How do you calculate a VA funding fee?

VA funding fee calculation . Here's how to calculate the cost of the VA funding fee: Loan amount - $200,000 Funding fee percentage X 2.3% = $4,600 Add the funding fee to the loan amount - $204,600 Final mortgage amount = $204,600. Funding fee percentage for VA cash out refinance

What is the current VA funding fee?

What is the current VA funding fee? The VA funding fee is 2.3% of the amount borrowed on a VA home loan. The fee increases to 3.6% for borrowers who have already used the VA loan program in the past. Can I use my VA disability to buy a home?

How much does a VA funding fee cost?

The VA funding fee is 2.15% when you use a zero down payment and is usually rolled into the loan. For example: If you have a $200,000 VA loan and you put zero down, the VA funding fee will be 2.15%, or $4,300. Regular military members pay slightly lower Funding Fees than Reservists and National Guard members.

How to get a VA funding fee exemption?

Those exempt from paying the VA funding fee include:

- Veterans who receive compensation for service-connected disabilities

- Veterans who would receive disability compensation if they didn't receive retirement pay

- Veterans rated as eligible to receive compensation based on a pre-discharge exam or review

- Veterans who can but are not receiving compensation because they're on active duty

What is a typical VA funding fee?

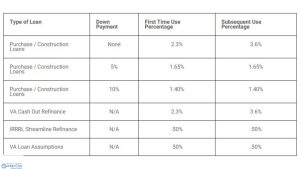

The VA funding fee is a one-time fee paid to the Department of Veterans Affairs. While most Veterans pay 2.3%, this fee ranges from 0.5% to 3.6%, depending on the loan type, if you've used a VA loan before or if you have a down payment greater than 5%.

How much will my VA funding fee be?

Rates for Veterans, active-duty service members, and National Guard and Reserve membersIf your down payment is…Your VA funding fee will be…If your down payment is…1.4%After first useIf your down payment is…3.6%If your down payment is…1.65%If your down payment is…1.4%2 more rows•Mar 16, 2022

How much is a VA funding fee 2022?

a 2.3 percentVA funding fees in 2022 Most veterans will pay a 2.3 percent funding fee when buying a home. This is equal to $2,300 for every $100,000 borrowed. This one-time fee applies to the most popular type of VA loan benefit: a mortgage loan with no down payment.

What is the VA funding fee for 2020?

As of January 1, 2020, the VA funding fee rate is 2.30% for first-time VA loan borrowers with no down payment. The funding fee increases to 3.60% for those borrowing a second VA loan. The funding fee rate is only applied to the amount financed in the VA loan, so no fee is applied to a borrower's down payment.

What is VA funding fee 2021?

2021 VA Funding Fees For Purchase And Construction Loans For cash-out or regular mortgage refinance, first-time borrowers will pay a 2.3% funding fee, while subsequent borrowers pay 3.6%.

How can I avoid the VA funding fee?

According to VA lending guidelines, you may be exempt from the VA funding fee if:You receive VA disability compensation for a disability related to your military service.You're eligible to receive disability income for a service-related disability, but instead receive retirement or active-duty pay.More items...•

What percentage of disability does the veteran have to have for the VA funding fee to be waived?

10 percentThe VA Funding Fee helps cover those losses and keeps the program available so future generations of military homebuyers can capitalize on this incredible program. But borrowers and homeowners with a disability rating of at least 10 percent are exempt from paying the VA Funding Fee.

Is a VA funding fee tax deductible?

The entire funding fee can be deducted from your taxes because it's technically mortgage insurance. The fee can either be paid entirely upfront or broken up and built into the mortgage payments.

When did the VA funding fee change?

January 1, 2020SD: The Blue Water Navy Vietnam Veterans Act of 2019 caused the VA funding fee to rise from 2.15% to 2.30% for first-time borrowers and 2.40% to 3.60% for those who have previously used a VA Home Loan. Those changes took effect on January 1, 2020, and are expected to remain through 2022.

