Do I need to pay a PMI If I have a FHA loan?

So, technically speaking, PMI is not required for an FHA loan . But you'll still have to pay a government-provided insurance premium, and it might be required for the full term, or life, of the mortgage obligation.

How much PMI will I pay on FHA?

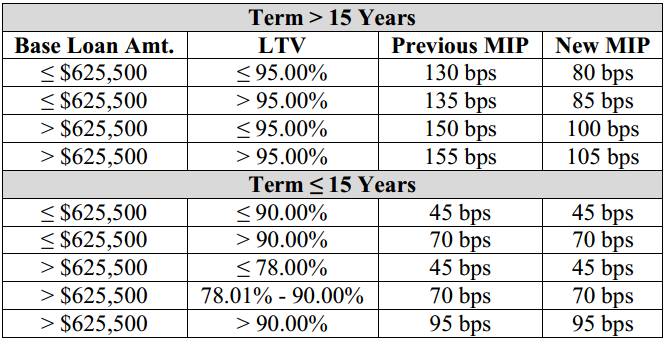

You will pay an annual mortgage insurance premium between .45 and 1.05% basis points depending on the loan-to-value ratioand loan amount. This is actually a great deal; the FHA mortgage insurance premium used to be over 1%. However, it was recently lowered per Mortgagee Letter 2015-01.

How to avoid paying PMI with a FHA loan?

You must also do the following to cancel PMI:

- Make the PMI cancellation request to your lender or servicer in writing.

- Be current on your mortgage payments, with a good payment history.

- Meet other lender requirements, such as having no other liens on the home (i.e., a second mortgage).

- If required, you might need to get a home appraisal. ...

Does PMI ever go away on FHA loans?

Typically, the minimum 3.5% down payment is chosen. Therefore, the FHA PMI will continue for the life of the loan. Although, the PMI does go down each year. The mortgage insurance premium is based on the mortgage balance at each annual anniversary. Since the balance decreases, so does the PMI until the loan is satisfied.

Can PMI be waived on FHA loan?

These FHA mortgage loans are not eligible for automatic mortgage insurance cancellation. To stop paying mortgage insurance premiums you'd need to refinance out of your FHA loan. The good news is that there are no restrictions on refinancing out of FHA into a conventional loan with no PMI.

How can I avoid paying PMI on an FHA loan?

One way to avoid paying PMI is to make a down payment that is equal to at least one-fifth of the purchase price of the home; in mortgage-speak, the mortgage's loan-to-value (LTV) ratio is 80%. If your new home costs $180,000, for example, you would need to put down at least $36,000 to avoid paying PMI.

How long do you have to have PMI on a FHA loan?

If your loan balance is 78% of your original purchase price, and you've been paying FHA PMI for 5 years, your lender or service must cancel your mortgage insurance today — by law. While a low mortgage balance is a sure-fire way to cancel FHA mortgage insurance, it can take a while to get there.

Why do I have to pay PMI on FHA?

Mortgage insurance protects lenders from losing money if you default on the loan. Most lenders require private mortgage insurance (PMI) for conventional loans when the home buyer makes a down payment of less than 20%. The same goes for refinancers with less than 20% equity.

How can I avoid PMI with 5% down?

The traditional way to avoid paying PMI on a mortgage is to take out a piggyback loan. In that event, if you can only put up 5 percent down for your mortgage, you take out a second "piggyback" mortgage for 15 percent of the loan balance, and combine them for your 20 percent down payment.

Is it better to put 20 down or pay PMI?

PMI is designed to protect the lender in case you default on your mortgage, meaning you don't personally get any benefit from having to pay it. So putting more than 20% down allows you to avoid paying PMI, lowering your overall monthly mortgage costs with no downside.

How can I get rid of PMI without 20% down?

To sum up, when it comes to PMI, if you have less than 20% of the sales price or value of a home to use as a down payment, you have two basic options: Use a "stand-alone" first mortgage and pay PMI until the LTV of the mortgage reaches 78%, at which point the PMI can be eliminated. 2. Use a second mortgage.

When can PMI be removed?

