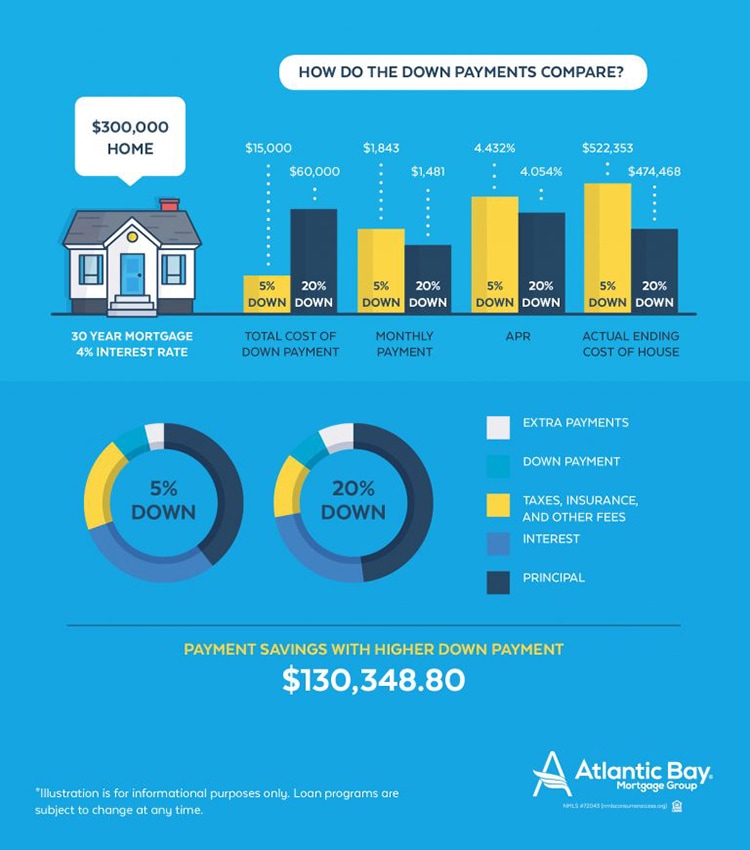

The down payment amount can also affect the interest rate that is assigned to your mortgage loan. In some cases, a larger investment from the buyer could result in a lower rate. This in turn could significantly reduce the amount of money paid over the term of the loan.

How to save for a down payment on a mortgage?

The amount you'll need to save for a down payment depends upon:

- How much you plan to spend on a home

- Your lender's down payment requirements

- The amount of equity interest you want in your home

- Whether you hope to avoid mortgage insurance, which raises your monthly payment

How much does a down payment affect your monthly mortgage?

Does Your Down Payment Affect Your Monthly Mortgage Payments? Just as it typically results in a lower interest rate, a larger down payment usually means smaller monthly payments. Since the balance of your loan is less, your monthly payments are smaller.

Does a higher down payment mean a lower mortgage?

The more money you put down, the better. Your monthly mortgage payment will be lower because you're financing less of the home's purchase price, and you can possibly get a lower mortgage rate.

Can a down payment lessen the amount of a mortgage loan?

A bigger down payment helps you minimize borrowing. The more you pay upfront, the smaller your loan. That means you pay less in total interest costs over the life of the loan, and you also benefit from lower monthly payments.

Is it better to make a large down payment on a house?

It's better to put 20 percent down if you want the lowest possible interest rate and monthly payment. But if you want to get into a house now and start building equity, it may be better to buy with a smaller down payment — say 5 to 10 percent down.

What are the disadvantages of a large down payment?

Drawbacks of a Large Down PaymentYou will lose liquidity in your finances. ... The money cannot be invested elsewhere. ... It is inconvenient if you will not be in the house for long. ... If the home loses value, so does your investment. ... You might not have the money to begin with.

Is it smart to put more than 20 down on a house?

There's no doubt that putting down greater than 20% will get a homebuyer a lower monthly mortgage payment. A large down payment lowers the overall risk to the lender of financing the home, and so they will reward the customer with a better rate.

Is it better to put 20 down or pay PMI?

Before buying a home, you should ideally save enough money for a 20% down payment. If you can't, it's a safe bet that your lender will force you to secure private mortgage insurance (PMI) prior to signing off on the loan, if you're taking out a conventional mortgage.

How much do I need to make to buy a 300K house?

between $50,000 and $74,500 a yearTo purchase a $300K house, you may need to make between $50,000 and $74,500 a year. This is a rule of thumb, and the specific salary will vary depending on your credit score, debt-to-income ratio, the type of home loan, loan term, and mortgage rate.

How much house can I afford if I make 3000 a month?