Is the VA funding fee tax deductible in 2021?

The good news is that the VA loan funding fee is entirely tax deductible. Since it is a form of mortgage insurance, you can take entire amount you pay as a deduction on your annual income taxes.

Is VA funding fee the same as closing cost?

Buyers who receive VA disability compensation are exempt from paying this fee. The funding fee is the only closing cost VA buyers can roll into their loan balance, and that's how most borrowers approach this fee. You could ask the seller to pay it, but doing so would count against the 4 percent concessions cap.

Is the VA funding fee rolled into the mortgage?

The VA funding fee can be rolled into the mortgage or be paid upfront. Borrowers usually choose to roll the funding fee amount into their monthly m...

Does the VA funding fee have to be paid upfront?

Not necessarily. The VA funding fee can be paid in multiple ways. Borrowers have the choice to pay the fee upfront or finance it into monthly mortg...

How is the VA Funding Fee calculated?

The VA funding fee is calculated as a percentage of the total loan amount. Several factors, such as down payment size, disability status, and if it...

What is the VA funding fee?

VA loans include a fee charged to most borrowers called the VA funding fee. This fee gets sent directly to the Department of Veterans Affairs. Funding fees help the VA cover lenders’ losses. If a borrower defaults, the VA can step in and pay off a portion of the loan.

How much is the VA loan refinance fee?

1.50%. VA loan refinances also require a funding fee. With a VA streamline refinance, all borrowers pay a 0.5% funding fee. With a first-time VA cash-out refinance, however, regular military borrowers pay a funding fee of 2.15%.

Do you have to put down a VA loan?

While VA loans usually don’t require a down payment , putting a small percentage down can reduce the cost of your funding fee. The VA will also look at whether you’ve had a VA loan or you’ve refinanced in the past. The VA funding fee is expressed as a percentage of the loan amount.

Can veterans get a VA loan without a down payment?

These loans often give active and former service members the opportunity to buy homes without making a down payment or paying for mortgage insurance. The VA limits how much veterans can contribute to closing costs. But one cost most VA borrowers can’t avoid is the VA funding fee.

When did VA funding fees change?

VA funding fees were changed beginning January 1, 2020. VA loans exist so veterans and those dedicated to protecting our country can easier purchase a new home. VA loans do not require a down payment and do so without the existence of monthly mortgage insurance (AKA "MI" or "PMI").

Is a VA refinance considered cash out?

All VA refinance loans that are not Interest Rate Reduction Refinance Loans (IRRRL) are considered cash-out refinances. Unlike VA purchase loans, there are no loan-to-value discounts on VA refinances. *The VA funding fee is added to your base loan amount. It is not something you typically pay out of pocket at closing.

What is VA funding fee?

The VA funding fee is a one-time loan fee paid to the Department of Veterans Affairs (VA). The VA uses the money received through the VA funding fee to help pay for a variety of veteran-centric programs, including the VA home loan program.

Who is exempt from paying the VA funding fee?

Veterans with a disability rating of higher than 10%, Purple Heart recipients, and surviving spouses of veterans who died in the line of duty are exempt from paying the VA funding fee. About one-third of all VA loan borrowers are exempt, so ask a VA loan lender if you qualify for an exemption.

How much down payment is required for VA loan?

Borrowers can decrease their funding fee rate by putting at least 5% down on a VA home loan, and about one-third of all borrowers are exempt from paying the funding fee altogether.

What is the VA funding fee?

The VA funding fee is a one-time payment to the federal government to help keep the program running for future generations. Veterans receiving disability benefits, military spouses and Purple Heart recipients are exempt from paying the VA funding fee. The VA funding fee is 2.3% for first-time VA loan users and 3.6% for subsequent use.

How much is the VA loan fee?

