How much can you save with a $2500 deductible?

Earl Jones, the owner of Earl L. Jones Insurance Agency, says, “If you pay a deductible of $2500 - $5000 on your home, condo, or mobile home insurance, you might be able to save 10%-20% on your premium. “If you bundle your home and auto insurance, you can save even more.

What is a normal deductible for homeowners insurance?

Normal options for policy deductibles are $500, $1000, $2500, and sometimes $5000 when we are speaking about homes valued under $1 million in reconstruction value. Every deductible offers a percentage discount off the base premium of your insurance policy.

What is the difference between a $500 and a $2500 deductible?

Let’s look at the difference in premium and risk between a $500 deductible and a $2500 deductible. The increase in risk to you is $2000 ($2500-$500=$2000). If we were to increase our policy deductible from $500 to $2500 the premium savings would approach 30%. If your policy was $2500/yr you could be looking at a savings of as much as $750/yr.

Is a higher or lower deductible better for homeowners insurance?

Typically, the higher your homeowners insurance deductible, the lower your premium will be. However, that means lower payouts from your insurer when bad things happen. So it's important to recognize the trade-off you're making and settle on a homeowners insurance deductible that makes sense for you and your finances.

How does a deductible work on a home insurance policy?

What is deductible in insurance?

Why are disaster deductibles important?

What is a hurricane deductible?

What is the percentage of deductible for earthquakes?

Where to find deductions on insurance?

Can you raise your deductibles to save money?

See 2 more

The Average Recommended Homeowners Insurance Deductible

What is A Deductible? The homeowners insurance deductible is defined as “an amount of money that you yourself are responsible for paying toward an insured loss.” The deductible can come in a set dollar amount. However, you can also set a percentage of the total amount of insurance as your deductible.

How High Should My Homeowners Insurance Deductible Be?

Even if you don’t consider your home an investment, you are still pouring thousands of dollars into a house. You’ve got a down payment worth thousands of dollars, your monthly payment, property taxes, and landscaping maintenance costs.

How High Should I Set My Homeowners' Insurance Deductible?

Martindale-Hubbell® Peer Review Ratings™ are the gold standard in attorney ratings, and have been for more than a century. These ratings indicate attorneys who are widely respected by their peers for their ethical standards and legal expertise in a specific area of practice.

How Much Will Raising the Deductible on House Insurance Lower My ...

A deductible is the amount of money you must pay after experiencing a loss before the insurance company considers paying the claim. For example, if your house suffers $10,000 worth of damage and your deductible is $1,000, the most the insurance company will pay is $9,000.

How many deductibles are there for homeowners insurance?

First, let’s talk about the different types of deductibles. Typical homeowners insurance policies have 2 deductibles. The first deductible is known as the policy deductible and the second is commonly referred to as the hurricane deductible, or as known in the industry as the catastrophic windstorm deductible.

What factors go into choosing the best deductible for your situation?

So we now know that many factors go into choosing the best deductible for your situation including; risk appetite, financial position, and premium. My personal opinion is to pay the insurance company the least amount of money, fix the screen door when damaged, and save the insurance for catastrophic events like fire, hurricanes, and pipe bursts.

How much is a home insurance deductible?

A standard homeowners insurance policy deductible is usually in the range of $500 to $2,000, although lower and higher deductible home insurance plans are also common. Dollar amount deductibles work like this: if your deductible is $1,000 and you file a roof claim totaling $6,500 in damages, you pay the first $1,000 of the repair costs out ...

What is a deductible on a home insurance policy?

A deductible is the amount that you pay out of pocket for an insurance claim before your insurance company pays for the remainder of the loss. Usually a higher deductible means lower insurance premiums, and a lower deductible means higher insurance premiums. Most homeowners insurance policies include two types of deductibles: a standard ...

When do you pay the deductible for homeowners insurance?

Your deductible is paid once your claim is accepted and you’ve agreed to a claim settlement with your insurance company. You don’t pay your deductible like you would your phone or utility bills — rather, your insurer simply subtracts it from the claim amount. If your claim is for $10,000 and you have a $500 deductible, you’ll receive a $9,500 claim check from your insurer.

How do homeowners insurance deductibles work?

The claim check you get from your insurance company is the insured damage or loss amount minus your deductible.

What are disaster deductibles?

Deductibles can vary depending on what type of storm caused the damage or loss to your home or personal property. While wind, hail, and hurricane damage are covered by a standard homeowners insurance policy, a special percentage deductible may kick in depending on the details of your policy and what state you live in.

What is the deductible for hurricane damage?

Most homeowners insurance policies include two types of deductibles: a standard (typically $500 to $2,000) for most causes of loss, and percentage deductibles (typically 1% to 5% ) for wind/hail or hurricane-related damage.

How much is deductible for water backup?

If your policy contains additional coverage endorsements like equipment breakdown coverage, service line coverage, or water backup coverage, you may have to pay a small deductible for individual claims involving those coverages (some companies cap endorsement deductibles at $250).

What is a deductible on home insurance?

