Is it really necessary to balance your checkbook?

While balancing a checkbook is certainly not required for someone who never writes checks, it is important that everyone does some form of reconciliation. In fact, reconciliation a bank account has slowly become the new form of balancing a checkbook in a way that is appropriate for the 21st century.

How to balance your checkbook in 10 Easy Steps?

Steps for Balancing Your Checkbook

- Print your last bank statement and record any interest earned on your register book or on your excel sheet. ...

- Now do the same with charges taken from the account, like check or monthly services charges, ATM and/or insufficient funds fees. ...

- Now make sure all the deposits on the statement match the ones you have previously recorded on your register. ...

What does it mean if you "balance your checkbook"?

- When you balance a checkbook, you compare your bank statement to the records in your checkbook.

- Balancing your checkbook may help with identifying errors and keeping track of payments.

- If you don't use physical checks often, you'll still want to monitor your spending.

- Read more stories from Personal Finance Insider.

Why you should balance your checking account?

Why You Should Balance Your Checking Account

- Keeping Track. So why bother doing these exercises? ...

- Money Management. St. ...

- Fraud and Fees. Other reasons to go through the exercise of balancing, reconciling and reviewing an account are to spot financial management mistakes and fraudulent activity, says Alan Moore, a ...

Do you really need to balance your checkbook?

Why Balance Your Checkbook? Even today, when much (if not all) of your transaction information is available with the click of a button, it's still a good idea to maintain a record of your transactions and regularly balance that record.

Should you balance your checkbook every month?

If you're using the checkbook register method and comparing transactions with your account statement, you should balance your checkbook every month. If you're using online banking or mobile banking to track your accounts, you can log in daily to view new credit and debit transactions as well as balance information.

Do people balance a checkbook anymore?

It's not just the checks written you want to keep track of. It's every debit and credit transaction. Although balancing a checkbook might have been more common for your grandparents, looking over your transactions and receipts are as relevant today as in decades past. Basically, it's the modern-day checkbook balancing!

How often should you balance your checking account?

You should monitor your checking account at least once or twice a week. The more activity and transactions you make, the more often you should check your account. You should check your balance and your transactions for accuracy. We make it easy to manage your account with online banking and our mobile app.

What percentage of people balance their checkbooks?

According to StatisticBrain.com, 79 percent of us never or rarely balance our checkbooks.

What is the best way to balance a checkbook?

Eight Steps to BalancingRecord Interest Earned. ... Record Service Charges, Etc. ... Verify Deposit Amounts. ... Match All Check Entries. ... If Transactions Don't Match. ... To Correct the Errors. ... Check for Outstanding Items from Previous Statements. ... Verify Other Debits on Statement.More items...

How do you balance a checkbook that has never been balanced?

Total all outstanding checks (the ones not found on the statement yet). Subtract this total from the ending balance your bank/credit union is showing. Total all outstanding deposits. Add this to the number you arrived at after subtracting the outstanding checks.

Why would it still be useful to balance and reconcile your checking account?

Reconciling your spending with your balance helps prevent overspending, which could lead to overdraft fees or checks being returned due to insufficient funds. A great way to stay ahead of spending is to keep a running balance of what's available in your account.

What is the difference between book balance and bank balance?

Difference between Book Balance and Bank Balance The cash balance recorded by the corporation or company in their company's cash book is known as cash book balance. The balance on the bank statement is the cash balance that is recorded by the bank in bank records.

How often does the average person check their bank account?

According to a Lexington Law survey, 36% of Americans say they review their checking account daily, while 30% check it once weekly. There are several good reasons to keep a close eye on your banking activity, particularly if you're concerned about preventing fraud or minimizing fees.

Do banks track your spending?

The bank is able to review spending trends for the past 12 months and help people set a budget. The bank's philosophy is that it's not just big events that require some planning and a heads up. Little everyday moments need some financial planning, too.

Can banks see your balance?

Can bank tellers see your account balance? Yes. Bank tellers have access to your account balance. They can tell how much money is in your account.

How often should you update a check register?

It is important to be diligent about updating your check register with each transaction so it serves as a reliable source of your financial activity. When you write a check or use your debit card, you should record the transaction in your check register immediately.

What is the difference between book balance and bank balance?

Difference between Book Balance and Bank Balance The cash balance recorded by the corporation or company in their company's cash book is known as cash book balance. The balance on the bank statement is the cash balance that is recorded by the bank in bank records.

Why would it still be useful to balance and reconcile your checking account?