The VA funding fee is 2.3% for first-time VA loan users and 3.6% for subsequent use. The VA funding fee can roll into the entire loan amount. The VA loan is partly paid for by federal tax dollars and by users of the program through the VA funding fee. One of the first questions a VA mortgage applicant asks after learning about ...

What form is required to pay VA funding fee?

The VA requires the following documentation and paperwork: A VA Form 26-8937, Verification of VA Benefits, indicating the borrower's exempt status, and.

Does Purple Heart qualify for VA funding?

As of January 1, 2020, Purple Heart recipients also qualify to receive a VA funding fee exemption when obtaining a VA home loan. Here's the complete list of those exempt from the VA funding fee: Veterans who receive VA compensation for service-related disabilities rated 10% or greater.

Does the VA offer home loans?

It's common knowledge among vets, active duty service members and their families that the Department of Veterans Affairs offers VA home loans. What's not so common knowledge is how the government pays for it and how VA borrowers contribute to the program.

Is there a flat rate for VA funding?

There is no one-size-fits-all answer or flat rate when it comes to VA funding fee amounts. The fee is a percentage that varies on if the borrower has a down payment or has used the VA loan before. Additionally, the borrower may not even need to pay the VA funding fee.

What is VA funding fee?

The VA funding fee is a government fee applied to many VA purchase and refinance loans. Here we take a deep dive into why this fee exists, how much it costs and who is exempt from paying.

What is the VA funding fee for cash out refinance?

Unless otherwise exempt, the VA funding fee for borrowers using the VA streamline refinance (IRRRL) is 0.5 percent regardless of service history or prior usage. The funding fee for a Cash-Out refinance is similar to a VA purchase loan, except borrowers cannot lower the VA funding fee by making a down payment or using equity.

What are the benefits of VA?

Those exempt from paying the VA funding fee include: 1 Veterans who receive compensation for service-connected disabilities 2 Veterans who would receive disability compensation if they didn't receive retirement pay 3 Veterans rated as eligible to receive compensation based on a pre-discharge exam or review 4 Veterans who can but are not receiving compensation because they're on active duty 5 Purple Heart recipients 6 Surviving spouses who are eligible for a VA loan

How much down payment do you need to pay for VA loan?

Though not required, both first-time and subsequent purchasers can decrease the funding fee with a minimum 5% down payment.

What happens if two veterans contribute to a VA loan?

If two veterans contribute entitlement, but one of them is exempt from paying the funding fee, the funding fee on their loan is cut in half. If the same set of veterans seek a VA loan, but the exempt veteran is not contributing entitlement, their loan would carry the full funding fee. Last, VA loan assumptions come with a 0.5 percent funding fee.

Do mortgage lenders have to pay VA funding fees?

Mortgage lenders have no control over who must pay the VA funding fee or the specific amount. Your Certificate of Eligibility (COE) typically indicates if you're required to pay the VA funding fee.

Who is responsible for collecting the VA funding fee?

Your lender is responsible for collecting the funding fee and sending it directly to the VA through their automated system. VA buyers have a handful of options to pay the VA funding fee. These options include: Financing the VA funding fee over the life of the loan. Paying the fee out of pocket.

What is the VA funding fee?

VA home loans require an upfront, one-time payment called the VA funding fee. The fee is determined by the loan amount and your service history. VA home loan applicants can pay all (or part) of the fee in cash, or wrap it into the loan amount to reduce out-of-pocket expenses at loan closing. The VA funding fee allows the VA home loan program ...

Does the VA use taxpayer dollars?

The VA home loan program is self-sustaining and does not use taxpayer dollars or use funds from other VA benefit programs.

Can a spouse of a veteran be exempt from the VA funding fee?

Some veterans are exempt from the funding fee if they have a service-related disability as determined by VA. Surviving spouses of veterans who died during service are also eligible for a funding fee exemption.

What is VA funding fee?

