Is Deferred income an asset or liability?

Deferred income is a current liability and would sit on the balance sheet under trade payables.

What type of account is deferred income?

short term liability accountDeferred revenue is a short term liability account because it's kind of like a debt however, instead of it being money you owe, it's goods and services owed to customers. Deferrals like deferred revenue are commonly used in accounting to accurately record income and expenses in the period they actually occurred.

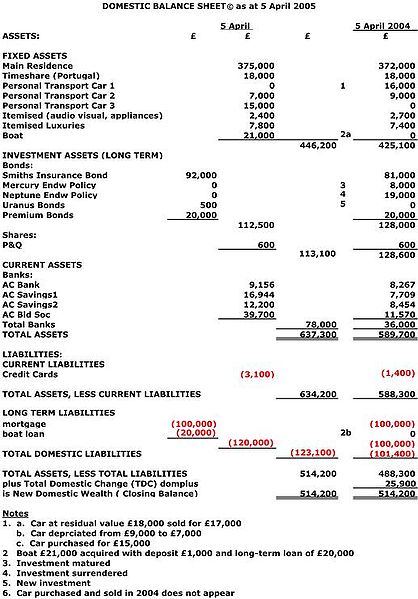

Where should deferred revenue on the balance sheet?

When a company receives advance payment from a customer before the product/service has been delivered, it is considered deferred revenue. Unlike accounts receivable, which is considered an asset, deferred revenue is listed as a current liability on the balance sheet.

Is deferred revenue A expense?

It describes money spent by a business that will create future revenue. The revenue earned will cover more than one accounting year. It's usually a one-time expense that creates ongoing benefits. It's important to disclose deferred revenue expenditure on financial statements.

How do you record deferred income?

Accounting for Deferred Expenses Like deferred revenues, deferred expenses are not reported on the income statement. Instead, they are recorded as an asset on the balance sheet until the expenses are incurred. As the expenses are incurred the asset is decreased and the expense is recorded on the income statement.

Is deferred revenue part of current liabilities?

Deferred revenue is typically reported as a current liability on a company's balance sheet, as prepayment terms are typically for 12 months or less.

Is deferred revenue a receivable?

Unlike accounts receivable (A/R), deferred revenue is classified as a liability since the company received cash payments upfront and has unfulfilled obligations to its customers.

Is accrued income an asset?

Accrued income is listed in the asset section of the balance sheet because it represents a future benefit to the company in the form of a future cash payout.

Is Deferred income the same as accrued income?

Deferred revenue, also known as unearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed in the future. Accrued expenses refer to expenses that are recognized on the books before they have actually been paid.

Why is deferred expense an asset?

A deferred expenditure is placed on the balance sheet as an asset, since it is something that has been paid a certain amount for, but has not yet been used in its entirety. Some are considered current assets, if they are used fully within a year.

Is Retained earnings an asset?

Retained earnings are a type of equity and are therefore reported in the shareholders' equity section of the balance sheet. Although retained earnings are not themselves an asset, they can be used to purchase assets such as inventory, equipment, or other investments.

What type of account is accrued income?

Accrued income is usually listed in the current assets section of the balance sheet in an accrued receivables account.

What type of accounts are deferred revenues and unearned revenues?

Deferred revenue, which is also referred to as unearned revenue, is listed as a liability on the balance sheet because, under accrual accounting, the revenue recognition process has not been completed.

What kind of account is deferred revenue quizlet?

A Deferred Revenue : A liability recognized when cash is received before the service is provided or before the goods are shipped to customers.

Is deferred revenue part of accounts payable?

Unlike accounts receivable (A/R), deferred revenue is classified as a liability since the company received cash payments upfront and has unfulfilled obligations to its customers.

What Is a Deferred Tax Asset?

A deferred tax asset is an item on a company's balance sheet that reduces its taxable income in the future.

Why are deferred assets important?

This asset helps in reducing the company’s future tax liability.

What Is a Deferred Tax Asset vs. a Deferred Tax Liability?

A deferred tax asset represents a financial benefit, while a deferred tax liability indicates a future tax obligation or payment due.

When do deferred taxes exist?

