The principal is the amount of money you borrow when you originally take out your home loan. To calculate your mortgage principal, simply subtract your down payment from your homes final selling price. For example, lets say that you buy a home for $300,000 with a 20% down payment.

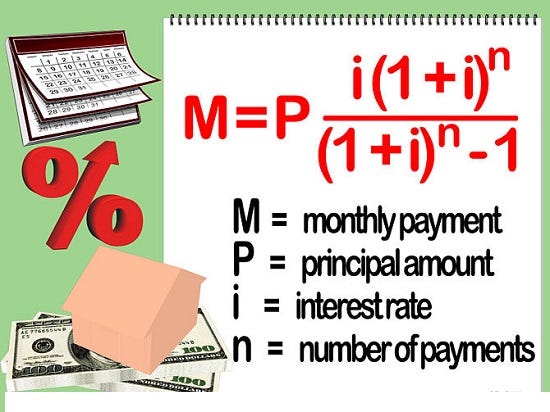

How do you manually calculate a mortgage payment?

- You can calculate a monthly mortgage payment by hand, but it's easier to use an online calculator.

- You'll need to know your principal mortgage amount, annual or monthly interest rate, and loan term.

- Consider homeowners insurance, property taxes, and private mortgage insurance as well.

- Click here to compare offers from refinance lenders »

How do you calculate interest on a mortgage loan?

- Comparing the monthly payment for several different home loans

- Figuring how much you pay in interest monthly and over the life of the loan

- Tallying how much you actually pay off over the life of the loan versus the principal borrowed, to see how much you actually paid extra

How do you calculate principal loan?

Steps to Calculate Loan Principal Amount

- Firstly, the opening loan amount has to be determined.

- Next, the rate of interest to be charged on loan during the period (say annually) has to be figured out.

- Now, the interest payment for the month can be calculated by multiplying the rate of interest with the opening loan amount and then dividing the result by 12 (since r ...

Is prepaying your mortgage a good decision?

Prepaying your mortgage can be a good way to save on interest and pay off your loan much sooner. If you have the extra money to put toward your mortgage balance, then “you’re also building equity,”...

How is the principal amount calculated?

The principal is the original loan amount not including any interest. For example, let's suppose you purchase a $350,000 home and put down $50,000 in cash. That means you're borrowing $300,000 of principal from the lender, which you'll need to pay back over the length of the loan.

How are principal and interest calculated?

In a principal + interest loan, the principal (original amount borrowed) is divided into equal monthly amounts, and the interest (fee charged for borrowing) is calculated on the outstanding principal balance each month. This means the monthly interest amount declines over time as the outstanding principal declines.

How do you calculate monthly principal and interest payments?

Amortizing loansDivide your interest rate by the number of payments you'll make that year. ... Multiply that number by your remaining loan balance to find out how much you'll pay in interest that month. ... Subtract that interest from your fixed monthly payment to see how much in principal you will pay in the first month.More items...

How are principal and interest payments calculated on a mortgage?

Let's use the $300,000 fixed-rate mortgage example again, with a monthly payment of $1,703. To find out how much you're paying in principal and interest each month, multiply the principal ($300,000) by the annual interest rate of 5.5% (0.055). Then, divide that total ($16,500) by 12 months.

What happens if I pay 2 extra mortgage payments a year?

Making additional principal payments will shorten the length of your mortgage term and allow you to build equity faster. Because your balance is being paid down faster, you'll have fewer total payments to make, in-turn leading to more savings.

Is it better to pay the principal or interest?

Is It Better to Pay the Interest or Principal First? In general, you want to only be paying toward the principal as often as possible. Paying interest on your loan costs you more money, so it's been to avoid paying interest as much as possible within the terms of your loan.

How can I calculate my mortgage faster?

Calculating Your Mortgage Payment To figure your mortgage payment, start by converting your annual interest rate to a monthly interest rate by dividing by 12. Next, add 1 to the monthly rate. Third, multiply the number of years in the term of the mortgage by 12 to calculate the number of monthly payments you'll make.

Is principal the same as monthly payment?

The principal is the amount you borrowed and have to pay back, and interest is what the. For most borrowers, the total monthly payment you send to your mortgage company includes other things, such as homeowners insurance and taxes that may be held in an escrow account.

