The Citizens Bank card is a good option for cardholders looking to transfer with the card. Cardholders are offered 0 percent on balance transfers but not new purchases for up to 15 months.

Full Answer

Are Citizens Bank personal loans any good?

We'd recommend a Citizens Bank personal loan as a good option if you have good to excellent credit, especially if you are an existing customer of the bank. One disadvantage we found is that there are restrictions on the use of funds - you cannot use a Citizens Bank personal loan for home improvement, educational or business purposes.

Does Citizens Bank have personal loans?

Citizens Bank is best for borrowers who’ve worked with the lender in the past and haven’t had any issues. Its personal loans come with absolutely zero fees, competitive rates and two chances for discounts on your APR. You can also apply with a coapplicant to help you qualify. But don’t discount its awful online reputation.

Does Citizens Bank offer used auto loans?

Does Citizens Bank offer used auto loans? | Citizens Bank. Unfortunately, we do not currently offer direct auto-loan financing, and we only offer financing through our partnerships with car dealerships and other third party companies. A newer version of your browser is available.

Which bank is good for personal loan?

- Marcus: Best for flexible payments.

- LightStream: Best for low rates.

- Discover: Best for debt consolidation.

- HSBC: Best for fast funding.

- PNC: Best for joint borrowers.

- Wells Fargo: Best for large loan amounts.

- American Express: Best for Amex cardholders.

- TD Bank: Best for small loan amounts.

What credit score is needed for citizens bank card?

Some requirements include being at least 18 years old, having enough income to make monthly payments and having a credit score of 660+. If you meet all the requirements, your approval odds are high, but approval is never guaranteed.

Which Bank giving credit card is best?

Top 10 Credit Cards in India – Features & BenefitsBenefits of Standard Chartered Platinum Rewards Credit Card.Benefits of Indian Oil Citi Credit Card.Key Highlights of HDFC Freedom Credit Card.Benefits of Axis Bank Neo Credit Card.Benefits of Yatra SBI Credit Card:Benefits of IndusInd Bank Platinum Credit Card.More items...

What is the number 1 best credit card?

Best credit cards of 2022Citi Premier® Card: Best for good credit.Capital One Platinum Credit Card: Best for fair credit.Discover it® Secured Credit Card: Best for no credit history.Discover it® Student Cash Back: Best for students.Capital One Platinum Secured Credit Card: Best for bad credit.More items...

Does Citizens Bank do a hard credit check?

The lender will conduct a hard credit pull. You'll provide your W2s, bank statements, and other documents needed for a loan application.

Is it better to get credit card from store or bank?

Store credit cards tend to have higher APRs Generally speaking, the better your credit, the lower your APR will be. But store credit cards tend to have APRs that can range well above 16% — sometimes as high as 25% or beyond. Consider, for instance, the Banana Republic Rewards Mastercard® Credit Card.

Is it better to get a credit card through your bank or another bank?

If you get approved, having a credit card at the institution where you already bank could also make it easier to pay your monthly bill on time since you can simply transfer funds between accounts versus between issuers, and it removes the hassle of having to set up a different profile on another issuer's website.

What are 3 good credit cards?

The Best Credit Cards of 2022Chase Freedom Flex℠: Best Cash Back, Best No Annual Fee Card.Wells Fargo Active Cash® Card: Best 0% APR and Best Flat Rate Cash Back.Capital One Venture X Rewards Credit Card: Best Flexible Rewards Card.Chase Sapphire Preferred® Card: Best Entry Level Travel Card.More items...

Is it bad to have two credit cards?

Bottom line: Is it good to have multiple credit cards? Being a multiple credit card holder is good as long as you keep track of payments due, avoid overspending and maintain a low credit utilization ratio.

Which credit card is not accepted the most?

Consumers who have Discover and American Express credit cards are likely to run into the most trouble finding merchants who accept their cards, especially when travelling outside the United States. Discover has leveraged international partnerships with other card networks, including UnionPay.

How long does it take to get approved for a credit card Citizens Bank?