If you make $3,000 a month ($36,000 a year), your DTI with an FHA loan should be no more than $1,290 ($3,000 x 0.43) — which means you can afford a house with a monthly payment that is no more than $900 ($3,000 x 0.31). FHA loans typically allow for a lower down payment and credit score if certain requirements are met.

How can I avoid PMI with 5% down?

The traditional way to avoid paying PMI on a mortgage is to take out a piggyback loan. In that event, if you can only put up 5 percent down for your mortgage, you take out a second "piggyback" mortgage for 15 percent of the loan balance, and combine them for your 20 percent down payment.

What if I can't afford closing costs?

Apply for a Closing Cost Assistance Grant One of the most common ways to pay for closing costs is to apply for a grant with a HUD-approved state or local housing agency or commission. These agencies set aside a certain amount of funds for closing cost grants for low-to-moderate income borrowers.

What happens if you don't put 20 down on a house?

If your down payment is less than 20% and you have a conventional loan, your lender will require private mortgage insurance (PMI), which is an added insurance policy that protects the lender if you can't pay your mortgage.

How much is a downpayment on a 300K house?

How much is the down payment for a $300K house? You'll need a down payment of $9,000, or 3 percent, if you're buying a $300K house with a conventional loan. If you're using an FHA loan, you'll need a downpayment of $10,500, which is 3.5 percent of the purchase price.

Is it better to have a bigger down payment or less debt?

If you'd like to buy a home, carrying credit card debt doesn't have to keep you from fulfilling your dream. But paying down the debt will lower your debt-to-income ratio (DTI) and could strengthen your credit score. That, in turn, will help you qualify for a home loan and potentially score you a lower interest rate.

Does it make sense to put 20 down on a house?

Putting down 20% results in smaller mortgage payments, since you're starting off with a smaller overall mortgage. It also saves you from the added expense of PMI. Greater purchasing power. A higher down payment mean you can afford to buy a more expensive home.

What is down payment in home?

A down payment is a portion of the cost of a home that you pay up front. It demonstrates your commitment to investing in your new home. Generally, the more you put down, the lower your interest rate and monthly payment.

What is the APR for a $225,000 loan?

Estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down-payment of 20% would result in an estimated monthly payment of $1,058.04 with an Annual Percentage Rate (APR) of 3.946%. 1

What is a mortgage loan officer?

An experienced mortgage loan officer is just a phone call or email away , with answers for just about any home-buying question.

What does the down payment on a home mean?

The down payment you make on your home impacts what kind of mortgage you qualify for, how much money a lender will give you, and the loan's terms and conditions.

What Is the Minimum Down Payment on a House?

Generally, however, 3%-5% would be the absolute minimum, and only for certain borrowers.

How Much House Can You Afford?

When you are pre-approved for a mortgage, a lender will tell you the maximum loan amount for which you qualify, based on responses in your application. Your mortgage application asks about your estimated down payment amount, income, employment, debts, and assets. A lender also pulls your credit report and credit score. All of these factors influence a lender’s decision about whether to lend you money for a home purchase, how much money, and under what terms and conditions.

How Much Money Do I Need To Buy a House for the First Time?

As of October 2021, the median home price in the U.S. is around $404,700. 14 Assuming a 20% down payment, you would need $80,940 for a down payment, plus several thousand more for closing costs and fees to your lender, realtor, lawyer, and title company. Still, no set amount is required and home prices vary state-to-state and city-to-city. It's all dependent on what you're looking for in terms of size and type of property, neighborhood, amenities, and any other details specific to your situation.

Why is LTV ratio lower?

A lower LTV ratio presents less risk to lenders. Why? You’re starting out with more equity in your home, which means you have a higher stake in your property relative to the outstanding loan balance. In short, lenders assume you’ll be less likely to default on your mortgage. If you do fall behind on your mortgage and a lender has to foreclose on your home, they’re more likely to resell it and recoup most of the loan value if the LTV ratio is lower.

Why is a higher down payment needed?

A higher down payment can indicate to a seller that you have enough cash on hand and solid finances to get a final loan approval (and get to the closing table) without a hitch. Also, a higher down payment could beat out other offers that ask for sellers to pay closing costs or offer below the asking price.

How much do you put down on a home when you buy it?

In fact, homebuyers who financed their home put down an average of 12% of the purchase price, according to NAR’s 2020 Profile of Home Buyers and Sellers. First-time buyers using financing typically put down just 7% of the purchase price, the survey found. 2

What is the average down payment on a house?

The typical down payment on a mortgaged home in 2019 was 10-19% of the purchase price of the home. While 20% is the traditional down payment amount, 56% of buyers put down less than 20%, according to the Zillow Group Consumer Housing Trends Report 2019.

Why is a larger down payment better?

In a competitive market, a larger down payment can make your offer more appealing to a seller, as they feel confident that you won’t have financing issues at closing that could cause the sale to fail.

