How much does a Louisiana homeowner spend on their mortgage?

What is the median home price in 2020?

What is the average mortgage payment in West Virginia?

Why is South Carolina a 28% mortgage rate?

Why are house prices going up in June 2020?

What is the median condo value in Pennsylvania in 2020?

What is the median home value in Seattle?

See 4 more

About this website

What is the average house price in LA?

The average sale price of a home in Los Angeles was $950K last month, up 3.3% since last year. The average sale price per square foot in Los Angeles is $606, up 2.5% since last year.…...Los Angeles Migration & Relocation Trends.InboundNet Search Flow10Charleston, WV +2910 more rows

Are houses in La expensive?

Housing: Home Purchase Prices The median sale price of $738,000 is slightly higher than the median price in a number of other major cities, including Washington, D.C., Boston, and New York City. This is about 3 times the nationwide median purchase price of $245,000.

What is the average house cost in California?

In March 2020, median home prices in California were more than $600,000—nearly 88% higher than the national median of $320,000!...Housing Costs in California.California CityAverage Home PriceApartment RentL.A.$816,438$2,800San Diego$800,746$2,391Sacramento$440,447$1,9042 more rows•Sep 12, 2022

How much is it to live in LA?

In Los Angeles, rent averages $1,756 for a 1 bedroom apartment. Transportation costs in Los Angeles amount to $4,900 a year. Food costs $5,007 a year on average for a single resident of Los Angeles.

Who owns the largest house in LA?

The buyer of the Bel-Air mega mansion dubbed 'The One' has been revealed to be none other than Fashion Nova CEO Richard Saghian days after the estate sold well below its asking price at auction.

Where can I live in LA on a budget?

Safe, Affordable Neighborhoods in Los AngelesEncino.Los Feliz.Playa Vista.Porter Ranch.Studio City.

What city is the cheapest to live in California?

Eureka. The cheapest place to live in California is Eureka. ... Stockton. Stockton is another cheap place to live in California. ... Clovis. A quiet, medium-sized city in the heart of the San Joaquin Valley, Clovis is just outside of Fresno. ... Sacramento. ... Vallejo. ... Redlands. ... Murrieta. ... Vacaville.More items...•

Which state is the cheapest to buy a house?

1. Iowa. Iowa came in at the top of our list of the most affordable homes in America. It takes a mere 10.6 percent of the median household income to afford a home in the Hawkeye State.

What's the most expensive state to live in?

HawaiiHawaii. With a cost of living index score of 189.9 Hawaii is the most expensive state to live in right now. Groceries alone are 50 percent more expensive than the country's average though poverty remains low.

What is middle class in LA?

Middle Class in Los Angeles CountyPersons in HouseholdHousehold IncomeLower ClassMiddle Class1Up to $32,793$32,794 to $98,3802Up to $46,376$46,377 to $139,1303Up to $56,799$56,800 to $170,3992 more rows

What is a good salary in LA?

A good salary in Los Angeles, CA is anything over $47,000. That's because the median income in Los Angeles is $47,000, which means if you earn more than that you're earning more than 50% of the people living in Los Angeles. The average salary in Los Angeles is $57,417.

What is Los Angeles minimum wage?

The minimum wage in California is currently $15.00/hour for employers with 26 or more employees, and $14.00/hour for employers with 25 or less employees. Some cities and counties have higher minimum wages than the state's rate. UC Berkeley maintains a list of City and County minimum wages in California.

Why are houses in LA so expensive?

Why are California housing costs so high? At its most basic level, it's a story of supply and demand -- lots of people want to live here, and there aren't enough homes to go around.

Is LA California expensive to live?

Los Angeles's housing expenses are 129% higher than the national average and the utility prices are 7% higher than the national average. Transportation expenses like bus fares and gas prices are 27% higher than the national average.

Does LA have a high cost of living?

