For example, if you’re refinancing a $300,000, 20-year, fixed-rate mortgage at 6% with a new 4% interest rate, refinancing will reduce your original monthly mortgage payment from $2,149.29 to $1,817.94—yielding a monthly savings of $331.35.

Full Answer

Will I save money by refinancing my mortgage?

When you refinance your house, yes, you will save money. That is because you will be paying a lower interest rate and less interest over the duration of your loan. Keep in mind though that you will start at the beginning of the amortization table. (See example of an amortization table below)

Should I refinance or pay extra on my mortgage?

Yes! Consider applying any extra funds at the end of the month toward your loan balance. Even paying an extra $50 or $100 a month allows you to pay off your mortgage faster. Another idea is to refinance to a 15-year mortgage. Though your payments will be a bit higher, your overall savings will be greater.

What percentage is worth refinancing?

Refinancing to save 1 percent is often worth it. One percentage point is a significant rate drop, and it should generate meaningful monthly savings in most cases. For example, dropping your rate 1 percent — from 3.75% to 2.75% — could save you $250 per month on a $250,000 loan. That’s nearly a 20% reduction in your monthly mortgage payment.

Is now a good time to refinance your mortgage?

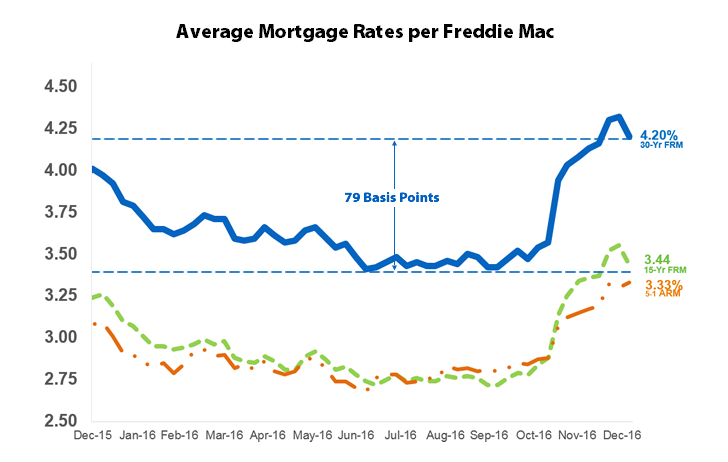

While refinancing could work to your benefit, now may not be the best time to trade in your existing mortgage for a new one. Ultimately, you'll need to consider your personal circumstances and run the numbers to see if a refinance makes sense. Chances are, interest rates won't stay put at multi-decade lows for much longer.

How much does a refinance add to your mortgage?

In the case of a refi, you can expect to pay about 2 – 6% of the remaining principal on your mortgage in closing costs. In this article, we'll look at a breakdown of refinancing costs and the benefits of doing so, to help you decide if a refinance is right for you.

Does your mortgage get higher when you refinance?

Debt consolidation refinance Your mortgage debt will increase, but because mortgage rates are usually lower than those for other forms of debt, this can save you money in the long run.

How much does your payment drop when you refinance?

Likewise, refinancing can help you reduce your monthly mortgage payment by extending the term of the loan. Refinancing your mortgage is generally a good option if you can decrease your interest rate by 1% to 2%.

Will refinancing reduce my mortgage?

One of the primary benefits of refinancing is the ability to reduce your interest rate. A lower interest rate may mean lower mortgage payments each month. Plus, saving on interest means you end up paying less for your house overall and build equity in your home at a quicker rate.

At what point is it worth it to refinance?

A rule of thumb says that you'll benefit from refinancing if the new rate is at least 1% lower than the rate you have. More to the point, consider whether the monthly savings is enough to make a positive change in your life, or whether the overall savings over the life of the loan will benefit you substantially.

At what point is it not worth it to refinance?

Key Takeaways. Don't refinance if you have a long break-even period—the number of months to reach the point when you start saving. Refinancing to lower your monthly payment is great unless you're spending more money in the long-run.

Is it better to refinance or pay off early?

It's usually better to make extra payments when: If you can't lower your existing mortgage rate, a refinance likely won't make sense. In this case, paying extra on your mortgage is a better way to lower your interest costs and pay off the loan faster. You want to own your home faster.

Does refinancing hurt your credit?

