To analyze accounting transactions follow these steps:

- Is this a business transaction or is it informational? ...

- Reading through the transaction, see what accounts are being impacted. ...

- Determine what types of accounts the impacted accounts are. ...

- Determine whether the impacted accounts are increasing or decreasing. ...

How do Accountants analyze a transaction?

Now, in order to analyze a transaction, you must know what it is you're looking for. Accountants are equipped with a very special tool that they use when analyzing transactions - that tool is the accounting equation. The accounting equation states that assets = liabilities + owner's equity.

How does the accounting equation affect transaction analysis?

The accounting equation, which forms the foundation of the double-entry accounting system, states that a company’s total assets must be equal to the sum of its liabilities and equity, as reflected on the company’s balance sheet. To understand the analysis of transactions, you’ll want to understand what the accounting equation is and how it works.

What is an accountant's equation?

Accountants are equipped with a very special tool that they use when analyzing transactions - that tool is the accounting equation. The accounting equation states that assets = liabilities + owner's equity. An asset is something that a business owns.

What is transaction analysis and why is it important?

Transaction analysis is the act of examining a transaction to decide how it affects the accounting equation. It's also the first step in the accounting cycle. In order to properly analyze a transaction, you must know and understand a few key things.

What is the analysis of transactions in accounting?

What is accounting transaction analysis? Accounting transaction analysis involves documenting every transaction that has an impact on your company's finances. This recordkeeping step is very important in the accounting process and helps to show how your business transactions impact your assets, liabilities, and equity.

How do you analyze business transactions in accounting?

Analysis of business transactions involves the following four steps:Ascertaining the accounts involved in the transaction.Ascertaining the nature of the accounts involved in the transaction.Determining the effects (i.e., in terms of increases and decreases in the accounts)Applying the rules of debit and credit.

How do you analyze transactions and Journalize accounting principles?

2:454:18How to Analyze Transactions and Journalize Accounting PrinciplesYouTubeStart of suggested clipEnd of suggested clipThis case as cash is coming into the business cash and asset account increases. And as borrowingsMoreThis case as cash is coming into the business cash and asset account increases. And as borrowings are made by signing a note notes payable a liability account increases. To record this transaction.

How do you do accounting analysis?

2:2716:11Accounting Process Step 1: Transaction Analysis - YouTubeYouTubeStart of suggested clipEnd of suggested clipWe have to determine what accounts are affected are the accounts getting bigger or smaller if they'MoreWe have to determine what accounts are affected are the accounts getting bigger or smaller if they're getting bigger they're going up if they're getting smaller they're going down.

What are the 4 steps of analyzing a transaction?

The first four steps in the accounting cycle are (1) identify and analyze transactions, (2) record transactions to a journal, (3) post journal information to a ledger, and (4) prepare an unadjusted trial balance.

Why do we need to analyze transactions?

Primary Purpose. Primary purposes of transaction analysis are to gauge the relevance and reliability of a transaction. Relevance indicates a transaction has predictive value. In short, the transaction should add value to the business and allow for predicting future earnings.

What is the role of the accounting equation in the analysis of business transactions?

The accounting equation ensures that all entries in the books and records are vetted, and a verifiable relationship exists between each liability (or expense) and its corresponding source; or between each item of income (or asset) and its source.

How transactions affect the accounting equation?

Different transactions impact owner's equity in the expanded accounting equation. Revenue increases owner's equity, while owner's draws and expenses (e.g., rent payments) decrease owner's equity. Both sides of the equation must balance each other.

How do you do transactions in accounting?

When you record a financial transaction in your books, use debits and credits to show the equal and opposite effects on two or more accounts. For example, you send an invoice to a customer for a product. Record the income at the time the customer receives the invoice by debiting the asset account for income.

What is the equation for analyzing transactions?

The accounting equation states that assets = liabilities + owner's equity.

How to analyze a transaction?

In order to properly analyze a transaction, you must know and understand a few key things. First, you need to know what the components of the accounting equation are. Assets are things that a business owns. Liabilities are things that a business owes .

What is the accounting equation for assets?

If you recall, the accounting equation states that assets are equal to the sum of the total of liabilities and owner's equity. The key to this is in the word 'equals'. The same premise applies to transaction analysis as it does to the accounting equation. The bottom line is that everything must balance.

What is the equation for assets and liabilities?

The accounting equation states that assets = liabilities + owner's equity. An asset is something that a business owns. A liability is something that a business owes. Owner's equity is the amount of money that a business owner personally invests in the business.

What do you need to know before you can analyze business transactions?

The third thing that you need to know before you can analyze business transactions is that, no matter what, the sum of the amounts debited and credited must be equal. Once you know these concepts, transaction analysis will be a breeze! Learning Outcomes. When you have completed this lesson you should be able to:

What does debit mean in accounting?

It means that at least one account will be debited and one account will be credited. A debit is an entry on the left side of an account that signifies an increase in the balance of an asset account and a decrease in the balance of a liability or owner's equity account.

What is double entry accounting?

A double-entry accounting system is one that is based on the premise that for every one transaction at least two accounts will be affected.