Reconciling your spending with your balance helps prevent overspending, which could lead to overdraft fees or checks being returned due to insufficient funds. A great way to stay ahead of spending is to keep a running balance of what's available in your account.

What is the first step in balancing a checkbook?

How to balance a checkbook in 6 stepsGet out your checkbook register or make one. ... Write down your starting balance. ... Record credits, income and interest earned. ... Record all payments and fees. ... Check your statement. ... Investigate mismatched numbers.

What to do when you receive a bank statement?

When you receive your statement in the mail, you should sit and cross-check your transactions from the bank statement. Examine what the bank says against the information you have already written in your register. This is a great way to identify missed transactions or mistakes you may have made in transposing numbers.

Why do you need to keep receipts for debit card purchases?

If you frequently make transaction using your debit card for purchases, it may be wise to also keep your payment receipts to ensure the bank has deducted the transaction amount properly. These receipts will be the only way to prove your case in the event you have been overcharged.

Why do you highlight items you don't remember?

By highlighting the items you question or do not remember, you can identify incidents of fraud quickly and have the resolved within a reasonable time frame. If you are constantly updating your checkbook, you have the notes you need to remember the purpose of your transactions which makes finding mistakes or unauthorized usage easier to identify.

Can you find bank errors?

Many people may be writing down transactions in their checkbook but they are making a financially fatal mistake by only copying down what their online banking statement provides. While technically you may be able to find bank errors, most people attribute inconsistencies to their own mistakes.

Is it good to balance your checkbook?

It is still very useful to balance your checkbook. Here are 4 good reasons to always keep a balanced checkbook. Even with the proliferation of personal financial management tools, there are still folks that have no idea the true amount of cash they have in the bank at any one time.

Is keeping a checkbook balanced a personal finance skill?

Keeping a checkbook balanced is part of Personal Finance 101. It should continue to be a skill that is taught to teens and continually practiced by adults. Imagine for just a second that technology fails for a few days. Would you know how to survive? Would you be able to confirm exactly what is available in your bank account? While we may not foresee such a situation where this would happen, the reality is things do happen. You cannot solely rely on electronic banking to maintain your money accurately.

Why is it important to balance your checkbook?

Balancing your checkbook each month is an important way to see how much you are spending, how much in fees you are paying, and any errors that may have occurred. This also helps minimize any overdraft fees or other penalties that you may incur from these discrepancies.

What happens if you write a check for more than the amount in your account?

If you write a check for MORE than the amount in your account, the check will “BOUNCE” and multiple fees will be issued. AVOID BOUNCING CHECKS – the practice is a clear indicator of fiscal irresponsibility and financial laziness.

Is it important to know the amount of money in your checking account?

As you can begin to see, it is extremely important to always know the ACTUAL amount available in your checking account and not just the ending balance in your bank statement.

Does the ending balance on a bank statement match the ending balance on a checkbook?

More often than not, the ending balance on your bank statement will NOT match the ending balance on your checkbook. Do not be alarmed. There are transactions that may have not posted yet by the time the bank issued their statement. It is important to reconcile these numbers so you know the actual amount in the account that is available to write checks with.

Why is it important to keep track of your money?

When you start to track every transaction, you might be surprised to find how much you are spending on something that isn’t adding much value to your life. Thus, you can start to prioritize your spending and work on achieving your financial goals instead.

Can you keep track of paper checks?

These days, you can do things digitally instead. Thus, you may not actually be keeping track of paper checks you have written; instead, you might keep track of all your transactions. In doing so, you know exactly how much you spend each month, helping you stay on budget.

Can you balance your checkbook digitally?

Unless you are still writing paper checks, you won’t actually have a checkbook to balance digitally. You can, however, balance your budget to ensure you aren’t spending too much in any given area. And even if you are just managing your digital transactions, many of the same skills apply from balancing a checkbook.

What does it mean to balance a checkbook?

To “balance a checkbook” — in its literal and maybe old-fashioned sense — means going through your bank statement and checking each transaction against what you’ve recorded in your check register. The idea is to make sure everything is accurate, that your balance is correct, and that your records and the bank’s are in sync.

What does "balancing your checkbook" mean?

While we might still use the phrase “balancing your checkbook,” you can take it more generally to mean tracking all of your account activity and making sure your records match your bank’s — whether you use a checkbook register or other tools.

What is a checkbox in a checkbook register?

