Is depreciation overhead or period costs?

As shown in the income statement above, salaries and benefits, rent and overhead, depreciation and amortization, and interest are all period costs that are expensed in the period incurred. On the other hand, costs of goods sold related to product costs are expensed on the income statement when the inventory is sold.

What kind of cost is depreciation?

fixed costDepreciation is a fixed cost, because it recurs in the same amount per period throughout the useful life of an asset. Depreciation cannot be considered a variable cost, since it does not vary with activity volume.

What is included in the overhead cost?

Overhead expenses are all costs on the income statement except for direct labor, direct materials, and direct expenses. Overhead expenses include accounting fees, advertising, insurance, interest, legal fees, labor burden, rent, repairs, supplies, taxes, telephone bills, travel expenditures, and utilities.

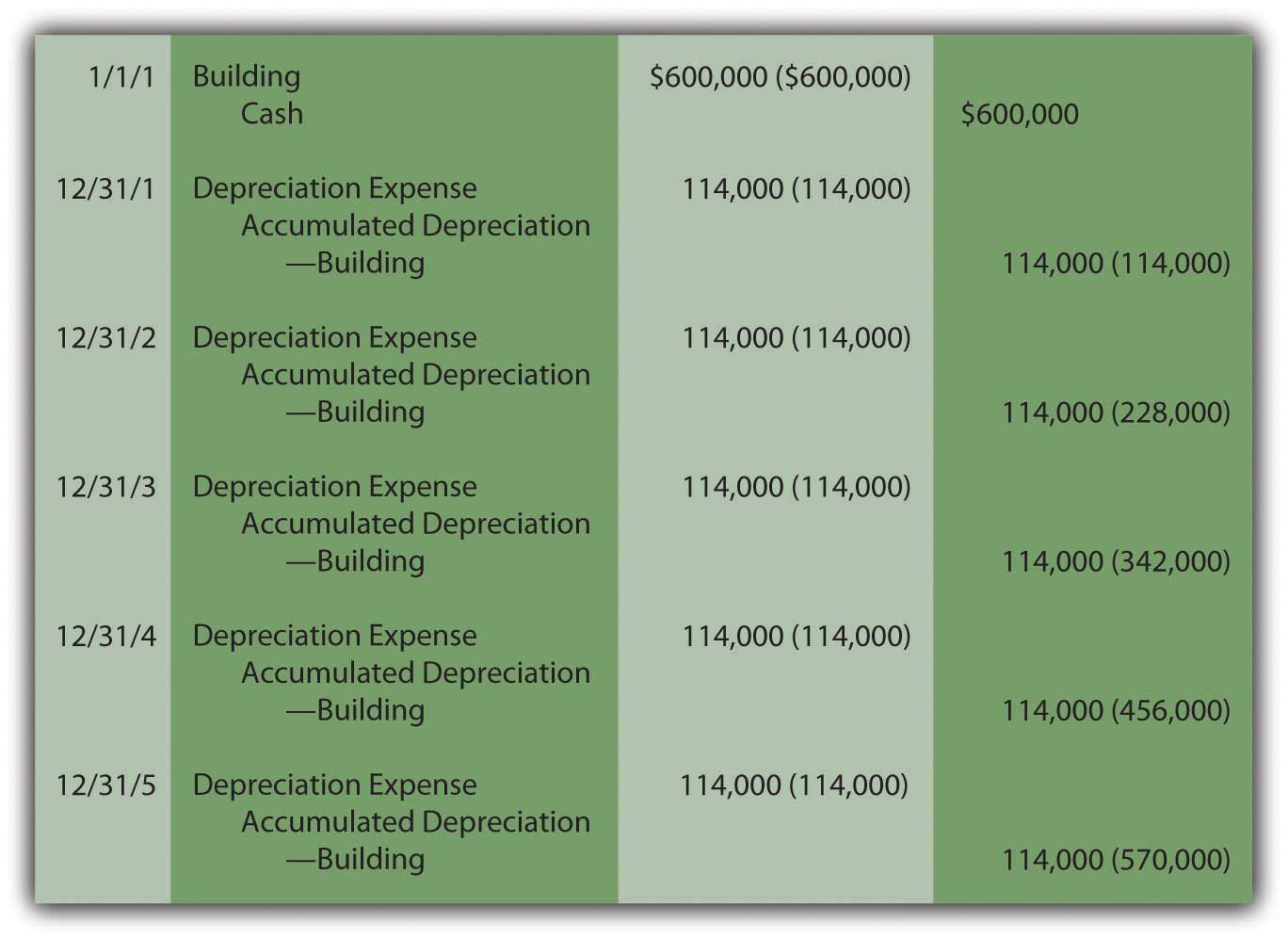

How do you account for depreciation?