How is the balance of a mortgage paid?

The balance of the purchase price is usually paid by a loan you secure from a lender and pay back in a monthly mortgage payment. Down payments are expressed as a percentage of the total purchase price and the percentage you’re required to pay is dictated by the terms of your loan.

What is down payment assistance?

Down payment assistance program: These programs allow buyers to take out a second mortgage to cover the cost of their down payment, sometimes with benefits such as zero percent interest and deferred payments. These programs are usually run by government agencies or nonprofits.

Why is 20% down good?

20% down improves mortgage rates. Buyers purchasing with a 20% down payment can often get better interest rates. A higher down payment is considered a sign that you’re financially stable, and thus a less risky borrower in the eyes of your lender.

What does 20% down mean?

20% down eliminates private mortgage insurance (PMI) When you put 20% down, that means you own 20% of your home. This allows you to avoid paying PMI, which is a monthly charge that’s rolled into your mortgage payment to protect the lender from what they see as a riskier loan.

How many first time home buyers are there?

According to the Zillow Group Report, almost half of all home buyers (45%) are first-time buyers. While most repeat buyers can apply the equity from the home they’re selling to their new home, it’s more challenging for first-time home buyers to get the money they need to secure a down payment.

How much is a down payment on a house?

How much down payment you need for a house depends on which type of mortgage you get.

What is a down payment?

In real estate, a down payment is the amount of cash you put towards the purchase of home.

How much do you have to put down on a house?

First things first: The idea that you have to put 20 percent down on a house is a myth.

What if I can’t afford the down payment?

Not everyone qualifies for a zero–down mortgage. Most borrowers need at least 3% down for a conventional mortgage or 3.5% down for an FHA loan.

What are today’s mortgage rates?

Today’s mortgage rates are still at historic lows, even for borrowers with less than 20% down. In fact, borrowers with low–down–payment government loans often get access to below–market rates.

Why is it important to make a big down payment?

That’s because a large down payment shrinks your loan amount and reduces your monthly mortgage payment.

How much down do you need to buy a house with a FHA loan?

FHA loans let you buy with 3.5% down, which would be $8,750 on the same house.

What is the down payment on a home?

A down payment is a large initial payment that you make when you buy a home. It’s usually a percentage of the purchase price and ranges from as little as 3% to as much as 20% for a primary residence. The required down payment is usually determined by the type of mortgage you choose, but your financial situation and the type ...

How does the size of a down payment affect the interest rate?

The size of your down payment has a direct impact on the interest rate your mortgage lender will set for your loan. The larger the down payment you offer your lender, the lower your interest rate may be. A larger down payment generally means you’re a less risky borrower, and a less risky borrower means a lower interest rate.

How Do Down Payments Work?

The amount you decide to pay for a down payment can dictate the terms for a few different aspects of your mortgage repayment process.

How is down payment determined?

The required down payment is usually determined by the type of mortgage you choose, but your financial situation and the type of property you’re buying (whether it’s your primary residence or an investment property, for example). The type and condition – HomePath property, foreclosed home or a short sale – doesn't affect how much you have ...

Why do you have to put 20% down on a mortgage?

On a conventional loan, you generally need to put 20% down to avoid paying private mortgage insurance, which is usually a monthly fee that you pay as part of your monthly payment or is paid up front by the lender in exchange for a slightly higher interest rate. On an FHA loan, 20% down could be the difference between paying for mortgage insurance ...

Why is it important to have a lower interest rate?

A lower interest rate will help you save on your monthly payment and allow you to pay less interest over the life of the loan. On the other hand, if you decide to put down less money upfront, you might end up with a higher interest rate on your loan.

Why do lenders like to see large down payments?

Lenders love to see large down payments because it lowers the risk you pose to them. The larger your down payment, the less you have to pay each month in both principal and interest. Think of a down payment as an interest-free way to get a jump-start on paying off your home.

What is the average down payment on a new home?

The average amount financed is 90%, so the average down-payment on a median existing home is $23,600 while the average down-payment on a median new home is $38,820. Closing costs are not included in these figures.

What is the down payment calculator?

Basic down-payment calculator: quickly calculates down-payment ranges for common down-payment amounts & states what percent of a purchase a specified down-payment represents. This calculator includes PMI and automatically subtracts closing costs (which typically ranges between 2% to 5% of a home's purchase price) from the downpayment amount. You can set the closing costs setting to zero if you do not want to factor it into your calculations.

How Much Money Should I Save for a House?

Further, outside of saving on interest payments, there is another benefit for putting down at least 20%.

Why do I need a second mortgage?

Some buyers may apply for a second mortgage to help pay part of their down-payment & remove PMI insurance requirements. This loan format is often referred to as a "piggyback loan," where a borrower pays 10% down on the home & uses the second mortgage for the next 10% down to avoid PMI payments.

