Cons to capitalized interest are often more negative for individuals rather than businesses. For example, educational loans will continue to accrue interest as long as the borrower remains in college.

What is capitalized interest and how does it affect you?

Often, capitalized interest is seen with student loans. When a borrower delays paying the interest and the lender capitalizes it, the monthly payments may be larger and lifetime interest costs will be higher.

How do you avoid capitalized interest on a loan?

Capitalized interest may be avoided by paying at least the new interest that accrues. Pay off the interest on unsubsidized federal loans in a lump sum at the end of the grace period or other deferment periods before it is added to the loan balance.

When should I book capitalized interest?

Capitalized interest can only be booked if its impact on a company's financial statements is material. Otherwise, interest capitalization is not required, and it should be expensed immediately.

Is capitalized interest good or bad?

Capitalized interest is one of the biggest reasons borrowers end up repaying substantially more than they originally borrowed. If you don't pay interest as it accrues, you'll pay more in interest charges.

Should I pay off capitalized interest?

Capitalized interest may be avoided by paying at least the new interest that accrues. Pay off the interest on unsubsidized federal loans in a lump sum at the end of the grace period or other deferment periods before it is added to the loan balance.

What happens when interest is capitalized on your loan?

Capitalization increases your loan's principal balance, and interest is charged on the new, larger balance. Your monthly payment may also increase.

Should I pay off capitalized interest student loan?

Capitalized interest is unpaid interest that's added to your student loan, increasing the total you repay....How to avoid capitalized interest on student loans.Pay off interest during grace periodDon't pay off any interest; let interest capitalizeMonthly payment$274.44$306.021 more row•Apr 9, 2021

How do you avoid interest capitalization?

Pay Off Interest While You're in School Some students may also prefer to wait until they receive their tax refunds so they can use the money to pay off their accrued interest for the year in-full. Either way, paying down your interest while you're in school will help you avoid capitalization.

How can I avoid paying interest on a loan?

Pay your monthly statement in full and on time: Paying the full amount will help you avoid any interest charges. If you can't pay your statement balance off completely, try to make a smaller payment (not less than the minimum payment).

Why do we capitalize interest?

Interest is capitalized in order to obtain a more complete picture of the total acquisition cost associated with an asset, since an entity may incur a significant interest expense during the acquisition and start-up phases of the asset.

How does capitalized interest work?

At certain points in time—when your separation or grace period ends, or at the end of forbearance or deferment—your Unpaid Interest may capitalize. That means it is added to your loan's Current Principal. From that point, your interest will now be calculated on this new amount. That's capitalized interest.

How is capitalized interest treated?

Capitalized Interest This makes it so the interest is not recognized in the current period as an interest expense. Instead, capitalized interest is treated as part of the fixed asset or loan balance and is included in the depreciation of the long-term asset or loan repayment.

Is it better to pay off interest or principal on student loans?

If you're wondering whether it is better to pay off the interest or the principal on student loans while you are still in college, you should focus on making interest payments as often as possible. Most students need loans to help them pay for tuition, associated fees, and living expenses while they are in school.

How can I pay less on my student loans?

Refinance for a lower interest rate. One of the best ways to optimize your student loan debt repayment is by refinancing your private (and even federal) student loans. ... Make extra payments. ... Enroll in autopay. ... Consider income-driven repayment plans. ... Check if you qualify for student loan forgiveness.

Why are my student loans still accruing interest?

With forbearance, payments stop but interest still accrues. If the interest is not paid, it's added to the loan's principal balance. Deferment is similar, but subsidized loans — which generally have slightly better terms — won't accrue interest while they're paused.

Why would you want to capitalize interest?

Interest is capitalized in order to obtain a more complete picture of the total acquisition cost associated with an asset, since an entity may incur a significant interest expense during the acquisition and start-up phases of the asset.

What is the benefit of capitalizing interest?

When a company capitalizes its interest and adds the cost to its long-term asset, it effectively defers the interest expenses to a later accounting period. When it comes to taxes, the company can recognize the interest expense in the form of depreciation expense in a later period when its tax bill is higher.

How is capitalized interest treated?

Capitalized Interest This makes it so the interest is not recognized in the current period as an interest expense. Instead, capitalized interest is treated as part of the fixed asset or loan balance and is included in the depreciation of the long-term asset or loan repayment.

How does Capitalised interest work?

Capitalized interest is the cost of borrowing to obtain a long-term asset. Unlike typical interest expenses, capitalized interest is not expensed immediately on a company's income statement. Because many companies finance long-term assets with debt, companies are allowed to expense the assets over the long term.

What Is Capitalized Interest?

Capitalized interest refers to the cost of the funds used to finance the construction of a long-term asset that a company constructs. This treatment of interest is a requirement under the accrual basis of accounting and increases the amount of the fixed asset on a company's balance sheet.