What is the VA funding fee? The VA funding fee is an administrative fee added to most VA mortgages. The funding fee supports the VA loan guaranty program so that these mortgages can remain low-cost and available to future veterans. As a result, VA home loans offer some of the best benefits in today’s market.

How much will VA funding fees be in 2021?

VA funding fees in 2021. Most veterans will pay a 2.3 percent funding fee when buying a home. This is equal to $2,300 for every $100,000 borrowed. This one-time fee applies to the most popular type of VA loan benefit: a mortgage loan with no down payment. The full range of funding fee amounts are as follows.

What is the VA funding fee for manufactured homes?

Loans for manufactured homes require a funding fee of 1 percent. A veteran who assumes a VA mortgage will pay just 0.5 percent. VA construction loan fees match those of first-time purchase loans for all types of veterans and down payment amounts. In this case, the funding fee percentage is based on the loan amount and not the purchase price ...

What determines the size of the VA funding fee?

Several factors determine the size of the VA funding fee, including: Loan purpose (refinance, cash-out refinance, home purchase, etc.) Type of home. Down payment amount. Whether or not you’ve used a VA loan before. Some veterans are exempt from paying a funding fee for any VA home loan.

Do veterans have to pay mortgage insurance?

Qualifying veterans get low interest rates, zero down payment, and never have to pay mortgage insurance. Many veterans realize that, even with the fee, VA home loans are typically the most affordable loan type with which to buy or refinance a home. Verify your VA loan program eligibility (Jul 25th, 2021)

When will VA funding fees be reviewed again?

Prior to 2020, guidelines for VA funding fees were in effect from 2011 to 2019. The newer 2020 funding fees will be in effect through January 1, 2022, then will be reviewed again. This is good news for military home buyers who are still a couple years away from becoming a homeowner or refinancing an existing home.

Do all veterans have to pay the VA funding fee?

Not all veterans have to pay the VA funding fee. For instance, a disabled veteran who is receiving compensation from the VA for a service-connected disability is exempt. The full list of VA funding fee exemptions is as follows: A veteran receiving VA compensation for a service-related disability.

What is VA funding fee?

A VA funding fee is the upfront expense paid to secure a VA mortgage. This expense helps fund the VA mortgage program and is one of the heftier expenses when closing a VA loan. The funding fee is typically settled upon closing, but you will have the option to finance the expense off over time.

How much is VA funding fee in 2021?

According to the VA, the VA funding fee in 2021 is 2.3% of the home’s principal amount. If you’ve utilized the VA mortgage program previously, you’ll have to pay a slightly higher 3.6%.

What is VA loan?

VA mortgages are backed by the U.S. government, meaning the program’s expenses are carried by taxpayers. As a means of supplemental funding and to ease the tax burden on U.S. citizens, the VA funding fee was established. Calculated as a percentage of the overall loan amount, VA funding fees allow for the continuation of veteran assistance programs ...

How much does it cost to take out a VA loan?

Let’s say it’s your first time taking out a VA mortgage that amounts to $200,000. You’d be expected to pay $4,600 to satisfy the VA funding fee. This cost can be settled as part of your closing costs in a one-time payment, or you can have the expense added to your mortgage and finance it over the term of the loan.

Can a spouse of a veteran die as a result of their military service?

If you’re uncertain about whether you qualify for VA disability benefits, you can check with the Department of Veterans Affairs to determine your status.

Does the VA require a credit score to approve a mortgage?

The VA also does not set a credit score minimum for mortgage eligibility, so any financial issues in your past won’t automatically disqualify you from the program. Your lender, however, will set their own credit score minimums and approve your application accordingly.

Do you have to pay a funding fee for VA mortgage?

Borrowers who qualify for a VA mortgage will almost always be required to pay a funding fee. These mortgages come with the advantages of zero down payment requirements, comparatively lower interest rates and no need for private mortgage insurance, making them an extremely popular lending option for military members and their families.