Are conventional and conforming loans the same thing?

Sometimes, people refer to conventional loans and conforming loans as if they are the exact same thing. But are they? Actually, there is a difference between a conventional loan and a conforming loan. Technically, a conforming loan is a type of conventional loan. But non-conforming loans are also a type of conventional loan.

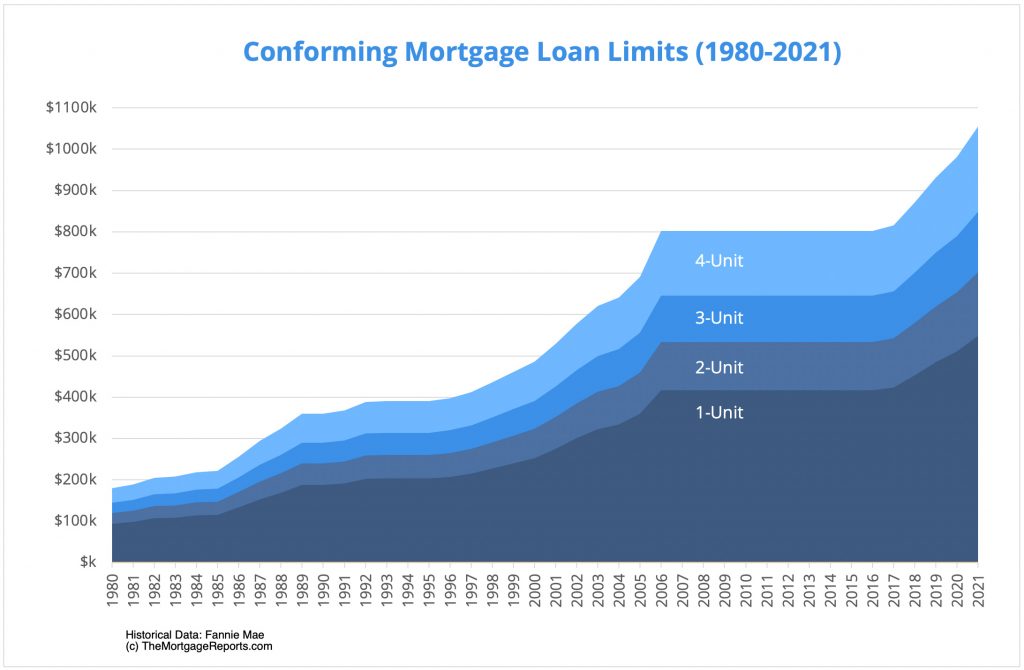

What is the maximum loan amount for a conventional loan?

- Single-family home: $970,800

- Two-unit multifamily home: $1,243,050

- Three-unit multifamily home: $1,502,475

- Four-unit multifamily home: $1,867,275

What is the maximum amount of a conventional mortgage?

The 2022 conventional loan limit for a single-family home is $647,200, up over 18% from 2021, when the limit was $548,250. These limits are available effective immediately, even before the new year. This represents the largest one-year jump in history, and reflects the massive home price increases seen in 2021.

What are conforming and non-conforming loans?

Conforming and nonconforming loans: What's the difference?

- Conforming Loans: An Overview. A conforming loan is one that meets the guidelines set by government-backed agencies such as Fannie Mae and Freddie Mac.

- Nonconforming Loans: An Overview. Mortgage loans that don't meet the requirements for a conforming loan are considered to be nonconforming loans.

- Shopping for a nonconforming loan. If you've decided that a nonconforming loan is the right choice for your situation, make sure to do your homework before selecting a lender.

What are the three types of conventional conforming loans?

If you are interested in a conventional loan, you should know about your different options.Conforming Conventional Loan.Non-Conforming Conventional Loan.Fixed-Rate Conventional Loans.Adjustable-Rate Conventional Loans.

What are conventional conforming loans?

Conforming loans are mortgages that meet Fannie Mae and Freddie Mac guidelines. Conforming lenders underwrite and fund the loans and then sell them to investors like Fannie Mae and Freddie Mac. Once securitized, the loans are sold to investors on the open markets.

Are conventional mortgages conforming?

A conventional mortgage loan is a “conforming” loan, which simply means that it meets the requirements for Fannie Mae or Freddie Mac. Fannie Mae and Freddie Mac are government-sponsored enterprises that purchase mortgages from lenders and sell them to investors.

Is a conforming loan the same as an FHA loan?

Mortgage rates for FHA mortgage are based on Ginnie Mae (GNMA) mortgage bonds. By contrast, conforming mortgage rates are based on mortgage bonds backed by Fannie Mae and Freddie Mac. These are separate products with separate prices. On some days, FHA mortgage rates are lower than conforming mortgage rates.

Is conforming and conventional the same thing?

You see, all conforming loans are conventional loans, but not all conventional loans are conforming loans. Conventional loans are defined by the type of lender who offers them. Banks, credit unions, and mortgage companies offer conventional loans. Conforming loans are defined by their lending criteria.

Is conforming and conventional the same?

Understanding Conforming and Conventional Loans So in this context, the term “conventional” basically means a normal or regular loan that does not receive government backing. A conforming loan is a conventional mortgage product that meets or “conforms” to certain size limits and other parameters.

