Reverse repurchase agreements (RRAs) or reverse repo are agreements for parties buying securities originally and they expect to sell those securities afterward. Nonetheless, it’s not a loan; the asset is sold at a premium to repay the seller at the end of the agreement.

What is the difference between a repurchase agreement and reverse repo?

To the party selling the security with the agreement to buy it back, it is a repurchase agreement. To the party buying the security and agreeing to sell it back, it is a reverse repurchase agreement. The reverse repo is the final step in the repurchase agreement closing the contract.

What is a reverse repo (RRP)?

Reverse Repo A reverse repurchase agreement (RRP) is an act of buying securities with the intention of returning, or reselling, those same assets back in the future at a profit. This process is the opposite side of the coin to the repurchase agreement.

What is a repo in finance?

A repurchase agreement (repo) is a form of short-term borrowing for dealers in government securities. In the case of a repo, a dealer sells government securities to investors, usually on an overnight basis, and buys them back the following day at a slightly higher price.

Is it safe to invest in Repo?

BREAKING DOWN 'Repurchase Agreement - Repo'. Repurchase agreements are generally considered safe investments because the security in question functions as collateral, which is why most agreements involve U.S. Treasury bonds.

Is repo an asset?

In a repo, one party sells an asset (usually fixed-income securities) to another party at one price and commits to repurchase the same or another part of the same asset from the second party at a different price at a future date or (in the case of an open repo) on demand.

Is reverse repo off balance sheet?

Under IFRS, assets relating to repos transactions are maintained at the balance sheet and assets relating to reverse repos transactions do not enter the balance sheet.

What does reverse repo indicate?

A reverse repurchase agreement conducted by the Desk, also called a “reverse repo” or “RRP,” is a transaction in which the Desk sells a security to an eligible counterparty with an agreement to repurchase that same security at a specified price at a specific time in the future.

Are repos considered securities?

Securities lending, like repo, is a type of securities financing transaction (SFT). The two types of instrument have many similarities and can often be used as functional substitutes for each other.

How does repo affect balance sheet?

Assets sold as collateral in a repo remain on the balance sheet of the seller, even though legal title to those assets has been transferred. This could give the appearance that the assets would be available to other creditors in the event of default.

How do you account for repo transactions?

As regards repo / reverse repo transactions outstanding on the balance sheet date, only the accrued income / expenditure till the balance sheet date should be taken to the Profit and Loss account. Any repo income / expenditure for the remaining period should be reckoned for the next accounting period.

What is the difference between a repo and a reverse repo?

Repo and Reverse Repo The repo rate is the interest paid by the Central Bank to Commercial Banks for lending money in the repo market. Reverse Repos, on the other hand, are conducted whenever the Central Bank is injecting liquidity into the domestic market.

What happens if reverse repo rate is increased?

An increase in the Reverse Repo Rate provides an incentive to the banks to park their surplus funds with the central bank on a short-term basis, thereby reducing liquidity in the banking system and overall economy.

What does it mean when reverse repo is high?

An increase in reverse repo rate means that commercial banks will get more incentives to park their funds with the RBI, thereby decreasing the supply of money in the market.

Is repo considered OTC?

'Nego repo' is a title transfer instrument which is not actually negotiated on KASE but simply registered post-trade. To this extent, it can be seen as part of the OTC market.

What are the different types of repos?

Broadly, there are four types of repos available in the international market when classified with regard to maturity of underlying securities, pricing, term of repo etc. They comprise buy-sell back repo, classic repo bond borrowing and lending and tripartite repos.

Why do banks do repurchase agreements?

Repurchase agreements are used by certain MMFs to invest surplus funds on a short-term basis and by financial institutions to both manage their liquidity and finance their inventories. Cash investors may utilize term repo to fulfill a specific need for a customized period of time.

What is the difference between a repo and a reverse repo?

Repo and Reverse Repo The repo rate is the interest paid by the Central Bank to Commercial Banks for lending money in the repo market. Reverse Repos, on the other hand, are conducted whenever the Central Bank is injecting liquidity into the domestic market.

What happens when reverse repo rate increases?

Description: An increase in the reverse repo rate will decrease the money supply and vice-versa, other things remaining constant. An increase in reverse repo rate means that commercial banks will get more incentives to park their funds with the RBI, thereby decreasing the supply of money in the market.

How does repo and reverse repo work?

To the party selling the security with the agreement to buy it back, it is a repurchase agreement. To the party buying the security and agreeing to sell it back, it is a reverse repurchase agreement. The reverse repo is the final step in the repurchase agreement, closing the contract.

Who decides reverse repo rate?

