Is $10000 a good down payment for a house? Conventional mortgages, like the traditional 30-year fixed rate mortgage, usually require at least a 5% down payment. If you're buying a home for $200,000, in this case, you'll need $10,000 to secure a home loan.

Full Answer

How much down payment do I need for a 250 000 house?

The most popular loan option, a conventional mortgage, starts at 3% to 5% down. On a $250,000 house, that’s a $7,500-$12,500 down payment. But to avoid private mortgage insurance on one of these loans (which costs extra every month) you need 20% down. That’s $50,000 on a $250,000 home.

Is it better to put 10 or 20 down on a house?

It’s better to put 20 percent down if you want the lowest possible interest rate and monthly payment. But if you want to get into a house now and start building equity, it may be better to buy with a smaller down payment — say 5 to 10 percent down. You might also want to make a small down payment to avoid draining your savings.

What is a down payment on a house?

What is a down payment on a house? The down payment on a house is a portion of the cost of a home that’s paid in cash. The balance of the purchase price is usually paid by a loan you secure from a lender and pay back in a monthly mortgage payment.

How much down payment do first-time homebuyers put down?

In fact, first-time buyers put down only 6 percent on average. Just note that with 10 percent down, you’ll have a higher monthly payment than if you’d put 20 percent down. For example, a $300,000 home with a 4% mortgage rate would cost about $1,450 per month with 10 percent down, and just $1,150 per month with 20 percent down.

What is the average down payment on a house?

How much would you borrow with a 20% down payment?

How is the balance of a mortgage paid?

What is down payment assistance?

Why is 20% down good?

What does 20% down mean?

How many first time home buyers are there?

See 4 more

About this website

Down Payment Calculator

Free down payment calculator to find the amount of upfront cash needed, down payment percentage, or an affordable home price based on 3 potential situations.

Down Payment Calculator - How much should you put down? - SmartAsset

Mortgage Term: We assume a 30-year fixed mortgage term. Mortgage Type Loan Limits: We use mortgage loan limits down to the county level to identify if a user qualifies for an FHA or Conforming loan. Mortgage data: We use live mortgage data to calculate your mortgage payment. Closing costs: We have built local datasets so we can calculate exactly what closing costs will be in your neighborhood.

Average Down Payment on a House 2021: $27,850 - The Motley Fool

In 31 states, the median down payment was between $20,000 and $30,000. Only five states saw median down payments below $20,000: Mississippi, Wyoming, Montana, West Virginia, and Vermont.

What is the average down payment on a house? - ConsumerAffairs

The median down payment on a house is around 12% and increases with buyer age. Read our breakdown and find out minimum down payments by loan type.

Down Payment Calculator | How much to put down on a house | U.S. Bank

Our down payment calculator helps estimate your mortgage based on how much money you use as a down payment on a house. Learn how much you should put down with U.S. Bank.

How much down payment is needed to buy a house at 295,000?

For the median $295,000 home, that would mean a down payment of $10,325. On a $150,000 home, you’d only have to put down $5,250. Depending on where you live, that could be enough to buy an excellent house in a great area.

How much does closing cost on a 295,000 home?

So on a $295,000 home, your closing costs would amount to about $5,900 to $20,650. However, that doesn’t necessarily mean you have to raise that money yourself. There are two other ways to cover closing costs.

How to pay closing costs?

One of the best ways to pay for closing costs is to negotiate with the home’s seller to cover some or all of the costs. Depending on the housing market in your area, sellers may be anxious to close a deal quickly and will be more motivated to pay for your closing costs just to get the sale over with.

What do you need to cover closing costs on a home loan?

Even if you get a home loan that covers 100% of the home’s cost, you typically need to come up with thousands of dollars to cover closing costs. Those are the fees paid to third parties who facilitate the sale of a home. They include the loan origination fee, credit report fee, title search fee, and more.

Do you have to pay mortgage insurance on a small down payment?

The one downside? Because you’re making a small down payment, you will need to pay mortgage insurance (PMI). But you can roll that cost into your total mortgage.

Do you have to pay mortgage insurance?

You’ll need to pay ongoing fees for mortgage insurance, he notes, but it’s less than an FHA or conventional mortgage.

Can you roll a USDA loan into a mortgage?

Department of Agriculture offers loans to Americans with low to moderate incomes who want to buy a home in a rural area. Like with VA loans, you can borrow up to 100% of the home’s cost, eliminating the need for a down payment. USDA loans do have some fees, but you can roll them into the mortgage.

What is the down payment for a house?

Often, a down payment for a home is expressed as a percentage of the purchase price. As an example, for a $250,000 home, a down payment of 3.5% is $8,750, while 20% is $50,000.

What happens if your down payment is less than 20%?