What is the tax advantage of capitalizing interest?

Tax Advantages of Capitalizing Interest. Depreciation expense is a pretax cost that reduces the profit of a company without reducing its cash flow. When a company capitalizes its interest and adds the cost to its long-term asset, it effectively defers the interest expenses to a later accounting period. When it comes to taxes, the company can ...

Why is a company not required to capitalize its interest on a loan used to construct a long-term asset?

When a company is required to capitalize its interest on the loan used to construct a long-term asset, it cannot reduce its tax bill in the current period because the interest expense is deferred to a later period. It is unable to realize the tax benefits in the period for which the loan was taken out.

Is capitalized interest an expense?

The advantages and disadvantages of capitalizing interest for tax purposes lie in a company's ability to manage or manipulate both the period in which the capitalized interest is recognized as an expense on the income statement and by the way in which the capitalized interest is recognized on the income statement .

How Does Capitalized Interest Work?

With some loans, such as student loans, you might have the option to skip payments on your loan temporarily.

What happens when you capitalize unpaid interest?

When unpaid interest is capitalized, it's added to the balance of the loan. Capitalized interest makes your loan balance grow larger. As a result, you’re not only borrowing the original loan amount, you’re also borrowing to cover the interest costs. Because of that, you also have to pay interest on the interest your lender charged you.

Why is it important to capitalize interest costs when taking out student loans?

That’s an attractive feature because it helps with your cash flow while you're going to school. However, it might result in higher costs and tighter cash flow in the future. When you take out student loans, your lender may capitalize interest costs at the end of a deferment or forbearance.

What does the higher the interest rate mean?

The interest rate: The higher the rate, the more expensive it is to borrow.

What is the cost of a loan?

The cost of a loan, ignoring any one-time fees, is the interest you pay. In other words, you repay what they gave you, plus a little extra. Your total cost is driven by:

When will credit cards be capitalized?

After March 2020 and with the relief measures taken during the pandemic, many financial institutions are using capitalized interest within the framework of the forbearance granted to millions of mortgages, car loans, credit cards, and many other types of loans.

Do you have to pay interest on top of interest?

Paying interest on top of interest is a form of compounding, but it works out in your lender’s favor—not yours. 1.

What is capitalized interest?

Capitalized interest is a process where lenders defer interest payments on loans made to individuals and businesses. This is beneficial as borrowers can avoid spending money to repay the loan if they are not making money from the invested funds. Cons are also present with capitalized interest as the principle balance typically increases for ...

What are the requirements for capitalized interest?

The three requirements for loans with capitalized interest include: interest incurred on the loan, business activities that ensure the asset is going to meet an intended use, and specific expenditures made for the asset in question.

What happens if you extend your degree?

Extending the number of years to complete the degree will result in higher amounts of interest capitalized — added to the principle balance — of the loan. This will significantly increase the principle balance, thereby increasing the future interest payments for the loans .

Why capitalize interest on educational loans?

The benefit is that the interest will add to the company’s economic wealth , especially once the company pays back the loan and the debt is off the company’s accounting books. For individuals, capitalized interest is common on educational loans. Students are not required to repay the loans until they graduate or stop attending school ...

When businesses borrow funds and engage in a loan with interest capitalization, the loan must meet specific requirements?

When businesses borrow funds and engage in a loan with interest capitalization, the loan must meet specific requirements. These requirements allow the company to account for the loan in a certain way, according to national or global accounting standards.

Is capitalized interest negative?

Cons to capitalized interest are often more negative for individuals rather than businesses. For example, educational loans will continue to accrue interest as long as the borrower remains in college. Extending the number of years to complete the degree will result in higher amounts of interest capitalized — added to the principle balance — ...

How to avoid capitalization of interest?

Interest capitalization involves paying interest on interest (compounding) and should be avoided if at all possible. Payments on most federal student loans are first applied to fees, then to collection charges, then to interest and lastly to principal.

When Is Interest Capitalized?

Accrued but unpaid interest may be capitalized on a student loan at various stages in each loan.

What is it called when you pay interest on student loans?

Pay the interest on private student loans and private parent loans as it accrues during forbearance periods. This is called a partial forbearance. Pay at least the interest that accrues and remains unpaid on negatively amortized repayment plans, such as income-driven repayment plans.

What is capitalized interest?

Capitalized interest is accrued but unpaid interest that is added to the principal balance of the loan. Not only does this increase the amount of debt, but it leads to compound interest, where interest is charged on the capitalized interest.

When to pay off unsubsidized federal loans?

Pay off the interest on unsubsidized federal loans in a lump sum at the end of the grace period or other deferment periods before it is added to the loan balance .

When is interest capitalized on a student loan?

Unpaid interest on a private student loan may be capitalized as frequently as monthly, even during a forbearance.

Who is responsible for interest on student loans?