A homeowners insurance deductible is the amount a person agrees to pay toward any claim. For example, if a homeowner opts for a $1,000 deductible, that means they are responsible for paying the first $1,000 when a claim is filed. Let's say a tree falls on a house, causing $11,000 worth of property damage. The homeowner would pay $1,000 toward ...

What is the average homeowners insurance deductible?

For anyone wondering, "What is the standard deductible for homeowners insurance?" a typical homeowners insurance deductible ranges from $500 to $2,000, although the average homeowners insurance deductible is $500. The low deductible means homeowners are paying more for their annual premium, but have peace of mind knowing that they only have to come up with $500 in the event of a covered claim.

What are disaster deductibles?

Disaster deductibles are required for predictable "big dollar" claims. For example, insurers expect there to be claims for hurricanes in parts of the Southeast, and they expect those claims to be costly. For that reason, homeowners living in hurricane-prone areas may be required to pay a percentage of hurricane-related claims. Here are some of the most common disaster deductibles, including more about hurricane deductibles:

How do homeowners insurance deductibles affect premiums?

How high (or low) a homeowners insurance deductible is directly impacts premiums.

What is the deductible for hurricane damage?

Hurricane. Let's say a home suffers hurricane damage and the homeowner's deductible is 2%. Because the homeowners insurance deductible applies to the home's total value, how much they end up paying depends on how much the home is worth. For example, if the house has a value of $300,000, a homeowner with a 2% deductible would pay ...

What are the different types of deductibles for homeowners insurance?

The most common types of homeowners insurance deductibles are flat, percentage, and split. Here's how each works:

What is a percentage deductible?

As the name suggests, a percentage deductible is based on a percentage of a home's insured value. Let's say a home is insured for $200,000 and the deductible is 2%. That means the policyholder is responsible for the first $4,000 of a claim ($200,000 x .02 = $4,000).

What is a deductible on home insurance?

A homeowners insurance deductible is the amount you'll pay out of pocket if you file an approved claim. Typically, you'll get to decide what the deductible will be, but it's important to your wallet that you have a solid grasp on the relationship between homeowners insurance deductibles and premiums.

What is a home insurance deductible?

A deductible for homeowners insurance is the amount the policyholder will pay if there is an approved claim. It is agreed upon between you, the policyholder and the insurance company at the time the policy is established.

How do home insurance deductibles affect the cost of insurance premiums?

Generally, the higher the insurance premium, the lower your deductible will be.

What is a 1% deductible?

A percentage deductible is calculated as a percentage of your homeowner’s insurance coverage. “For instance, if your home insurance policy includes a dwelling coverage limit of $100,000 and you have a 1% deductible, then it would be $1,000, Cohen explains, “In the same scenario, if you have a 2% deductible, it would be $2,000. You can also have different deductibles (either dollar amount or percentage) based on the cause of loss.”

Why do homeowners with low deductibles pay the highest insurance premiums?

Because insurance companies take the brunt of the risk when you file a claim, homeowners with low deductibles pay the highest insurance premiums.

What is a dollar amount deductible?

With a dollar amount deductible, you pay a fixed dollar amount before your insurer covers the rest of the claim. It might be $1,000, $2,500, or any other amount you've agreed on with your insurance company when the policy was created. This is typical of standard homeowners insurance policies.

What does higher deductible mean?

Seth Lytton, Chief Operating Officer at The Detroit Bureau, explains, “Higher insurance deductibles mean lower insurance premiums and vice versa . If you're trying to save money upfront and can fix much of the damage to your house yourself, stick with a higher deductible.”

What is deductible on home insurance?

Like most insurance policies there is a deductible, the amount of money a claim must pass before the insurance company will start to reimburse you for expenses associated with the claim. Some policies have a single deductible for all types of claims covered on the policy. Some policies have “special” deductibles for specific claims (wind, hurricane, tornado, earthquake). All policies have exclusions for what they will not cover. Earthquake and Flood are two of the major natural disasters that are excluded from most policies. We will talk about coverage for these risks in future articles.

What is the most common deductible?

There are two types of deductibles. The most common is a Dollar Amount Deductible. With this type of deductible, you choose a dollar amount ($250, $500, $1,000, $2,500, etc.) that you are responsible for in the event of a claim. After that the insurance company will reimburse you for covered expenses associated with the claim. For example, a tree falls on your home and causes $4,000 in damage including the cost to remove the tree and repair the home. If you have a $1,000 deductible, the insurance company will reimburse you for the additional $3,000.

What is the second type of deductible?

The second type of deductible is a Percentage Deductible. With this type of deductible, your deductible is equal to a percentage (1%, 2%, 5%) of the insured value of the home. If you home was insured for $400,000 and you had a 1% deductible you would have a $4,000 deductible. If we used the above example with $4,000 in damage, your policy would not provide any coverage as it did not exceed your deductible. With this type of deductible, as your home increases in insured value your deductible increases.

Do you need to have cash at an unexpected claim time?

You need to have the cash at an unexpected claim time to be able to “afford” the higher deductible. When choosing an insurance policy, you do not want to focus just on the annual premium. You need to pay attention to how you are being covered. Two policies that are insuring the home for the same value may have completely different policy wording allowing one policy to provide much better coverage. Internal policy wording impacts if and how much you will be paid at claim time. We will discuss that in future articles.

