What is construction in progress in accounting?

Construction in progress is an asset to a business. If the business uses the asset, it will be a fixed asset. If the business is building assets under contract to sell, they are inventory assets. CIP accounting is important because it can easily be used to manipulate financial statements. As a result, auditors will scrutinize this account.

Where does construction work in progress go on a balance sheet?

The account has a natural debit balance, and is reported within the property, plant and equipment line item on the balance sheet. Once an asset is placed in service, all costs associated with it that are stored in the construction work in progress account are shifted into whichever fixed asset account is most appropriate for the asset.

Is construction work in progress depreciated?

Thus, construction work in progress is one of only two fixed asset accounts that are not depreciated - the other one being the land account. The construction work in progress account is a prime target of auditors, since costs may be stored here longer than they should be, thereby avoiding depreciation until a later period.

Why is construction in progress account given double entry?

When the construction in progress is completed, the corresponding long-term asset account gets debited, and Construction in progress account is credited. Hence, the double-entry system is given both sides. Entry to record the purchase of material: Entry to record the completion of work: It gives a clear vision to the company for its future costs.

Is construction in progress an expense?

Construction work in progress is a general ledger account in which the costs to construct a fixed asset are recorded. This can be one of the largest fixed asset accounts, given the amount of expenditures typically associated with constructed assets.

How do I account for construction work in progress?

Construction work-in-progress accounting refers to the record-keeping of all expenditures that accrue in constructing a non-current asset. An accountant will report spending related to the construction-in-progress account in the “property, plant, and equipment” asset section of the company's balance sheet.

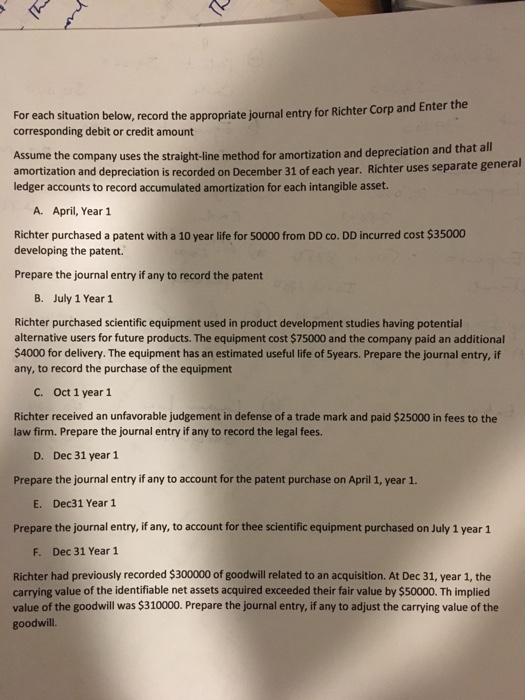

What is the journal entry for construction in progress?

The construction in progress account has a natural debit balance, and is labeled as property, plant, and equipment as part of a company's long-term assets on a balance sheet. Accountants will begin tracking depreciation once construction of the asset is complete and is put into service.

What transactions are debited to the account construction in progress?

The capital costs are debited to construction in progress and in most cases credited to accounts payable. The credit side of this entry might be to cash if paid for immediately or to the business's inventory if it used the inventory assets in the construction.

Is construction in progress a current asset?

No, construction works-in-progress are not current assets. A current asset is any asset that will provide an economic benefit for or within one year. A construction work-in-progress is recorded in a company's balance sheet as a part of the PP&E, or property, plants, and equipment account.

Is construction in progress a fixed asset?

Construction in progress, or most commonly known as CIP, is a fixed asset account with a natural debit balance.

When should construction in progress be capitalized?

For construction in progress assets, no depreciation is recorded until the asset is placed in service. When construction is completed, the asset should be reclassified as building, building improvement, or land improvement and should be capitalized and depreciated.

How do I record construction in progress in Quickbooks?

Work in Progress - General Contractor - ConstructionGo to the Lists menu, and select Chart of Accounts.Click the Account button, and then select New.Select Other Current Asset for the account type.Click Continue.For the Account Name, you can put Work in Progress.

Can construction in progress be negative?

The over/under billing result from the WIP shows up in the revenue area of your income statement. If you are under-billed it will show up as additional revenue. If you are over-billed it will show up as negative revenue.

How do you record work in progress in accounting?

Simply start with the beginning balance of the work in progress account. Then add the costs of resources transferred into the account during the relevant period. Finally, subtract the ending balance of the work in progress account for that period.

When can you write off construction in progress?

Writing off work in progress/construction in progress (WIP/CIP) Equipment work in progress and/or construction in progress costs that have been on the General Ledger for an extended period of time (i.e., more than one year), where the project has been either abandoned or significantly altered from its original plan, ...