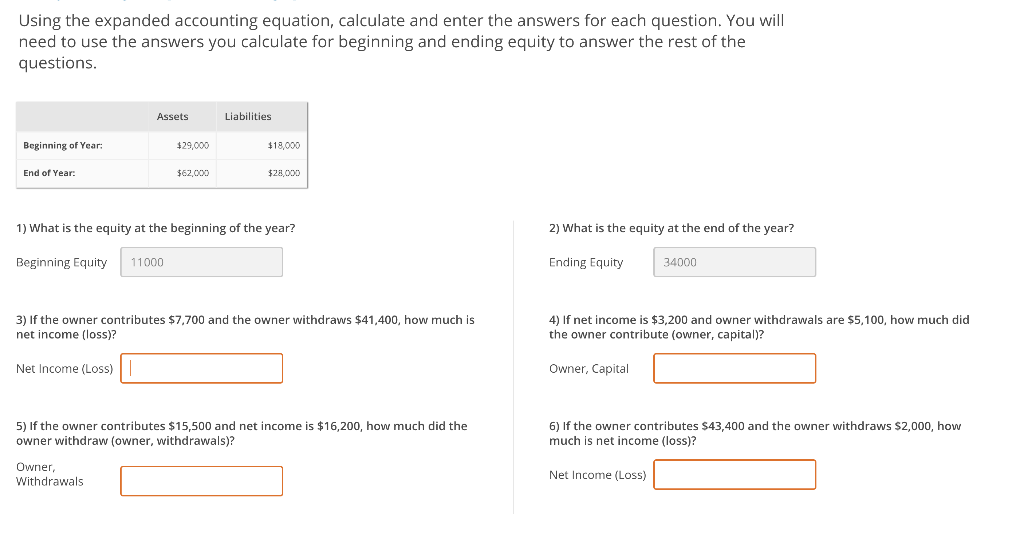

1.2 Transaction Analysis- accounting equation format

Now that you’ve gained a basic understanding of both the basic and expanded accounting equations, let’s consider some of the transactions a business may encounter. We’ll review how each transaction affects the basic accounting equation.

Reviewing and Analyzing Transactions

Let us assume our business is a service-based company. We use Lynn Sanders’ small printing company, Printing Plus, as our example. Please notice that since Printing Plus is a corporation, we are using the Common Stock account, instead of Owner’s Equity. The following are several transactions from this business’s current month:

What is the first step in accounting?

The first step in the accounting process is to analyze every transaction (economic event) that affects the business. The accounting equation (Assets = Liabilities + Owner's Equity) must remain in balance after every transaction is recorded, so accountants must analyze each transaction to determine how it affects owner's equity and ...

What is an account in accounting?

An account is a record of all transactions involving a particular item. Companies maintain separate accounts for each type of asset (cash, accounts receivable, inventory, etc.), each type of liability (accounts payable, wages payable, notes payable, etc.), owner investments (usually referred to as the owner's capital account in a sole ...

What is the chart of accounts?

For organizational purposes, each account in the general ledger is assigned a number, and companies maintain a chart of accounts, which lists the accounts and account numbers. Account numbers vary significantly from one company to the next, depending on the company's size and complexity.

What are the basic components of accounting?

Each of these categories, in turn, includes many individual accounts, all of which a company maintains in its general ledger. A general ledger is a comprehensive listing of all of a company’s accounts with their individual balances.

What is journal in accounting?

A journal is the first place information is entered into the accounting system. A journal is often referred to as the book of original entry because it is the place the information originally enters into the system. A journal keeps a historical account of all recordable transactions with which the company has engaged. In other words, a journal is similar to a diary for a business. When you enter information into a journal, we say you are journalizing the entry. Journaling the entry is the second step in the accounting cycle. Here is a picture of a journal.

What is an Accounting Transaction Analysis?

An accounting transaction analysis is the first step of the recording process of the accounting cycle. This is the process of analyzing business transactions to determine their effects on the books.

Example of an Accounting Transaction Analysis

Referencing an illustration of the accounting equation above, let’s perform the accounting transaction analysis of a business transaction. Brian Kimberly invested $55,000 cash and office equipment valued at $8,850 in the company in exchange for its common stock.

What is accounting equation?

Accounting Equation indicates that for every debit there must be an equal credit. assets, liabilities and owners’ equity are the three components of it. Accounting equation suggests that for every debit there must be a credit. Accounting is a way of getting information about the transactions and events within the business in reports ...

What is accounting in business?

Accounting is a way of getting information about the transactions and events within the business in reports that are used by persons interested in the entity. Assets, liabilities and owners’ equity are the three components of the accounting equation that make up a company’s balance sheet.

What is an asset?

Assets. Assets or the economic resources of the entity which is owned by it. Items like; cash, accounts receivable (amounts owed to a firm by its customers), inventories, land, buildings, equipment, and even intangible assets like patents and other legal rights and claims.

What are the components of a company's balance sheet?

Assets, liabilities and owners’ equity are the three components that make up a company’s balance sheet. The balance sheet, which shows a business’s financial condition at any point, is based on this equation.

Why is debit considered net assets?

It is also referred to as net assets because it is equivalent to assets minus liabilities. Accounting Equation demonstrates the dual aspect of a transaction and proofs that Debit = Credit. Here is a table to show you the effects of transactions on the accounting equation.