Can you test goodwill for impairment?

Jan 09, 2022 · January 09, 2022. / Steven Bragg. The goodwill of a reporting unit should be tested for impairment on an annual basis, which can be performed at the same time in each succeeding year. It is not necessary to test all reporting units of a business at the same time. The accountant should also test the goodwill of a reporting unit for impairment between the normal annual …

When should the goodwill of a reporting unit be tested?

Annual Test for Goodwill Impairment U.S. generally accepted accounting principles (GAAP) require companies to review their goodwill for impairment at least annually at a reporting unit level. If the fair value exceeds the carrying value, no impairment exists. Companies are not allowed to write up their goodwill.

What is the examination of goodwill for the possible existence?

Feb 11, 2022 · After goodwill has initially been recorded as an asset, it must be regularly tested for impairment. The examination of goodwill for the possible existence of impairment involves a multi-step process, which is noted below. Step 1. Assess Qualitative Factors. Review the situation to see if it is necessary to conduct further impairment testing, which is considered to be a …

How often should I conduct impairment testing?

The FASB’s new goodwill impairment testing guidance—ASU 2017-04, required for public SEC filers for periods beginning after December 15, 2019—while intended as a simplification, could result in less precise goodwill impairments for reporting entities. Early and ongoing cross-functional coordination between accounting, valuation and tax professionals is critical to …

How often is an impairment test done?

annuallyUnder IAS 36, 'Impairment of assets', these assets are required to be tested annually for impairment irrespective of indictors of impairment (IAS 36 para 10). The standard states that it is acceptable to perform impairment tests at any time in the financial year, provided they are prepared at the same time each year.

How often is goodwill tested for impairment under IFRS?

annuallyIAS 36 currently requires a quantitative impairment test to be performed at least annually for a CGU that contains goodwill (and some identifiable intangible assets, see paragraphs 54–62 below).

When Should goodwill impairment be tested?

Impairment Assessment Under ASU 2017-04, companies must record goodwill impairment charges if a reporting unit's carrying value exceeds its fair value.Sep 26, 2018

How often should assets be tested for impairment?

annualThe goodwill of a reporting unit should be tested for impairment on an annual basis, which can be performed at the same time in each succeeding year.Jan 9, 2022

How is goodwill tested for impairment?

Upon adoption of the revised guidance, a goodwill impairment loss will be measured as the amount by which a reporting unit's carrying amount exceeds its fair value, not to exceed the carrying amount of goodwill.

How do you audit goodwill impairment?

Auditing goodwill for impairment is a complex process and involves performing procedures over the existence of an impairment triggering event, carrying value of the reporting unit(s), the calculation of fair value, and the impairment loss (if applicable).Jun 19, 2020

How is goodwill evaluated?

Goodwill is calculated by taking the purchase price of a company and subtracting the difference between the fair market value of the assets and liabilities. Companies are required to review the value of goodwill on their financial statements at least once a year and record any impairments.

Why do we do step 1 in the goodwill impairment test?

Under Step 1, the fair value of the reporting unit is determined and compared with its carrying amount, including goodwill. If the fair value of the reporting unit exceeds its carrying amount, then goodwill is considered not impaired and no further analytics are required.

How do you perform an impairment test?

How to test the impairment?Perform the recoverability test: It involves evaluating whether the future value of asset undiscounted cash flows is less than the book value of the asset. ... Measurement of impairment loss: It is calculated by finding the difference between book value and market value of the asset.More items...

Which assets are required to be tested for impairment annually quizlet?

An intangible asset with an indefinite useful life (a nonamortized intangible asset) must be reviewed for impairment at least annually. It is tested more often if events or changes in circumstances suggest that the asset may be impaired.

What is goodwill?

Before we explain how to test goodwill for impairment, you need to understand what a goodwill is all about.

A little recap – basic principles of impairment testing

I don’t want to describe what’s the impairment testing about in a detail here – you can read the whole article about it here (with video).

How to test goodwill for impairment

You CANNOT test goodwill for impairment as an individual asset, standing on its own, because it is NOT possible.

Example – a company with 3 divisions

Mommy Corp. purchased 100% shares in Baby Ltd. for CU 200 000 when Baby’s net assets were CU 185 000. Baby operates in 3 geographical areas:

What is goodwill impairment?