For example, deferred taxes exist when expenses are recognized in a company's income statement before they are required to be recognized by the tax authorities or when revenue is subject to taxes before it is taxable in the income statement. 2

When is deferred tax asset recognized?

It is important to note that a deferred tax asset is recognized only when the difference between the loss-value or depreciation of the asset is expected to offset future profit. 1 . A deferred tax asset can conceptually be compared to rent paid in advance or refundable insurance premiums; while the business no longer has cash on hand, ...

When is there an opportunity for the creation of a deferred tax asset?

Essentially, whenever the tax base or tax rules for assets and/or liabilities are different , there is an opportunity for the creation of a deferred tax asset.

Is a loss an asset?

2 In that sense, the loss is an asset. Another scenario where deferred tax assets arise is when there is a difference between accounting rules and tax rules.

Why is deferred income important?

However, deferred income is essential to the Company as they help it to manage its finances and cover the cost of operating activities.

What is deferred revenue?

Deferred revenue is the amount of income earned by the company for the goods sold or the services , however, the product or service delivery is still pending and examples include like advance premium received by the insurance companies for prepaid insurance policies, etc.

Why is deferred revenue accounting important?

Deferred revenue accounting is a critical concept to avoid misreporting of assets and liabilities. It is majorly essential for Companies that get advance payments before it delivers its products and services. The bottom line is that once the Company receives money instead of goods and services to be done in the future, it should report it as deferred income liability. It will realize such revenue only after the goods and services are provided to the customers. If the Company realizes the revenue as it receives the money, it will overstate its sales. However, deferred income is essential to the Company as they help it to manage its finances and cover the cost of operating activities.

When is deferred income reported in Salesforce?

Please note that Salesforce follows the fiscal year with 31st January year-end.

Is deferred revenue an asset or liability?

Thus, the Company reports it as a deferred revenue a liability than an asset until the time it delivers the products and services. It is also called as unearned revenue or deferred income.

When should deferred income be recognized?

Deferred income should be recognized when the Company has received payment in advance for a product/service to be delivered in the future. Such payments are not realized as revenue and do not affect the net profit or loss.

Does deferred income overvalue net worth?

This safeguards investors’ interest as the Company cannot treat deferred income as its assets, which will overvalue its net worth. It provides that the Company has outstanding liabilities before it can realize its revenue and convert it into assets.

What is deferred tax asset?

Deferred tax asset is created when the Company has already paid the tax. The benefit of deferred tax assets is that the Company will have less tax outgo in the future subsequent years.

What is deferred income tax?

Deferred income tax is a balance sheet item which can either be a liability or an asset as it is a difference resulting from recognition of income between the accounting records of the company and the tax law because of which the income tax payable by the company is not equal to the total expense of tax reported.

What is deferred liability?

Deferred tax liability is created when the Company underpays the tax, which it will have to pay in the near future. The liability is created not due to Company defaulting on its tax liabilities but due to timing mismatch or accounting provisions, which causes less tax outgo than required by the Company.

How does deferred tax affect cash flows?

Deferred tax impacts the future cash flows for the Company Cash Flows For The Company Cash Flow is the amount of cash or cash equivalent generated & consumed by a Company over a given period . It proves to be a prerequisite for analyzing the business’s strength, profitability, & scope for betterment. read more – while deferred tax assets lower the cash outflow, deferred tax liability increases the cash outflow for the Company in the future

How does deferred income affect tax?

Deferred Income tax affects the tax outgo to the authorities for the financial year. If there is a deferred tax asset, the Company will have to pay less tax in the particular year, whereas, if there is a deferred tax liability, it will have to pay more tax. How to Provide Attribution?

What is change in deferred tax?

Change in deferred tax Deferred Tax Deferred Tax is the effect that occurs in a firm as a result of timing differences between the date when taxes are actually paid to tax authorities by the company and the date when such tax is accrued. Simply put, it is the difference in taxes that arises when taxes due in one of the accounting period are either not paid or overpaid. read more balances should be analyzed to understand the future course – if the difference is going to rise or there will be a reversal in the trend of the deferred taxes

How to look for changes in deferred taxes?

