Can I deduct the UFMIP on an FHA loan?

The FHA allows you to pay the premium in one of two ways: You may finance the amount by adding it to the loan's principal balance or you may pay it in a lump sum along with your closing costs. You can deduct the UFMIP if you opted for the latter method – the out-of-pocket lump sum payment at closing.

Is FHA mortgage insurance tax deductible?

The ability to deduct the FHA mortgage insurance depends on the home's occupancy status and the taxpayer's adjusted gross income. The mortgage insurance premium deduction comes and goes.

What is MIP and how does it affect my loan?

MIP is payable in one lump sum at closing and it makes up a percentage of your premiums over the course of the loan’s life. This effectively acts as two separate premiums.

What are the deductible parts of an FHA loan?

Deductible Parts of Your Mortgage Payment. A typical FHA loan payment usually consists of the following each month: principal, interest, property taxes, mortgage insurance and homeowners insurance. Of these, only the interest and taxes are deductible at the time of publication.

Can you deduct MIP on 2020 taxes?

The mortgage insurance premium deduction is available through tax year 2020. Starting in 2021 the deduction will not be available unless extended by Congress.

Is PMI tax-deductible in 2021?

The tax deduction for PMI was set to expire in the 2020 tax year, but recently, legislation passed The Consolidated Appropriations Act, 2021 effectively extending your ability to claim PMI tax deductions for the 2021 tax period. In short, yes, PMI tax is deductible for 2021.

Can you write off mortgage insurance premiums on your taxes?

Mortgage insurance premiums. The itemized deduction for mortgage insurance premiums has been extended through 2021. You can claim the deduction on line 8d of Schedule A (Form 1040) for amounts that were paid or accrued in 2021.

Can I claim FHA mortgage insurance?

Borrowers may be allowed to deduct such interest (including FHA mortgage insurance premiums as described by IRS rules) when they have filed a Form 1040 and itemized deductions. The mortgage must be "a secured debt on a qualified home in which you have an ownership interest."

Why does my 1098 not show mortgage insurance premiums?

In the past, there's been a deduction for mortgage insurance premiums, but the law that would allow this deduction this year is still under review. That is probably why your lender did not report it on your 1098. If you do not know the amount of mortgage insurance you paid in 2018, contact your lender.

What part of closing costs are tax deductible?

Typically, the only closing costs that are tax deductible are payments toward mortgage interest, buying points or property taxes. Other closing costs are not. These include: Abstract fees.

How do I know if my PMI is tax deductible?

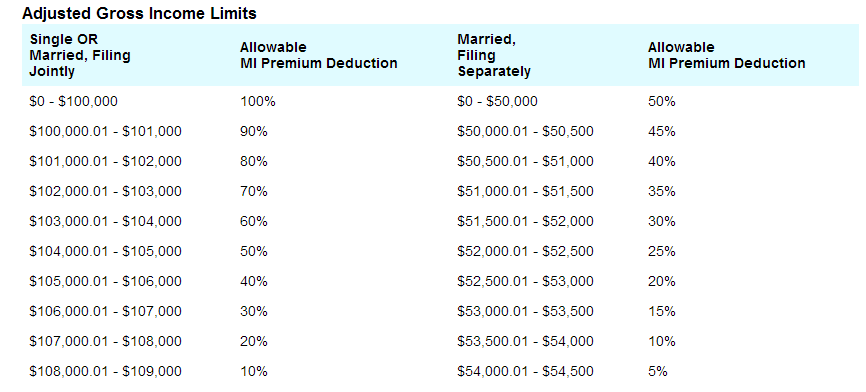

If your adjusted gross income (AGI) is over $100,000, then the PMI deduction begins to phase out. Between $100,000 and $109,000 in AGI, the amount of PMI you can claim is reduced by 10% for each $1,000 in increased income. Once you hit $109,000 in AGI, you are no longer eligible to claim a PMI tax deduction.

Can I write off PMI?

Finally, while there is no statutory limit on the amount of PMI premiums you can deduct, the amount might be reduced based on your income. The deduction begins phasing out when a homeowner's adjusted gross income, or AGI, is more than $100,000.

Is upfront PMI tax deductible?

Up front PMI paid has to be spread over a 84 month period or the life of the loan, whichever is less. It is deductible on your federal income tax return as an itemized deduction on Schedule A.

How does FHA MIP refund work?

If you refinance your FHA loan within 12 months, you'll receive a refund of 58% of your upfront payment. If you wait until 3 years to refinance, you'll receive a refund equal to just 10% of your upfront payment. You won't receive your refund as a cash payment.

Can you deduct mortgage insurance premiums in 2019?

Mortgage insurance premiums. You can claim the deduction on line 8d of Schedule A (Form 1040 or 1040-SR) for amounts that were paid or accrued in 2019.

What is the upfront premium on a mortgage?

