Was there a housing crisis during the Great Depression?

The National Mortgage Crisis of the 1930s was a Depression-era crisis in the United States characterized by high-default rates and soaring loan-to-value ratios in the residential housing market.

What were houses like in the Great Depression?

Bungalows were also rising in popularity during this period. The new homes of 1930s suburbia featured a bathroom, inside toilet and a third bedroom. They also tended to be dry, better insulated, light and airy. The homes of this era featured a new style kitchen in which the cooking and washing were both done.

Why did people lose their houses in the Great Depression?

As businesses failed, people lost their jobs and the unemployment rate skyrocketed. Home prices declined substantially, making it nearly impossible for homeowners to sell their properties. Both underemployment and unemployment led inevitably to a home mortgage crisis because people could not afford to pay their bills.

What were 5 major effects of the Great Depression on people's lives?

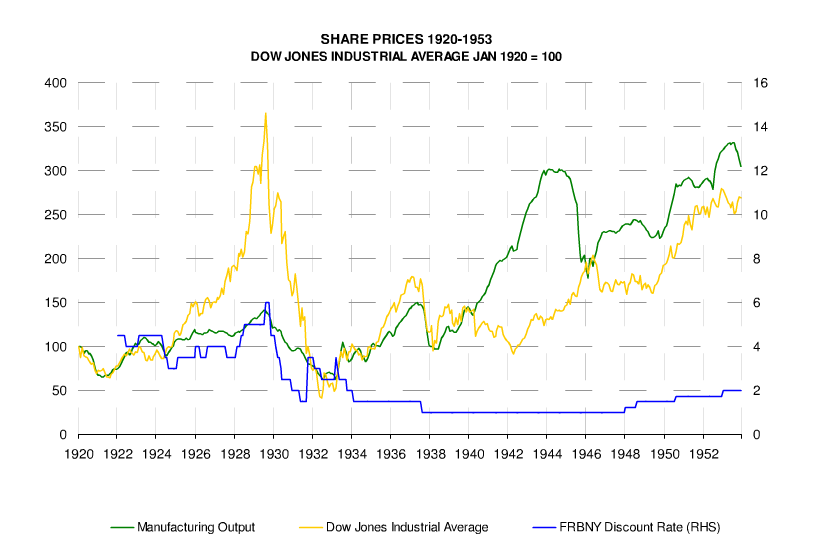

The Great Depression of 1929 devastated the U.S. economy. A third of all banks failed....A third of all banks failed. Unemployment rose to 25%, and homelessness increased. Housing prices plummeted, international trade collapsed, and deflation soared. It took 25 years for the stock market to recover.

Did people buy homes during the Great Depression?

The homeownership rate declined from 1900 to 1920. During the 1920s, it increased, but then during the Depression it dropped again, and was at about 44 percent (percentage of heads of households who owned their homes) by 1940. After World War II, the rate increased dramatically, recently approaching 70 percent.

What happens to house prices during a Depression?

Using new data on market-based transactions we construct real estate price indexes for Manhattan between 1920 and 1939. During the 1920s prices reached their highest level in the third quarter of 1929 before falling by 67% at the end of 1932 and hovering around that value for most of the Great Depression.

What happened to property taxes during the Great Depression?

Property taxes decreased as a percentage of the overall city revenue from 67 percent during 1930–1932 to only 61 percent during 1933–1940—a shift in the structure of local government revenue and a victory for the tax resistance movement. The third channel for alcohol-related tax revenue was the federal government.

What happened to the housing market in 1929?

Home prices did amazingly well during the Great Depression. According to Schiller's index, it looks likes inflation-adjusted prices fell from about 74 to 69 between 1929 and 1933 – about a 7% decline. By 1940, they were up to about 82.

Why did everyone lose their homes in 2008?

The stock market and housing crash of 2008 had its origins in the unprecedented growth of the subprime mortgage market beginning in 1999. U.S. government-sponsored mortgage lenders Fannie Mae and Freddie Mac made home loans accessible to borrowers who had low credit scores and a higher risk of defaulting on loans.

Did food prices go up during the Great Depression?

Food prices in the great depression. During the Great Depression, food prices plummeted. This was due to a combination of factors, some of which were not related to the recession itself. The 1920s had seen an oversupply of food.