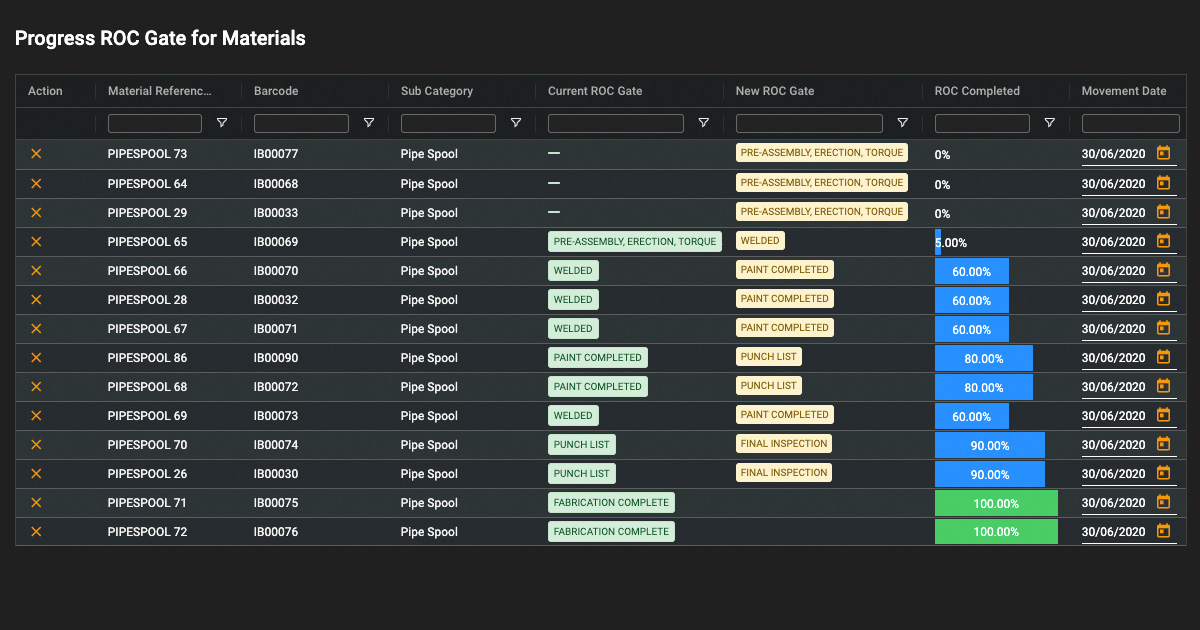

How do you reconcile construction in progress?

Reconciling Construction in Progress AssetsNavigate to the Capital Planning task list. ... Launch Add New Assets, and then select CIP Assets tab.Right-click the CIP Assets form, and then select Reconcile CIP Asset. ... From Reconcile CIP Asset, specify or select the values that apply to the CIP asset that you are reconciling:More items...

What is construction in progress?

Construction in progress (CIP) is a type of account that tracks expenses for fixed assets being built or assembled during the building phase. Companies use construction in progress accounts when they are constructing a new building, expanding a facility or building new machinery.

Who uses construction in progress accounting?

Any business that takes on a major building project, such as constructing a new warehouse, expanding a health care facility or building a new retail store, can use a construction-in-progress account. The following industries may commonly use this type of accounting:

Why is construction-in-progress accounting important?

Construction-in-progress accounting is important because it allows companies to track, organize and report expenses for projects during the building phase. These accounts provide businesses with a more thorough representation of their financial position for stakeholders and regulatory bodies.

How to use construction-in-progress accounting

Here are the steps to track and record construction-in-progress expenses:

Example of construction in progress accounting

Here is an example of using construction-in-progress accounting using the hospital expansion mentioned above:

What is a construction work in progress account?

A construction work-in-progress asset is any asset that is not currently usable, such as assets that are undergoing testing or that a company is building. Depending on the project’s size, construction work-in-progress accounts can be some of the largest fixed asset accounts in a business’s books. A construction-in-progress asset account records any ...

Why do companies keep work in progress accounts open?

Because incomplete assets do not depreciate, a company may keep a work-in-progress account open for an extended time and misrepresent its profits. Construction-work-in-progress accounts can be challenging to manage without proper training and experience.

When did Business A receive a $100,000 bill?

1) On March 11, 2021, Business A received a $100,000 bill from Builder’s Warehouse for construction materials. Debit-Construction In Progress $100,000. Credit-Accounts Payable $100,000. 2) On March 22, 2021, Business A used some of its own materials valued at $2,000 to construct the expansion.

