In the past, purchase discounts were considered as financial management income. However, modern accounting theory holds that income is not derived from a purchase but rather from a sale or an exchange and that purchase discounts are reductions in the cost of whatever was purchased.

What type of account is purchase discounts on income statement?

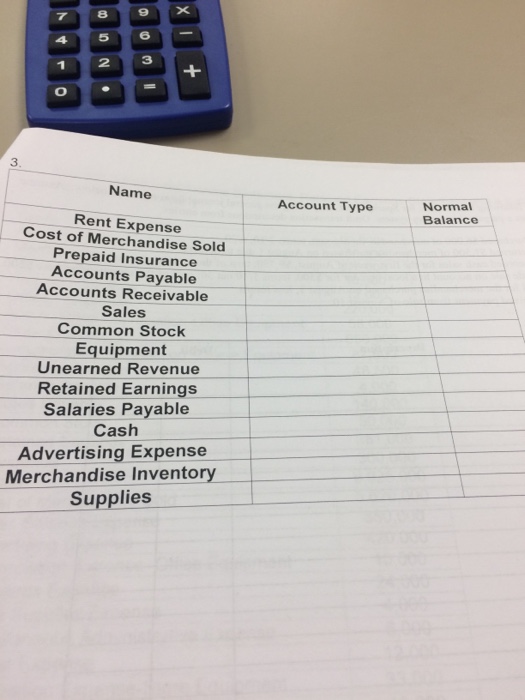

Purchase discounts is a contra revenue account. Revenue accounts carry a natural credit balance; purchase discounts has a debit balance as a contra account. On the income statement, purchase discounts goes just below the sales revenue account.

What are purchase discounts returns and allowances?

Purchase Discounts, Returns and Allowances are contra expense accounts with a credit balance, which are used to offset the Purchase expense account that normally carries a debit balance in order to report the net value of purchases made by a business in an accounting period on its income statement.

What is the difference between sales revenue and purchase discounts?

Revenue accounts carry a natural credit balance; purchase discounts has a debit balance as a contra account. On the income statement, purchase discounts goes just below the sales revenue account. The difference between the two results in net sales revenue.

Is purchase discount normal balance a debit or credit?

The purchases discounts normal balance is a credit, a reduction in costs for the business. The discount is recorded in a contra expense account which is offset against the appropriate purchases or expense account in the income statement. Purchase Discount Not Taken

Is a purchase discount an expense or income?

Purchase Discounts is a contra expense account with a credit balance that records the value of purchase cost deductions granted by a seller if a buyer makes a payment within an allowable time period, used as an incentive to encourage prompt payment of invoices.

Is purchase discount an asset?

When the buyer receives a discount, this is recorded as a reduction in the expense (or asset) associated with the purchase, or in a separate account that tracks discounts.

What are purchase discounts classified as?

(1) Purchase discounts have been classified as cash, trade, or quantity discounts. Cash discounts are reductions granted for the settlement of debts before they are due. Trade discounts are reductions from list prices granted to a class of customers before consideration of credit terms.

Is purchase discount an income statement or balance sheet?

Companies that take advantage of sales discounts usually record them in an account named purchases discounts, which is another contra‐expense account that is subtracted from purchases on the income statement.

How is purchase discount treated in the income statement?

Purchase discounts is a contra revenue account. Revenue accounts carry a natural credit balance; purchase discounts has a debit balance as a contra account. On the income statement, purchase discounts goes just below the sales revenue account. The difference between the two results in net sales revenue.

How do you record purchase discounts?

Accounting for Early Pay Discounts: Gross Method When you pay the invoice, debit accounts payable for the total amount, credit your purchases discount account for the amount of the discount and credit cash for the difference between the invoice and the discount, explains Corporate Finance Institute.

Where do discounts go on income statement?

Reporting the Discount Report the amount of total sales discounts for an accounting period on a line called “Less: Sales Discounts” below your sales revenue line on your income statement. For example, if your small business had $200 in discounts during the period, report “Less: Sales discounts $200.”