Are conventional loans non conforming?

Both conforming and nonconforming loans are types of conventional mortgages. Conventional mortgages aren't backed by the federal government, unlike loans from the Federal Housing Administration, Department of Veterans Affairs and U.S. Department of Agriculture.

Is a conforming loan good?

A conforming loan is a mortgage that meets the dollar limits set by the Federal Housing Finance Agency (FHFA) and the funding criteria of Freddie Mac and Fannie Mae. For borrowers with excellent credit, conforming loans are advantageous due to their low interest rates.

What credit score is needed for a conventional loan?

620Conventional Loans A conventional loan is a mortgage that's not insured by a government agency. Most conventional loans are backed by mortgage companies Fannie Mae and Freddie Mac. Fannie Mae says that conventional loans typically require a minimum credit score of 620.

What is a 30 year fixed conforming loan?

Conforming loan definition A common example of a conforming loan is a mortgage with a 20 percent down payment, a 15- or 30-year term, monthly principal and interest payments, no prepayment penalty, no balloon payment and no private mortgage insurance.

Difference Between Conforming and Conventional Loans

Conventional Loans. Conventional loans are loans that are not backed by a government agency. That means an FHA loan is not a conventional loan, because it is backed by the Federal Housing Administration. A VA loan is not a conventional loan, since it is backed by the Department of Veterans Affairs.

Have More Questions About Conventional, Conforming, and Non-Conforming Loans?

We know that the different types of loans can be confusing and that you may have many questions about all of these types of mortgages.

WHAT IS A CONFORMING LOAN? – CONFORMING VS CONVENTIONAL LOANS

Since the financial crisis of 2008, most consumers are familiar with the names Fannie Mae and Freddie Mac. These two quasi-government entities are mortgage aggregators that were placed into conservatorship under the oversight of the Federal Housing Finance Agency (FHFA)1.

TYPES OF CONFORMING LOANS – CONFORMING VS CONVENTIONAL LOANS

Conforming loans are called conforming because they conform to Fannie Mae and Freddie Mac guidelines. Once a conventional loan has met this standard, then the conventional loan is now conforming. Not every conventional loan though is conforming, as these loans may not meet the Fannie Mae or Freddie Mac standard.

WHAT IS A NON-CONFORMING LOAN? – CONFORMING VS CONVENTIONAL LOANS

While conventional mortgage loans can certainly be conforming loans, they do not always meet the conforming criteria outlined by Fannie Mae and Freddie Mac. Thus, conventional mortgage loans can also be non-conforming mortgage loans.

TYPES OF NON-CONFORMING LOANS

The two best examples of non-conforming mortgage loans are government-backed loans and jumbo mortgage loans.

COMPARING CONFORMING VS NON-CONFORMING OPTIONS: PROS AND CONS

If you are in the market for a new mortgage loan figuring out whether to go with a conforming or non-conforming option can be a bit tricky.

BENEFITS OF CONFORMING LOANS

Conforming mortgage loans certainly have some benefits over their non-conforming counterparts.

BENEFITS OF NON-CONFORMING LOANS

Non-conforming mortgage loans can be ideal programs for clients, some may even offer lower rates than conforming. The only difference is the loan programs simply don’t meet the requirements to be a conforming mortgage loan, another words these loans do not ‘conform’ to the standards set out by Fannie and Freddie.

Why is a conforming loan called a conforming loan?

A conforming loan gets its name because it “conforms” to specific guidelines set by two government-controlled entities — Fannie Mae and Freddie Mac — that were created decades ago to boost U.S. homeownership.

What is a conforming loan?

A loan is considered conforming when it meets specific guidelines set by two government-sponsored institutions, Fannie Mae and Freddie Mac. Getting a conforming loan can benefit you because eligibility, pricing and features are standardized; loan terms are usually reasonable; and the interest rate may be lower than on a nonconforming loan.

How do Fannie and Freddie get loans?

There are two ways Fannie and Freddie acquire loans from mortgage lenders. Lenders can sell a loan directly to Fannie or Freddie and get a cash payment. Or lenders can group a whole bunch of loans together and exchange that group of loans for a mortgage-backed security guaranteed by Fannie or Freddie.

Why is it easier to get approved for a conforming loan?

As a borrower, once you’ve met the requirements for a conforming loan, getting approved can be easier because the bank can sell the loan. Plus, Fannie and Freddie guidelines ensure that lenders follow certain rules for issuing you a loan.

What is the debt to income ratio for a mortgage?

Debt-to-income ratio that doesn’t exceed 36% or 45%, depending on loan type and down payment. Minimum reserves for certain loans. Loan fees. Private mortgage insurance is typically required if you borrow more than 80% of the value of the home. The appeal of conforming loans.

Can you apply for conforming loans with different lenders?

In fact, you should shop loans with several different lenders so that you can compare rates and terms.

Do you have to pay PMI on a mortgage?

Under the guidelines for conforming loans, borrowers with a small down payment must pay for private mortgage insurance, or PMI. You’ll have to pay for PMI if you put less than 20% down on the home. So if a home was valued at $100,000, unless you put down $20,000, you’d have to pay PMI.