What is a CIP account?

Construction-in-progress (CIP) accounting is the process accountants use to keep track of the costs that relate to fixed-asset construction. Because construction projects necessitate a wide range of costs, CIP accounts keep construction assets separate from the rest of a company’s balance sheet until the project is complete.

Definition of Construction Work-in-Progress

Construction Work-in-Progress is a noncurrent asset account in which the costs of constructing long-term, fixed assets are recorded. The account Construction Work-in-Progress will have a debit balance and will be reported on the balance sheet as part of a company's noncurrent or long-term asset section entitled Property, plant and equipment.

Example of Construction Work-in-Progress

Let's assume that a company is expanding its warehouse and the project is expected to take four months to complete. The company will open the account Construction Work-in-Progress for Warehouse Expansion to accumulate the many expenditures that will occur.

How to Calculate?

The steps that are required to be followed while calculating construction work in progress are as follows:

Example

Suppose we take an example of XYZ Ltd. to whom the seller P Ltd delivered the materials on 1st April 2020 to the job site and charged an amount of $400,000. So the journal entry would be:

Construction Work in Progress Double-Entry

When the costs are added to the construction in progress, the construction in progress account is debited Debited Debit represents either an increase in a company’s expenses or a decline in its revenue.

Disadvantages

There can be some forecasting mistakes that management can make for which there can be mixed planning for future events.

Conclusion

Construction work in progress is an account that measures everything about the costs, expenses, etc. when the construction is still on, i.e., the construction is still not completed, and the service is not put to use. This account helps the management to predetermine many costs and future billings so that it can plan all its expenses.

Recommended Articles

This has been a guide to what is Construction Work in Progress. Here we discuss how to calculate construction work in progress and an example, advantages, and disadvantages. You may learn more about financing from the following articles –

What is construction work in progress?

Construction work in progress is a general ledger account in which the costs to construct a fixed asset are recorded. This can be one of the largest fixed asset accounts, given the amount of expenditures typically associated with constructed assets.

What is the most common fixed asset account to which these costs are shifted?

The most common fixed asset account to which these costs are shifted is Buildings, since most construction projects relate to that fixed asset. However, the account is also sometimes used for machinery, and as such would store the costs associated with buying, transporting, installing, and testing machinery.

What happens to assets once they are placed in service?

Once an asset is placed in service, all costs associated with it that are stored in the construction work in progress account are shifted into whichever fixed asset account is most appropriate for the asset.

Do you depreciate a construction work in progress account?

While costs are being accumulated in the construction work in progress account, do not commence depreciating the asset , because it has not yet been placed in service. Once the asset is placed in service and shifted to its final fixed asset account, begin depreciating it.

Why is construction in process accounting important?

If the business will the asset when it is complete, it will be a fixed asset. If the business is building assets under contract to sell, they are inventory assets. CIP accounting is important because it can easily be used to manipulate financial statements.

What does "process" mean in accounting?

Some accounting advice points to using the word "progress" when the asset is being built for a business to put into use for itself (for example a new headquarters), while "process" means an asset being built to sell to a customer. If the account shows up as a subaccount of PP&E, it is for the business to use itself and may be considered in progress.

What is CIP accounting?

CIP accounting describes the methods used to properly show construction in progress on the financial statements. Some of the costs of constructing additional PP&E (property, plant and equipment) are capitalized to depreciate over time, and some are expensed in the current accounting period. The capital costs are held in the construction in progress account, which is a fixed asset account shown on the balance sheet as a subaccount of property, plant and equipment. The capital costs include construction costs such as materials, labor and benefits, freight costs, interest incurred on construction loans, costs to prepare the site and professional fees related to the project. Expenses that are not specifically tied to the asset should be expensed in the accounting period they occur. This includes expenses that occur after construction is completed, but the asset isn't put in service yet.

What accounting principles require the percentage of completion in journal entries?

As a result, auditors will scrutinize this account. Generally accepted accounting principles (GA AP) requires the percentage of completion in journal entries whenever possible to account for construction in progress.

Where are capital costs held?

The capital costs are held in the construction in progress account, which is a fixed asset account shown on the balance sheet as a subaccount of property, plant and equipment. The capital costs include construction costs such as materials, labor and benefits, freight costs, interest incurred on construction loans, ...

Is capital cost credited to accounts payable?

The capital costs are debited to construction in progress and in most cases credited to accounts payable. The credit side of this entry might be to cash if paid for immediately or to the business's inventory if it used the inventory assets in the construction.

What Is IAS 11 Construction Contract?

What Is Construction in Progress?

