A conventional loan is often better if you have good or excellent credit because your mortgage rate and PMI costs will go down. But an FHA loan

FHA insured loan

An FHA insured loan is a US Federal Housing Administration mortgage insurance backed mortgage loan which is provided by an FHA-approved lender. FHA insured loans are a type of federal assistance and have historically allowed lower income Americans to borrow money for th…

Is monthly mortgage insurance higher on FHA than conventional?

While Conventional loans may have a slightly higher interest rate than FHA loans, they can still be less costly and have a lower monthly payment because of the differences in mortgage insurance between these two types of loans. In general, the higher the down payment and the higher your credit score, the lower your interest rate will be.

Why are conventional loans better?

- There’s not one clear winner across all loan scenarios

- Determining the cheaper option will depend largely on your credit score and LTV

- FHA loans tend to benefit those with low credit scores and high LTVs

- While conventional loans are often cheaper for those with better credit scores and larger down payments

Is FHA a conventional loan?

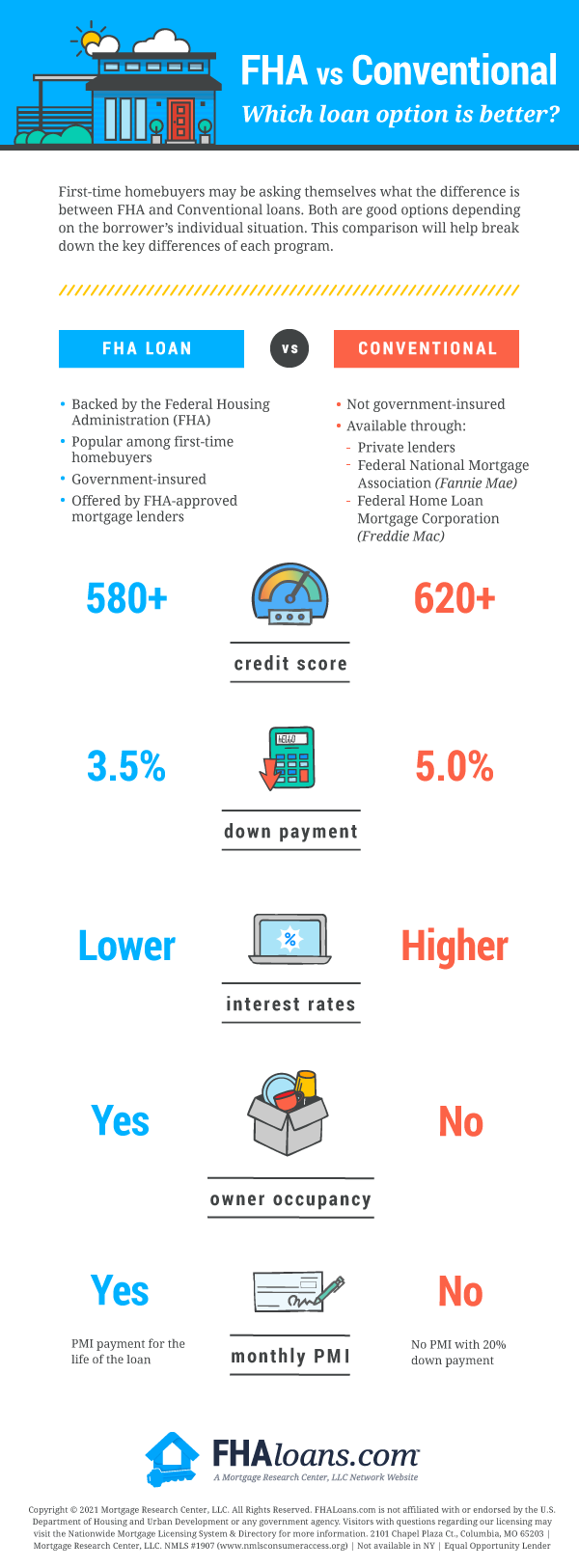

In short, conventional loans are non-government mortgages, typically backed by Fannie Mae or Freddie Mac. Whereas FHA loans are government-backed mortgages that are insured by the Federal Housing Administration (FHA). Both can be a good choice depending on your credit profile and homeownership goals, but there are key differences.

Do FHA mortgage loans have minimum amounts?

Mortgage programs backed by the government (FHA, VA and USDA) have no minimum mortgage amount Home loans backed by Fannie Mae and Freddie Mac do not require a minimum amount

See more

Why would you choose FHA over conventional?

An FHA loan has less-restrictive qualifications compared to a conventional loan, which is not backed by a government agency. You need to have a higher credit score, lower debt-to-income (DTI) ratio and higher down payment to qualify for a conventional loan.

What is the downside of a conventional loan?