Are discounts part of income statement?

Sales discounts only appear as expenses on the income statement, and not on the balance sheet. Another term for sales discounts is cash discounts or early payment discounts.

How do you record discounts on an income statement?

The discount allowed is accounted for as an expense of the seller. Hence, it is debited while making accounting entries.

Are purchase discounts included in gross profit?

Gross income represents the total income from all sources, including returns, discounts, and allowances, before deducting any expenses or taxes. Gross profit is the profit a company makes after deducting the costs of making and selling its products, or the costs of providing its services.

What type of account is purchase discounts lost?

What is Purchase Discounts Lost? Purchase discounts lost is a general ledger account that contains the amounts a business did not save through its failure to take early payment discounts offered by suppliers.

Do discounts go on the balance sheet?

A discount offered on receivables can have a direct effect on your balance sheet if a customer chooses to take advantage of the discount when they are not eligible. This will leave an outstanding receivable on the balance sheet in the amount of the discount, unless you opt for a bad-debt write-off for that portion.

What purchases are considered assets?

Assets include physical items such as machinery, property, raw materials and inventory, and intangible items like patents, royalties and other intellectual property.

Are purchase discounts included in inventory?

Purchase Discounts is also a general ledger account used by a company purchasing inventory goods and accounting for them under the periodic inventory system.

Where does discount on purchases go in final accounts?

The discount received is an income for the buyer. Hence, the balance of the discount received account is shown on the credit side.

What is the nature of purchase discount?

Purchase discount is an offer from the supplier to the purchaser, to reduce the payment amount if the payment is made within a certain period of time. For example, a purchaser bought a $100 item, with a purchase discount term 3/10, net 30. If he pays within 10 days, he will only need to pay $97.

What is purchase discount?

A purchase discount is a deduction that a company may receive if the supplier offers it and the company pays the supplier's invoice within a specified period of time.

How much can a company deduct on an invoice?

If a company purchases office equipment for $20,000 and the invoice has credit terms of 1/10, net 30, the company can deduct $200 (1% of $20,000) and remit $19,800 if the invoice is paid within 10 days.

What is a purchase discount?

The purchase discount is based on the purchase price of the goods and is sometimes referred to as a cash discount on purchases, settlement discount, or discount received.

Why do businesses take purchase discounts?

The purpose of a business taking purchase discounts is to reduce its costs. The downside of course is that the business must make payment earlier (10 days instead of 30 days in the above example) and will lose the use of the cash for an extra 20 days.

What happens if a business does not pay the invoice?

If the business does not pay within the discount period and does not take the purchase discount it will pay the full invoice amount of 1,500 to the supplier and the discount is ignored. In this instance the accounts payable balance is cleared by the cash payment and no purchase discount is recorded.

What is the gain to the business of paying 1,470 20 days earlier than expected?

If we use the example above, the gain to the business of paying 1,470 20 days earlier than expected was the purchase discount of 30. The ‘interest rate’ for the 20 days is calculated as follows.

When a business purchases goods on credit from a supplier, the terms will stipulate the date on which the amount outstanding?

When a business purchases goods on credit from a supplier the terms will stipulate the date on which the amount outstanding is to be paid. In addition the terms will often allow a purchase discount to be taken if the invoice is settled at an earlier date. The purchase discount is based on the purchase price of the goods ...

How much does a business earn on a payment discount?

By paying early and taking the payment discount the business effectively earns 37.23% on the funds it uses. Providing they have the funds or can borrow at a rate cheaper than 37.23% (in the above example), the business is better off borrowing and taking the discount. Last modified November 11th, 2019 by Michael Brown.

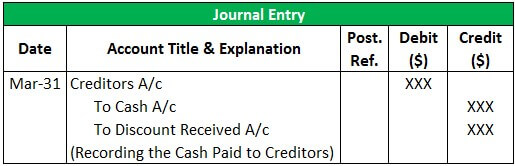

How many journal entries are required for purchase discounts?

