How Much Should You Save for a House?

- The down payment: 3% to 20% of the purchase price The down payment will take up the bulk of what you save because it’s still generally recommended that you put down 20% of a home’s purchase price. ...

- Home inspection: $500 or more ...

- Closing costs: 2% to 5% of the purchase price ...

- Moving expenses: $1,000 or more ...

How much money do you need to save to buy a house?

This can vary, though: Some lenders might require that you save enough money to cover six months' worth of mortgage payments, while others might not require that you have any reserves built up at all.

How much can you afford to spend on a mortgage?

Keeping your mortgage payment under 25% of your income is best, but some lenders may allow you to go as high as a 50% DTI ratio. How Much Can You Spend on a Mortgage? Rather than looking at the total amount of money you can borrow for a house, it's better to look at how affordable your monthly payment might be.

Do lenders really want to know how much money you have saved?

It's true: Lenders want to know that you have enough money saved to cover at least some of your future mortgage payments should you unexpectedly suffer a financial setback. This is why it's so important to save diligently before deciding to apply for a mortgage. (See also: 4 Easy Ways to Start Saving for a Down Payment on a Home)

How much reserves do I need to pay off my mortgage?

The reason why most require at least two months' reserves is because lenders want to be certain that you can cover some of your mortgage payments should you lose your monthly income stream or see it drop significantly. This offers protection for the lender, making it less likely that you'll default on your loan.

How much should I save each month for a house?

How much can you afford to save? – Data from the Federal Reserve shows that the average American saves only 6% of his or her disposable income. Assuming he or she earns the median household income, 6% would be roughly $300 per month, enough to buy a $100,000 home by 35 if he or she started saving at 28.

How much do I need to save to buy a 150k house?

To afford a house that costs $150,000 with a down payment of $30,000, you'd need to earn $22,382 per year before tax. The monthly mortgage payment would be $522. Salary needed for 150,000 dollar mortgage.

How do people afford a 600k house?

What income is required for a 600k mortgage? To afford a house that costs $600,000 with a 20 percent down payment (equal to $120,000), you will need to earn just under $90,000 per year before tax. The monthly mortgage payment would be approximately $2,089 in this scenario. (This is an estimated example.)

What income do I need to buy a 400k house?

To afford a house that costs $400,000 with a down payment of $80,000, you'd need to earn $59,685 per year before tax. The monthly mortgage payment would be $1,393. Salary needed for 400,000 dollar mortgage.

How much is a downpayment on a 200K house?

Conventional mortgages, like the traditional 30-year fixed rate mortgage, usually require at least a 5% down payment. If you're buying a home for $200,000, in this case, you'll need $10,000 to secure a home loan. FHA Mortgage. For a government-backed mortgage like an FHA mortgage, the minimum down payment is 3.5%.

How much should I spend on a house if I make $100 K?

The 30% rule for home buyers If your annual salary is $100,000, the 30% rule means you should spend around $2,500 per month on your house payment. With a 10% down payment and a 6% fixed interest rate, you could likely afford a home worth around $350,000 to $400,000 (depending on the cost of taxes and home insurance).

How much should I make before buying a house?

The median home price in the U.S. is $284,600. With a 20% down payment, you can expect to pay roughly $1,200 a month for your mortgage on a home at that price. That means that in order to follow the 28% rule, you should be making $4,285 each month.

How long does it take to save 10k?

How long will it take to save $10k? If you save $200 per month it will take you 4 years and 2 months to reach $10,000. If you save $300 per month it will take you 2 years and 10 months. Saving $400 per month will mean that you reach your $10,000 target in just 2 years and 1 month.

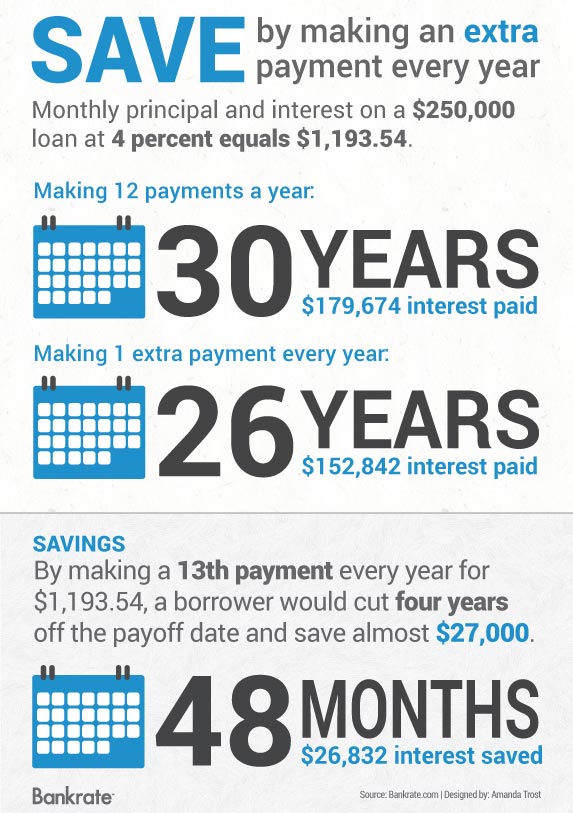

What makes up a monthly mortgage payment?