It is widely known as one of the most expensive cities in the country, but offers its residents a wealth of local activities and unique places to see. Apart from housing expenses, the average cost of living in Los Angeles for a single person is right at $1,000 per month.

Why are LA home prices so high?

Simply put, governments make little in tax revenue from, say, apartment buildings. Because property taxes are capped, a used car dealer or Wal-Mart makes the city more in taxes. This has removed the incentive to build affordable housing in California, further widening the gulf in real estate prices.

Median Home Price by State 2022 - worldpopulationreview.com

One way people are bringing down the cost of purchasing a home is by relocating. Location is the most significant contributor to housing costs, with a typical home in Hawaii, for example, costing more than six times a typical home in West Virginia.Home prices are highest in the Northeast and West, with the highest prices concentrated around the most densely populated areas.

MSN

Your customizable and curated collection of the best in trusted news plus coverage of sports, entertainment, money, weather, travel, health and lifestyle, combined with Outlook/Hotmail, Facebook ...

Housing Costs by State 2022 - worldpopulationreview.com

In the majority of states, the median home price is over $200,000. While buyers can find a house at that price in almost every state, a $200,000 home looks very different depending on where you are looking.

What Is the Average Price Per Square Foot for a Home? - realtor.com

If you're hoping to buy a house, you'll want to know the average price per square foot for a home in the area you're looking at. Here's why.

How much does a Louisiana homeowner spend on their mortgage?

The typical homeowner in Louisiana spends just under a quarter of their salary on their mortgage. That reasonable amount is due to the cheap housing, as incomes in this state are 22% lower than the U.S. median.

What is the median home price in 2020?

The median existing home price was $295,300 in June 2020. Hawaii has the highest median home value in the U.S. at $646,733. California has the highest median home value in the continental U.S. at $579,332. West Virginia has the lowest median home value in the U.S. at $107,064.

What is the average mortgage payment in West Virginia?

The average mortgage payment is 57.9% of the state's median income. West Virginia has the cheapest home prices according to Zillow at 40% of the typical U.S. price. Mortgage payments there take up 16.1% of the state's median income on average, the lowest rate in the nation.

Why is South Carolina a 28% mortgage rate?

South Carolina outdoes its neighbor to the north when it comes to housing costs. Mortgage payments pass the 28% rule because of this state's cheap homes , which make up for a median income 14% lower than the national median .

Why are house prices going up in June 2020?

Because inventory is historically low, and so are the rates on mortgage loans. According to the National Association of Realtors®, there were 18.2% fewer homes available for purchase in June 2020 than the year before. This has pushed house prices up, in spite of the recession and impact of COVID-19.

What is the median condo value in Pennsylvania in 2020?

Median condo value in 2020: $185,901. Pennsylvania's median home value is about 20% less than the national median. The state has more underwater homeowners who owe more than their homes are worth, more delinquent homeowners, and a higher foreclosure rate than the national average.

What is the median home value in Seattle?

The median home value in the Seattle-Tacoma-Bellevue metro area is $544,451. That's the price you'll pay to live in one of the country's most socially-conscious cities and have access to some of the most scenic hikes in the country.

How much does an apartment cost in Los Angeles?

In neighborhoods like North Hills East and Crenshaw, one-bedroom apartments average $1,417 and $1,791, respectively.

What is the average price of a home in Los Angeles in 2021?

As of April 2021, Los Angeles home prices were up 23.3 percent compared to last year, selling for a median price of $841,834.

How much does ibuprofen cost?

If you need a quick fix, you can pick up a bottle of ibuprofen for $11.90 on average.

What is the minimum sales tax in California?

In California, the minimum sales tax is a rate of 7.25 percent. In the city of Los Angeles, it's 9.5 percent. That means if you're spending $1,000 shopping at the Grove, you'll pay $95 in sales tax.

How hot is the air in Los Angeles?

Come summertime, expect to keep your air conditioning blasting. Some parts of L.A. reach up to 120 degrees Fahrenheit in the peak of the hot season — so you'll want to keep that air conditioner on high.