You have the right to request that your servicer cancel PMI when you have reached the date when the principal balance of your mortgage is scheduled to fall to 80 percent of the original value of your home. This date should have been given to you in writing on a PMI disclosure form when you received your mortgage.

Is PMI deductible in 2021?

Taxpayers have been able to deduct PMI in the past, and the Consolidated Appropriations Act extended the deduction into 2020 and 2021. The deduction is subject to qualified taxpayers' AGI limits and begins phasing out at $100,000 and ends at those with an AGI of $109,000 (regardless of filing status).

Is PMI always required?

Key Takeaways. Lenders require borrowers to pay PMI when they can't come up with a 20% down payment on a home. PMI can be removed once a borrower pays down enough of the mortgage's principal. A homebuyer may be able to avoid PMI by piggybacking a smaller loan to cover the down payment on top of the primary mortgage.

How is PMI calculated on a FHA loan?

Divide the loan amount by 100 and you will get the annual MIP amount. The FHA requires you to pay MIP in monthly installments, therefore, you can divide the annual amount by 12 to get the monthly payment for MIP: $679,650 / 100 = $6,796.50; $6,796.50 / 12 = $566.375.

Is it worth refinancing to remove PMI?

Is it worth refinancing to remove mortgage insurance? It's worth refinancing to remove PMI mortgage insurance if your savings will outweigh your refinance closing costs. The current climate of low interest rates offers a chance to get out of a loan with higher interest rates while also eliminating mortgage insurance.

What are FHA loan mortgage insurance requirements?

The first thing to understand is that all FHA loans require mortgage insurance. This is different than the PMI you might need to pay when you get a...

How much is mortgage insurance on an FHA loan?

The cost of FHA loan mortgage insurance depends on your loan amount, your loan-to-value ratio ("LTV"), and your mortgage term. This means the cost...

How to stop paying FHA loan mortgage insurance?

For recent FHA loans, you will need to pay insurance premiums for at least 11 years and you may need to pay them for the life of the loan. Some FHA...

What does PMI mean on a mortgage?

PMI stands for private mortgage insurance. This protection is typically required whenever a home loan accounts for more than 80% of the purchase price (which occurs when the borrower makes a down payment below 20% in a single-mortgage scenario). But the key word here is “private.”. PMI applies to conventional loans that do not have any kind ...

Do you have to pay your mortgage insurance premium for the life of the loan?

To answer your second question: Yes, you could end up paying your annual premium for the life of the loan, depending on the size of your down payment.

Is PMI required for FHA?

So, technically speaking, PMI is not required for an FHA loan. But you’ll still have to pay a government -provided insurance premium, and it might be required for the full term, or life, of the mortgage obligation.

Do FHA loans require PMI?

FHA Loans Require Mortgage Insurance, But Not PMI. All home loans insured by the Federal Housing Administration require insurance to protect the lender — it’s just not the “private” kind. So the policies applied to FHA loans are simply referred to as mortgage insurance premiums, or MIPs.

Does FHA require insurance on down payment?

As you can see, whenever the LTV is greater than 90% (meaning the borrower makes a down payment below 10%), FHA annual mortgage insurance is required for the life of the loan. This is true for all purchase loans regardless of the length of the term, as indicated in the first column of the table.

What is PMI insurance?

If a borrower can't afford that amount, a lender will likely look at the loan as a riskier investment and require that the homebuyer take out PMI, also known as private mortgage insurance, as part of getting a mortgage. 1 .

How to avoid PMI?

If a homebuyer doesn't have the funds for a 20% down payment, it's possible to avoid PMI by taking out two loans—a smaller loan (typically at a higher interest rate) to cover the amount of the 20% down, plus the main mortgage. This practice is commonly known as piggybacking. 5 .

How much does PMI cost?

PMI costs between 0.5% and 1% of the mortgage annually and is usually included in the monthly payment. PMI can be removed once a borrower pays down enough of the mortgage's principal. A homebuyer may be able to avoid PMI by piggybacking a smaller loan to cover the down payment on top of the primary mortgage.

Is PMI required on 2 loans?