Who did the Great Depression affect the most?

The country's most vulnerable populations, such as children, the elderly, and those subject to discrimination, like African Americans, were the hardest hit. Most white Americans felt entitled to what few jobs were available, leaving African Americans unable to find work, even in the jobs once considered their domain.

Which economy was the worst hit by the Great Depression?

In dollar terms, American exports declined over the next four years from about $5.2 billion in 1929 to $1.7 billion in 1933; so, not only did the physical volume of exports fall, but also the prices fell by about 1⁄3 as written. Hardest hit were farm commodities such as wheat, cotton, tobacco, and lumber.

What happened in 1932 during the Great Depression?

America had no choice. At the Great Depression’s height in 1932, the country’s wealthiest pulled their investments and money from banks in a panic. The average national income fell to below 50 percent of what it was just three years prior. More than one million homeowners faced foreclosure, as people immediately resorted to homes made entirely out of scrapyard materials—loose lumber, cardboard, with newspapers as blankets. Some people simply lived out of empty conduits and water mains. The U.S. Department of Commerce found a $300 million to $500 million demand for homes, “which could be undertaken if financing was available.” Meanwhile Charles Michelson, a newspaper-reporter-turned-Democratic-National-Committee-publicity-manager, nicknamed the era’s shantytowns “Hoovervilles,” epitomizing the popular opinion that sitting U.S. president Herbert Hoover deserved the lion’s share of the blame.

What was the purpose of the 1932 Federal Home Loan Bank Act?

The 1932 Federal Home Loan Bank Act attempted to make home financing more readily available. Federal Reserve banks were allocated $125 million in total capital that they could loan to savings banks and insurance companies—a sort of safety net that was previously reserved for commercial real estate.

How much of a home can you get with a 30 year mortgage?

These government agencies allowed for 30-year loans with fixed interest rates that could cover 80 percent of the cost of a home.

What was the impact of the subprime mortgage crisis on the housing market?

The Aftermath for the Housing Market. The subprime mortgage collapse caused many people to lose their homes, and the fallout created economic stagnation. Americans faced financial disaster as the value of their homes dropped well below the amount they had borrowed, and subprime interest rates spiked.

When did the housing bubble burst?

The U.S. economy had been experiencing a boom for many years. But the economic gain was wiped out in a matter of months. Beginning in 2007, millions of people lost their jobs and homes when the housing market started to plummet (i.e., the "bursting" of the housing bubble ). From the mid-1990s to the mid-2000s the average price of housing rose rapidly and peaked in 2007 when the average price of a house in the United States reached $314,000, according to U.S.census data.

What was the cause of the Great Recession?

The combination of rising home prices and easy credit led to an increase in the number of subprime mortgages, an underlying cause of the Great Recession.

What was the average house price in 2000?

In 2000, the average price of a house was $207,000. Artificially high home prices, loose lending practices, and the increase in subprime mortgages ...

How has the net effect of near zero interest rates stabilized the U.S. economy?

economy by encouraging lending among financial institutions that are systemically critical to the housing market. Today, supply and demand for housing have stabilized. As a result, mortgage rates are in balance with the economy.

When did the real estate downturn start?

Ryan Boykin. Updated Oct 25, 2019. Over the last decade, the global economic downturn that began in December 2007 has influenced the current real estate environment more than any other. This period of economic turmoil was is referred to as the Great Recession when many, if not most people, faced unprecedented challenges.

Is the housing bubble on the rise?

Housing prices have been on the rise again since the housing bubble burst, and some economists believe that the nation could experience another possible real estate bubble, particularly at the local and city level, according to Econofact.

How much did the economy shrink during the Depression?

During the first five years of the depression, the economy shrank 50% . In 1929, economic output was $105 billion, as measured by gross domestic product (GDP). 5 That's equivalent to more than $1 trillion today.

How many banks failed during the Great Depression?

During the Depression, a third of the nation's banks failed. 1 By 1933, 4,000 banks had failed. 11 As a result, depositors lost $140 billion. 12 . People were stunned to find out that banks had used their deposits to invest in the stock market. They rushed to take their money out before it was too late.