Why is my interest higher than principal?

In the beginning, you owe more interest, because your loan balance is still high. So most of your monthly payment goes to pay the interest, and a little bit goes to paying off the principal. Over time, as you pay down the principal, you owe less interest each month, because your loan balance is lower.

Can you just pay the principal on my mortgage?

A principal-only mortgage payment, also known as an additional principal payment, is a supplementary payment applied directly to your mortgage loan principal amount. It exceeds the scheduled monthly amount, possibly saving you on interest and helping you to pay off your mortgage early.

What happens when you make principal payment on my mortgage?

Save on interest The amount of interest you pay each month is calculated using your principal balance. As your principal balance decreases, your interest goes down as well. You could potentially save thousands of dollars in interest over the life of your loan by paying down your principal faster.

Can I pay extra in interest and principal to bring down my bill?

Paying additional principal on your mortgage can save you thousands of dollars in interest and help you build equity faster. There are several ways to prepay a mortgage: Make an extra mortgage payment every year. Add extra dollars to every payment.

How is principal and interest calculated on first payment?

How to Calculate First Month's Principal PaymentFirst, convert your annual interest rate from a percentage into a decimal format by diving it by 100: ... Next, divide this number by 12 to calculate the monthly interest rate: ... Now, multiple this number by the total principal.More items...

How do I calculate interest?

Here's the simple interest formula: Interest = P x R x T. P = Principal amount (the beginning balance). R = Interest rate (usually per year, expressed as a decimal). T = Number of time periods (generally one-year time periods).

How do you calculate how much principal time and interest rate is given?

We can rearrange the interest formula, I = PRT to calculate the principal amount. The new, rearranged formula would be P = I / (RT), which is principal amount equals interest divided by interest rate times the amount of time.

How do you calculate interest using principal and time?

r and t are in the same units of time.Calculate Interest, solve for I. I = Prt.Calculate Principal Amount, solve for P. P = I / rt.Calculate rate of interest in decimal, solve for r. r = I / Pt.Calculate rate of interest in percent. R = r * 100.Calculate time, solve for t. t = I / Pr.

What happens if you make extra payments toward your mortgage principal?

You could pay $100 more toward your loan each month, for example. Or maybe you pay an extra $2,000 all at once when you get your annual bonus from your employer.

Will your monthly principal payment ever change?

Even though you'll be paying down your principal over the years, your monthly payments shouldn't change. As time goes on, you'll pay less in interest (because 3% of $200,000 is less than 3% of $250,000, for example), but more toward your principal. So the adjustments balance out to equal the same amount in payments each month.

What is PMI insurance?

Mortgage insurance: Private mortgage insurance (PMI) is a type of insurance that protects your lender should you stop making payments. Many lenders require PMI if your down payment is less than 20% of the home value. PMI can cost between 0.2% and 2% of your loan principal per year.

What makes up a mortgage payment?

Together, your mortgage principal and interest rate make up your monthly payment. But you'll also have to make other payments toward your home each month. You may face any or all of the following expenses:

What is mortgage principal?

What is a mortgage principal? Your mortgage principal is the amount you borrow from a lender to buy your home. If your lender gives you $250,000, your mortgage principal is $250,000. You'll pay this amount off in monthly installments for a predetermined amount of time, maybe 30 or 15 years.

How much does PMI cost?

PMI can cost between 0.2% and 2% of your loan principal per year. Keep in mind, PMI only applies to conventional mortgages, or what you probably think of as a regular mortgage. Other types of mortgages usually come with their own types of mortgage insurance and sets of rules.

What is the difference between adjustable rate and fixed rate?

While a fixed-rate mortgage keeps your interest rate the same over the entire life of your loan, an ARM changes your rate periodically. So if your ARM changes your rate from 3% to 3.5% for the year, your monthly payments will be higher.

What is the balloon payment on a mortgage?

Because the monthly payments aren’t high enough to pay off the full loan, the remaining loan balance is due as one large final payment (known as the “balloon” payment) at the end of the loan term. So, for example, if you had a mortgage loan of $100,000 for 30 years at an interest rate of four percent, your monthly principal ...

How long is a balloon loan?