Refinancing will hurt your credit score a bit initially, but might actually help in the long run. Refinancing can significantly lower your debt amount and/or your monthly payment, and lenders like to see both of those. Your score will typically dip a few points, but it can bounce back within a few months.

Is refinancing your house worth it?

Generally, if refinancing will save you money, help you build equity and pay off your mortgage faster, it's a good decision. It's best to do if you can lower your interest rate by one-half to three-quarters of a percentage point, and plan to stay in your home long enough to recoup the closing costs.

What is the downfall of refinancing?

Refinancing costs money. In fact, chances are good you'll have to pay thousands of dollars in closing costs including a loan origination fee, an appraisal, and title insurance. If you save money on your monthly payments and interest costs, you can eventually cover those closing costs.

Does refinancing mean you owe more?

Refinancing doesn't reset the repayment term of your loan, but it does replace your current loan with a new loan.

What are cons of refinancing?

Cons Of RefinancingYou Might Not Break Even. ... The Savings Might Not Be Worth The Effort. ... Your Monthly Payment Could Increase. ... You Could Reduce The Equity In Your Home.

Is it worth refinancing to save $100 a month?

Saving $100 per month, it would take you 40 months — more than 3 years — to recoup your closing costs. So a refinance might be worth it if you plan to stay in the home for 4 years or more. But if not, refinancing would likely cost you more than you'd save.

Is refinancing for .5 percent worth it?

In general, refinancing for 0.5% only makes sense if you'll stay in your home long enough to break even on closing costs. For example: Let's say you took out a 30-year fixed-rate mortgage for $200,000 and put down 20%. With a 3.75% mortgage rate, your principal and interest payment amounts to $740 per month.

When should you refinance your mortgage?

If you have at least 20% equity in your home and a strong credit score, refinancing your mortgage is a great way to lower your interest rate—especi...

How do you calculate if you should refinance?

Evaluate whether you should refinance your mortgage by calculating how much you can save each month as well as the total cost of refinancing. Then,...

Can you get denied for a mortgage refinance?

Estimates suggest over 50% of mortgage refinance denials are due to inadequate credit scores or debt-to-income ratios. Another 17% of applications...

How often can you refinance your home?

You can refinance your home countless times, though some lenders have their own limits. Be sure to use a refinance calculator every time to underst...

What credit score is needed to refinance?

Borrowers with credit scores of 620 or greater may be eligible to refinance their home, but credit scores of 740 or higher receive the most favorab...

How much equity do you need to refinance?

Expect a minimum requirement of home equity if you hope to cancel mortgage insurance, usually 20%. Otherwise, refinance equity requirements vary by...

What is a no closing cost refinance?

No closing cost refinances are simply mortgage refinances with closing costs rolled into the loan. While you won't pay your closing costs out-of-po...

How does refinancing work?

The process of refinancing will follow these typical steps:Select a type of mortgage refinance: You have many refinancing options, including refres...

How much does it cost to refinance?

Average refinance closing costs range between 2%-6% of the loan amount. Closing fees vary depending on your location, loan type, loan size and mortgage lender.

How to calculate breakeven point on a mortgage?

Use a mortgage refinance calculator to determine the breakeven point, which is the number of months it takes for the savings to outweigh the cost of refinancing. Divide the breakeven timeframe (months) by 12 to calculate the number of years you need to make payments on the loan before realizing any savings from the refinance. If you plan to sell before the breakeven point, it is probably not financially worth it to refinance.

How does amortization work on a mortgage?

Amortization ensures you pay more interest than principal during the first half of your loan term. Refinancing restarts your mortgage amortization schedule with the new loan, reducing the amount of principal you’re paying each month. If you plan to sell your home soon or if you’ve been paying your mortgage for more than half of the term, be sure to use a loan refinance calculator.

How to calculate the value of a refinance?

To calculate the value of refinancing your home, compare the monthly payment of your current loan to the proposed payment on the new loan. Then use an amortization schedule to compare the principal balance on your proposed loan after making the same number of payments you’ve currently made on your existing loan. Both the monthly payment and principal balance of the new loan should be lower. Enter your specific details into the refinance calculator above for a detailed savings breakdown.

How long does a refinance last?

Refinancing typically resets the length of your mortgage to 15 or 30 years. Your current principal balance stretches across the additional payments, reducing your monthly cost. If you have a lump sum to apply to your existing mortgage amount, try a cash-in refinance which reduces monthly payments further. The cash decreases the balance which is then spread across additional payments.