Goodwill impairment occurs when a company decides to pay more than book value for the acquisition of an asset, and then the value of that asset declines. The difference between the amount that the company paid for the asset and the book value of the asset is known as goodwill. The company has to adjust the book value of ...

What happens if goodwill is impaired?

If the goodwill asset becomes impaired by a decline in the value of the asset below the purchase price, the company would record a goodwill impairment. This is a signal that the value of the asset has fallen below the amount that the company originally paid for it.

Who is Evan Tarver?

Evan Tarver has 6+ years of experience in financial analysis and 5+ years as an author, editor, and copywriter. David Kindness is an accounting, tax and finance expert. He has helped individuals and companies worth tens of millions to achieve greater financial success. Goodwill impairment occurs when a company decides to pay more ...

Is goodwill an asset?

Since goodwill is an intangible asset, treating it like a normal asset and amortizing it does not give a clear picture as to the value of the asset.

Does goodwill depreciate?

A company accounts for its goodwill on its balance sheet as an asset. It does not, however, amortize or depreciate the goodwill as it would for a normal asset. Instead, a company needs to check its goodwill for impairment yearly.

What are the factors that contribute to goodwill?

To begin with, there are many possible justifications for goodwill: intangible assets such as strong customer relations, intellectual property, or a popular brand are just some of the factors that can contribute to goodwill. As such, it is often difficult to understand what exactly is supporting any given goodwill asset.

What is impairment charge?

Under United States generally accepted accounting principles ( GAAP ), the acquiring company must periodically adjust the stated value of the goodwill asset held on its balance sheet and claim the difference as a loss. This loss adjustment is called an impairment charge and it can have a devastating effect on a company’s value.

Who is Jason Fernando?

Goodwill Impairment Test: Understand the Basics. Jason Fernando is a professional investor and writer who enjoys tackling and communicating complex business and financial problems. During the infamous dotcom bubble in the late-1990s, many companies overpaid for their acquisitions.

How do you know if you are in a stock market bubble?

When this happens, the difference between the price paid to acquire the target company and the fair market value of that company is stated as an asset called goodwill on the acquirer’s balance sheet. (Learn more in Breaking Down the Balance Sheet .)

Is goodwill impairment expensive?

Conducting goodwill impairment tests every year can be expensive and time consuming, particularly for smaller businesses that may have limited internal expertise and resources. In order to reduce the cost and complexity, the Financial Accounting Standards Board introduced an alternative method of completing the goodwill impairment test. The catch is only private companies can use the alternative.

Is goodwill a controversial charge?

Given the difficulty of putting a dollar value on intangible assets like brands, customer relations, and proprietary technologies, it is no surprise that goodwill charges can be controversial. Indeed, as the above discussion shows, the valuation of goodwill can prove as difficult for managers as for investors.

Is goodwill an intangible asset?

Goodwill is an intangible asset arising from the acquisition of one company by another. When an acquiring company purchases a company for more than its book value, the excess over book value is included as goodwill on the acquirer's balance sheet. Many investors consider goodwill to be among the most difficult assets to value.

What Is Goodwill?

What to Do with Goodwill After Acquisition?

- Some years ago, IFRS asked you to amortize goodwill, but no longer! You do NOT amortize goodwill. Instead, you need to test it for impairment annually, as the standard IAS 36 Impairment of Assetsrequires. Why is it so? Well, if an investor is willing to pay more than he gets, then he probably believes that the new business will generate enough prof...

A Little Recap – Basic Principles of Impairment Testing

- I don’t want to describe what’s the impairment testing about in a detail here – you can read the whole article about it here (with video). Just to refresh the basics: You need to compare an asset’s carrying amount with its recoverable amount(higher of fair value less costs of disposal and value in use). When the carrying amount is greater that the recoverable amount, then you need to reco…

How to Test Goodwill For Impairment

- Please, remember this: You CANNOT test goodwill for impairment as an individual asset, standing on its own, because it is NOT possible. The reason is that you just cannot calculate the recoverable amount of goodwill. Why? Because, goodwill is not an asset that you can sell to someone else separately –there’s no fair value. Also, you cannot really estimate goodwill’s valu…