The upfront premium is 1.75 percent of the amount you’re borrowing as of 2020. The annual fee, typically broken up into 12 payments a year over the lifetime of the mortgage, runs from 0.45 to 1.05 percent of your mortgage balance. You can include the upfront payment in your overall loan amount so you don’t have to come up with ...

Will the tax deduction disappear in 2021?

Given its on-again-off-again history, this tax deduction might not disappear for all time on Jan. 1, 2021. Keep your eye on the news so you’ll know if Congress renews it for another year or more. This deduction isn’t technically part of the Internal Revenue Code, but rather a gift that Congress periodically throws to the taxpaying masses.

Can you deduct mortgage premiums from your taxes?

The IRS allows you to deduct these premiums from your taxable income, at least through 2020. But, of course, there are rules. Mortgages taken out before Jan. 1, 2007 fail to qualify, but a loophole allows the deduction if you refinance a mortgage that was originated before the deadline.

Is FHA mortgage insurance a tax deduction?

It can increase your monthly payments, and your closing costs as well. But the federal government takes pity. It’s provided a tax deduction for this expense over the years, although in fits and start s.

Can you deduct mortgage insurance premiums?

You can deduct the full amount of the insurance premiums you pay if your AGI falls below these limits. Otherwise, the IRS provides a Mortgage Insurance Premiums Deductible Worksheet on its website to help you calculate how much of a deduction you’re entitled to claim, as well as an interactive calculator online.

What does it mean to apply for an FHA mortgage?

One thing applying for an FHA mortgage teaches many people is to pay close attention to the bottom line, watching ever dollar that goes out. Measuring the value of money spent and time invested also means getting to know your tax situation better.

What is home mortgage interest?

Reference that with another IRS rule which says "Generally, home mortgage interest is any interest you pay on a loan secured by your home (main home or a second home). The loan may be a mortgage to buy your home, a second mortgage, a line of credit, or a home equity loan.".

Can you deduct FHA mortgage insurance premiums?

Borrowers may be allowed to deduct such interest (including FHA mortgage insurance premiums as described by IR S rules) when they have filed a Form 1040 and itemized deductions. The mortgage must be "a secured debt on a qualified home in which you have an ownership interest.".

When was the last year that mortgage insurance was tax deductible?

Craig Anthony. Updated Mar 21, 2021. The last year that the tax deduction for private mortgage insurance (PMI), also known as mortgage insurance premium (MIP), was allowed was for tax year 2017—but only for mortgages taken out or refinanced after Jan. 1, 2007. 1 2 Note that the Further Consolidated Appropriations Act of 2020 allows MIP ...

How much does PMI cut your taxes?

The deduction for PMI cuts your taxable income by $1,500. If you’re in the 12% tax bracket, you save $180 on your tax bill ($1,500 x 12%), and if you’re in the 22% tax bracket, you save $330 ($1,500 x 22%).

When does mortgage insurance expire?

Initially, this deduction for premiums expired on Dec. 31, 2017 due to the Tax Cuts and Jobs Act of 2017. The Further Consolidated Appropriations Act extended the deduction through Dec. 31, 2020. This made the deduction available for the 2019 and 2020 tax years, and retroactively for 2018 taxes. If certain requirements were met, mortgage insurance ...

Can I cancel PMI if I have 20% equity?

A step better than a tax deduction, getting rid of PMI altogether is even nicer. A homeowner can cancel PMI when they have 20% equity in your home. 8

Is PMI tax deduction allowed for 2018?

3 The PMI tax deduction is no longer allowed for tax year 2018, but that could change.

What happens if you put down less than 20 percent on your mortgage?

If you put down less than 20 percent when you purchased your home, chances are you're paying mortgage insurance. While the deductibility of PMI premiums has been an on-again, off-again affair for years, homeowners are again in luck, as it is "on again" through tax year 2020.

Is PMI premium deductible for 2020?

The "extenders" in the "Further Consolidated Appropriations Act, 2020" also made PMI premiums retroactively deductible for the tax year 2018, which they previously weren't. If you filed with itemized deductions on Schedule A back in 2018, you might consider filing an amended tax return, to capture the MI deduction for that year, ...

How much can I deduct for PMI?

So if you paid $2,000 in upfront PMI premiums on Jan. 1, 2019, you might be able to deduct $286 on your 2019 taxes ($2,000 / 84 x 12). You could deduct another $286 for tax year 2020. But deducting the rest depends on whether Congress extends the provision beyond 2020. And deductions are only a thing if you itemize.

How does the tax law affect home ownership?

How the New Tax Law Affects Home Ownership 1 A Veterans Administration (VA) or USDA Rural Housing-guaranteed loan, the upfront fee will be labeled “funding fee” or “guarantee fee.” 2 An FHA loan, it’ll be listed as “upfront fee.” 3 Private mortgage insurance, an upfront fee is a “single premium,” and it’s likely labeled MIP (mortgage insurance premium). 4 No up front fee, and you do have mortgage insurance, you likely got a monthly payment policy.

