If you are a consumer, tariffs affect you because they result in an increase in the price of imported goods. If you are a domestic producer, tariffs can help you by making your goods cheaper when compared to international goods, helping your business.

Full Answer

What are tariffs and how do they impact the economy?

Tariffs have historically been a tool for governments to collect revenues, but they are also a way for governments to try to protect domestic producers. As a protectionist tool, a tariff increases the prices of imports. As a result, consumers would choose to buy the relatively less expensive domestic goods instead.

What are the long term effects of tariffs?

“The consequence is the entire economic system becomes less efficient; that is the long-term cost to all of us,” said Meyer. Of the two likely outcomes of the tariff war Berkovich identified, the implications for the financing of the U.S. debt is more significant in the long run.

What is tariff and its economic effects?

The effects of tariff rates on the U.S. economy: what the Producer Price Index tells us. By Brian Hergt. A tariff is a tax levied on an imported good with the intent to limit the volume of foreign imports, protect domestic employment, reduce competition among domestic industries, and increase government revenue.

How could tariffs affect the U.S. economy?

The tariffs also increase government revenues that can be used to the benefit of the economy. There are costs to tariffs, however. Now the price of the good with the tariff has increased, the consumer is forced to either buy less of this good or less of some other good.

How do tariffs affect citizens?

Tariffs Raise Prices and Reduce Economic Growth Historical evidence shows tariffs raise prices and reduce available quantities of goods and services for U.S. businesses and consumers, which results in lower income, reduced employment, and lower economic output. Tariffs could reduce U.S. output through a few channels.

What happens if tariffs are increased?

Tariff increases also result in more unemployment, higher inequality, and real exchange rate appreciation, but only small effects on the trade balance. The effects on output and productivity tend to be magnified when tariffs rise during expansions, for advanced economies, and when tariffs go up, not down.

Who benefit from tariffs?

Tariffs mainly benefit the importing countries, as they are the ones setting the policy and receiving the money. The primary benefit is that tariffs produce revenue on goods and services brought into the country. Tariffs can also serve as an opening point for negotiations between two countries.

How do tariffs hurt the American consumer?

One of President Trump's most prominent policy actions in office was to raise tariffs, which significantly harm the U.S. economy. Trade barriers such as tariffs increase the cost of both consumer and producer goods and depress the economic benefits of competition, inhibiting economic growth.

Are tariffs good for the economy?

Tariffs can have unintended side effects. They can make domestic industries less efficient and innovative by reducing competition. They can hurt domestic consumers, since a lack of competition tends to push up prices. They can generate tensions by favoring certain industries, or geographic regions, over others.

What are the four direct effects of a tariff?

Tariffs will increase prices and raise money for the government. Tariffs will encourage the launching of new businesses and create jobs. Reduced spending on imports can be diverted to domestic spending and increase domestic employment. Tariffs will lower prices and increase the exporting of U.S. goods.

What would happen if the US stopped trading with China?

By cutting back on China-made products, raw materials could be greatly reduced. The result of that event will be a commodities market crash, which may crash all financial markets that will plunge the world into a global financial crisis almost impossible to recover from.

What are the pros and cons of tariffs?

Import tariffs have pros and cons. It benefits importing countries because tariffs generate revenue for the government....Import tariff disadvantagesConsumers bear higher prices. ... Raises deadweight loss. ... Trigger retaliation from partner countries.

Do consumers benefit from tariffs?

Often, goods from abroad are cheaper because they offer cheaper capital or labor costs; if those goods become more expensive, then consumers will choose the relatively costlier domestic product. Overall, consumers tend to lose out with tariffs, where the taxes are collected domestically.

How do tariffs affect household income?

When tariffs are reduced (increased), households typically face lower (higher) prices for consumption goods, but they may also face a reduction (increase) in their incomes when they are selling such goods.

What are the negatives of tariffs?