Analysts should look for changes in deferred taxes by reading the footnotes to the financial statements Financial Statements Financial statements are written reports prepared by a company's management to present the company's financial affairs over a given period (quarter, six monthly or yearly). These statements, which include the Balance Sheet, Income Statement, Cash Flows, and Shareholders Equity Statement, must be prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all levels. read more, which could include information about the warranty, bad debts, write-downs, policy on capitalizing or depreciating assets, policy on amortizing financial assets, revenue recognition policy, etc.

What is a deferred tax asset?

A deferred tax asset (DTA) is an entry on the balance sheet that represents a difference between the company’s internal accounting and taxes owed. For example, if your company paid its taxes in full and then received a tax deduction for that period, that unused deduction can be used in future tax filings as a deferred tax asset.

What is the difference between deferred tax assets and deferred tax liabilities?

A deferred tax asset is a business tax credit for future taxes, and a deferred tax liability means the business has a tax debt that will need to be paid in the future.

What is deferred tax liability journal entry?

Certain tax incentives will create a deferred tax liability journal entry, giving the business some temporary tax relief, but will be collected later. Depreciation expenses—like the annual devaluation of a fleet of company vehicles—can generate deferred tax liabilities.

What is a temporary difference between the amount of money owed in taxes and the amount of money that is required to?

Any temporary difference between the amount of money owed in taxes and the amount of money that is required to be paid in the current accounting cycle creates a deferred tax liability.

How to illustrate deferred tax liability?

To illustrate the concept of a deferred tax liability, imagine you’re at a bar with an open tab. At the end of the night, you go to the bar to pay off your tab, but the bartender has mistakenly closed out the register and can no longer process your tab. You agree to return to the bar and pay off your tab on your next visit. You make a note to yourself of the outstanding balance, and keep cash on hand to pay it off.

When is a deferred tax asset created?

Whenever there is a difference between the income on the tax return and the income in the company’s accounting records (income per book) a deferred tax asset is created.

Do you take a greater deduction at the outset?

That’s because while you take a greater deduction at the outset, the difference in depreciation schedules will adjust over time, and in later years the business essentially “pays back” the initial tax deductions until the difference between depreciation models evens out.

What Is Deferred Income Tax?

A deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company's accounting methods. For this reason, the company's payable income tax may not equate to the total tax expense reported.

What would happen if there was no deferred income tax liability account?

However, without a deferred income tax liability account, a deferred income tax asset would be created. This account would represent the future economic benefit expected to be received because income taxes charged were in excess based on GAAP income.

What is the most common cause of deferred income tax?

The difference in depreciation methods used by the IRS and GAAP is the most common cause of deferred income tax.

Is depreciation a GAAP method?

However, the IRS requires the use of a depreciation method that is different from all the available GAAP methods. For this reason, the amount of depreciation recorded on a financial statement is usually different than the calculations found on a company’s tax return.

Why is deferred revenue listed as a liability on the balance sheet?

Deferred revenue, which is also referred to as unearned revenue, is listed as a liability on the balance sheet because, under accrual accounting, the revenue recognition process has not been completed.

Is money earned a liability?

In other words, the revenue or sale is finally recognized and, therefore, the money earned is no longer a liability. Each contract can stipulate different terms, whereby it's possible that no revenue can be recorded until all of the services or products have been delivered. In other words, the payments collected from the customer would remain in ...

Is deferred revenue different from financial statements?

Each method would result in a different amount recorded as deferred revenue, despite the total amount of the financial transaction being no different.

What is deferred revenue?

Deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered. Deferred revenue is recognized as earned revenue on the income statement as the good or service is delivered to the customer.

Is a prepaid expense an asset?

The other company involved in a prepayment situation would record their advance cash outlay as a prepaid expense, an asset account, on their balance sheet. The other company recognizes their prepaid amount as an expense over time at the same rate as the first company recognizes earned revenue.

Is deferred revenue a liability?

Deferred revenue is a liability because it reflects revenue that has not been earned and represents products or services that are owed to a customer. As the product or service is delivered over time, it is recognized proportionally as revenue on the income statement .

Is deferred revenue earned revenue?

Deferred revenue is recognized as earned revenue on the income statement as the good or service is delivered to the customer.