Tougher credit score requirements than for government loan programs. Conventional loans often require a credit score of at least 620, which leaves out some homebuyers. Even if you qualify, you will likely pay a higher interest rate than if you had good credit.

Do sellers prefer conventional or FHA?

There are two situations when a seller should choose a Conventional offer over an FHA offer. First, if the property has safety issues or things that need to be fixed, a Conventional appraisal will be less likely to point out those issues while an FHA appraiser will require those to be fixed prior to closing.

Which loan is harder to get FHA or conventional?

To put it simply, FHA loans are generally easier to qualify for because of their lower credit score and down payment requirements. Conventional loans, meanwhile, may not require mortgage insurance with a large enough down payment. Choosing the best loan option for you depends on your personal financial situation.

What score is needed for a conventional loan?

620Conventional Loans A conventional loan is a mortgage that's not insured by a government agency. Most conventional loans are backed by mortgage companies Fannie Mae and Freddie Mac. Fannie Mae says that conventional loans typically require a minimum credit score of 620. But lenders can raise their own requirements.

What is the minimum down payment for conventional loan?

3%The minimum down payment required for a conventional mortgage is 3%, but borrowers with lower credit scores or higher debt-to-income ratios may be required to put down more. You'll also likely need a larger down payment for a jumbo loan or a loan for a second home or investment property.

Why do sellers not like FHA buyers?

Reasons Sellers Don't Like FHA Loans Both reasons have to do with the strict guidelines imposed because FHA loans are government-insured loans. For one, if the home is appraised for less than the agreed-upon price, the seller must reduce the selling price to match the appraised price, or the deal will fall through.

Why do people not like FHA?

FHA financing is not trusted because real estate agents do not understand how they work. Many real estate agents think that a FHA appraisal, which is a little more thorough than a conventional appraisal, is going to jeopardize their clients sales price or identify repairs that need to be done before the sale.

Why do people prefer conventional loans?

Sellers often prefer conventional buyers because of their own financial views. Because a conventional loan typically requires higher credit and more money down, sellers often deem these reasons as a lower risk to default and traits of a trustworthy buyer.

Is there a downside to FHA loans?

Higher cost In short, the government guarantee on an FHA loan isn't free. Borrowers have to pay for FHA mortgage insurance, which has both an upfront premium added to your FHA loan closing costs, as well as an ongoing cost.

Do conventional loans require 20 down?

Conventional loans require as little as 3% down (this is even lower than FHA loans). For down payments lower than 20% though, private mortgage insurance (PMI) is required. (PMI can be removed after 20% equity is earned in the home.) The more you put down, the lower your overall loan costs.

Do FHA loans have higher monthly payments?

That's because conventional loan costs are more dependent on your credit and down payment than FHA loan costs. And as a result, your monthly payments and PMI are lower when your credit score is higher. This is a key difference from how FHA loans work.

What are the pros of conventional?

Top 10 Conventional Farming Pros & Cons – Summary ListConventional Farming ProsConventional Farming ConsMore efficient land useMay ruin the soil in the long runMay decrease global hungerDecreasing yields in the futureBetter food supplySpread of plant diseases7 more rows

What's the difference between a conventional loan and a regular loan?

Conventional Loans. FHA loans allow lower credit scores than conventional mortgages do, and are easier to qualify for. Conventional loans allow slightly lower down payments. Many or all of the products featured here are from our partners who compensate us.

What is an advantage for a conventional fixed rate loan?

With the added feature of fixed interest rates, conventional loans are appealing to many. They also offer higher loan limits than government-backed loans. Conventional loans also tend to be more flexible in down payment and term length options.

How long do you pay mortgage insurance on a conventional loan?

For conventional loans, mortgage insurance is temporary. It's only required until your home equity percent reaches 20% of your home's market value. In time, because your monthly mortgage payment includes principal repayment, you're likely to gain that home equity and petition your lender to cancel PMI.

Which Is Better: FHA Or Conventional 97?

There are a multitude of low-downpayment options for today’s home buyers but many will choose between the FHA 3.5% downpayment program and the Conv...

Additional Low Down Payment Mortgage Options

Today's mortgage rates are low and rents are rising nationwide. In many U.S. markets, the answer to “Should I rent or should I buy?” has shifted to...

About The FHA 3.5% Downpayment Program

The Federal Housing Administration (FHA) is not a lender. Rather, it’s a loan insurer. The federal agency was established in 1934 and exists to sup...

About The Conventional 97 LTV Program

The Conventional 97 loan is another low down payment option available to today’s mortgage borrowers.Available via Fannie Mae and Freddie Mac, the p...

What Are Today’S Mortgage Rates?

For today’s low down payment home buyers, there are scenarios in which the FHA loan is what’s best for financing; and there are scenarios in which...