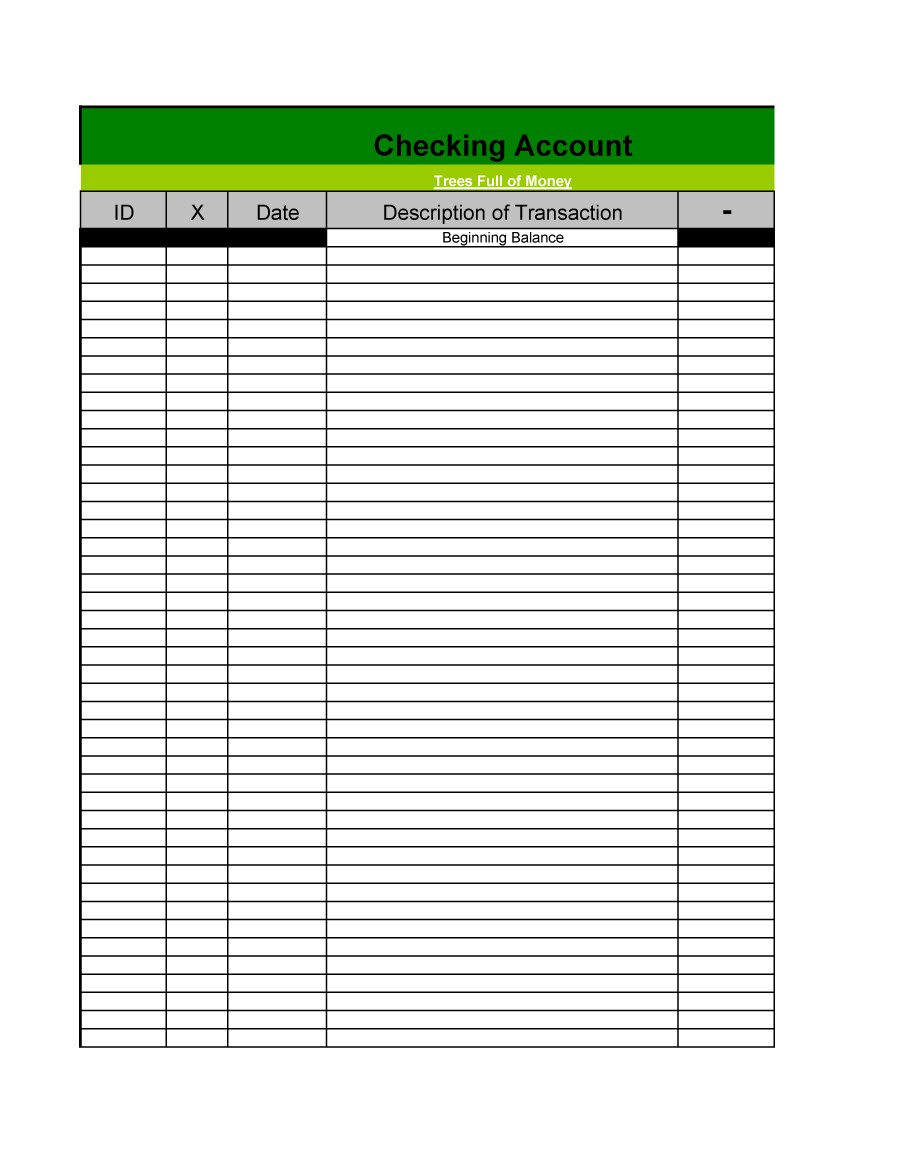

If you’re using a paper checkbook register, there’ll be a little column with a checkbox in it to mark cleared charges. If you’re using a spending tracker, it’ll look a bit different depending on the program you use.

Where do you record transactions when you write a check?

Any time you write a check, make a payment using your debit card, or initiate any other kind of debit or withdrawal, always record the transactions in your spending tracker or checkbook ledger.

Why do you update your balance when you enter a new transaction?

This will be your actual balance, which is a better picture of how much you have to spend because it includes payments that might not have hit your bank account yet.

Does your bank statement match your checkbook register?

Your bank statement balance will exactly match the cleared charges from your checkbook register. That is, your cleared charges on your register and your bank statement will be the same. There may be some additional charges on your checkbook register that aren’t listed on your bank statement.

Can you use a check register to balance your checkbook?

But most people use checks very little these days, if at all — so tools like Microsoft Excel spreadsheets or Google Sheets, or spending trackers like YNAB or Mint, might make a lot more sense than using your check register to balance your checkbook and keep track of your account. Along with allowing you to easily record lots of different types of transactions, these digital tools also can help you budget and do the math for you — things a checkbook register can’t do.