What is a collateral trust bond?

A collateral trust bond has a claim against a security or basket of securities. These bonds are typically issued by holding companies since they usually have little to no real assets to use as collateral. Instead, holding companies have control over other companies, known as subsidiaries, by owning stock in each of the subsidiaries.

What is a trust certificate?

Updated Jun 25, 2019. A trust certificate is a bond or debt investment, usually in a public corporation, that is backed by other assets.

What is a collateral security?

The term " collateral security" might refer to the safety that a particular asset gives a lender in case a borrower fails to fulfill his or her obligation of making payments.

What is an example of a collateral bond?

For example, say Company A issues a collateral trust bond, and as collateral for the bond it includes the right to Company A shares held by a trust company. If Company A were to default on the bond payments, the bondholders would be entitled to the shares held in trust.

What is a collateral trust agreement?

Collateral Trust Agreements means a collateral sharing or trust agreement by and among the Agent, the Banks, the Long-Term Lenders, and the holders of the Applicable Senior Debt Securities and any security agreements, pledge agreements or other collateral documents delivered in connection therewith, as each may be ...

What Are Corporate Backed Trust Certificates?

Corporate Backed Trust Certificates operates as a special purpose entity. The Company was formed for the purpose of issuing debt securities to repay existing credit facilities, refinance indebtedness, and for acquisition purposes.

Can bonds be used as collateral?

By using their own portfolio of bonds as a collateral, they are able to, in essence, back themselves and streamline the process of loan approval. A cash for bond lending structure naturally favors borrowers with high levels of cash to work with, something not every borrower will have access to.

What is a trust bond?

A trust is a document created by a settlor that provides how property and assets within a trust are managed and distributed to trust beneficiaries. A trustee bond protects the interests of the trust beneficiaries in case the trustee does not adequately perform their duties to the beneficiaries.

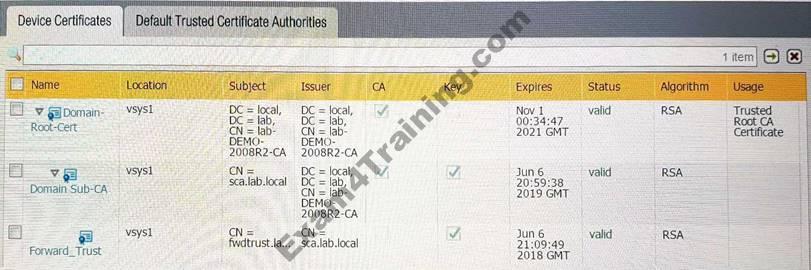

How does a certificate trust work?

When a browser downloads your website's SSL certificate upon arriving at your homepage, it begins chaining that certificate back to its root. It will begin by following the chain to the intermediate that has been installed, from there it continues to tracing backwards until it arrives at a trusted root certificate.

How do I download a trust certificate?

ProcedureOn the left navigation pane, click Security Settings.Click Certificate Authority on the setting page.Click Download Certificate Authority Root Certificate.Double-click the ca. ... Click the General tab, and click Install Certificate.Click Next.More items...

Which property should not be taken as collateral security against investment?

Except residential and commercial real-estate financing, mortgage of land and building is no more an acceptable form of collateral security in the developed countries.

What security if any is available as collateral for any loan?

The term collateral refers to an asset that a lender accepts as security for a loan. Collateral may take the form of real estate or other kinds of assets, depending on the purpose of the loan. The collateral acts as a form of protection for the lender.

What investments can be used as collateral?

Types of Collateral You Can UseCash in a savings account.Cash in a certificate of deposit (CD) account.Car.Boat.Home.Stocks.Bonds.Insurance policy.More items...•

Can you use a trust fund as collateral?

The trust document will dictate whether these funds can be collateralized – or not. Most trusts do not permit beneficiaries from using funds as collateral. Check with the trustee and read the trust document to confirm. Then, of course, check with a number of lenders.

Why use a bond in a trust?

The bond is put in a trust that allows investors to access their original capital, retaining control, but growth in the bond is not included in their estate for IHT purposes. There are two types of loan trust – absolute and discretionary.

Can a trust open a TreasuryDirect account?

Multiple Trusts Each trust can open a TreasuryDirect account and buy up to $10,000 in I Bonds each calendar year (see comment #36 for a confirmation from TreasuryDirect customer service).

What is a certificate of trust in Arizona?