The borrower is responsible for the interest that accrues during all of these periods. With private student loans, interest accrues and is the responsibility of the borrower during the in-school and grace periods, as well as during forbearance periods.

What is Capitalized Interest?

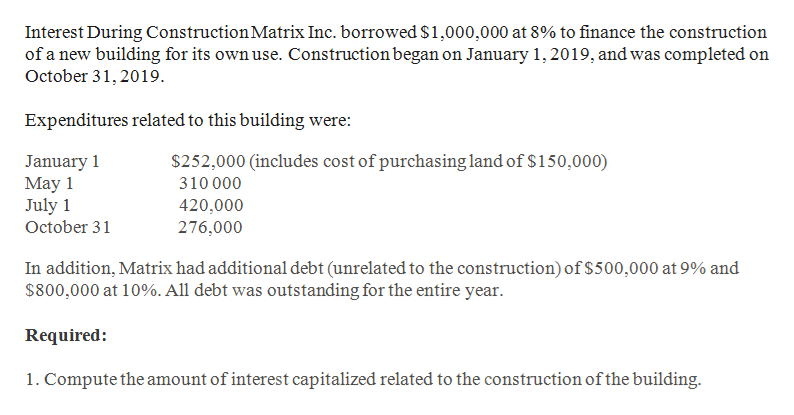

Capitalized interest is the cost of the funds used to finance the construction of a long-term asset that an entity constructs for itself. The capitalization of interest is required under the accrual basis of accounting, and results in an increase in the total amount of fixed assets appearing on the balance sheet . An example of such a situation is when an organization builds its own corporate headquarters, using a construction loan to do so.

Why is interest capitalization important?

Also, interest capitalization defers the recognition of interest expense, and so can make the results of a business look better than is indicated by its cash flows.

What is borrowing cost to capitalize?

If borrowings were specifically incurred to obtain the asset, then the borrowing cost to capitalize is the actual borrowing cost incurred, minus any investment income earned from the interim investment of those borrowings. Borrowing costs from a general fund.

When does capitalization of borrowing costs end?

Capitalization of borrowing costs terminates when an entity has substantially completed all activities needed to prepare the asset for its intended use. Substantial completion is assumed to have occurred when physical construction is complete; work on minor modifications will not extend the capitalization period. If the entity is constructing multiple parts of a project and it can use some parts while construction continues on other parts, then it should stop capitalization of borrowing costs on those parts that it completes.

Is interest expense a fixed asset?

This interest is added to the cost of the long-term asset, so that the interest is not recognized in the current period as interest expense. Instead, it is now a fixed asset, and is included in the depreciation of the long-term asset. Thus, it initially appears in the balance sheet, and is charged to expense over the useful life of the asset; the expenditure therefore appears on the income statement as depreciation expense, rather than interest expense.

What interest should be capitalized to the asset?

What interest should be capitalized to the asset? – Interest to be capitalized, in theory, is the amount of interest that could have been avoided if funds were used to pay off the debt instead of constructing the asset. A common misconception is that only interest related directly to the asset’s expenditures must be capitalized. All interest a company incurs is potentially subject to being capitalized no matter what the purpose is for the borrowings. Below is an illustration for clarification:

What is considered an asset for which interest must be capitalized?

Does the asset qualify? – In order to qualify as an asset for which interest must be capitalized, the asset must require a period of time to get ready for its intended use. It must be an asset constructed or otherwise produced for a company’s own use, or intended for sale or lease that is constructed or is an otherwise discrete project (e.g. ships or real estate developments). happy new year 2018 wishes Assets already completed for their intended use or that are not in the process of being readied for their intended use do not qualify. Assets that are routinely manufactured or otherwise produced in large quantities should also be excluded. [i] Some examples include cars, refrigerators and equipment.

Do you capitalize interest in real estate?

Many people in the real estate development industry know that in certain circumstances interest may be capitalized as part of the cost of a development project. For example, assume Company X intends to purchase land upon which to build a hotel. Company X gets a loan from the bank to fund this project and purchases the land. As construction of the hotel progresses, Company X capitalizes the related interest on the loan as part of this project’s cost. 192.168.o.1 admin “Pretty straight forward”, you say? Not so fast! There are a number of pitfalls to watch out for. Consider the following questions:

Is the other interest cost capitalized?

If the other interest cost incurred during the construction period was less than $50,000, then the lesser of $50,000 or the other interest cost actually incurred for the year would be capitalized. [vi]

Is capitalizing interest optional?

Capitalizing interest is not optional. Generally accepted accounting principles require the capitalization of interest given the proper circumstances.

What is capitalized interest?

Capitalized interest is unpaid interest that's added to your student loan, increasing the total you repay.

How much does capitalized interest cost?

At repayment, that interest amount will capitalize — get added to your balance — and you’ll owe $22,937.

How to avoid capitalization costs on a loan?