If the down payment is lower than 20%, borrowers will be asked to purchase Private Mortgage Insurance (PMI) to protect the mortgage lenders. The PMI is normally paid as a monthly fee added to the mortgage until the balance of the loan falls below 80 or 78% of the home purchase price.

What is the down payment for a conventional mortgage?

Conventional loans normally require a down payment of 20% but some lenders may go lower, such as 10%, 5%, or 3% at the very least. If the down payment is lower than 20%, borrowers will be asked to purchase Private Mortgage Insurance (PMI) to protect the mortgage lenders. The PMI is normally paid as a monthly fee added to the mortgage until the balance of the loan falls below 80 or 78% of the home purchase price.

What is piggyback mortgage?

A piggyback mortgage is when two separate loans are taken out for the same home. Generally, the first mortgage is set at 80% of the home's value and the second loan is for 10%. The remaining 10% comes from the home-buyer's savings as a down payment. This is also called an 80-10-10 loan.

How long does a down payment on a FHA loan last?

To help low-income buyers in the U.S., the Department of Housing and Urban Development (HUD) requires all Federal Housing Administration (FHA) loans to provide insurance to primary residence home-buyers so that they can purchase a home with a down payment as low as 3.5% and for terms as long as 30 years.

Why are down payments important?

This is because big down payments lower risk by protecting them against the various factors that might reduce the value of the purchased home. In addition, borrowers risk losing their down payment if they can't make payments on a home and end up in foreclosure. As a result, down payments act as an incentive for borrowers to make their mortgage payments, which reduces the risk of default.

How much is mortgage insurance at closing?

However, home-buyers must pay an upfront mortgage insurance premium at closing that is worth 1.75% of the loan amount, on top of the down payment. In addition, monthly mortgage insurance payments last for the life of the loan unless refinanced to a conventional loan.

How much is a down payment on a house?

How much down payment you need for a house depends on which type of mortgage you get.

What is the down payment for a closing with $12,000 cash?

Similarly, if you brought $12,000 cash to your closing, your down payment would be 3%.

How much do you have to put down on a house?