- Construction in progress, or most commonly known as CIP, is a fixed asset account with a natural debit balance. We can define Construction in Progress as, It is an accounting term used to represent all the costs incurred in building a fixed asset. The CIP procedures dictate the proper recording of construction costs in financial statements. In the ...

Objective

- According to the matching principle of accounting of accrual accounting, the expenses related to certain revenues must be recorded in the same period when they were incurred. The fixed assets like building space, warehouse, plant manufacturing, etc., can take years. A company can leave the financial statements blank for all times when work was in progress. It will violate the accrua…

Progress vs. Process

- In most cases, the term of process or progress can be used interchangeably. However, there are chances that the term process written in a financial statement instead of progress indicates the business nature. In some accounting conventions, the term ‘progress’ refers to a fixed asset under construction for business use. For instance, the extension of its warehouse by a company is ‘co…

Build For Use

- Build to use can be an extension in an existing office facility, building a new plant, warehouse, or any business asset. The accounting treatment for the ‘build to use’ CIP is not much complicated. All the costs being incurred over time will be debited to the CIP account. In most cases, the credit will be account payable or cash if paid immediately. However, in some cases, the inventory asse…

Build to Sell

- Build to sell relates to the construction firms or companies that make build-to-sell contracts. These businesses mostly involve ship-manufacturing companies, space vehicle manufacturing, airplane manufacturing companies, construction firms, etc. The accounting for construction in progress for such businesses is a little bit complicated. According to Generally Accepted Accou…

Accounting Treatment Percentage of Completion Method

- When it comes to accounting under the percentage of completion method, the company can decide which basis to use. There are three completion-percentage appropriation methods: 1. Cost-to-cost method 2. Efforts Expended method 3. Units-to-deliver method

Cost-To-Cost Method

- In cost to cost method, all the cost incurred to the date is divided by the project’s total expected cost. It gives the estimation of work completed to the date.

Efforts Expended Method

- The appropriation is done similarly to the cost-to-cost method. The effort expended to the date is divided by total expected efforts. The basis for the effort expended can be labor hours, the material used, or machine hours.

Units-To-Deliver Method

- This percentage completion appropriation method is most common when a contract of delivering a large number of similar assets is made. For instance, it can be a contract to manufacture tires for a car manufacturing company. In this method, the number of units manufactured is divided by the total number of units to be manufactured.

What Is Construction in Progress?

Who Uses Construction in Progress Accounting?

- Any business that takes on a major building project, such as constructing a new warehouse, expanding a health care facility or building a new retail store, can use a construction-in-progress account. The following industries may commonly use this type of accounting: 1. Manufacturing 2. Healthcare 3. Retail 4. Aviation 5. Aeronautics 6. Laboratories Related: 10 Types of Accounting a…

Why Is Construction-In-Progress Accounting Important?

- Construction-in-progress accounting is important because it allows companies to track, organize and report expenses for projects during the building phase. These accounts provide businesses with a more thorough representation of their financial position for stakeholders and regulatory bodies. Some construction or building projects may last several years, and it's important for busi…

Example of Construction in Progress Accounting

- Here is an example of using construction-in-progress accounting using the hospital expansion mentioned above: A hospital is building a new pediatrics wing. On January 7, it receives a delivery of bricks totaling $11,000. Date: Jan. 7, 2019 1. Construction in progress: +$11,000 (debit) 2. Accounts payable: - $11,000 (credit) On January 22, the hospi...

What Is Construction-In-Progress Accounting?

- Construction work-in-progress accounting refers to the record-keeping of all expenditures that accrue in constructing anon-current asset. An accountant will report spending related to the construction-in-progress account in the “property, plant, and equipment” asset section of the company’s balance sheet. A construction work-in-progress asset is an...

Why Is Construction-In-Progress Accounting Necessary?

- Businesses need to prepare accurate, up-to-date financial reports that account for their expenses and profits. A balance sheet shows a company’s net worth at any given time and includes all of its assets, even those that are not currently in use. Construction work-in-progress assets are unique in that they can take months or years to complete, and during the construction process, they are …

Construction Work-In-Progress Accounting Process

- When you hire an accountant or CFO to complete construction-in-progress accounting for your business, the accountant will follow this process of recording and maintaining all associated expenses: 1. Open a construction-work-in-progress account under the property, plant, and equipment section of the company’s balance sheet. If the company has multiple CIPs, the accou…

Example of Construction-In-Progress Journal Entries

- Here is an example to help you visualize what construction-in-progress may look like in your accounting books. Business A is planning an office building expansion to create more workspace for its employees. Business A’s accountant will begin a Construction-in-Progress Office Expansion asset account to record expense statements for the construction job. They will then create a jou…