How much is the average home insurance deductible?

Homeowners insurance deductibles are an important part of figuring out how to choose homeowners insurance. The average home insurance deductible is $500 per claim .

What does a deductible on a home insurance policy mean?

A homeowners insurance deductible decides how much you pay when you file a claim. The deductible affects your insurance policy’s cost. Typically, the higher your homeowners insurance deductible, the lower your premium. However, a lower deductible means you’ll pay more in premiums. So it's essential to recognize the trade-off ...

When do you pay the deductible for homeowners insurance?

Homeowners insurance deductibles apply to every claim, regardless of how many you make during a year. In that way, it’s similar to an auto insurance deductible.

Why do insurance companies use deductibles?

Insurance companies use deductibles to reduce minor claims -- and lowers payouts on major claims. Taking on less risk allows insurance companies to reduce your premiums when you choose a higher deductible amount. High deductible insurance can reduce your payments by between 20% and 40% depending on your insurance company and coverage.

How much does a high deductible reduce your insurance premium?

High deductible insurance can reduce your payments by between 20% and 40% depending on your insurance company and coverage.

What is the deductible for hurricane damage?

Hurricane deductibles apply to damage solely from hurricanes. Windstorm or wind/hail deductibles apply to wind damage. The III reports that percentage-based deductibles typically apply to these coverages and run from 1% to 5% of the home’s insured value.

How much deductible do you have to have for insurance?

Insurance companies in high-risk areas will often ask you to have a deductible of at least 10% of the insured value. You will pay higher premiums for low deductibles, similarly, for high deductibles, you will pay lower premiums. IN THIS ARTICLE.

How does a deductible work on a home insurance policy?

It varies. For homeowners, in specific, the deductibles are executed in terms of percentages.

What is deductible in insurance?

Deductibles are the out of pocket costs that one must pay to evoke their insurance, and it only when the deductible is paid that your insurance kicks in to cover all that it includes. In simpler terms, when a disaster strikes your home, the deductible amount is deducted from the claim.

Why are disaster deductibles important?

It is imperative for homeowners to know how each disaster has its own set of rules for deductibles because they are generally applied to property damage and not the liability portion of the home insurance policies.

What is a hurricane deductible?

Hurricane deductibles are applied to claims via specified triggers assigned by your insurance companies. These deductibles are expressed in percentages, mostly and are higher than the rest of homeowners’ deductibles.

What is the percentage of deductible for earthquakes?

In the more prone to earthquakes, the percentage of deductible can vary anywhere from 2% to 20%.

Where to find deductions on insurance?

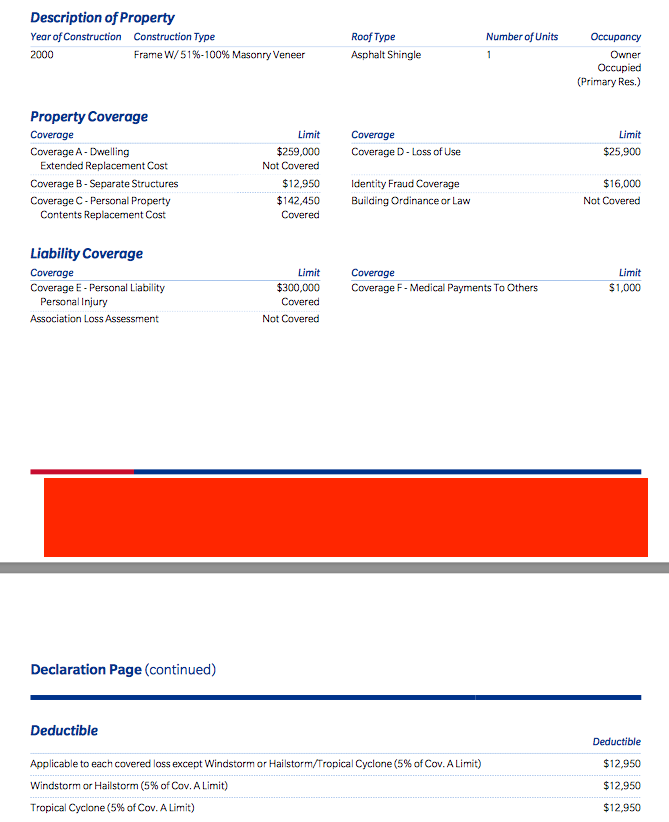

Deductibles are common in the world of insurance and can be found on the first page or the “declarations” page of most standard homeowners and auto insurance policies.

Can you raise your deductibles to save money?

Yes, they can help you save a great deal of money on your premiums. When you raise your deductible amount to $2500, you will be making a huge saving on your policy’s cost. You can save thousands of dollars on your insurance by developing a strategy that balances your financial situation with deductible amounts. Say, if you never have to make a claim and pay that higher deductible, then all that extra money stays in your pocket. On the other hand, if you end up needing to pay your deductible, you’ve got the money ready.