How long will it take to process my application? In most cases, it takes 7-10 days. However, it may take up to 30 days to process your application. Will I receive some sort of confirmation after I submit the online application?

How long does it take to get a credit card from Citizens Bank?

Once your application is submitted, one of three things will happen. It will be approved, submitted for further review, or denied. If your application is approved, congratulations — you should expect to receive your new card in the mail anywhere from a few days to several weeks.

Does citizens pay hurt your credit?

When you submit an application to Citizens Pay, Citizens Pay first checks eligibility using a soft credit check, which will not impact your credit report or score. If you qualify in the pre-approval process, at that time, Citizens Pay will do a hard credit check, which may impact your credit score.

Which bank has highest credit card customers?

HDFC Bank, with over 1.76 crore active credit cards (as of June 2022) is the largest card issuer in the country.

What are 3 types of credit cards?

What are the different types of credit cards?Rewards cards.Travel credit cards.Cash back credit cards.Starter credit cards.Business credit cards.Co-branded credit cards.

Which is Indias best credit card?

Best Credit Cards In India 2022Featured Partners.Best Credit Cards In India.LIT Credit Card (AU Small Finance Bank)IDFC FIRST Millennia Credit Card.Axis Bank ACE Credit Card.Flipkart Axis Bank Credit Card.SimplyCLICK SBI Credit Card.Dhanlaxmi Bank Platinum Credit Card.More items...•

What are the 4 major credit cards?

Credit card companies are classified as payment networks and/or card issuers. Four major credit card networks dominate the market in the U.S.: American Express, Discover, Mastercard and Visa.

Is Citizens Bank FDIC insured?

Yes, Citizens Bank is FDIC insured (FDIC# 57957). All Citizens Bank accounts are FDIC insured up to $250,000 per depositor, for each account owners...

Which states have Citizens Bank branches?

Citizens Bank has local branches in 12 states, including Connecticut, Delaware, Florida, Massachusetts, Michigan, New Hampshire, New Jersey, New Yo...

How do I reach a live person at Citizens Bank?

Citizens Bank phone support is available by calling 1-800-922-9999 (current customers) or 1-800-360-2472 (new customers) during business hours. Cur...

How much can you put down on a secured credit card?

With a secured credit card, you put down a deposit as collateral and in exchange the card company gives you a credit limit equal to the amount of your deposit – so if you put $300 down as collateral, your credit limit is $300. Secured credit cards can help you build credit just as any other credit card. However, make sure you have all the terms of ...

What is cash back credit card?

Cash-back credit cards allow you to earn rewards on purchases that can either be deposited into your bank account or applied to your statement. Frequent travelers might prefer a travel rewards card that allows you to earn points or miles for future trips. Those who struggle to make full payments could consider a low interest rate card.

How to redeem cash back rewards?

Cash back rewards can be redeemed in one of two ways: Deposited into your bank account. Applied as statement credit on your credit card. Some cash-back cards offer tiered rewards — you could get more cash back on grocery or gas purchases than on other types of everyday purchases. Others could have rotating cash-back offers for set timeframes, ...

What is balance transfer card?

For those struggling with credit card debt, a balance transfer card can help you pay down what’s owed without feeling the burden of interest rates. Here’s how it works: You transfer your debt from one card to a balance transfer card, which doesn’t charge interest for a set amount of time.

Can you transfer travel rewards to a card?

If you currently have a travel rewards card but find that you aren’t utilizing the rewards due to the pandemic, you might want to consider a balance transfer. Transferring the balance from your travel card to a card that earns cash back would help you buy things you’re actually going to use right now, like some more puzzles to do with the family, or fitness equipment to keep building out your basement gym.

Do cash back cards have annual fees?

Like we mentioned before, many cash-back cards don't have an annual fee. Some cards do charge a fee each year, but offset that fee with higher rewards than a typical cash-back card. That can add up nicely if you use your card frequently.

Can you buy anything with a co-branded card?

These cards tend to offer high rewards, but use of the rewards is limited to the corresponding brands on the card. Even though the rewards are limited to the brands, you can make purchases anywhere. Co-branded cards are prevalent with retail stores and airlines.