The Reverse Repo Rate is decided by the Monetary Policy Committee (MPC), headed by the RBI Governor.

What is reverse repos?

Essentially, repos and reverse repos are two sides of the same coin — or rather, transaction — reflecting the role of each party. A repo is an agreement between parties where the buyer agrees to temporarily purchase a basket or group of securities for a specified period. The buyer agrees to sell those same assets back to the original owner at a slightly higher price using a RRP.

How long does it take for a repo contract to be reversed?

However, some contracts are open and have no set maturity date, but the reverse transaction usually occurs within a year. Dealers who buy repo contracts are generally raising cash for short-term purposes.

What is collateral value?

The value of the collateral is generally greater than the purchase price of the securities. The buyer agrees not to sell the collateral unless the seller defaults on their part of the agreement. At the contract-specified date, the seller must repurchase the securities as well as the agreed-upon interest or repo rate.

What is the purpose of repo and RRP?

The Federal Reserve also uses the repo and RRP as a method to control the money supply. 1 . Essentially, repos and reverse repos are two sides of the same coin — or rather, transaction — reflecting the role of each party. A repo is an agreement between parties where the buyer agrees to temporarily purchase a basket or group ...

How does a counterparty earn interest?

The counterparty earns interest on the transaction in the form of the higher price of selling the securities back to the dealer. The counterparty also gets the temporary use of the securities.

How long does a reverse purchase contract last?

However, some contracts are open and have no set maturity date, but the reverse transaction usually occurs within a year.

What is a repo?

Repo. A repurchase agreement (RP) is a short-term loan where both parties agree to the sale and future repurchase of assets within a specified contract period. The seller sells a Treasury bill or other government security with a promise to buy it back at a specific date and at a price that includes an interest payment.

What is reverse repo?

What is Reverse Repurchase Agreement (Reverse Repo)? A Reverse Repurchase Agreement is also called reverse repo, which brings into the implementation of an agreement between a buyer and seller stating that that the buyers of the securities who purchased any kind of securities or assets have the right to sell them at a higher price in the future, ...

What happens when you reverse a repo?

A reverse repo on a large scale can lead to major banking disintermediation. The reverse repurchase agreement with an entity’s counterparty typically has no proper establishment. The financial health of the two parties involved and the value of the collateral is not judicially measured or checked. The counterparty has a chance to default on its ...

What is reverse repurchase agreement?

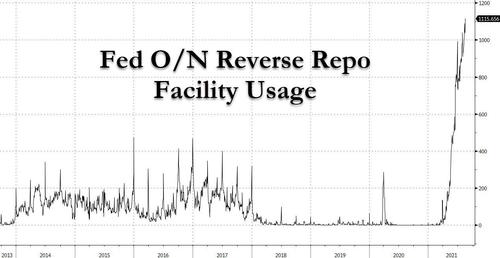

Reverse repurchase agreements, for the time being, reduces the number of reserve balances in the banking system.

What are the benefits of reverse repurchase?

Below are some benefits of the Reverse Repurchase Agreement. It encourages other banks to store their excess cash with the federal bank during high levels of inflation in the economy so that the banks can earn more returns on their excess funds.

How many parties are involved in reverse repurchase?

In a reverse repurchase agreement, there are generally two parties involved. One leg of the execution primarily comprises of a commercial bank purchasing security from a central bank. The other leg of the executed transaction comprises the sale of exact security or asset purchased earlier from the commercial bank again to the central bank.

What is the difference between a sale and a buyback?

One part is the “Sale,” and the other part is “Buyback.”. It involves collateral or security, which the seller in the “Sale” part procures from the buyer and again, which is returned back to the buyer during the “Buyback” part. Suppose the seller sells securities at $100 in the first leg taking collateral of $1000.

What is reverse repo?

What dealers call a reverse repo is the opposite arrangement, in which the dealer buys securities from the Fund and simultaneously agrees to resell them to the Fund for a higher price. Fund managers and Rule 18f‑4 also call this a reverse repo, even though it is the Fund that repurchases the securities.

What is a repurchase agreement?

When a securities dealer uses the term “repurchase agreement” or “repo,” this refers to an agreement in which the dealer sells securities to the Fund for slightly less than their current market value and simultaneously agrees to repurchase the securities from the Fund at a slightly higher price (still typically below market value). The combined transactions have the effect of a collateralized loan of the purchase price from the Fund to the dealer, for which the dealer compensates the Fund by paying the higher repurchase price.

What is the asset coverage ratio for BDCs?

The resulting asset coverage ratio still must be at least 300% (or lower for BDCs).