The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated Depreciation account (which appears in the balance sheet as a contra account that reduces the amount of fixed assets).

Why depreciation is indirect cost?

In the production department of a manufacturing company, depreciation expense is considered an indirect cost, since it is included in factory overhead and then allocated to the units manufactured during a reporting period. The treatment of depreciation as an indirect cost is the most common treatment within a business.

Is depreciation a manufacturing overhead?

Usually manufacturing overhead costs include depreciation of equipment, salary and wages paid to factory personnel and electricity used to operate the equipment.

Which of the following is not considered an overhead cost?

C is the correct option Direct materials are the raw materials used to make a finished product. Direct labor cost is directly associated with the cost of workers. Factory overhead cost is the cost related to the manufacturing process. Hence, C is the correct option.

Is depreciation a fixed manufacturing overhead?

Examples of fixed overhead costs include: Rent of the production facility or corporate office. Salaries of plant managers and supervisors. Depreciation expense of fixed assets.

Is depreciation a product cost?

So, the answer is equipment depreciation is classified as a product cost.

Is depreciation a real cost?

Depreciation is not a “paper” expense. It is very real. Depreciation is a common expense shown in the financial statements and tax returns of businesses. The purpose of recording depreciation expense is to recognize the decline in value of an operating asset over time.

Is depreciation a direct or indirect cost?

indirectYes, depreciation is included as either a direct or indirect cost when computing the credit. Depreciation is considered an ordinary and necessary business expense under the IRC, and is therefore included as a cost of generating production gross receipts.

Can depreciation be part of cost of sales?

Typically, depreciation and amortization are not included in cost of goods sold and are expensed as separate line items on the income statement. However, a portion of depreciation on a production facility might be included in COGS since it's tied to production—impacting gross profit.

Is Depreciation is direct or indirect cost (Overhead Cost)?

Depreciation expense is commonly classified as the indirect cost, as it incurs during the accounting period without any implication from production units. It doesn’t matter if the company produces 10 units or 1,000 units, the depreciation charge will remain the same. We cannot trace the consumption of depreciation per unit produced. The company simply add depreciation to the total overhead cost and allocate base on the unit produce during the period.

What is depreciation expense?

Depreciation is the amount of fixed assets which charge as expenses to the income statement during the accounting period. The depreciation expense will depend on the cost of the asset and useful life. The concept is the spread the cost over its useful life as the asset will decrease its value to zero/scrape value. At the end of fixed useful life, the total expense will equal to fixed cost less scrape value if any.

What is direct cost?

Direct cost is the cost associate with the production of goods. It includes direct material, directed labor, and it varies depending on the number of production.

Is depreciation a direct cost?

In some small circumstances, depreciation can charge as a direct cost to the product when the company can trace it to the finished product. For example, in Boeing production, many machines and equipment will be used specifically for each airplane. The depreciation expenses of these fixed assets is a part of production cost, they are linked between the production and expense. Management knows exactly how much deprecation charge per unit.

What is indirect cost?

An indirect cost is one that is not directly associated with an activity or product. Thus, the determination of depreciation as a direct or indirect cost depends upon what it is associated with. For example, a cost center such as the power generation facility of a university contains an electric turbine. The turbine is the entire responsibility of ...

Is depreciation a cost pool?

Conversely, the depreciation charge for the turbine may then be added to a cost pool that is allocated out to the departments of the university, based on their consumption of electricity . Since the actual depreciation expense incurred does not vary in direct proportion to the departmental use of electricity, depreciation can be considered an indirect cost of the various user departments.

Is turbine depreciation a direct cost?

The turbine is the entire responsibility of the power generation cost center. Since the depreciation expense associated with the turbine is charged entirely to the cost center, depreciation can be considered a direct cost of the power generation cost center. Conversely, the depreciation charge for the turbine may then be added to a cost pool ...

What is research and development overhead?

Research and Development Overheads. These Overhead expenses are usually incurred on a new product or process development. They are not identifiable to be charged on any specific product or service line cater by the business. Examples include the cost of raw material used in research, staff cost indulged in Research, etc.