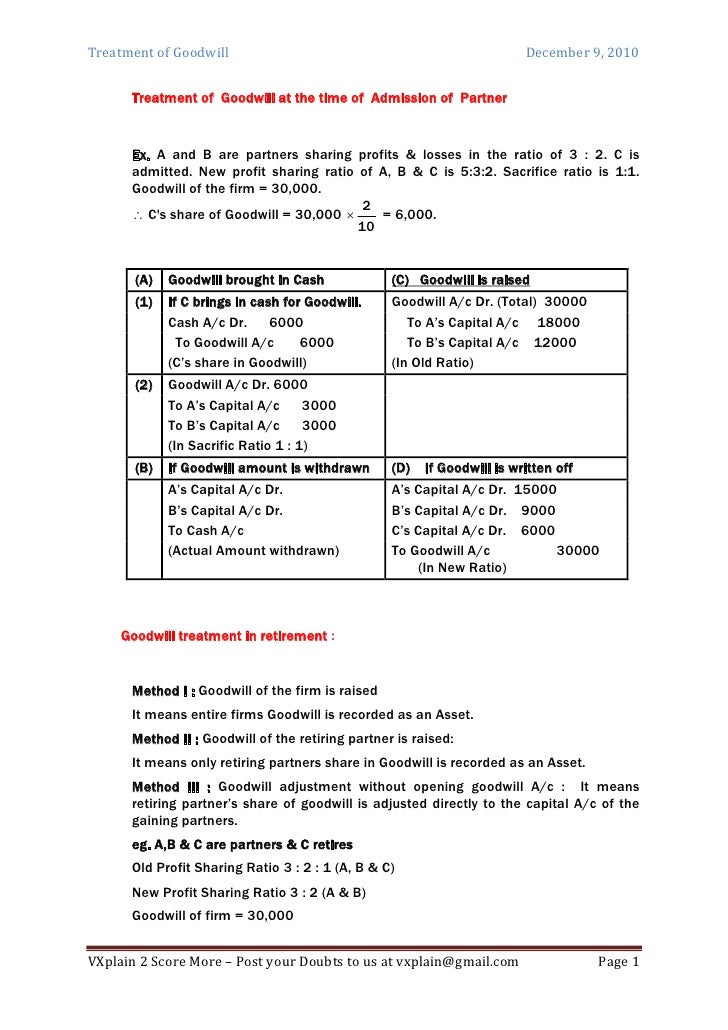

Example – A Company with 3 Divisions

- Mommy Corp. purchased 100% shares in Baby Ltd. for CU 200 000 when Baby’s net assets were CU 185 000. Baby operates in 3 geographical areas: 1. Division Aland; net assets of CU 70 000; 2. Division Bland; net assets of CU 50 000; 3. Division Cland; net assets of CU 80 000. Based on synergies expected from the business combination, Mommy allocated the goodwill of CU 15 00…

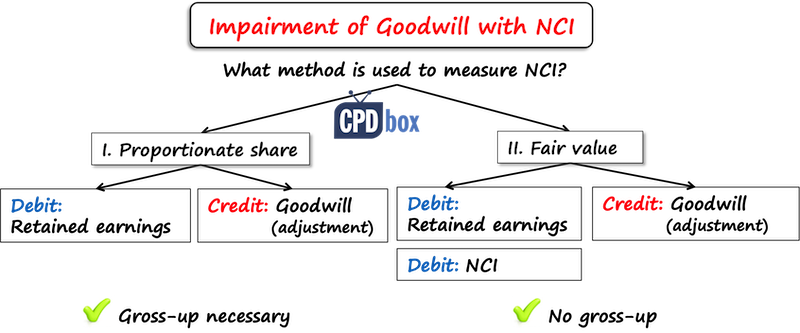

What If There’S A Non-Controlling Interest?

- A complication arises when a parent acquired less than 100% shares in a subsidiary and there is some non-controlling interest. As you might know, you have two options to measure the non-controlling interest: 1. Partial method, or at the proportionate share of NCI on subsidiary’s assets, or 2. Full method, or at fair value. Your calculation of goodwill impairment depends on the metho…