Accounting for purchase discounts requires two journal entries.

What is a purchase discount?

A purchase discount reduces the purchase price of certain inventories, fixed assets supplies, or any goods or products if the buying party can settle the amount in a given time period.

What would be the subsequent journal entry if a company does not avail of a trade discount?

If the company does not avail of a trade discount, the subsequent journal entry would be to Debit – Accounts Payable and Credit – Cash/Bank.

Why does cash outflow early?

A large amount of cash will have to outflow early than it should be if the company decides to pay its supplier to get the cash discount. This could lead to a shortage of cash for purchase or operating expenses.

What is the purpose of paying less to a supplier?

Paying less to the supplier for the same amounts or services that the company purchased. These will reduce the expenses or cash-out flow of the company. The company will have the remaining cash or budget the remaining for purchase.

Is a purchase discount a revenue or expense?

Purchase discount is neither the revenues nor the expenses. However, the company could benefit by paying less to its suppliers for the same products or services that it purchases.

Do companies have to give up interest on savings?

The company will have to give up the interest on the deposit from the saving that it has with the bank.

Who has the chance to earn more as a result of the amount that is being withheld?

On the contrary, the debtor, who has purchased the goods, has a chance to earn more as a result of the amount that is being withheld.

What is a purchase discount?

(1) Purchase discounts have been classified as cash, trade, or quantity discounts. Cash discounts are reductions granted for the settlement of debts before they are due. Trade discounts are reductions from list prices granted to a class of customers before consideration of credit terms. Quantity discounts are reductions from list prices granted because of the size of individual or aggregate purchase transactions. Whatever the classification of purchase discounts, like treatment in reducing allowable costs is required. In the past, purchase discounts were considered as financial management income. However, modern accounting theory holds that income is not derived from a purchase but rather from a sale or an exchange and that purchase discounts are reductions in the cost of whatever was purchased. The true cost of the goods or services is the net amount actually paid for them. Treating purchase discounts as income would result in an overstatement of costs to the extent of the discount.

What is discount in accounting?

Discounts, in general, are reductions granted for the settlement of debts. (2) Allowances. Allowances are deductions granted for damage, delay, shortage, imperfection, or other causes, excluding discounts and returns. (3) Refunds. Refunds are amounts paid back or a credit allowed on account of an overcollection.

What is the true cost of goods or services?

The true cost of the goods or services is the net amount actually paid for them. Treating purchase discounts as income would result in an overstatement of costs to the extent of the discount. (2) As with discounts, allowances, and rebates received from purchases of goods or services, refunds of previous expense payments are clearly reductions in ...

What is discount and allowance?

Discounts and allowances received on purchases of goods or services are reductions of the costs to which they relate. Similarly, refunds of previous expense payments are reductions of the related expense. (1) Discounts.

What is quantity discount?

Quantity discounts are reductions from list prices granted because of the size of individual or aggregate purchase transactions. Whatever the classification of purchase discounts, like treatment in reducing allowable costs is required. In the past, purchase discounts were considered as financial management income.

Is a purchase discount considered financial management income?

In the past, purchase discounts were considered as financial management income. However, modern accounting theory holds that income is not derived from a purchase but rather from a sale or an exchange and that purchase discounts are reductions in the cost of whatever was purchased.

What is a purchase discount?

Purchase Discounts is a contra expense account with a credit balance that records the value of purchase cost deductions granted by a seller if a buyer makes a payment within an allowable time period, used as an incentive to encourage prompt payment of invoices.

What is purchase allowance?

Purchase Allowances is a contra expense account with a credit balance that records the value of purchase cost deductions granted by a seller in exchange for a buyer retaining damaged, incorrect or otherwise faulty goods instead of returning them to the seller.

What does it mean when a buyer debits cash in bank?