What was the unemployment rate in 1928?

Charles Phelps Cushing / ClassicStock / Getty Images. In 1928, the final year of the Roaring Twenties, unemployment was 4.2%. That's less than the natural rate of unemployment. By 1930, it had more than doubled to 8.7%. 10 By 1932, it had increased to 23.6%. It peaked in 1933, reaching up to around 25%.

What happened in 1938?

Unfortunately, the government cut back on New Deal spending in 1938. The depression returned, and the economy shrank 6.3%. Preparations for World War II sent growth up 7% in 1939 and 10% in 1940. The next year, Japan bombed Pearl Harbor, and the United States entered World War II.

How did the Depression affect politics?

The Depression affected politics by shaking confidence in unfettered capitalism. That type of laissez-faire economics is what President Herbert Hoover advocated, and it had failed. As a result, people voted for Franklin Roosevelt. His Keynesian economics promised that government spending would end the Depression.

How much was the economy in 1929?

In 1929, economic output was $105 billion, as measured by gross domestic product (GDP). 5 That's equivalent to more than $1 trillion today. The economy began shrinking in August 1929. By the end of the year, 650 banks had failed. 6 In 1930, the economy shrank another 8.5%, according to the Bureau of Economic Analysis.

How much did the New Deal reduce unemployment?

New Deal programs helped reduce unemployment to 21.7% in 1934, 20.1% in 1935, 16.9% in 1936, and 14.3% in 1937. But less robust government spending in 1938 sent unemployment back up to 19%. It remained above 10% until 1941, according to a review of the unemployment rate by year.

Introduction: History of the U.S. Housing Market

As you probably know, the overall health of a nation’s economy fluctuates over time. The United States has experienced several periods of economic decline over the years, each varying in severity. The two most infamous downturns were the Great Depression of the 1930s and the Great Recession in 2008.

What Happened in to the U.S. Housing Market in 2008?

In an effort to help more Americans own real estate, mortgage lending standards loosened up in the early 2000’s. People with low credit scores were suddenly able to qualify for low-cost, low down-payment mortgages. These were known as subprime loans.

What's Been Happening to the Housing Market Since 2008

During the Great Recession, home prices dropped 33 percent. Surprisingly, 10 years later, the housing market had mostly recovered. Home values today are now up more than 50 percent since the recession. How? By unprecedented government stimulus.

How Obama's Presidency Impacted the U.S. Housing Market

President Obama took office in 2009, during the time when the value of homes was rapidly falling, unemployment rates were through the roof and banks were failing from the massive influx of foreclosures. The Obama administration’s goal was to keep the country from going into a full-blown depression.

How Trump's Presidency Has Impacted the U.S. Housing Market

When Trump was elected president in 2016, mortgage interest rates were 3.87% and the housing market was continuing to rebound. At the end of 2017, Trump signed the Tax Cuts and Jobs Act (TCJA), which changed the tax code tremendously and further stimulated the economy.

Final Thoughts

History defines the present… Understanding the history of the housing market is crucial to understanding what the future may bring. Everything happens in cycles. What’s happened before will likely happen again, just in a different form.

What was the New Deal housing project?

The relief provided by New Deal housing projects is as relevant today as it was in the 1930s. Government contracts rescued builders and industries. In turn, they provided jobs to skilled and unskilled laborers. Completed projects offered affordable homes ...

How would federally sponsored housing improve public health?

Not only would federally sponsored housing elevate public health, it could shape communities. New Deal housing would incorporate public spaces where children could play and be educated. Community and recreational centers would uplift neighborhoods by providing training and encouraging exercise.

What was the New Deal plan?

Franklin Delano Roosevelt’s New Deal plan to pull the nation out of the Great Depression could provide today’s leaders with a model to draw from to prevent the worst from coming true. Generally, Americans view housing as a privilege, something that is earned. But during the New Deal, President Roosevelt and his advisors embraced the idea ...

Is housing assistance a missed opportunity?

Federal housing assistance became a missed opportunity. But now it has become an urgent necessity. If the projected economic impact of COVID-19 proves true, it will require bold and decisive action of the sort we have not seen since the Depression.