A balloon loan has a much shorter loan term than a regular mortgage – typically only five years – but the monthly payments are calculated as if the loan was going to last for a much longer time, typically 30 years. Because the monthly payments aren’t high enough to pay off the full loan, the remaining loan balance is due as one large final payment (known as the “balloon” payment) at the end of the loan term.

How to contact the CFPB about a mortgage?

If you have a problem with your mortgage, you can submit a complaint to the CFPB online or by calling (855) 411-CFPB (2372). Read full answer.

What happens when interest rate adjusts?

When your interest rate adjusts, your payment will typically ( though not always) be re-calculated based on the new interest rate and the remaining loan term.

How long does a fixed rate mortgage last?

A typical fixed-rate mortgage is calculated so that if you keep the loan for the full loan term – for example, 30 years – and make all of your payments, you will precisely pay off the loan at the end of the loan term. Learn more about how this works.

What is included in a mortgage payment?

The total monthly payment often includes other things, such as homeowners insurance and taxes. Learn more.

Can I share my PII?

Please do not share any personally identifiable information (PII), including, but not limited to: your name, address, phone number, email address, Social Security number, account information, or any other information of a sensitive nature.

What Is Your Interest Payment?

The second major part of your monthly mortgage payment is interest. Interest is money you pay to your mortgage lender in exchange for giving you a loan. Most lenders calculate interest in terms of an annual percentage rate (APR). APR is the actual amount of interest that you pay on your loan per year (APR includes your mortgage rate and fees/costs). For example, if you borrow $100,000 at an APR of 5%, you’d pay a total of $5,000 per year in interest. At the beginning of your loan (when your principal is high), most of your monthly payment goes toward paying off interest.

What Else Is Included In Your Monthly Payment?

Principal and interest make up the bulk of your mortgage payment. On some loans you’ll only need to pay principal and interest to your lender each month, but your loan might also involve some other fees and expenses.

What is the second part of a mortgage payment?

The second major part of your monthly mortgage payment is interest. Interest is money you pay to your mortgage lender in exchange for giving you a loan. Most lenders calculate interest in terms of an annual percentage rate (APR). APR is the amount of interest that you pay on your loan per year.

How to calculate principal on a home loan?

To calculate your principal, simply subtract your down payment from your home’s final selling price. For example, let’s say that you buy a home for $200,000 with a 20% down payment.

Why do you need an appraisal when buying a home?

Part of the reason you get an appraisal when you buy a home is so your local government can correctly calculate your taxes. Taxes can vary from year to year, and your county might require you to get a new appraisal every few years.

What are the factors that determine home insurance?

Your homeowners insurance depends on a number of factors, including: 1 Home location 2 Home value 3 Whether you live in an urban or a rural area 4 How close you are to a fire department or police station

What is the most important factor when it comes to deciding how much home you can afford?

Your principal is the most important factor when it comes to deciding how much home you can afford. The principal you borrow accumulates interest as soon as you take it out. You’re also responsible for maintenance, repairs, insurance, taxes and more.

How Amortization Works

- You may be wondering why your mortgage payment—if you have a fixed-rate loan—stays the same from one month to the next. In theory, that interest rate is being multiplied by a shrinking principal balance. So shouldn’t your monthly bill get smaller over time? The reason that’s not the case is that lenders use amortizationwhen calculating your payment, which is a way of keeping y…

Adjustable-Rate Mortgages

- If you take out a fixed-rate mortgage and only pay the amount due, your total monthly payment will stay the same over the course of your loan. The portion of your payment attributed to interest will gradually go down, as more of your payment gets allocated to the principal. But the total amount you owe won’t change. However, it doesn’t work that way for borrowers who take out an …

Interest Rate vs. Apr

- When receiving a loan offer, you may come across a term called the annual percentage rate(APR). The APR and the actual interest rate that the lender is charging you are two separate things, so it’s important to understand the distinction. Unlike the interest rate, the APR factors in the total annual cost of taking out the loan, including fees such as mortgage insurance, discount points, loan ori…

The Bottom Line

- You likely know how much you're paying to the mortgage servicer each month. But figuring out how that money is divided between principal and interest can seem mysterious. In fact, figuring out how much you're paying in interest is as simple as multiplying your interest rate by your outstanding balance and dividing by 12. It's only because lenders a...