A buyer debits Cash in Bank if a purchase return or allowance involves a refund of a payment that the buyer has already made to a seller.

What is a return outwards account?

Purchase Returns, or Returns Outwards, is a contra expense account with a credit balance used by a buyer to record the value of previously purchased goods returned to a seller due to being damaged, defective, or otherwise undesirable.

What is a Contra account?

Contra accounts for purchase expenses like Purchase Discounts, Returns and Allowances are presented in the income statement as a deduction from the gross Purchases made by a business in an accounting period, which results in the net Purchase Expense after discounts, returns and allowances.

What is net balance of purchase expenses?

The net balance of Purchase Expenses on an income statement is calculated as the difference between a company’s gross purchases and all associated contra expenses like Purchase Returns, Allowances and Discounts.

When a seller grants a discount, refund or an allowance to a buyer, the buyer will credit the answer?

When a seller grants a discount, refund or an allowance to a buyer, the buyer will credit the respective Purchase Discounts, Returns or Allowances contra-expense account and debit the same amount to an Accounts Payable liability account or a Bank asset account in case of a payment refund.

What is a Purchase Discount?

Purchase Discount refers to the discount that the buyer avails of the goods to settle a particular debt earlier than the actual settlement date. During the normal course of the business, it is highly likely that businesses might procure certain goods or services on credit. However, regardless of the agreed-upon credit limit and timeline, the seller often offers a cash discount to the purchaser of goods and services to motivate him to settle the amount earlier than the agreed-upon date.

What is the incentive to the buyer of purchase discount?

The incentive to the buyer of purchase discount is the fact that the purchase costs decreases, and the business is able to save a considerable amount on procurement costs. On the other hand, the incentive to the seller in offering discounts is simply the fact that he is going to receive the total amount much earlier than the requested date.

How long does it take to get 5% discount?

The format that has been mentioned above means that the buyer of goods and services can avail of a discount of 5% if he settles the amount within 10 days.

Why is the net amount not mentioned earlier on in the analysis?

The net amount is not mentioned earlier on in the analysis because it is still not confirmed if the company will be able to pay the dues in time to be able to avail of the cash discount.

Why does the seller offer a cash discount?

However, regardless of the agreed upon credit limit and timeline, the seller of the goods often offers a cash discount to the purchaser of goods and services, in order to motivate him to settle the amount earlier than the agreed upon date.

What is a contra purchase account?

Purchase discounts, by nature, are supposed to decrease the purchase costs of the company. Therefore, they can best be described as a contra-purchase account.

When does Dolphin Inc. get the cash discount?

If Dolphin Inc. settles the amount on 8 th Jan (or any date before 10 th January), the cash discount is availed. So, the following journal entry is going to be made:

What is a discount for goods?

Definition of Goods Purchased at a Discount. There are two common types of discounts for companies buying goods to resell: Trade discount. Early payment discount.

What is an early payment discount?

The early payment discount is also referred to as a purchase discount or cash discount. If the company pays the supplier's invoice within 10 days, there are two ways to record the early payment discount of $280: Gross method. At the time goods are received: debit of $28,000 to Purchases, credit of $28,000 to Accounts Payable.

How much discount does a supplier give to a small volume buyer?

Let's assume that the supplier gives companies that purchase a high volume of goods a trade discount of 30%. A small volume buyer receives only a 10% discount. If a high volume company purchases $40,000 of goods, its cost will be $28,000 ($40,000 X 70%).

How long does it take to pay a 2/10 net 30 discount?

A "2/10 net 30" discount, for instance, gives you 2 percent off if you pay in full within 10 days. Otherwise, you pay the normal price within 30 days. Even though the supplier hasn't paid you money, you can treat it like a cash payment by recording it on your income statement.

What is $200 on income statement?

On your income statement, you report $200 in "miscellaneous income" or "other income.". An alternative approach is to report the cost of goods sold as $9,800 rather than the full $10,000. A graduate of Oberlin College, Fraser Sherman began writing in 1981.