How many times can you refinance a home?

You can refinance your home countless times, though some lenders have their own limits. Be sure to use a refinance calculator every time to understand the long-term cost or savings of the home loan.

How to refinance a loan?

Contact the lender, or find a lender to work with in your area. Apply for a re finance: Once you apply, your lender will provide you with initial disclosures that outline the terms of the loan. Read and sign. Lock your refinance rate: Work with your lender to lock your interest rate when you believe it's the lowest.

Should I refinance my mortgage?

Are you trying to decide whether to refinance your remaining mortgage loan amount?

What is the loan term for refinancing?

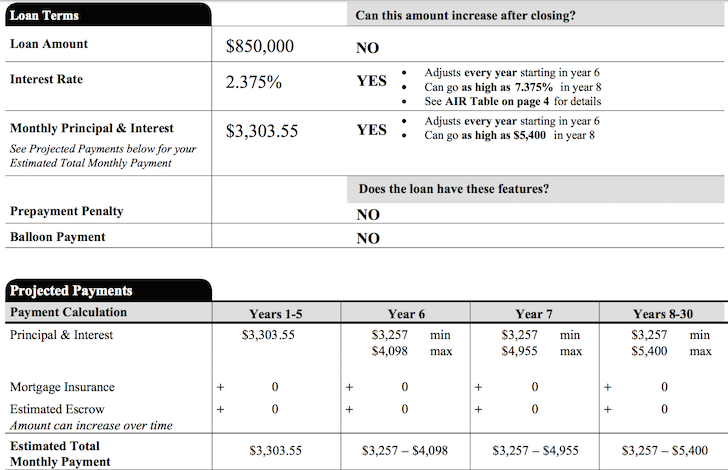

If you’re not sure what rate your new loan may carry, you can get an estimate here. Loan term: The loan term is how long your mortgage loan lasts. Usually, refinancing to a 30-year loan will lower monthly payments the most. If your goal is to pay off your loan sooner, you may want a loan with a shorter mortgage term.

How much closing cost to refinance a mortgage?

If your goal is to pay off your loan sooner, you may want a loan with a shorter mortgage term. Estimated closing costs: You’ll pay closing costs to refinance your mortgage, just as you did with the initial loan. These vary by mortgage lender but usually come out to around 2 to 5 percent of your total loan balance.

How to get a more accurate refinance rate?

To get a more accurate number, request estimates from lenders so you can see how low of a rate and payment you qualify for. Check your refinance rates today (Jul 18th, 2021) Step 1. Enter your current mortgage information. Step 2. Enter your new mortgage information.

Why is refinancing a loan important?

Refinancing gives you a chance to choose a different loan type. Your new loan can reflect your current financial life instead of reflecting your needs as they were when you took out the original mortgage.

What is current monthly payment?

Current monthly payment: Includes only the payments you make toward principal and interest each month. If your monthly payment also goes toward escrow (to cover taxes and insurance), you should check with your mortgage lender to determine the exact portion that goes toward principal and interest.

What is a cash out refinance?

With a cash-out refinance, your new loan amount is higher than your current mortgage balance. The bigger loan amount is first used to pay off your existing loan, and the ‘extra’ is returned to you as cash.

Is It Worth Refinancing For 1 Percent

How do I know if I should Refinance my Home | Should I Refinance My Mortgage?

You Want A Shorter Loan Term

If youre keen to pay off debt, you may want to refinance your mortgage to a shorter loan term. You could add to your savings if you can secure a lower interest rate and shorten your term. A shorter loan term means youll pay less in total interest.

When You Should Not Refinance

You always want to make sure youre refinancing for the right reasons. Refinancing can save you in the long run but it comes with some substantial up-front costs. So its important to make sure refinancing will substantially benefit your finances and that youll live in the home long enough to recover the costs.

Lets Evaluate Your Results

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes.

Refinancing Your Mortgage Can Be A Smart Financial Move Potentially Saving You Money On Your Monthly Mortgage Payment Or On Total Interest Over The Life Of Your Home Loan

Before you apply, youll want to think carefully about when to refinance your mortgage. Youll also want to decide if refinancing makes sense financially by weighing any money youll save against the cost of refinancing the loan.