What is the most expensive area in Los Angeles?

Some of the city's most expensive neighborhoods include Playa Vista, Fairfax District and Beverly Grove. Average one-bedroom rentals range between $3,528 and $4,118 in these areas.

Where does cost of living information come from?

Cost of living information comes from The Council for Community and Economic Research.

How much of the housing in Los Angeles is single family?

Single-family homes account for about 40% of Los Angeles' housing units. In April 2020, the single-family homes posted their biggest percentage gains of the year so far in the Los Angeles metro area. House prices increased by 4.9% in Los Angeles County, 3.7% in Orange County, and 5% in the Inland Empire.

What type of housing is in Los Angeles?

According to Neighborhoodscout.com, a real estate data provider, one and two-bedroom large apartment complexes are the most common housing units in Los Angeles. Other types of housing that are prevalent in Los Angeles include single-family detached homes, duplexes, rowhouses, and homes converted to apartments.

What are the economic indicators of Los Angeles?

Two of the most fundamental economic indicators are employment and income . Home sales usually are directly tied to an economy's health and rise and fall with economic activity. As economies slow, the supply of money tends to become more restrictive. What makes Los Angeles unique is the employment market. Want to work in Hollywood? Move to L.A. Want to work for a production company or in fashion? Come to L.A. If rent is too high, share an apartment or single-family home with friends. In terms of home prices, income, and employment indicate whether people can afford current and future increases.

How many jobs were added in California in 2019?

The Golden State added 310,300 jobs in 2019, a 1.8% increase, to a total of 17.61 million, according to data released by the California Employment Development Department. The previous year’s increase was 1.6%. In Los Angeles County, nonfarm jobs grew by 67,800 to a total of 4.65 million. That was a 1.5% rise, led by healthcare and social assistance (up 28,000) and construction (up 8,500). The unemployment rate was 4.4% in December, down from 4.7% a year earlier.

What does it mean when the housing market is balanced?

If a region’s housing market is balanced it means that there is enough demand from buyers to equal the supply from sellers. Based on the supply-demand dynamics, the real estate appreciation rate in Los Angeles is predicted to remain strong in 2021.

Does Los Angeles have a rent control law?

In the city of Los Angeles alone, renters live in more than 600,000 apartments spread across 118,000 properties, according to the city’s Housing and Community Investment Department. In late 2019, California became the second state (after Oregon) to pass a statewide rent control law . It covers all multi-family rental units built more than 15 years ago. The state law applies on top of any stricter local ordinances.

Is it a good investment to buy a house in Los Angeles?

It is also touted as the nation’s least affordable housing market. If you look in the long-term, it’s always a good investment to buy in Los Angeles. It is said that you will always get your money back or you would make a profit, as Los Angeles has a track record of being a great long-term investment.

How much were eggs in 2012 in Los Angeles?

The price of Eggs (regular) (12) in the year 2012 in Los Angeles was 2.14$. Would you like to see how prices increased over time? See Historical Data in Los Angeles, CA

Is Los Angeles cheaper than New York?

Los Angeles is 20.33% less expensive than New York (without rent, see our cost of living index ). Rent in Los Angeles is, on average, 24.70% lower than in New York. Do you live in Los Angeles?

What is the average house price in California?

Zillow says the average house price in California is $635,055, a 10.9 percent increase from last year. Certain cities, though, have higher average home prices. The average house price in Los Angeles is $826,566, and in Malibu the average home price is more than $3.4 million. If you’re looking for more affordable options in California, Eureka has an average house price of $329,525 and Sacramento has an average house price of $410,061.

How much is the average house in Utah?

Utah has seen a large increase in the average price of a home. That price tag is now up to $408,466, up 14.8 percent over the past year. Salt Lake City’s home prices, in particular, have had an impressive increase—now, the average house of a home there is $477,165, which is up 14.6 percent from last year.

What is the average price of a home in West Virginia?