The negative consequences of tariffs include higher prices for consumers and businesses, retaliation by foreign governments, and a weakening of the global rules-based trading system that will surely harm U.S. interests greatly in the long run.

What does China supply to the US?

The top U.S. import commodities from China are fruits and vegetables (fresh/processed), snack food, spices, and tea – the combined which accounts for nearly one-half of the total U.S. agricultural imports from China.

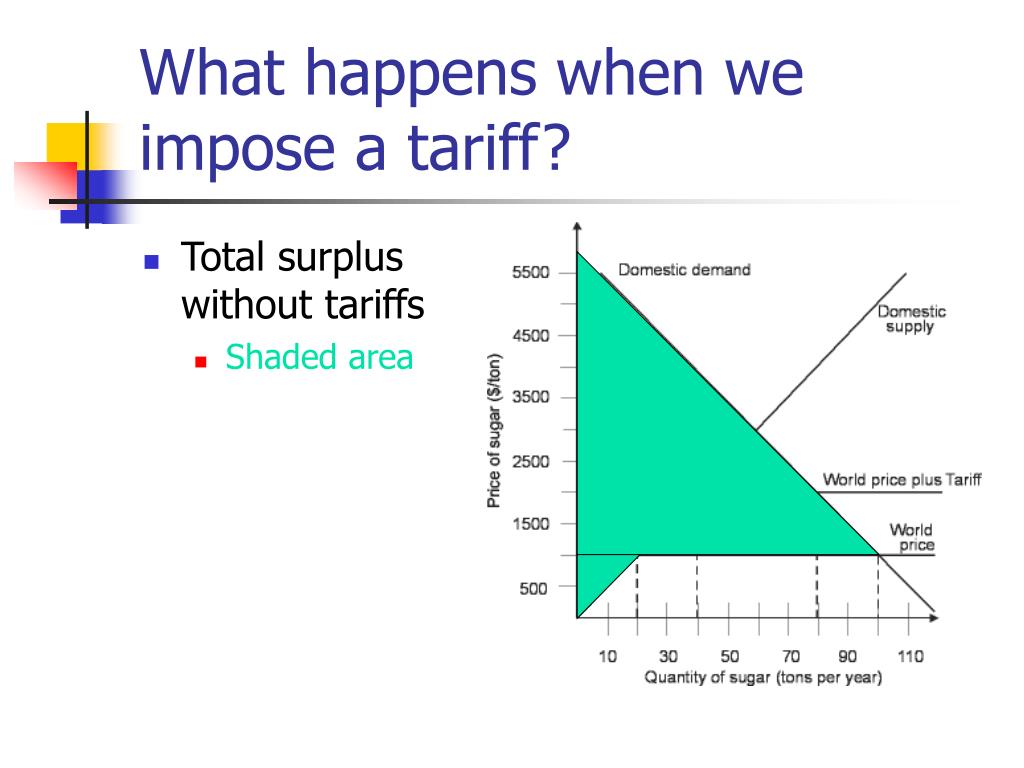

How do tariffs affect supply and demand?

Just as tariffs reduce demand by raising prices, government-imposed limits on imported goods reduce the available supply, raising prices.

Does tariffs cause inflation?

Those tariffs have only marginally contributed to US inflation. The second way that lifting tariffs could slow inflation is more indirect. If importers lower their prices because they no longer have to pay the tariffs, domestic competitors may need to lower their prices as well in order to compete.

What happens when you increase the tariffs on t shirts?

An increase in tariffs on imports will undoubtedly have an impact on the apparel industry, and consumers will see a price increase. Margins will be affected, and there is a strong potential for increases in consumer pricing.

How do tariffs affect developing countries?

Tariffs influence trade, production, consumption patterns and welfare of not only the countries that impose them, but also the welfare of their trading partners. They do so through both the absolute levels of protection they impart and through distortions associated with their structure.

What happens when tariffs take effect?