Although the borrower is committed on two loans, PMI is not required since the funds from the second loan are used to pay the 20% deposit. Some borrowers can deduct the interest on both loans on their federal tax returns if they itemize their deductions. 6 .

Is PMI permanent?

PMI isn't permanent —it can be dropped once a borrower pays down enough of the mortgage's principal. Provided a borrower is current on their payments, their lender must terminate PMI on the date the loan balance is scheduled to reach 78% of the original value of the home (in other words, when the equity reaches 22%). 2 . ...

Does a mortgage lender pay PMI?

2 . PMI is usually paid monthly as part of the overall mortgage payment to the lender, but sometimes it is paid as a one-time up-front premium at closing. PMI isn' t permanent— it can be dropped once ...

Can I avoid PMI on a mortgage?

It may be possible to avoid PMI by taking out the main mortgage plus a smaller loan to cover the costs of a 20% down payment. However, for first-time homebuyers, PMI may be worth the extra money for the mortgage—and at tax time, ...

What is FHA insurance?

FHA mortgage insurance is strictly to prevent losses incurred due to loan default/foreclosure. ------------------------------. RELATED VIDEOS:

What is the difference between FHA and conventional mortgages?

FHA home loans differ from their conventional loan counterparts in some important ways including the requirements for mortgage insurance. Conventional mortgages require private mortgage insurance (PMI) unless the borrower makes a specific, lender-prescribed percentage down payment that eliminates the need for the insurance.

How long does a mortgage insurance policy last?

Depending on the terms and conditions of your home loan, most FHA loans today will require MIP for either 11 years or the lifetime of the mortgage. FHA mortgage insurance is not the same as private mortgage insurance, and borrowers should discuss how FHA mortgage insurance premiums differ from conventional loan PMI if the borrower has concerns.

How much down payment is required for FHA?

FHA mortgage loans are different. They require a minimum 3.5% down payment for most transactions; borrower credit score issues may require a higher down payment depending on a set of variables including lender requirements and the borrower’s credit history.

Can you partially finance UFMIP?

You cannot partially finance the UFMIP, which is a standard closing cost for FHA mortgages. The UFMIP is a one-time charge, the FHA mortgage insurance premium is included as part of your monthly mortgage payment, or is paid as the legally binding loan agreement dictates.

Can you cancel MIP on FHA loans?

At one time, FHA loans allowed borrowers to cancel their mortgage insurance premium (MIP) once the Loan-To-Value ratio got to a certain point. But changes in FHA loan regulations eliminates this option.

What is an FHA loan?

The FHA Loan is the type of mortgage most commonly used by first time home buyers and there's plenty of good reasons why. FHA Loan Guide. Learn About FHA Requirements! FHA.com is a privately-owned website that is not affiliated with the U.S. government. Remember, the FHA does not make home loans.

What is mortgage insurance?

Mortgage insurance is a policy that protects lenders against losses that result from defaults on home mortgages. FHA requires both upfront and annual mortgage insurance for all borrowers, regardless of the amount of down payment.

What is the minimum credit score for a mortgage in 2021?

June 29, 2021 - On paper, FHA loan minimums for credit scores start at 580 for the lowest down payment. Its true that the lender may require a higher score, but for FHA mortgages, 580 is the bare minimum FICO score you can have and still be considered for maximum financing.

Is FICO the only thing a mortgage officer will look at?

It’s easy for a newcomer to the mortgage loan process to make certain assumptions, but there are some realities you should be aware of. The FICO score is not the only thing your loan officer will look at. Mortgage Rates and Credit Scores .

Why do I need PMI?

This is in order to protect the lender from losses in case you, the borrower, can no longer make payments and default on the loan. The PMI is then used to reimburse the lender. Private mortgage insurance is normally paid monthly, but in some cases there is an option to make a large upfront payment. The amount depends on the down payment made on ...

How much down payment do I need to pay for PMI?

There are ways for you to avoid paying the PMI on your mortgage: Make a down payment of at least 20 percent of the mortgage. If your loan-to-value ratio drops lower than 80 percent, you don’t have to pay for mortgage insurance. Depending on your payment habits, this can take a few years.