How to create an income statement?

The step-wise creation of the income statement is determined as under:

- Select the period for which the income statement is to be reflected.

- Generate the Trial Balance Report for the period, which is used to prepare the income statement.

- Determine the revenue for the period. ...

- Determine the Cost of goods sold for the period. ...

- Determine the Gross Profit from the following formula:

How do you create a profit and loss statement?

To create a basic P&L manually, take the following steps:

- Gather necessary information about revenue and expenses (as noted above).

- List your sales. ...

- List your COGS.

- Subtract COGS (Step 3) from gross revenue (Step 2). ...

- List your expenses. ...

- Subtract the expenses (Step 5) from your gross profit (Step 4). ...

- List interest on business debt and subtract from EBITDA (Step 6).

What is a basic income statement?

The basics of an income statement are revenue and the cost of goods sold. Cost of goods sold is calculated as opening stock plus purchases plus direct expenses less closing stock. The income statement is the summary statement of income and expenses. How to Create a Basic Income Statement?

How to calculate revenue on income statement?

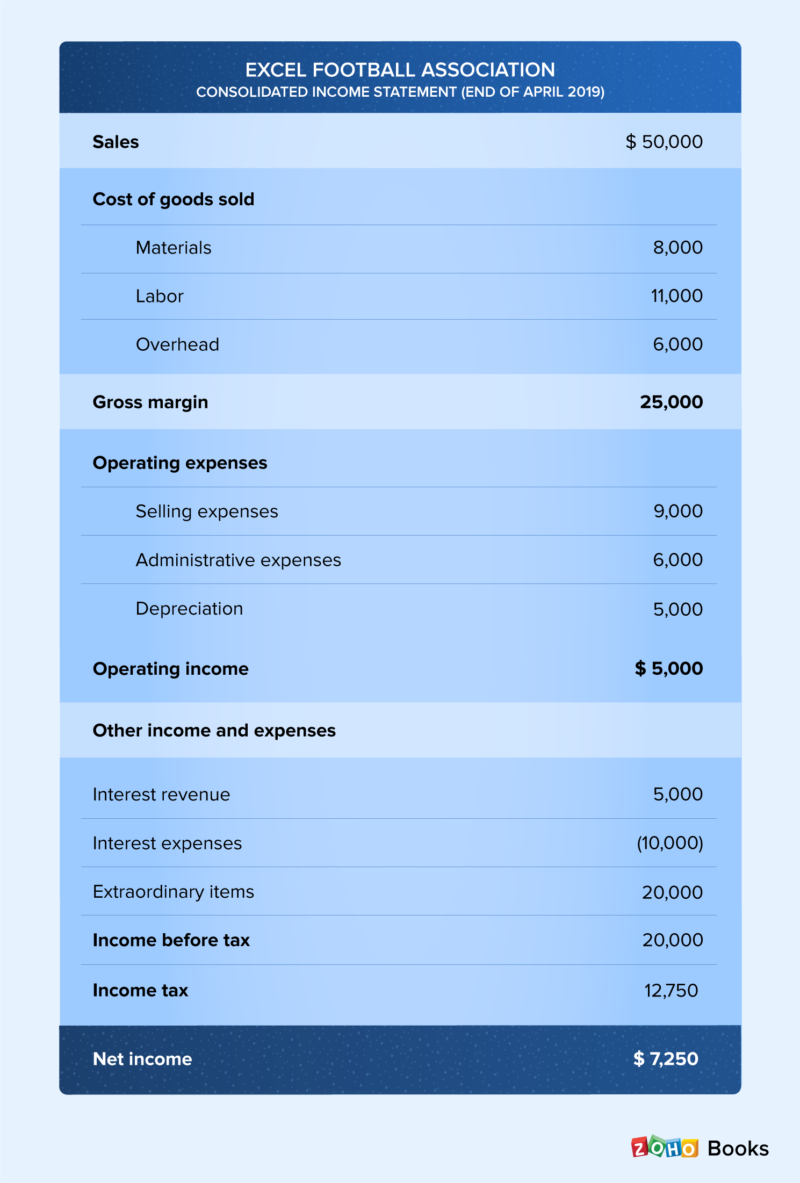

- Gross Profit = Revenues – Cost of Goods Sold

- Operating Income = Gross Profit – Operating Expenses

- Net income = Operating Income + Non-operating Items

What is another name for a profit and loss statement?

Other names for a P&L statement include the income statement, earnings statement, revenue statement, operating statement, statement of operations and statement of financial performance.

Why the income statement can also be called a profit and loss statement?

The income statement can also be called as the profit and loss statement because it shows the outing and the incoming of the money of the business. The income statement is used to calculate the profitability of the business using different ratios like gross margin ratio and profit margin ratio.

What is the other name of income statement?

An income statement shows a company's revenues, expenses and profitability over a period of time. It is also sometimes called a profit-and-loss (P&L) statement or an earnings statement.

What is another name for the income statement method?

The income statement, along with balance sheet and cash flow statement, helps you understand the financial health of your business. The income statement is also known as a profit and loss statement, statement of operation, statement of financial result or income, or earnings statement.

Is a profit and loss statement the same as a balance sheet?

The Balance Sheet reveals the entity's financial position, whereas the Profit and Loss account discloses the entity's financial performance. A Balance Sheet gives an overview of the assets, equity, and liabilities of the company, but the Profit and Loss Account is a depiction of the entity's revenue and expenses.

How is income statement related to the statement of financial position?

The balance sheet summarizes the financial position of a company at a specific point in time. The income statement provides an overview of the financial performance of the company over a given period. It includes assets, liabilities and shareholder's equity, further categorized to provide accurate information.