Fannie Mae and Freddie Mac

Although all conforming loans are conventional loans, not all conventional loans are conforming. A conforming loan is any conventional loan that meets certain criteria set by the Federal Housing Finance Agency. The main feature of these criteria is the limit on loan size.

What is the benefit of a conforming mortgage?

Conforming mortgages typically offer lower interest rates than non-conforming loans because they are less risky. Additionally, with a conforming mortgage, you may get some wiggle room on the down payment amount and the credit score needed to qualify.

What is conforming loan?

A conforming loan is a mortgage with terms and conditions that meet the funding criteria of Fannie Mae and Freddie Mac. Conforming loans cannot exceed a certain dollar limit, which changes from year to year.

What are the advantages of conforming loans?

Advantages of Conforming Loans. For consumers, conforming loans are advantageous due to their low interest rates. For first-time home buyers taking out Federal Housing Administration (FHA) loans, for example, the down payment can be as low as 3.5%. 2.

Why does Fannie Mae only buy conforming loans?

Because Fannie Mae and Freddie Mac only buy conforming loans to repackage for the secondary market, the demand for nonconforming loans is much less. The terms and conditions on nonconforming mortgages can vary widely from lender to lender, but the interest rate and minimum down payment is typically higher because these loans carry greater risk ...

What is the maximum amount of conforming loans in 2021?

In 2021, the limit is $548,250 for most parts of the U.S., but higher in some more expensive areas. Conforming loans typically offer lower interest rates than other types of mortgages. Lenders prefer to issue conforming loans because they can be packaged and sold in the secondary mortgage market.

What is FNMA mortgage?

The Federal National Mortgage Association (FNMA, or Fannie Mae) and Federal Home Loan Mortgage Corporation (FHLMC, or Freddie Mac) are government-sponsored entities that drive the market for home loans.

What is the conforming loan limit for 2021?

For 2021, this baseline limit is $548,250 for most of the United States.

What is the loan limit for Hawaii in 2021?

Virgin Islands. In these areas, the baseline loan limit is $822,375 for one-unit properties in 2021. 1.

What credit score do I need to get a conforming loan?

Borrowers must generally have a credit score of 620 or higher and a DTI ratio below 45% to qualify for a conforming loan. Conforming loans typically offer a lower interest rate and there may be fewer upfront fees than for jumbo loans or government-backed mortgages.

What to do if you don't qualify for a conforming loan?

If you don't qualify for a conforming loan, you'll need a lender that offers alternatives. There are many types of nonconforming loans. These include: A subprime loan. A jumbo loan with higher loan limits. Government-backed loans such as an FHA loan, VA loan, or USDA loan.

What are some examples of nonconforming loans?

Or they must find other investors to purchase them. There are many types of nonconforming loans. For example, a subprime loan, FHA loan, or jumbo loan. Jumbo loans exceed Fannie and Freddie's loan limits. They are an especially common type of nonconforming loan.

What are the two types of mortgage loans?

There are two primary types of mortgage loans: conforming loans and nonconforming loans. Conforming loans typically come with lower interest rates, but they aren't available to everyone. You must meet certain requirements and there are maximum borrowing limits. This guide will explain conforming vs.

What is the maximum amount of conforming loan for 2021?

To qualify for a conforming loan: Your loan must be below the FHFA's maximum limits. In most parts of the country, the 2021 conforming limit is $548,250. In high-cost areas, loan limits are higher, but cannot exceed $822,375. Your credit score must be above 620.

Can I qualify for a nonconforming loan if I don't meet the requirements of Fannie Mae

Lenders have more flexibility. It may be possible to qualify for a nonconforming loan even if you don't meet Fannie Mae and Freddie Mac's requirements. Look for lenders for first-time home buyers, those working with bad-credit borrowers, or lenders specializing in jumbo loans to explore options.

Do nonconforming loans require a larger down payment?

The requirements for nonconforming loans vary by loan type. For example, many lenders require larger down payments and better credit for jumbo loans because of the large loan size. In contrast, government-backed loans can be easier to qualify for.

Conventional Loans: Often Cheaper But Harder to Get

- According to the Consumer Financial Protection Agency: “Conventional loans typically cost less than FHA but can be more difficult to get.” The reason why conventional loans are sometimes harder to obtain is that they do not receive government backing or guarantees. That means they …

What Does It Mean to ‘Conform’?

- A conforming loan is one that meets certain pre-established criteria used by Freddie Mac and Fannie Mae. The most important of these criteria is the sizeor amount of the loan. When a borrower uses a mortgage that falls within the loan limits for his or her county, it is referred to as a conforming loan. It can therefore be sold to Fannie Mae or Freddie Mac via the secondary mortg…

Summary of Key Points

- We’ve covered a lot of terminology and concepts so far in this article. Here’s a quick recap of the key points: 1. A conventional loan is one that is not insured or guaranteed by a government agency (such as the Federal Housing Administration or the Department of Veterans Affairs). 2. The FHA, VA and USDA mortgage programs are not conventional loans because they doreceive …