A certificate of trust is used to disclose information about a trust to a person who is not a beneficiary of said trust. This document, an abbreviated version of the original trust, verifies the existence of the trust and the trustee's authority to act on behalf of the trust.

Does a certificate of trust need to be recorded in California?

In California, a trust does not have to be recorded to be legal unless it holds title on real estate. If a trust does not hold title on real estate property, all assets held in the name of the trust are kept private. The trustee maintains a record of all trust property in a trust portfolio.

What is a trust certificate on Iphone?

Trusted certificates establish a chain of trust that verifies other certificates signed by the trusted roots — for example, to establish a secure connection to a web server. When IT administrators create Configuration Profiles, these trusted root certificates don't need to be included.

What is a certificate of trust Michigan?

If you have a living trust, a certificate of trust will help the trustee open new financial accounts without needing to provide the entire trust. To the extent that real estate is in your trust, and you desire to sell it, the title company will require you to have a certificate of trust.

What is trust certificate?

A trust certificate is a type of bond that is backed by other company assets. It is a relatively safe investment with a relatively low return. Trust certificates are a choice for the conservative investor, such as a retiree seeking an income supplement. That can be an attractive balance for conservative investors, ...

What happens if a trust fails to make payments?

That is, if the company fails to make the payments that are due, the assets may be seized and sold to help specific trust certificate holders recover a portion of their investment.

Is a trust certificate a share of common stock?

A trust certificate is a bond, not a share of common stock, but the value and risk profile of both potential investments reflect the issuing company’s financial stability and potential for future growth.

Is trust certificate investment complex?

However, investing in trust certificates can be complex. It requires an understanding of a company's overall financial situation and the nature of the asset that underlies the trust certificate.

What is collateral security?

A collateral agreement is executed by the taxpayer and "collateral security" ensures that the taxpayer performs the terms of the agreement. A collateral agreement is a pledge, guaranteed by security, for the performance of a certain act, i.e., payment of a delinquency or the filing of a return.

Who prepares collateral agreements?

Requests for collateral agreements must be prepared in triplicate by the taxpayer, or the taxpayer's representative, and must include the following information:

When acceptance of collateral security is in the best interest of the Government, will the responsible collection employee negotiate the terms of the?

When acceptance of collateral security is in the best interest of the Government, the responsible collection employee will negotiate the terms of the collateral agreement and the nature of the collateral with the taxpayer or representative.

Is a 6324A lien a security?

CEASO shall determine whether to require a bond or, in the alternative, suggest to the Executor, or other Estate representative, that a 6324A lien would be acceptable security for the deferred payment of estate tax. See IRM 5.5.6.2, IRC Section 6166.

What Is an Equipment Trust Certificate?

An equipment trust certificate (ETC) refers to a debt instrument that allows a company to take possession of and enjoy the use of an asset while paying for it over time. The debt issue is secured by the equipment or physical asset. During this time, the title for the equipment is held in trust for the holders of the issue.

What is an ETC certificate?

An equipment trust certificate (ETC) refers to a debt instrument that allows a company to take possession of and enjoy the use of an asset while paying for it over time. The debt issue is secured by the equipment or physical asset.

What happens if a borrower defaults on an ETC?

If the borrower maintains payments and pays off the debt, the asset's title is transferred from the holder to the borrower . But, on the other hand, if the borrower defaults, the lender or seller has the right to repossess or foreclose on the asset.

What happens to the title of an asset in an ETC?

If the borrower maintains payments and pays off the debt, the asset's title is transferred from the holder to the borrower.

Can a trust reclaim assets if it goes bankrupt?

If a company goes bankrupt or insolvent, it may default on its financial obligation. But in the case of an ETC, the trust has the right to reclaim the asset.

Why do shareholders need to accept trust certificates?

A majority of shareholders must accept the voting trust certificates for the voting power arrangement to become effective. The purpose is typically to allow reorganization when a corporation needs to overcome a short-term financial challenge.

How long does a trust certificate last?

The life of a voting trust certificate in many cases ranges from two to five years, at which point the common stock, with voting rights, is returned to the shareholder.

What is a voting trust certificate?

A voting trust certificate is issued to a stockholder in exchange for his or her common stock, and represents all of the normal rights of a shareholder (e.g., receiving dividends) except the right to vote.

What is the purpose of handing over control to a group of trustees?

By handing over control to a group of trustees, a majority of shareholders express confidence that the trustees can more quickly and efficiently execute the changes necessary to rectify a problematic situation that threatens their financial interest in the company.