Introduction

Issue Summary

- The American attitude against government intervention in individuals' lives fundamentally shifted with the onset of the Great Depression. The Depression dealt severe blows to both the construction industry and the homeowner. Between 1929 and 1933, construction of residential property fell 95 percent. Repair expenditures decreased from $50 million t...

Contributing Forces

- Home Sweet Home

As early as the eighteenth century, Americans viewed their zone of private life—their home family space—uniquely. The space was a personal place of refuge from society at large, free from outside control. The early ideal American home included a great deal of land. As cities develope… - The Automobile and the Bungalow

In 1898 there was only one automobile, a sputtering little offspring of a bicycle, for every 18,000 people. In 1900 Ransom E. Olds began assembling an uncomplicated, inexpensive, and utilitarian model, his "merry Oldsmobile." Sixty-five hundred were on the road in 1905. By 1913 there was o…

Perspectives

- A House In The Country

Because Franklin D. Roosevelt believed the rural life bred superior qualities in men and that all people lived a better life in the country, he actually viewed cities as rather hopeless. Roosevelt, like many scholars of the day, believed that urban populations in the future would remain stable or e… - Public Housing—The Most Controversial Housing Issue

Real estate developers, home buildings, bankers, congressmen from rural districts, fiscal conservatives, and those concerned with public spending leading to public debt, opposed public housing. Campaigns against the ever-worsening slums of the cities fell to liberals, social reform…

Impact

- Private Money Builds Private Suburban Homes

No New Deal agencies had more lasting or powerful impact on Americans and American cities over the last half of the twentieth century than the HOLC and the FHA. Although short lived, the HOLC established standardized appraisal procedures and first introduced the long-term, low-inte… - At a Glance Cheaper to Buy Than Rent

In 1939 the Wilmington Construction Company built four hundred six-room houses just north of Wilmington, Delaware. This FHA-backed development was called Edgemoor Terrace. It demonstrated the use of tract production line techniques, including standardized models and lo…

Notable People

- Catherine Bauer (1905–1964). After graduating from college, Bauer began work in New York's City Housing Corporation in the 1920s. The corporation was in the process of building a model garden community. Bauer spent the early 1930s in Europe, studying solutions to housing problems. On her return in 1934 she published Modern Housing.Confident public housing was America's answ…

Primary Sources

- National Housing Act of 1934

The following words were spoken to Congress by President Roosevelt on May 14, 1934, as he stressed the need to pass the National Housing Act of 1934 to stimulate the construction industry (Roosevelt, 1938, p. 232): - Federal Housing Administration

President Roosevelt proclaimed the affordability of homes financed by FHA-insured loans established under the National Housing Act of 1934. As stressed by Roosevelt, many lower-income families were able to now afford homes, and the resulting mortgage payments did not pl…

Suggested Research Topics

- Research the many programs offered by the Department of Housing and Urban Development (HUD) at the beginning of the twenty-first century. Does the FHA still play a role in HUD? How does HUD help lo...

- If you had been part of a family faced with losing their home, how would this possibility affect you, your schoolwork, your family relations. Write a diary entry relating your thoughts.

- Research the many programs offered by the Department of Housing and Urban Development (HUD) at the beginning of the twenty-first century. Does the FHA still play a role in HUD? How does HUD help lo...

- If you had been part of a family faced with losing their home, how would this possibility affect you, your schoolwork, your family relations. Write a diary entry relating your thoughts.

- Contact and interview a local bank loan officer about the types of mortgages available today. What factors do bankers consider when making a home loan to a family?

- Research the architectural style of the American Bungalow house.

Bibliography

- Sources

Davies, Pearl Janet. Real Estate in American History.Washington, DC: Public Affairs Press, 1958. Gelfand, Mark I. A Nation of Cities: The Federal Government and Urban America, 1933–65. New York: Oxford UniversityPress, 1975. Glaab, Charles N., and A. Theodore Brown. A History of Urba… - Further Reading

Duchscherer, Paul. The Bungalow: America's Arts and Crafts Home.New York: Penguin Books USA, 1995. Housing and Urban Development (HUD), [cited November 8, 2001] available from the World Wide Web at http://www.hud.gov. Kennedy, David M. Freedom from Fear: The American P…