What is the APY on Citizens Wealth?

This money market account is only available for Citizens Wealth customers and has access to the same perks as other Wealth accounts. The Citizens Wealth Money Market account earns 0.04% APY on all balances. By funding the account with new money not already held in a Citizens Bank account, there is an option to earn a preferred rate of 0.05% APY on balances of $25,000 or more.

What is Citizens Wealth Checking?

Citizens Wealth Checking is a premium checking account for individuals who want exclusive banking perks and access to a team of financial professionals. The account has no monthly maintenance fee, but account holders must maintain $200,000 in combined monthly deposit and investment balances to be eligible for Wealth Checking. The primary perks of Citizens Wealth Checking are access to financial planning services and preferred rates on deposit accounts and lending products, in addition to the same perks included with Quest Checking. Currently, Citizens Wealth Checking earns 0.02% APY on all balances.

How much APY does a 14 month CD pay?

The online-only 14-month CD pays the same 0.03% APY on all balances and to all customers. Citizens Quest and Citizens Wealth customers earn relationship rates on CDs, currently 0.03% APY on the 10-month CD (the same as the standard rate) and 0.05% on the 25-month CD.

What is one deposit checking?

One Deposit Checking is a simple checking account with check-writing privileges and a complimentary debit card. The account features a $9.99 monthly maintenance fee, waived with one deposit (of any amount) during the statement period. There are no minimum balance requirements with One Deposit Checking.

How many branches does Citizens Bank have?

For in-person banking, Citizens Bank operates over 1,000 branches and 2,700 ATMs in select areas across the U.S.

What is Citizens Bank?

Citizens Bank is the 15th largest banking institution in the U.S., based on assets, according to data from the Federal Reserve. Founded in 1828, It’s also one of the nation’s oldest banks. Citizens Bank operates primarily along the East Coast, with branches also in the Midwest. The bank offers a full assortment of bank accounts and services and is one of the country’s largest lenders for student loans.

Is there a monthly fee for Citizens Quest?

This is another interest-bearing account you can pair with a Citizens Quest Checking account. There’s no monthly maintenance fee and it enjoys the same benefits as a Citizens Quest customer. The account features a slightly higher interest rate than Citizens’ other deposit accounts at 0.03% APY on all balances. Customers who open a new Citizens Quest Money Market account and fund it with $25,000 in new money from a linked external account earn a preferred rate of 0.05% APY on balances of $25,000 or more.