Here you’ll find the average price of a home runs $113,578, which has increased 5.2 percent over the last year. West Virginia is one of the most affordable places to live in the United States, and with plenty of outdoor activities to do, it’s a state to consider living in.

What is the average home price in Michigan?

The average home price in Michigan is $196,088 —a 10.6 percent increase over the past year. If you’re looking at Ann Arbor, expect to see houses listed for around $408,000. If you’re looking at Grand Rapids, expect a lower average home price at $272,446. Detroit houses, on average, are going for $47,616.

What is the average home price in Colorado Springs?

The average purchase price is$449,182, a 9.6 percent increase from last year. Notable cities include Colorado Springs, which has an average home price of $363,972 (an impressive 15.4% increase from last year), Federal Heights, which has an average home price of $336,436, and Denver, which has an average home price of $505,516.

How much does a house cost in South Carolina?

Although the average price of a home in South Carolina is $210,727, up 8.7 percent since last year. Some areas are more expensive than others, though—for instance, the average price for a home in Charleston is $366,358. However, the average price for a home in Columbia is $160,405, and a home in Myrtle Beach goes, on average, for $206,449. You’ll get year-round sunshine in South Carolina, and there are affordable areas to settle in.

How much does a home cost in Nebraska?

With an average home price of $195,635, Nebraska is an affordable place to settle down. If you want a home in Omaha, expect to pay around $221,098. Homes in Lincoln go for around the same price ($221,206). Housing inventory is pretty tight in Nebraska, though, so expect it to be a seller’s market.

What is the average rent in Los Angeles?

The average rent for an apartment in Los Angeles is $2,563. The cost of rent varies depending on several factors, including location, size, and quality.

How big is a Los Angeles apartment?

The average size for a Los Angeles, CA apartment is 791 square feet, but this number varies greatly depending on unit type, with cheap and luxury alternatives for houses and apartments alike.

What are the most affordable neighborhoods in Los Angeles?

The most affordable neighborhoods in Los Angeles are Vermont Knolls, where the average rent goes for $1,436/month, Vermont Vista, where renters pay $1,436/mo on average, and Jefferson Park, where the average rent goes for $1,465/mo. If you’re looking for other great deals, check out the listings from Winnetka ($1,571), El Sereno ($1,590), and Leimert Park ($1,637), where the asking prices are below the average Los Angeles rent of $2,563/mo.

How many households are owner occupied in Los Angeles?

559,804 or 40% of the households in Los Angeles, CA are renter-occupied while 824,065 or 59% are owner-occupied.