What is factory overhead?

Factory Overheads Factory Overhead, also called Factory Burden, is the total of all the indirect expenses related to the production of goods such as Quality Assurance Salaries, Factory Rent, & Factory Building Insurance etc. read more. , Work Overheads, etc.

What is overhead cost?

Overhead Cost refers to the cost of indirect material, indirect labor, and other operating expenses, which are associated with the typical day to day running of the business but cannot be conveniently charged directly to any specific product or service or cost center. In other words, it is the cost incurred on labor, material, ...

What is semi variable overhead?

Semi-Variable Overhead Expenses are the ones which are partly fixed and party variable in nature. As such, they contain both fixed and variable elements and, therefore, don’t fluctuate in direct proportion to business output. Semi-variable overhead examples include Telephone Charges etc.

What is work overhead based on?

Work Overhead is levied based on Direc Labor Hour Rate

What is indirect cost?

In other words, it is the cost incurred on labor, material, or services that cannot be economically identified with a specific saleable cost of goods or service per unit of the business. They are Indirect and need to be shared out among the cost units as precisely as possible.

What are overhead expenses?

Such Overhead expenses are the ones that vary in direct proportion to the volume of output. These overhead expenses are directly affected by business activity. Variable Overhead Examples include Shipping expenses, Advertising Costs, etc.

How Are Assets Depreciated for Tax Purposes?

This is the process of allocating the cost of an asset over the course of its useful life in order to align its expenses with revenue generation.

How Does Depreciation Differ From Amortization?

Amortization is an accounting term that essentially depreciates intangible assets such as intellectual property or loan interest over time .

What Is the Difference Between Depreciation Expense and Accumulated Depreciation?

The basic difference between depreciation expense and accumulated depreciation lies in the fact that one appears as an expense on the income statement while the other is a contra asset reported on the balance sheet.

How many years of depreciation is 5/15?

In the second year, only 4/15 of the depreciable base would be depreciated. This continues until year five depreciates the remaining 1/15 of the base.

What is depreciation in accounting?

Depreciation is an accounting convention that allows a company to write off an asset's value over a period of time, commonly the asset's useful life. Assets such as machinery and equipment are expensive. Instead of realizing the entire cost of the asset in year one, depreciating the asset allows companies ...

How to calculate depreciation rate?

The annual depreciation using the straight-line method is calculated by dividing the depreciable amount by the total number of years. In this case, it amounts to $800 per year ($4,000 ÷ 5). This results in a depreciation rate of 20% ($800÷ $4,000).

Why do companies depreciate assets?

Depreciating assets helps companies earn revenue from an asset while expensing a portion of its cost each year the asset is in use . If not taken into account, it can greatly affect profits . Businesses can depreciate long-term assets for both tax and accounting purposes.

How to Calculate Overhead Cost?

Now let’s understand how you can calculate the overhead cost as we now know the various methods of calculating the absorption rate.

What is the next step after calculating overhead rate?

After calculating the overhead rate, the next step is to calculate the overheads to be charged to production.

What is factory overhead?

Manufacturing or Factory Overheads. The Factory Overheads refer to the expenses incurred to run the manufacturing division of your company. These are indirect production costs other than direct material, direct labor, and direct expenses.

Why is it important to calculate the overhead rate?

These could include direct labor costs, machine hours, etc. Therefore, it is important to calculate the overhead rate because it helps you to achieve the following.

Why are overhead costs important?

This is because there may be times when the Overhead Expenses may exceed the direct costs of producing goods or services.

What are the overhead costs of manufacturing?

Other manufacturing overheads are the costs that include the costs of factory utilities. These include gas and electricity, depreciation on manufacturing equipment, rent and property taxes on manufacturing facilities, etc.

What is overhead cost?

As stated earlier, the overhead costs are the indirect costs that cannot be directly assigned to a particular product, job, process, or work order. Accordingly, Overhead costs are classified into indirect material, indirect labor, and indirect overheads. Indirect Material.

What Is Cost Accounting?

Companies use cost accounting to identify the expenses associated with manufacturing. For example, a shoe manufacturer uses cost accounting to track the material inputs for its shoes, the labor hours for its production workers, and all other factors considered by a traditional production budget. Cost accounting is different from financial accounting, which companies use to highlight overall performance and state assets and liabilities. Financial accounting has strict guidelines and is regulated by the IRS and the Financial Accounting Standards Board (FASB). Cost accounting is firm-specific and not regulated by the government.