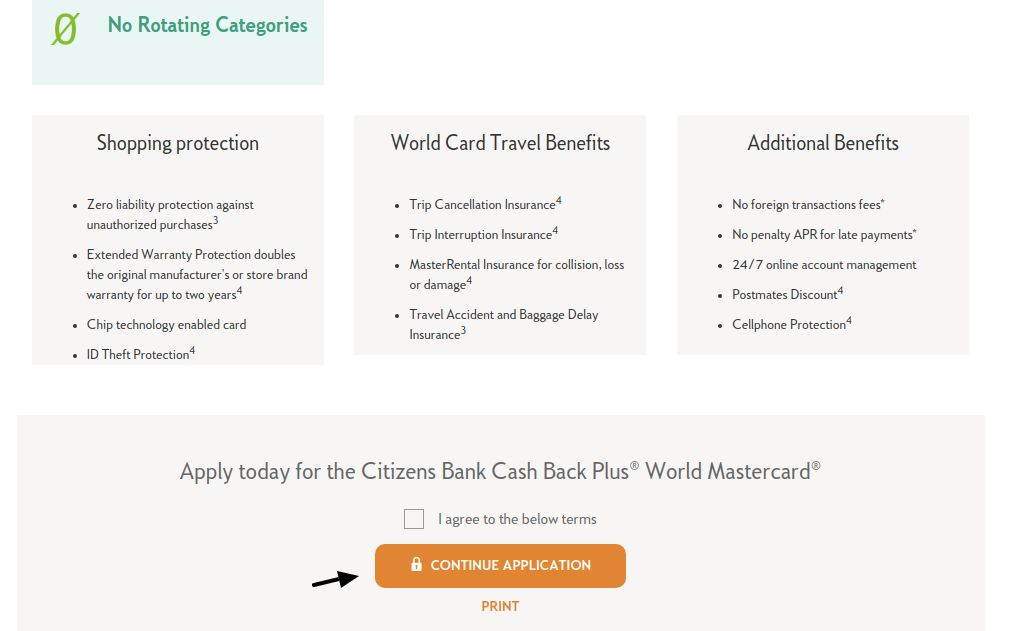

Two simple credit cards, unlimited possibilities

Selecting the right credit card shouldn't be complicated. That's why we offer two simple options designed around your preferences, whatever they are. Whether you pay it off every month, or carry a balance, we have a credit card with generous benefits and no annual fee*. Just right for you — and full of possibility.

We're ready to talk when you are

Our Colleagues are ready to help you with any questions about our Credit Card products or application. Schedule an appointment to meet at your convenience.

Does Cash Plus World Mastercard have a sign up bonus?

According to our calculations, cardholders who spend at least $1,325 a month could earn up to $286 or more in cash back by the end of the card’s first year. Citizens Bank doesn’t offer a sign-up bonus, though, so cardholders may have to wait awhile before they can redeem a significant amount back.

Is Citizens Bank Cash Back Plus a good card?

The Citizens Bank Cash Back Plus World MasterCard offers straightforward earnings and above-average cash rewards, making it a good choice for the casual rewards card user.

Is Citizens Bank a good card?

The Citizens Bank card is a good option for cardholders looking to transfer with the card. Cardholders are offered 0 percent on balance transfers but not new purchases for up to 15 months .

What is platinum plus checking?

Platinum Plus Checking: If you know you will deposit $5,000 in your primary checking account each month or have an average monthly balance of $10,000 each month, you can earn higher interest rates with this checking account.

How much do you need to deposit in Citizens Bank for college savings?

College Saver: You can open this account for your child's education before their 12th birthday. You must then deposit at least $25 per month for children ages 6 years and younger or $50 for children older than 6 years. Citizens Bank will provide a $1,000 bonus to the account when your child turns 18 years old. You do need a minimum $25 opening deposit if your child is 6 years old and younger or $500 if your child is over the age of 6. There is no monthly maintenance fee and the account does earn some interest.

How old do you have to be to open a student checking account?

Student Checking: If you are under the age of 25 , you can open this account, which has no service fee. Once you turn 25, the fee goes up to a few dollars per month. This account also doesn't offer interest on your deposits, but you get the same benefits as adults who open the One Deposit Checking account, including online and mobile banking and even the savings on your mortgage interest rate.

What is Citizens Bank savings account?

They offer the following savings accounts. Green Savings: Citizens Bank gives you the first four months free of charge when you open this savings account. After that point, you can get the fee waived by keeping a balance of $200 in your account.

How much is Citizens Bank overdraft fee?

The overdraft fees are excessive. Citizens Bank allows up to seven overdraft fees per day. This could amount to as much as $245 per day. If you keep your account in overdraft status for more than 4 days, you will then pay an additional $30 fee for sustained overdrafts.

How many branches does First Citizens Bank have?

First Citizens Bank. You'll find 500 First Citizens Bank branches throughout the United States as well as a large number of ATMs throughout the US. First Citizens Bank offers a large variety of personal deposit products that cater to people with little money all the way to those with a large amount of money to deposit.

What is money market account?

Money market accounts give you access to higher interest rates while also providing you easy access to your funds with an ATM card and checks.

How do I redeem my Citizens Bank credit card rewards points?

You can redeem your Citizens Bank credit card rewards by logging in to the Citizens Bank Credit Card Online website and clicking on the rewards redemption option in the white box in the lower-right corner of the page .

How can I reach the Citizens Bank credit card customer service?