There are other monthly costs beyond just principal and interest. In addition to paying for the mortgage itself, you'll also have to cover taxes and insurance, which may include private mortgage insurance (PMI). These four parts of a mortgage payment are often abbreviated as P.I.T.I.

How much of your income should you spend on debt?

A good benchmark is to spend no more than 36% of your gross monthly income on your total debt, including your mortgage payment and other debt such as car payments and credit card payments. If you are paying more, you may want to consider lowering your mortgage payment.

How to calculate your net monthly income?

Step 1: Know your income and expenses—Add up your monthly expenses and deduct that amount from your net monthly income. Step 2: Set your priorities —If you need more room in your budget to save, it’s helpful to separate your expenses into “need to have” and “like to have” categories. Step 3:

What factors affect mortgage payment?

Another factor in your payment is your credit score. Higher scores can often mean lower interest rates— improving your credit score before you get a mortgage can significantly reduce the amount you pay over time.

What is monthly payment?

A monthly payment isn’t just the principal and interest payment on your loan, but also taxes, insurance and, depending on your down payment amount, private mortgage insurance (PMI). Below is an example of what a monthly mortgage payment might look like. Example.

What is the mortgage payment ratio?

28% Mortgage payment ratio. It’s not about the maximum amount you can borrow based on your income; it’s about what you can comfortably afford. For a starting point, take whatever you make each month, before taxes, and multiply that by 28% .

What to do before you start looking at a home?

Before you fall in love with a home, and even before you start looking at homes, take the time to put together a budget. Even if you’ve been prequalified for a mortgage loan amount, check to make sure what mortgage payment will fit within your lifestyle without putting any other financial plans on hold.

How long do you have to have your savings seasoned before you apply for a mortgage?

Lenders want to see that the dollars in your savings or checking account are "seasoned.". Basically, this means that the money has been in your account for at least two months before you apply for a mortgage.

Why is it important to have a large cash reserve before applying for a mortgage?

It's easy to forget when buying a home that mortgage lenders want to see additional savings beyond the typical down payment and closing costs. This is why it's so important to work on building a large cash reserve before taking the plunge and applying for a mortgage.

Why do you need to have at least 2 months of reserves?

The reason why most require at least two months' reserves is because lenders want to be certain that you can cover some of your mortgage payments should you lose your monthly income stream or see it drop significantly. This offers protection for the lender, making it less likely that you'll default on your loan.

What happens if you receive a large amount of money?

If a large amount of cash suddenly appears in your bank account — maybe a generous cash gift from a relative, for example — it doesn't speak to your ability as a borrower to save responsibly. If you received the money as a loan that you have to pay back, you might put your mortgage application in jeopardy.

Do you need bank statements to get a mortgage?

When you apply for a home loan, the mortgage lender will ask for copies of your last two months' worth of bank statements. This is to ensure that buying the home won't be a financial burden for you, and that you are in good financial standing to pay your mortgage bill on time.

Do you have to save money to get a mortgage?

It's true: Lenders want to know that you have enough money saved to cover at least some of your future mortgage payments should you unexpectedly suffer a financial setback. This is why it's so important to save diligently before deciding to apply for a mortgage. (See also: 4 Easy Ways to Start Saving for a Down Payment on a Home)

Can you get a mortgage if you have too much debt?

If you have too much debt, you might only qualify for a smaller mortgage — or you might not qualify for a mortgage at all.

How much do I need to save for a mortgage?

This means that if you want to purchase a £300,000 property at a 5% deposit, you would need to save at least £15,000. The remaining £285,000 would be the value of your mortgage.

Why do you need a savings account for a mortgage?

Savings accounts can help you get into the habit of putting money aside regularly to build your mortgage deposit. Comparing the best savings accounts for mortgages will help you find the most competitive interest rates and the right savings accounts for your needs.

How do I save for a deposit?

Once you know the type and cost of the property you want to buy, you can work out roughly how much you’ll need to save for a deposit . Starting to save for a deposit might seem like an insurmountable challenge, but there are things you can do that could help straight away.

How long does it take to withdraw money from a savings account?

This type of savings account allows you to withdraw money when you give your savings provider a certain amount of notice, typically between 30 and 90 days. If you’re saving for a mortgage but don’t know when you’ll need to pay a deposit, having the flexibility to withdraw at short notice can be beneficial.

How long can you lock a savings account?

You can lock a lump sum of money away for a set time, typically between six months and five years, confident of a guaranteed return as you’ll earn the same interest rate from the day you open the account until the end of your fixed term.

What happens if you pay a higher percentage of your mortgage deposit?

It’s worth considering that the higher the percentage of your mortgage you pay as a deposit, the more likely it is that you’ll find a more flexible mortgage lender and be able to get a mortgage on a higher value property.