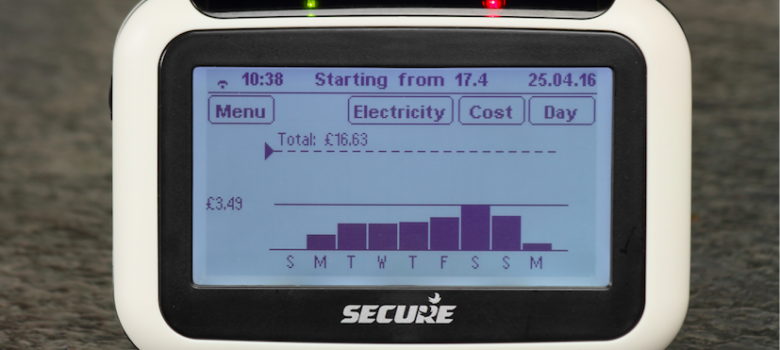

Once the tariffs take effect, you might see prices go up slightly on everyday items like peanut butter, orange juice and even jeans. That means you need to keep an eye on your monthly budget so you don’t overspend. Now you know why keeping track of your expenses throughout the month is so important!

Why do tariffs make the cost of goods go up?

That’s one theory from economists. Others say tariffs could make the cost of goods go up because companies just increase their prices to cover the tariff.

Why do tariffs benefit domestic producers?

Tariffs benefit domestic producers of those goods because the tax essentially makes the imported version of the same product more expensive. Any country can impose a tariff on goods from any other country. There are basically two types of tariffs. An ad valorem tariff is a fixed percentage of the good’s value.

What is the theory behind tariffs?

The theory behind a tariff is simple—at least on paper. When taxes are imposed on an imported item like steel, U.S. companies that need the item have to pay more for it. But, as an alternative to buying imported (foreign) steel, a U.S. company could instead purchase it from a domestic supplier at a better price.

What goods did China impose tariffs on?

They imposed new tariffs on Chinese goods including solar panels, washing machines, steel, cash registers and even artificial teeth. 3 Well, as you can guess, China wasn’t happy about that. In return, the country imposed tariffs on American goods such as fruits, wine, nuts and pork. 4. That was the start of the friction.

Why are tariffs important?

Well, the goal of tariffs is to make marketplace competition fair. This helps economies grow as nations compete with each other to sell their resources. When the U.S. economy is growing, that trickles down to you in the form of more affordable goods.

What is an ad valorem tariff?

An ad valorem tariff is a fixed percentage of the good’s value. So the tax on that product will go up or down as the international price of that good changes. A specific tariff is a fixed amount that doesn’t change if the international price of the good goes up or down.

What Are Tariffs?

When a person or business imports a product or material, customs authorities can require them to pay a charge. This charge is the tariff.

Why Do Countries Impose Tariffs?

Tariffs primarily exist to make imported goods less attractive. If the price of imported goods rises, buying or selling domestically-produced goods might be a more attractive option. They might also serve to keep certain products out of the country altogether.

How Do Tariffs Affect Businesses?

Tariffs have different effects on different types of businesses and people.

How Are Tariffs Affected By Politics?

Some governments reject tariffs, believing that free trade between nations is a positive thing – even if it means some domestic businesses are priced out of domestic markets.

How do tariffs affect domestic retailers?

Tariffs typically hurt domestic retailers. Consider the example above, with the US clothing retailer changing its supplier to a US manufacturer. This will cut into the retailer’s profits one way or another. Either it absorbs the costs of tariffs or passes them onto its customers.

What is a tariff on a computer?

A tariff can take several forms: Ad valorem tariff – a tariff calculated as a proportion of the price of the goods being imported. For example, if all computers imported into a country are subject to a 10 percent ad valorem tariff, a computer that costs $100 will incur a tariff of $10.

What is a tariff in trade?

Countries can sign free trade agreements to reduce or eliminate them. A tariff is a charge levied on imported goods. Customs authorities impose tariffs on goods arriving at a nation’s borders. Countries can sign free trade agreements to reduce or eliminate them.