The easiest way you can reach the Citizens Bank credit card customer service is either online, by clicking on the “Contact Us” link at the top of the page or by calling (800) 922-9999. Ultimately, you could talk to a customer service representative in person at your nearest Citizens Bank branch.

How do I apply for the Citizens Bank Cash Back Plus card?

You can apply for the Citizens Bank Cash Back Plus™ World Mastercard® card:

What is the APR of Citizens Bank Business Platinum?

The only other Citizens Bank business credit card is the Citizens Bank Business Platinum Mastercard® Credit Card, which has no rewards. However, it also has a $0 annual fee and the potential for a lower APR than the Citizens Bank Everyday Points® Business Mastercard®. Its APR range is 8.24% - 19.24% (V), compared to 11.24% - 21.24% (V) for the Citizens Bank Everyday Points® Business Mastercard®.

What is the best business credit card from Citizens Bank?

The best Citizens Bank business credit card is the Citizens Bank Everyday Points® Business Mastercard® because it has a $0 annual fee. It also offers 2 points per $1 on all purchases and a bonus of 25,000 points for spending $5,000 in the first 90 days.

How to contact Citizens Bank?

The easiest way you can reach the Citizens Bank credit card customer service is either online, by clicking on the “Message us” tab or by calling (800) 684-2222. Ultimately, you could talk to a customer service representative in person at your nearest Citizens Bank branch. 0. 0.

Do you have to have good credit to get a Citizens Bank card?

You should have excellent credit to be considered eligible. But Citizens Bank will also look at your income and existing debts to decide if you're a good fit for their card.

Card Summary

With the Citizens Bank Cash Back Plus World Mastercard rewards program, for a limited time, you'll earn 10% cash back on up to $500 in monthly grocery store, restaurant and food delivery purchases made through May 5, 2021 (your account must be opened by Dec 31, 2020 to be eligible).

Best Features

Introductory APR on balance transfers: With the Citizens Bank Cash Back Plus World Mastercard, new cardholders receive a 15-month 0% APR introductory rate on balance transfers. After that, a variable APR of 15.99%, 19.99%, or 23.99%, based on your creditworthiness applies.

Drawbacks

Potentially high interest rate: Citizens Bank Cash Back Plus World Mastercard has a variable APR of 15.99%, 19.99%, or 23.99%, based on your creditworthiness. The upper end of the APR range is high in comparison to similar credit cards’ APRs.

Citizens Bank Cash Back Plus World Mastercard Benefits

Citizens Bank Cash Back Plus World Mastercard holders receive cardholder benefits including:

Maximizing Rewards

The Citizens Bank Cash Back Plus World Mastercard earns 1.8% cash back on all eligible purchases after the promotional period. There are no limits to the amount of cash back you can earn.

How long is the draw period for Citizens Bank?

Citizens Bank’s standard home equity line of credit has a 10-year draw period and a 15-year repayment term with a variable interest rate between 2.5 percent and 21 percent. While you can pay on both the principal and interest during the draw period, you only have to make payments on the interest. Loan amounts start at $17,500. The GoalBuilder HELOC has no annual fee or prepayment penalty.

How much is the prepayment penalty on a HELOC?

There are no annual fees on home equity loans. Additionally, there is a prepayment penalty of $350 on a HELOC if the account is paid off and closed within the first 36 months. There is no fee if the account is paid off but remains open during the first 36 months.

How long is Citizens Bank home equity loan?

Citizens Bank’s home equity loans come with terms of 10, 15 or 20 years. Loan amounts range from $10,000 to more than $400,000. Rates vary by location.

When was Bankrate founded?

Founded in 1976 , Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

What is the draw period for HELOC?

Flexible repayment options: Borrowers can choose between interest-only payments and payments that include principal and interest during a HELOC’s 10-year draw period.

Is Bankrate a strict editorial policy?

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

How many branches does Citizens Bank have?

Founded in 1828, Citizens Bank is one of the country’s oldest banks and its 13th largest. Headquartered in Providence, Rhode Island, it has about 1,000 branches and 2,700 ATMs in 11 states in New England, the Mid-Atlantic and the Midwest.