What is the second sentence of Rule 18f4?

The second sentence indicates how Rule 18f‑4 (d) departs from Release 10666: Funds will no longer be required to segregate liquid assets equal to the repurchase price. Instead, Funds must

How long does a reverse repose last?

Repos and reverse repos are thus used for short-term borrowing and lending, often with a tenor of overnight to 48 hours.

How does an open repo work?

An open repurchase agreement (also known as on-demand repo) works the same way as a term repo except that the dealer and the counterparty agree to the transaction without setting the maturity date. Rather, the trade can be terminated by either party by giving notice to the other party prior to an agreed-upon daily deadline. If an open repo is not terminated, it automatically rolls over each day. Interest is paid monthly, and the interest rate is periodically repriced by mutual agreement. The interest rate on an open repo is generally close to the federal funds rate. An open repo is used to invest cash or finance assets when the parties do not know how long they will need to do so. But nearly all open agreements conclude within one or two years. 3

What Is a Repurchase Agreement?

A repurchase agreement (repo) is a form of short-term borrowing for dealers in government securities. In the case of a repo, a dealer sells government securities to investors, usually on an overnight basis, and buys them back the following day at a slightly higher price. That small difference in price is the implicit overnight interest rate. Repos are typically used to raise short-term capital. They are also a common tool of central bank open market operations .

Why are repurchase agreements considered safe?

Repurchase agreements are generally considered safe investments because the security in question functions as collateral, which is why most agreements involve U.S. Treasury bonds. Classified as a money-market instrument, a repurchase agreement functions in effect as a short-term, collateral-backed, interest-bearing loan. The buyer acts as a short-term lender, while the seller acts as a short-term borrower. 1 The securities being sold are the collateral. Thus the goals of both parties, secured funding and liquidity, are met.

What is the difference between a buyer and a seller in a repurchase agreement?

The buyer acts as a short-term lender, while the seller acts as a short-term borrower. 1 The securities being sold are the collateral. Thus the goals of both parties, secured funding and liquidity, are met. Repurchase agreements can take place between a variety of parties.

What is the difference between a term and an open repo?

The major difference between a term and an open repo lies in the amount of time between the sale and the repurchase of the securities.

How many types of repurchase agreements are there?

There are three main types of repurchase agreements.

What is a repo in accounting?

A repo is created when the party who owns the asset sells it to another party for cash and at the same time promises to buy it back on the repurchase date at a specified repurchase price.

What is repo margin?

A repo is structured so as to protect the lender, i.e. the loan amount is less than the market value of collateral by an amount called repo margin (also referred to as haircut ).

What is a repo with a maturity of 1 day called?

A repo with the maturity of 1 day is called overnight repo, and repo with longer maturity is called term repo. A repo whose term matches the tenor of the collateralized asset is called a repo to maturity.

What is a repurchase agreement?

A repurchase agreement (or repo) is a sale of a security with a simultaneous agreement to buy back the security at an agreed price and date. It is effectively a collateralized loan.

When is interest paid on a repo?

The interest earned on a repo is paid on the repurchase date and any income earned during the repo term accrued to the borrower.

What is credit risk in a repurchase agreement?

Credit risk exists in a repurchase agreement even if the collateral is of very high quality. It is because the value of the collateral may fall during the term of the repo in which case the investor (lender) faces a risk of default by the borrower. Also, when the price of collateral increases, the investor (lender) is liable to the borrower for any excess of the collateral value over the loaned amount and the borrower faces a risk of default by the lender.

Repurchase Agreements – Repos

A repurchase agreement is a form of short-term financing where one party transfers a financial asset to another party in exchange for cash.

How Do Repurchase Agreements Work?

Repurchase agreements are also referred to as money-market instruments. These arrangements work as collateralized and interest-bearing loans. However, unlike collateralized loans, repos actually involve a sale and a repurchase of the financial security.

Types of Repurchase Agreements

Repurchase agreements are designed to minimize the counterparty credit risk. Any changes to the market value of the financial security may lead to a margin call or margin excess.

Accounting for Repurchase Agreements (Repos)

The accounting treatment of repurchase agreements is based on the guiding principles of ASC 860- Transfer and Services of GAAP rules.

Recognition of Repurchase Agreements

All types of repurchase-to-maturity agreements should be accounted for under ASC 860-10-40-24A.

Repurchase Agreements as a Sale Transaction

In some arrangements, repos may be accounted for as a sale transaction. If the repurchase contract does not fulfill all the conditions required under ASC 860-10-40-24, it can be accounted for as a sale transaction.

Examples

Let us understand the repurchase agreements with the help of a working example.