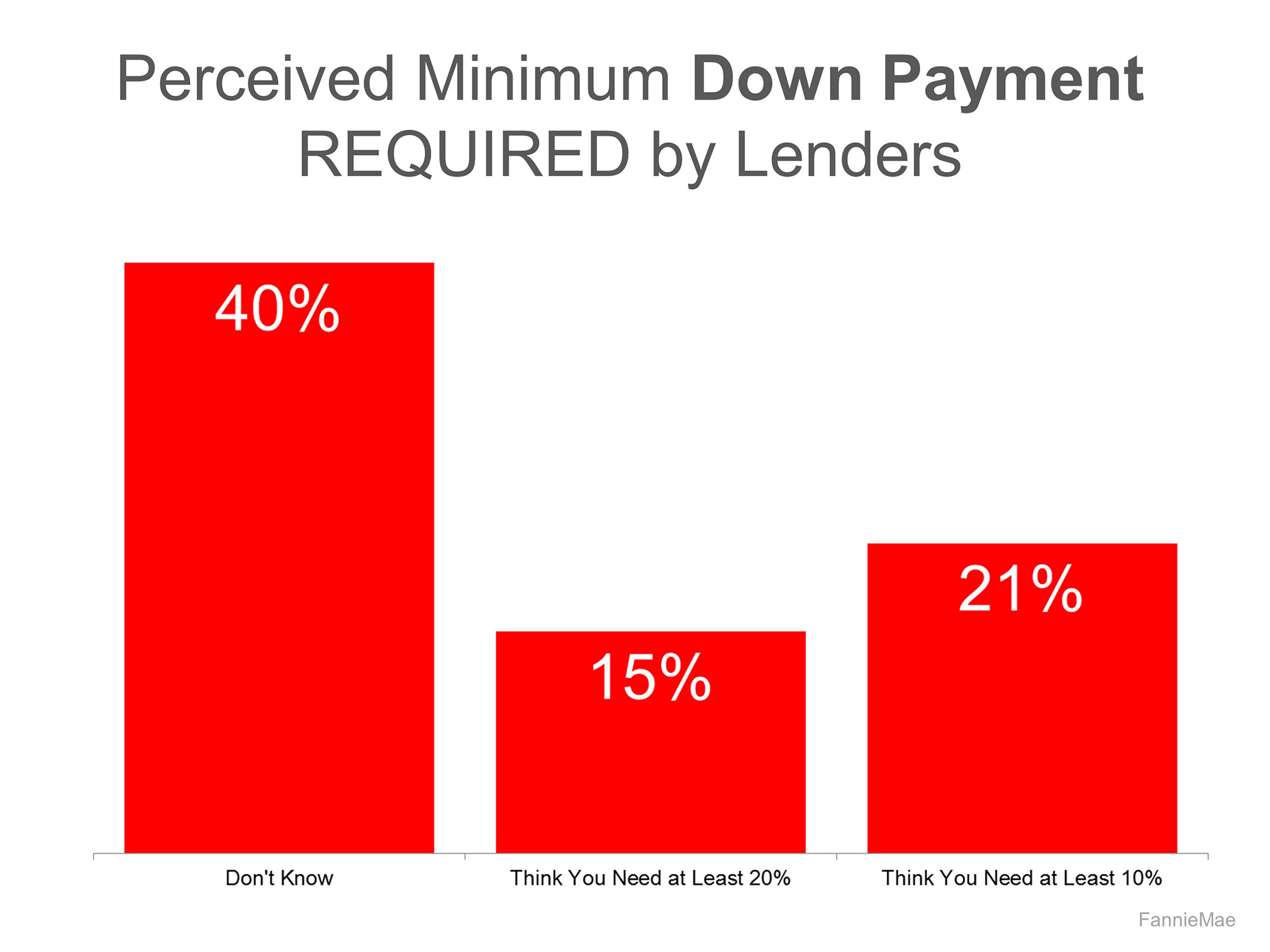

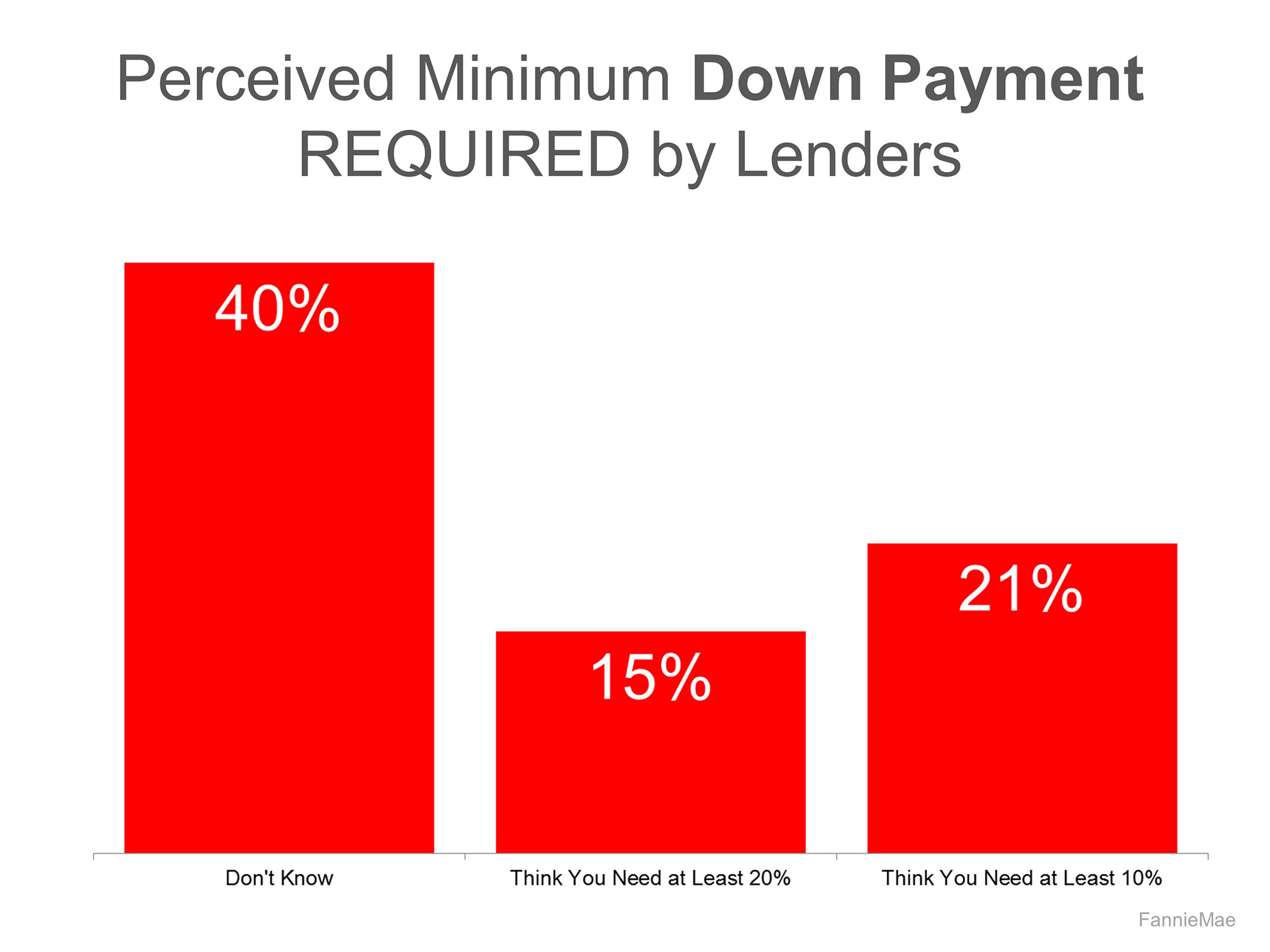

First things first: The idea that you have to put 20 percent down on a house is a myth.