What is upfront mortgage insurance?

An upfront mortgage insurance payment is different than monthly payments for mortgage insurance. Check the settlement statement you got at closing, i.e. the sheet showing what you paid and what the home seller paid when you closed on your home purchase. If you have:

Is mortgage insurance back on my taxes?

The mortgage insurance deduction is back — at least through 2020. But only if you itemize. If you paid a really big upfront mortgage insurance premium at the closing table, you may be able to recoup some of that cost by deducting your payments on your federal income tax return. There are a couple of caveats, however.

Is mortgage insurance good for first time buyers?

The upside is that it’s a good deal for aspiring homeowners. Many people, especially first-time buyers, can’t come up with big down payments. Mortgage insurance encourages lenders to give home loans to those who have the means to pay a mortgage but lack the hefty down payment.

Is there an upfront fee for FHA?

An FHA loan, it’ll be listed as “upfront fee.”. Private mortgage insurance, an upfront fee is a “single premium,” and it’s likely labeled MIP (mortgage insurance premium). No up front fee, and you do have mortgage insurance, you likely got a monthly payment policy.

How much can I save in taxes if I have 20%?

And if you’re in the 20% tax bracket, your annual tax savings would be around $240 per year. Of course, rather than saving through tax deductions, the best way to save is to get rid of your PMI payments entirely. While naturally this isn’t always possible, one way to reduce your PMI premiums is to work with an expert real estate agent who can help ...

How much equity do you need to pay for PMI?

You’ll pay monthly PMI costs until you’ve accumulated enough equity in your home. Essentially, once you’ve built up at least 20% equity, the lender doesn’t see you as a high risk anymore and you’ll be able to cancel your private mortgage insurance. Once the mortgage’s loan-to-value ratio drops to 78%, the lender is required to automatically cancel ...

What is the down payment for a mortgage?

To obtain financing on a home with a down payment of less than 20%, your lender will likely require you to purchase private mortgage insurance as a condition of your mortgage loan. If you offer a down payment between 5% and 19.99%, your lender sees you as a higher risk. Private mortgage insurance helps protect the lender if you suddenly lose your ...

When will PMI be extended?

As of now, PMI tax deductions have been extended through the end of 2021. And until Congress extends PMI deductions again, it’s uncertain whether you’ll be able to take advantage of these deductions in 2022.

Is PMI tax deductible for 2021?

In short, yes, PMI tax is deductible for 2021.

Can I deduct my PMI premium?

Understandably, you’d like to be able to deduct your PMI to take some of the stress and strain out of paying your premiums. To know if your PMI is deductible, you’ll need to meet some basic requirements. The first is your annual income. If your adjusted gross income for the year is $109,000 or more, you’re not qualified for a PMI deduction.

Can you claim PMI if you are married?

For married couples filing separately, if each partner earns more than $54,500, you also won’t be able to claim a PMI tax deduction. If your combined household adjusted gross income is less than $100,000, your PMI is entirely tax deductible.

How long do you have to allocate mortgage insurance premiums?

You must allocate the premiums over the shorter of the stated term of the mortgage or 84 months, beginning with the month the insurance was obtained. No deduction is allowed for the unamortized balance if the mortgage is satisfied before its term. This paragraph does not apply to qualified mortgage insurance provided by the Department of Veterans Affairs or the Rural Housing Service.

When is a taxpayer considered to have incurred the home acquisition debt?

A taxpayer who enters into a written binding contract before December 15, 2017, to close on the purchase of a principal residence before January 1, 2018, and who purchases such residence before April 1, 2018, is considered to have incurred the home acquisition debt prior to December 16, 2017.

What happens if you pay off your mortgage early?

If you pay off your home mortgage early, you may have to pay a penalty. You can deduct that penalty as home mortgage interest provided the penalty isn't for a specific service performed or cost incurred in connection with your mortgage loan.

What is home mortgage interest?

Generally, home mortgage interest is any interest you pay on a loan secured by your home ( main home or a second home). The loan may be a mortgage to buy your home, or a second mortgage.

How to figure out home acquisition debt?

To figure your home acquisition debt, you must divide the cost of your home and improvements between the part of your home that is a qualified home and any part that isn't a qualified home. See Divided use of your home under Qualified Home in Part I, earlier.

Is mortgage insurance deductible on Schedule A?

Mortgage insurance premiums. The itemized deduction for mortgage insurance premiums has been extended through 2020. You can claim the deduction on line 8d of Schedule A (Form 1040) for amounts that were paid or accrued in 2020.

Is interest on a home equity loan deductible?

Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy, build, or substantially improve the taxpayer’s home that secures the loan. The loan must be secured by the taxpayer’s main home or second home (qualified residence), and meet other requirements.