How much down do you need for a conforming mortgage?

For a standard conforming mortgage, it is ideal to put at least 20% down on the loan. Loans which have less than 20% down-payment have a loan-to-value (LTV) above 80% & are required to carry property mortgage insurance (PMI), which is an additional expense paid by the home buyer to insure the lender will get paid in case the homeowner can not make payments. These insurance payments must be made until the LTV falls below 80% & are automatically removed when the LTV falls to 78%.

What is a renter budget equivalent?

Renter budget equivalent calculator: given a monthly budget this calculator can be used to quickly estimate what size down-payment will be needed to be able to afford a set fixed monthly mortgage payment amount. By default this tool presumes the home buyer will add the closing costs to their down-payment, so the amount shown in each down-payment amount includes the closing cost.

How much does PMI cost?

PMI typically costs from 0.35% to 0.78% of the loan balance per year. The annual payment amount is divided by 12 and this pro-rated amount is automatically added to your monthly home loan payment.

What is the down payment on a 5 percent mortgage?

On a 5 percent 30-year mortgage, that higher down payment means paying $96,627.89 less over the life of the loan -- $50,000 in less principal repayment plus a total of $46,627.89 less interest. 4. Reduced mortgage insurance premiums. Mortgage insurance covers the risk of borrowers not repaying their loans.

What is the average down payment on a house?

While 20 percent of the purchase price is a traditional target for a house down payment, there are programs for both FHA and conventional mortgages (those backed by Fannie Mae and Freddie Mac) that allow for much smaller down payments.

How do mortgage lenders measure risk?

Lower mortgage rates. One way mortgage lenders measure risk is through the loan-to-value (LTV) ratio. The smaller your down payment, the higher your LTV ratio is and the riskier your loan appears in the eyes of lenders.

How does a larger down payment affect the interest rate?

3. Less interest expense. The above two effects of a larger down payment -- making loan balances smaller and mortgage rates lower -- combine to reduce the total interest you pay over the life of a loan. A mortgage calculator can show you the total interest you would have to pay so you can see how much a lower down payment would save you in the long run.

What is mortgage insurance?

Mortgage insurance covers the risk of borrowers not repaying their loans. Since this risk is greater for mortgage loans with higher LTV ratios, the size of your down payment can affect how much mortgage insurance you have to pay, how long you have to pay it, and the size of your premiums. 5.

Why put 20 down on a house?

Why you should put 20 down on a house. Here are six advantages of making a house down payment of 20 percent or more. 1. Smaller mortgage loan balance. A larger down payment means starting out with a smaller loan balance, which has a few advantages.

How much down payment do you need for a conventional mortgage?

In fact, conventional mortgages can have down payments as low as 3 percent, though people generally make a larger down payment for a variety of reasons. The typical size of a down payment varies greatly depending on the local real estate market.

What is down payment in finance?

The down payment is the portion of the purchase price that you pay out-of-pocket, as opposed to borrowing.

What Is a Down Payment?

A down payment is an upfront payment you make to purchase a home, vehicle, or another asset. That money typically comes from your personal savings, and in most cases, you pay with a check, a credit card, or an electronic payment .

What percentage of down payment do you need to pay for PMI?

For home purchases: Paying at least 20% allows you to avoid paying for PMI, which protects your lender if you default on the loan. 2 If you can’t bring 20% to the table, an FHA loan might be a viable option, requiring only 3.5% down. 3 However, you still pay for insurance with an FHA loan, and you need to evaluate whether or not you’re in a good position to buy if you’re short on funds.

Why is a large down payment good?

Future borrowing power: A large down payment also makes it easier to qualify for additional loans in the future. Lenders like to see that you have more than enough income to meet your monthly obligations, and they evaluate your finances with a debt-to-income ratio. Your debt-to-income ratio compares your total monthly debt payments to your pre-tax monthly income. A lower monthly payment means a lower debt-to-income ratio, which makes you look better to potential lenders.

What is the best down payment for a car?

An ideal down payment on a new car is 20%, or 10% on a used car. Any amount of down payment on a car will help protect your investment and lower your monthly payments and loan costs. Having a large down payment also helps ensure that you have equity in your car, so it is worth more than the amount you owe on it. 7

What is debt to income ratio?

Your debt-to-income ratio compares your total monthly debt payments to your pre-tax monthly income. A lower monthly payment means a lower debt-to-income ratio, which makes you look better to potential lenders. Potential equity: Sometimes you can borrow against assets like your home, using the asset as collateral.

Why is a bigger down payment better?

The Pros of a Larger Down Payment. A bigger down payment helps you minimize borrowing. The more you pay upfront, the smaller your loan. That means you pay less in total interest costs over the life of the loan, and you also benefit from lower monthly payments.