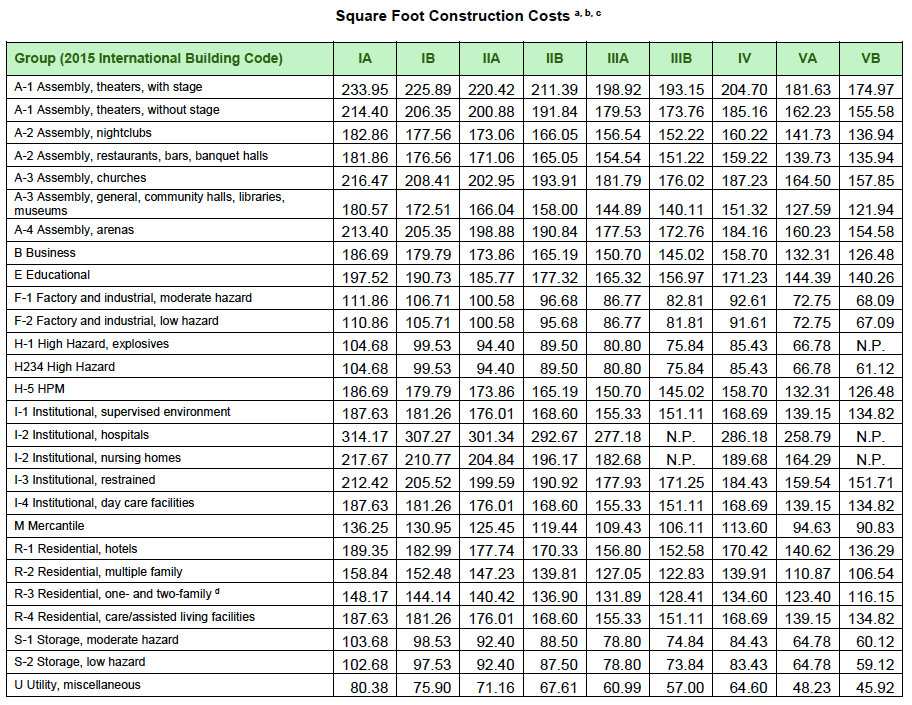

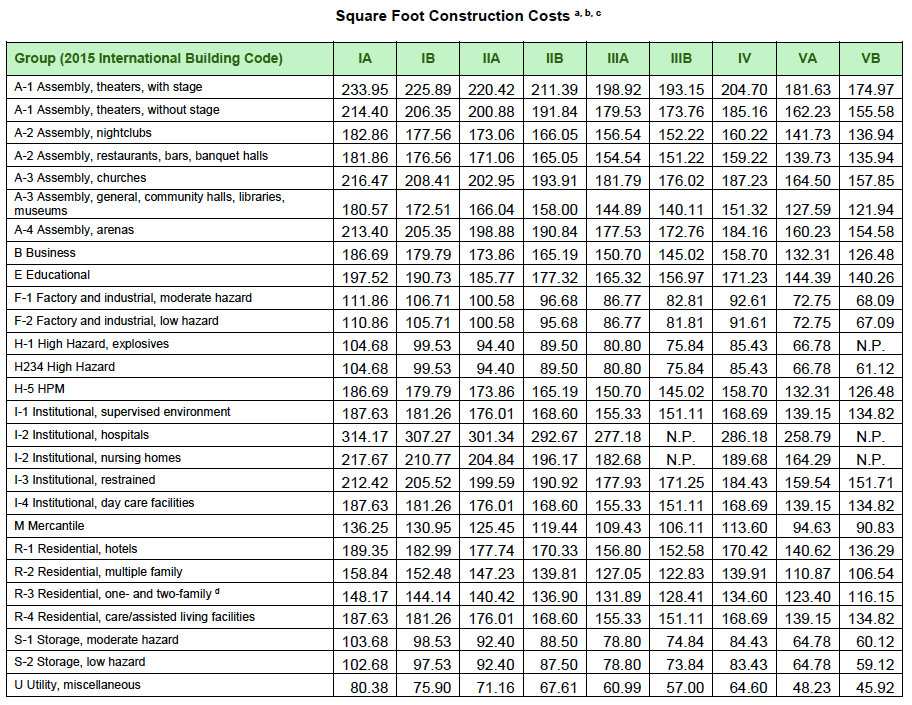

How much does a home cost per square foot?

According to the latest estimates, the median price for each square foot for a home in the United States is $123. But that can vary widely based on where you live and other factors.

When you run your comparison of a home’s cost per square foot with the neighborhood median, can you use that?

When you run your comparison of a home’s cost per square foot with the neighborhood median, you can use that information to help you determine whether a place is a bargain or overpriced.

Why does a new home cost more?

A new home generally costs more. And a large house may cost more overall because of higher labor costs and total construction costs, but the market will only pay so much. A house may actually sell for less than you might expect, based on its size, if it is overbuilt for the area. home prices house size square feet.

How to find out the square footage of a home?

If you’re looking at a home that doesn’t have its square footage listed, contact the county tax assessors’ office to find out how you can access the property’s tax records, which are public documents that will specify the square footage of the home’s living space. In many counties, this information is available online, making it quick and easy to find your answer.

What is median in real estate?