What is a help to buy account?

A Help to Buy savings account or loan from the government can help first-time buyers get on the property ladder. There are several different options available, including an ISA, an equity loan and shared ownership. Remember that the size of the loan will differ and it depends on where you live.

How much money do you need to save to get a mortgage?

The more you save, the less you will have to pay each month. You will usually need to save at least 5% of the property’s value to get a mortgage. This means you take out a mortgage for the remaining 95%. Most first-time buyers will put down a larger deposit.

Why do you save for a larger deposit?

Saving for a larger deposit, therefore, means you are likely to have better mortgage deals available to you . If your salary is relatively low, you may find lenders will be reluctant to accept a smaller deposit. This will mean saving for a larger deposit to make up more of the property’s value.

What should I do if I am struggling to save?

Saving for a mortgage can be difficult, especially if you are a first-time buyer. Fortunately, there are plenty of options available that can help you save for your mortgage.

What does it mean to put down a bigger deposit?

Most first-time buyers will put down a larger deposit. It’s important to remember that the bigger your deposit, the higher your chance of being accepted for a mortgage. Saving for a bigger deposit will also mean you have access to more competitive mortgage rates. Usually, a deposit of 20% or more will get you access to better rates, ...

Why is saving for a larger deposit better?

Saving for a larger deposit, therefore, means you are likely to have better mortgage deals available to you.

What is help to buy equity?

A Help to Buy equity loan is a government scheme where you put down a deposit of 5% and the government lends you up to 20% in England and Wales (this amount varies in London and Scotland). You can then get a mortgage to cover the rest.

How much of a property can you buy with a shared ownership scheme?

Shared ownership schemes allow you to buy between 25% and 75% of the property and pay rent on the rest. This can help make your mortgage more affordable.

How to budget for a month?

First, sit down with your bank statements and all your credit card payments. Look at where you’re spending the most money. Note how much you spend on necessities like rent, student loan payments and utilities. Then consider how much you spend each month in nonessentials like entertainment, restaurants, etc. A budgeting app can help you automate this process if you’d like to avoid calculating your expenses yourself.

What happens if you have less than 20% down?

If you have less than 20% down at closing, you may need to pay for private mortgage insurance. This protects the lender and mortgage investor if you default on your loan.

What is the best way to start a home buying journey?

If you’re just beginning your homebuying journey, a great place to start is figuring out how much home you can afford. Once you take this into consideration, you’ll be able to get a realistic expectation of what your down payment could be.

How to downsize a house?

Moving into a smaller apartment, selling one of your family’s extra vehicles or moving to a more affordable area are all great ways to downsize. Many people downsize while they save for a major purchase. You may find that you enjoy the simple life.

How much does a family of 4 spend on vacation?

Exploring a new destination can be an amazing experience. Unfortunately, it’s also often an expensive one. The average family of four spends about $4,500 on vacation – that’s a big chunk of cash.

Is it easier to make money on your own time?

In the on-demand “gig economy,” it’s easier than ever to earn money on your own time with a lucrative side hustle. Here are a few ideas you can use to get started:

How much of your income should you spend on a mortgage?

The Federal Housing Administration (FHA) is a bit more generous, allowing consumers to spend as much as 31% of their gross income on a mortgage.

How much of the purchase price do you have to pay for a mortgage?

Generally, lenders want homebuyers to be able to pay at least 20% of the purchase price in cash. If they can only make a down payment below that amount, they can still get a mortgage, but often must also shoulder the extra expense of private mortgage insurance (PMI). 5 Paying PMI means their monthly mortgage payment will go up by anywhere from 0.5% to 1% of the loan amount.

How much PMI should I pay on a $300000 home?

How much you pay in PMI will depend on the size of the home, your credit score, and the potential for the property to appreciate, among other things. If you can't swing $60,000 down on a $300,000 home, shoot for at least 10%. The more down payment, the less interest you'll pay over the life of the loan, and the smaller your monthly mortgage payment will be, even if you are hit with mortgage insurance.

How to determine if a home is affordable?

To determine if a home is affordable, calculate your entire debt-to-income ratio: all your monthly expenses divided by your gross income. Homeownership involves a variety of ongoing costs, including homeowners' insurance, property taxes, and repair/upkeep expenses. Affording a home means being able to make at least a 20% down payment on it;

What does it mean to afford a house?

Affording a home means being able to make at least a 20% down payment on it; otherwise, you'll incur costly private mortgage insurance.

What is the median price of a new home in 2020?

As of December 2020, the median sales price for a new home was nearly $355,900, which means that some folks pay a lot more than that, and others a lot less. 1 Wherever you fall on the spectrum, it's probable that a home will be one of the largest single purchases you'll ever make.

Can I still get a mortgage with a down payment?

If they can only make a down payment below that amount, they can still get a mortgage, but often must also shoulder the extra expense of private mortgage insurance (PMI). 5 Paying PMI means their monthly mortgage payment will go up by anywhere from 0.5% to 1% of the loan amount.