What is indirect labor in shoe manufacturing?

If the shoe is produced using a machine or other capital equipment, a very small portion of the expenses associated with the equipment are allocated to it. This includes indirect labor, or those people who set up, repair and clean the equipment (as opposed to those who use the equipment to make the footwear; these would be considered direct labor). It also includes electricity for the factory and any other energy inputs for the aforementioned equipment. The depreciation for the factory and its equipment are also considered.

What are some examples of overhead in accounting?

Other typical examples of overhead in cost accounting include indirect labor, indirect materials, utilities, and depreciation .

What is overhead cost in 2021?

Updated Jun 27, 2021. Put simply, overhead costs are any and all costs not directly associated with generating profit for a firm. That is not to say overhead costs are not important or necessary. It is just that, on their own, overhead costs do not actually bring in revenue.

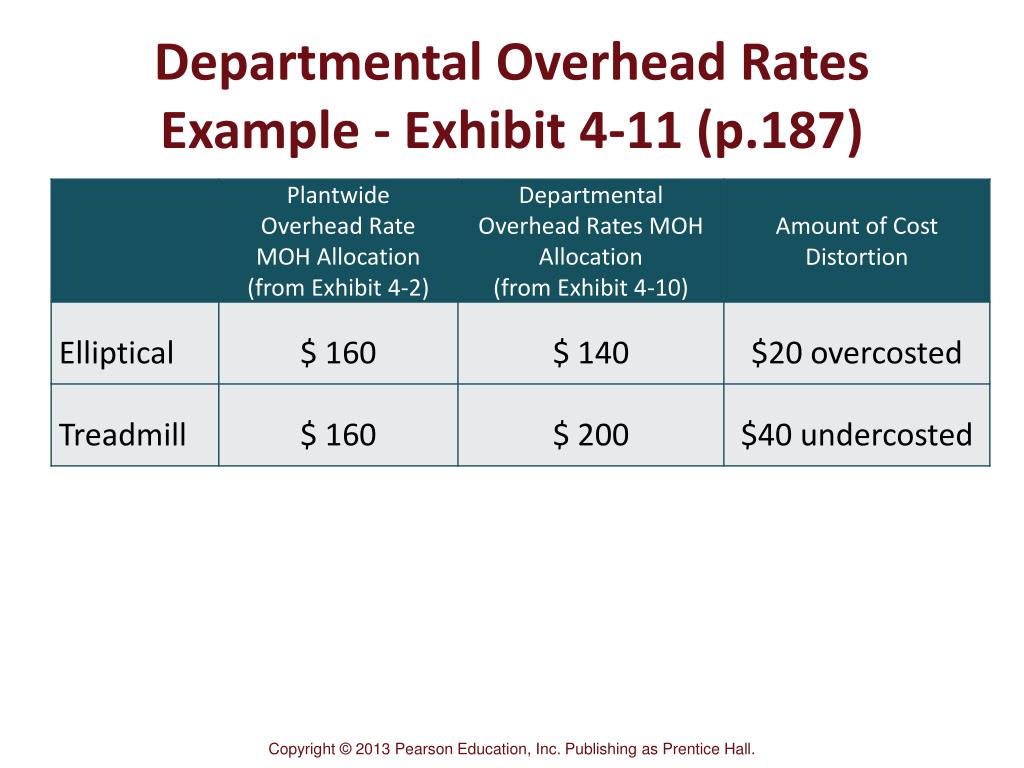

Why should managers aim for a cause and effect relationship?

There is some degree of subjectivity in the choice of allocation base for factory overhead, but managers should aim for a cause-and-effect relationship if they want to produce the most useful accounting of their operations and obtain the most accurate sense of their profitability.

Who is Peggy James?

Peggy James is a CPA with 8 years of experience in corporate accounting and finance who currently works at a private university. Put simply, overhead costs are any and all costs not directly associated with generating profit for a firm. That is not to say overhead costs are not important or necessary.

Is depreciation for equipment considered in cost accounting?

The depreciation for the factory and its equipment are also considered. Under cost accounting, there is always an "allocation base" that links the overhead costs to the cost object . Since it is arduous to apply overhead cost to each individual cost object, such as a shoe, companies tend to use the average of an aggregate number of objects.