The median, however, is the value separating the higher half of a data sample from the lower half. If all of the real estate property prices were lined up by value, the home sale in the middle would represent the median home value.

Is price per square foot a point of comparison?

The bottom line is, while price per square foot provides a point of comparison, unless homes are completely uniform, it’s unwise to allow it to be your lone deciding factor.

Is a single family home worth more than a 5 acre lot?

A single-family home on 5 acres of real estate will generally be worth more than one with the same square footage, but on a small-size lot. A new home generally costs more.

How much does home insurance cost?

The average home insurance cost is $2,305 nationwide but, it can vary by state. Below by using our home insurance calculator you can find average home insurance rates by ZIP code for 10 different coverage levels. Enter in your ZIP code, then select a dwelling coverage amount, deductible and liability amounts. The annual home insurance calculator will show you the average homeowners insurance cost for your neighborhood and desired policy limits. Further below we explain how to choose the best limits to ensure sufficient coverage and you will also get the home insurance estimates by zip code. You can get a customized home insurance rate so you know what to expect to pay and can see how much you can save by comparing home insurance companies.

How much is homeowners insurance?

Here are are the nationwide average annual costs for home insurance for common coverage levels, all with a $1,000 deductible:

Why are home insurance rates lower in rural areas?

That’s because the cost to rebuild tends to be more affordable and insurers consider that when setting rates.

What are the factors that affect the cost of homeowners insurance?

The biggest factors influencing the cost of homeowners insurance are: Location: Your home’s location, which reflects its exposure to hazards, such as storm damage, wild fires, burglaries and so on. Your home’s value. Cost to rebuild: The cost to rebuild your home if it were completely destroyed.

How much does buying home insurance save you?

For example, buying your home insurance from the same company that covers your cars, called bundling, can save you an average of 19%, and discounts for building materials and new homes can also trim your premium significantly.

What is construction cost?

Construction cost: Local construction costs, which account for building materials availability and price, building regulations, among other factors.

Is it cheaper to insure a new house or an old house?

There are many factors that influence the cost of home insurance, but you can take steps to lower your rates. For example, if you buy a new house with excellent quality materials it might be cheaper to insure than the one with old stuff.

How much does a Louisiana homeowner spend on their mortgage?

The typical homeowner in Louisiana spends just under a quarter of their salary on their mortgage. That reasonable amount is due to the cheap housing, as incomes in this state are 22% lower than the U.S. median.

What is the median home price in 2020?

The median existing home price was $295,300 in June 2020. Hawaii has the highest median home value in the U.S. at $646,733. California has the highest median home value in the continental U.S. at $579,332. West Virginia has the lowest median home value in the U.S. at $107,064.

What is the average mortgage payment in West Virginia?

The average mortgage payment is 57.9% of the state's median income. West Virginia has the cheapest home prices according to Zillow at 40% of the typical U.S. price. Mortgage payments there take up 16.1% of the state's median income on average, the lowest rate in the nation.

Why is South Carolina a 28% mortgage rate?

South Carolina outdoes its neighbor to the north when it comes to housing costs. Mortgage payments pass the 28% rule because of this state's cheap homes , which make up for a median income 14% lower than the national median .

Why are house prices going up in June 2020?

Because inventory is historically low, and so are the rates on mortgage loans. According to the National Association of Realtors®, there were 18.2% fewer homes available for purchase in June 2020 than the year before. This has pushed house prices up, in spite of the recession and impact of COVID-19.

What is the median condo value in Pennsylvania in 2020?

Median condo value in 2020: $185,901. Pennsylvania's median home value is about 20% less than the national median. The state has more underwater homeowners who owe more than their homes are worth, more delinquent homeowners, and a higher foreclosure rate than the national average.

What is the median home value in Seattle?

The median home value in the Seattle-Tacoma-Bellevue metro area is $544,451. That's the price you'll pay to live in one of the country's most socially-conscious cities and have access to some of the most scenic hikes in the country.