Refinance At A Lower Mortgage

Let Ratehub.ca help you calculate your new monthly payment and refinance penalty.

How Much Are Prepayment Penalties

When you agree to a particular mortgage term, your are signing a contract for that amount of time, generally between 1 and 10 years. If you break your mortgage before that term is over, you’ll be charged a prepayment penalty, as a way to compensate the mortgage provider.

What is Loan Refinancing?

Loan refinancing involves taking out a new loan, usually with more favorable terms, in order to pay off an old one. Terms and conditions of refinancing vary widely. Refinancing is more commonly associated with home mortgages, car loans, or student loans. In the case that old loans are tied to collateral (assets that guarantee loans), they can be transferred to new loans. If the replacement of debt occurs under financial distress, it is called debt restructuring instead, which is a process to reduce and renegotiate delinquent debts to improve or restore liquidity. For more information about or to do calculations involving debt, please visit the Debt Consolidation Calculator or Debt Payoff Calculator.

Why do you refinance a loan?

Save Money —If a borrower negotiated a loan during a period of high interest rates, and interest rates have since decreased , it may be possible to refinance to a new loan with a lower interest rate. This saves money on interest costs for the borrower. It is also possible to refinance when a borrower's credit score improves, which may qualify them for more favorable rates. This can in turn improve credit score even further if borrowers use the money saved to pay off other outstanding debts.

What is refinancing calculator?

The refinance calculator can help plan the refinancing of a loan given various situations, and also allows the side-by-side comparison of the existing or refinanced loan.

What does it mean when you need cash for a home loan?

Need Cash —The balance of a loan will decrease during the payback process. When enough equity has accumulated, the borrower may cash out by refinancing the loan (mostly home mortgage loans) to a higher balance. However, refinancing normally requires the payment of certain fees. Unless accompanied with a lower interest rate, cash-out refinancing is normally expensive.

How to consolidate debt?

This can be achieved by refinancing multiple loans into a single loan (especially one that has a lower interest rate than all previous loans).

What is student loan consolidation?

Student loan consolidation is different from student loan refinancing; the former is a special program offered by the Department of Education in the U.S. that allows all federal student loans to be combined into a single loan.

What does "upside down" mean when refinancing?

When refinancing, beware of "upside-down" auto loans, which refer to loans that the amount owed is more than the book value of the vehicle. This can occur when refinancing to a longer loan, since the value of the car will decrease over the loan term, and the car may eventually be worth less than what is owed.

What is cash-out refinance?

A cash out refinance is when you take a portion of your home's equity out as cash when refinancing your current mortgage. While a traditional refinanced loan will only be for the amount that you owe on your existing mortgage, a cash-out refinance loan will increase the amount of the loan, allowing you to both pay off your existing mortgage and take a lump-sum payment in cash for the additional amount of the loan. When mortgage rates are low, a cash out refinance may be advantageous over other types of credit like credit card, personal loans, or HELOCs that have a variable rate.

How much cash can you receive through cash-out refinance?

Typically, lenders will use your Combined Loan-to-Value (CLTV) ratio to understand your ability to take on new debt. To generate your CLTV on your own, follow these steps:

How does a cash-out refinance compare with a traditional refinance loan?

A cash-out refinance does the same thing, but also allows you to take out an additional amount that you can receive as a lump-sum payment. The additional amount will be included in your new loan balance and can be used for a variety of different purposes like debt consolidation, home improvement or making a large purchase.

What is the maximum cash out value for a home loan?

Since you owe $145,000 on your existing loans, the maximum cash-out value you can get is $360,000 - $145,000 = $215,000. While the homeowner does not have to take out the full amount available, finding these values for your home can help you understand the limits of your loan application before you apply.

What is the combined value of a home loan?

Add up the balances on all your existing home loans such as first mortgages, second mortgages or home equity lines of credit. This is your combined loan value.

Is Discover a cash out refinance?

Discover's cash out refinance loan has a low, fixed rates that never change for the life of the loan, as well as has no cash due at closing. Learn more.

Can you use equity in your home to consolidate debt?

You can use the equity in your home to consolidate other debt or to fund other expenses. A cash-out refinance replaces your current mortgage for more than you currently owe, but you get the difference in cash to use as you need. This calculator may help you decide if it's something worth considering, and give you a possible idea ...