Make interest payments monthly while you're in school. Paying the interest on unsubsidized loans during an in-school deferment will help you avoid capitalization costs, as will avoiding deferment or forbearance altogether. If you have a private loan, opt for a repayment plan that starts with making interest-only payments in school.

What is capitalization on a loan?

Capitalization: A process that adds unpaid interest to the principal balance of your loan, increasing the amount on which you pay interest going forward. Capitalization generally happens after periods of authorized nonpayment, like deferment and the grace period. You can avoid capitalization by paying at least the interest on your loan each month.

How much would you owe if you paid $2,937 in interest?

If you pay the $2,937 in interest before it’s added to your balance, you would owe $20,000. By avoiding capitalization, you would save $802 over the life of the loan, making it easier to pay off your student loans sooner.

When does interest capitalize?

For federal student loans, capitalization of unpaid interest occurs: When the grace period ends on an unsubsidized loan. After a period of forbearance. After a period of deferment, for unsubsidized loans.

When do you capitalize student loans?

If you’re on the Income-Contingent Repayment (ICR) plan, it capitalizes annually. When you consolidate federal loans. For private student loans, interest capitalization typically happens in the situations below, but check with your lender to confirm. At the end of the grace period. After a period of deferment.

What is capitalized interest on student loans?

What is capitalized interest on student loans? It’s simple. It occurs when unpaid loan interest is added onto the principal balance of the loan. Unfortunately, once the unpaid interest makes the loan balance larger, repaying loans becomes costlier.

When does interest capitalize on student loans?

Figuring out how to avoid capitalized interest on student loans requires you to make payments before the capitalization process occurs. So it’s helpful to know not only what is capitalized interest on student loans, but also when it occurs.

Why are my student loan payments smaller?

Instead, it’s to cover interest costs to keep your loan balance from getting bigger.

Does interest accrue on school loans?

When you borrow money for school, interest starts accruing right away on most loans. But you may not always make payments immediately, so the amount of interest you accrue will keep growing. Eventually an event, such as entering repayment, causes interest to capitalize.

Can you capitalize income if you leave a payment plan?

Leaving most income-driven payment plans, failing to recertify your income under these plans, or losing eligibility for income-driven plans can also trigger capitalization. And if you’ve chosen the Income-Contingent Repayment plan, interest will capitalize annually.

Do you max out your subsidized loans?

You should also max out the amount of Direct Subsidized Loans you take, as interest doesn’t accrue on these loans while you are in school, during your post-graduation grace period, or when you are eligible for deferment after graduating.

Do you have to make monthly payments before capitalization?

You’ll need to make these payments before capitalization happens. You can make monthly payments that cover the interest that has currently accrued. Or you can make a lump sum payment to cover the unpaid interest balance before capitalization happens.

How to avoid capitalized interests?

Pay your interest installments on a monthly basis while you’re in school. Paying the capitalization interest on unsubsidized credits during an in-school postponement will assist you with evading capitalization costs, as will dodging suspension or restraint by and large. In the event that you have a private advance, choose a reimbursement plan that begins with making interest-just installments in school.

What is interest capitalization?

Interest capitalization happens when unpaid interest is added to the chief measure of your loan. At the point when the enthusiasm on your loan isn’t paid as it gathers (during periods when you are answerable for paying the interest), your loan specialist may underwrite the unpaid interest. This builds the remarkable chief sum due on the advance. Interest is then charged on that higher chief equalization, expanding the general expense of the credit (since interest will presently be charged on the higher chief sum).

What happens to interest when you graduate?

But once you’ve graduated, your loan servicer takes all the interest that was accumulated during those four years and adds it to your loan balance. That new, higher number becomes your new loan balance. That’s interest capitalization. Of course, if you had a federal subsidized loan, the federal government paid that interest for you during those four years. But if you had an unsubsidized loan or a private loan, the interest that accrued unpaid during that time will be capitalized at the end.

Can interest be increased in installments?

Interest can likewise be increased in case you’re making installments, yet they’re not big enough to cover everything of intrigue gathered . In case you’re making installments through a pay driven reimbursement plan for a government advance, intrigue is promoted after certain setting off occasions, for example,

Do student loans add interest?

Your student loans begin adding interest the day they’re paid out. So the day you start college, your loans are already accumulating interest. And they continue to do so over the next four years. Let’s go back in time for a moment back to when you first started college: You’re not making any payments on your loans because you’re in school and enjoying the grace period that a federal loan servicer offers students, and you are content with how life is moving.

Is capitalized interest bad?

Capitalized interest on students credits continuously expands and increases the aggregate sum you need to take care of. It’s unpaid intrigue that regularly gets added to your understudy advance parity after periods when you don’t make installments —, for example, during delay or self control. This intrigue is something to dodge; else, you’ll reimburse considerably more than you initially acquired.