What is a down payment?

In real estate, a down payment is the amount of cash you put towards the purchase of home.

What if I can’t afford the down payment?

Not everyone qualifies for a zero–down mortgage. Most borrowers need at least 3% down for a conventional mortgage or 3.5% down for an FHA loan.

What are today’s mortgage rates?

Today’s mortgage rates are still at historic lows, even for borrowers with less than 20% down. In fact, borrowers with low–down–payment government loans often get access to below–market rates.

Why is it important to make a big down payment?

That’s because a large down payment shrinks your loan amount and reduces your monthly mortgage payment.

What is the average down payment for a house in 2019?

There is no such thing as a “typical 20% down payment.”. The average down payment in 2019 was 11%. For first-time buyers, the average down payment was about 6%. People who buy into the 20% myth delay their home purchase until they can save up the additional cash. As they do so, they watch home prices continue to rise at 3%-.

How long to wait to pay 10% down on house?

If you can afford a 10% down payment now on a house, or to wait 6 months or a year to have the 20% for the down payment, what would be the best decision, buy now or to wait?

How much does mortgage insurance cost?

The cost of mortgage insurance is far less than many people have claimed. The borrower’s credit score and the loan to value ratio will determine the premium. Someone buying a $350,000 home with a 15% down payment will pay monthly PMI of as little as $47 per month. The insurance will drop off automatically when they’ve paid the balance down to 78% of the purchase price—about four years.

How much does PMI cost on a 720 credit score?

Lower scores increase the cost of PMI. A 720 score would give a premium of $230 (.95%). The monthly premium could be as high as $546 (2.25%) for a 620 score, the minimum for a conventional loan.

When do lenders rely on mortgage insurance?

Lenders are always aware of risk when they make loans. When a buyer’s down payment is less than 20%, they rely on mortgage insurance to manage that risk. Mortgage insurance is an alternative t

How do buyers manage down payment in California?

Buyers manage the down payment in California the same way they do in other states where prices are lower: they save it , borrow it from their retirement account, or get a gift from a relative.

Why is 20% down payment bad?

The myth of the “normal 20% down payment” is a damaging one because it has kept people from becoming homeowners. For many people, trying to save a large sum of money as prices continue to rise is like running after a train that has just left the station.

What is a down payment on a mortgage?

A mortgage is a loan used to purchase a house. But there are very few mortgages available that will cover the total cost of the home.

Low Down Payment Mortgage Options

Most lenders these days don’t expect you to have a full 20% down payment saved up. How much down payment you’ll need for a house depends on the type of loan you choose. The exact amount you’ll need varies based on several factors.

What other costs are associated with buying a home?

We’ve talked a lot about private mortgage insurance adding to the total cost of your loan. But it’s also important to remember that there are fees and expenses to consider.

What is the average down payment on a house?

The typical down payment on a mortgaged home in 2019 was 10-19% of the purchase price of the home. While 20% is the traditional down payment amount, 56% of buyers put down less than 20%, according to the Zillow Group Consumer Housing Trends Report 2019.

How much would you borrow with a 20% down payment?

With a 20% down payment ($60,000), you’d borrow $240,000 , and your monthly payment would be $1,548.

How is the balance of a mortgage paid?

The balance of the purchase price is usually paid by a loan you secure from a lender and pay back in a monthly mortgage payment. Down payments are expressed as a percentage of the total purchase price and the percentage you’re required to pay is dictated by the terms of your loan.

What is down payment assistance?

Down payment assistance program: These programs allow buyers to take out a second mortgage to cover the cost of their down payment, sometimes with benefits such as zero percent interest and deferred payments. These programs are usually run by government agencies or nonprofits.

Why is 20% down good?

20% down improves mortgage rates. Buyers purchasing with a 20% down payment can often get better interest rates. A higher down payment is considered a sign that you’re financially stable, and thus a less risky borrower in the eyes of your lender.

What does 20% down mean?

20% down eliminates private mortgage insurance (PMI) When you put 20% down, that means you own 20% of your home. This allows you to avoid paying PMI, which is a monthly charge that’s rolled into your mortgage payment to protect the lender from what they see as a riskier loan.

How many first time home buyers are there?

According to the Zillow Group Report, almost half of all home buyers (45%) are first-time buyers. While most repeat buyers can apply the equity from the home they’re selling to their new home, it’s more challenging for first-time home buyers to get the money they need to secure a down payment.