What is a profit and loss?

6. Net profit or loss. Take your gross profits and add any extra income, then subtract your expenses. This gives you your net income — a positive net income is a profit; a negative net income is a loss. Even businesses that have high gross profits can post losses if their expenses get out of hand.

What does a profit and loss statement show?

A profit and loss statement, also known as an income statement or a P and L statement, is a financial report that shows a business's net income by subtracting total costs and expenses from total income and revenue.

Income Statement Vs. Profit And Loss Statement

One of the most fundamental questions first-time startup founders have about the three basic financial statements is, “Is profit and loss the same as income statement?”

What is the income statement?

An income statement summarizes the business’s operations during a given financial period (usually a month, quarter, or year).

Background

There are numerous success factors for businesses, among which efficient and effective management of finances takes utmost importance. Financial statements are the primary tools businesses use for financial management, planning and forecasting.

What is an Income statement?

The income statement is a components of financial statement that shows the revenues and expenditures of a firm and helps to calculate the net profit or loss over a period of time. The income statement analysis helps management in better strategy formulation and evaluation.

Major Components of Income Statement

Following are the essential components that make up the income statement.

Income statement and P&L statement

Three terms are used interchangeably in accounting; income statement, profit, and loss statement and profit and loss accounts. There is practically no difference between a profit and loss statement and an income statement. P&L is just another name for an income statement because it shows net profits and losses.

What is a Profit and Loss Account?

The Profit and Loss Account is a T-account made at the end of the year to show the company’s annual expenses and gross profit. The expenses and Tax are then deduced from the gross profit to calculate the company’s net profit at the end of the year. This net profit/loss figure should be the same as the one shown on the income statement.

Main features of Income statement and P&L

Following are some of the main features related to income statements and P&L.

Conclusion

Income statement and profit and loss statement are used interchangeably. There is no such difference in these terms, and both can be used in place of another. It’s one of the main components presented in the financial statement.

What is the difference between income statement and cash flow statement?

The income statement summarizes income and expenses. The balance sheet shows assets, liabilities, and owner’s equity. The cash flow statement summarizes your incoming and outgoing money from operations , investing, and financing .

What are the parts of an income statement?

The necessary parts of an income statement include revenues, expenses, and the net profit/loss. Revenues, or income, are amounts earned from primary business activities, like product sales, or other financial gains. Expenses include amounts you paid, like the cost of goods sold. The bottom line of the income statement is the net profit or loss, ...

What is a P&L statement?

P&L is short for profit and loss statement. A business profit and loss statement shows you how much money your business earned and lost within a period of time. There is no difference between income statement and profit and loss. An income statement is often referred to as a P&L. The income statement is also known as statement ...

Why do investors want to see your income statement?

Investors and lenders want to see your income statement to assess your business’s risk. And, your accountant can provide financial expertise based on your statement. You can also use the statement to measure profitability by calculating business financial ratios, like the profit margin and gross margin ratios, from the financial data.

How to make a cash flow statement?

You can create a cash flow statement in one of two ways: indirect or direct. If you use the indirect method, you need to use your income statement’s net profit or loss. The last line of the income statement is the first line of the cash flow statement.

How long is profit and loss?

A company’s statement of profit and loss is portrayed over a period of time, typically a month, quarter, or fiscal year.

What is a P&L statement?

What is the Profit and Loss Statement (P&L)? A profit and loss statement (P&L), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The P&L statement shows a company’s ability to generate sales, manage expenses, ...

What is the purpose of statement of cash flow?

The statement of cash flow shows how much cash a company generated and consumed over a period of time. It consists of three parts: cash from operations, cash used in investing, and cash from financing. This statement is important for assessing:

What is balance sheet?

The balance sheet shows a company’s assets, liabilities, and equity at a specific point in time. This snapshot of the company’s financial position is important for assessing:

What is the best way to assess a company's financial health?

To properly assess a business, it’s critical to also look at the balance sheet and the cash flow statement.

What is the purpose of income statement?

The income statement measures a company's financial performance, such as revenues, expenses, profits, or losses over a specific period of time. This financial document is sometimes called a statement of financial performance. An income statement shows whether a company made a profit, and a cash flow statement shows whether a company generated cash.

How to analyze a company's cash flow from net income or losses?

Operating activities analyze a company’s cash flow from net income or losses by reconciling the net income to the actual cash the company received from or used in its operating activities.

What is the indirect method of cash flow?

The cash flow statement is linked to the income statement by net profit or net burn, which is the first line item of the cash flow statement. The profit or loss on the income statement is then used to calculate cash flow from operations. This is referred to as the indirect method.

What is the first line item in a cash flow statement?

The cash flow statement is linked to the income statement by net profit or net loss, which is usually the first line item of a cash flow statement, used to calculate cash flow from operations. A cash flow statement shows the exact amount of a company's cash inflows and outflows over a period of time. The income statement is the most common ...

What are the three main financial statements?

The cash flow statement and the income statement , along with the balance sheet, are the three main financial statements. The cash flow statement and income statement integrate with the corporate balance sheet.

Where does cash flow come from?

The cash flow generally comes from revenue received as a result of business activity, but it may be augmented by funds available as a result of credit. A cash flow statement is used to determine the short-term viability and liquidity of a company, specifically how well it is positioned to pay its bills to vendors. 2.

Is the cash flow statement the same as the income statement?

The income statement and the cash flow statement are two out of the three components of a financial statement, the other being the balance sheet. Though they both differ in the types of information they show—the income statement reflecting a business's performance via its revenues, expenses, and profits, and the cash flow statement reflecting how that profit or loss flows throughout the company—they are both inextricably linked.