Does SG&A include general and administrative expenses?

Selling, General and Administrative Expenses. SG&A includes nearly everything that isn't included in cost of goods sold (COGS). Interest expense is one of the notable expenses not in SG&A and is listed as a separate line item on the income statement. Also, research and development costs are not included in SG&A.

What is the difference between SG&A & G&A?

As a type of operating expense, a company may deduct R&D expenses on its tax return. However, some companies may report selling expenses as a separate line item, in which case the SG&A is changed to G&A. Like operating expenses, administrative expenses are incurred regardless of the number of sales being generated by the company.

What are SG&A costs in the chemical industry?

Operating expenses and selling, general and administrative expenses (SG&A) are both types of costs involved in running a company, and significant in determining its financial well-being. The chemicals sector, one of the larger R&D sectors, spends an average of 2 to 3%.

What is not included in SG&A?

SG&A includes nearly everything that isn't included in cost of goods sold (COGS). Interest expense is one of the notable expenses not in SG&A and is listed as a separate line item on the income statement. Also, research and development costs are not included in SG&A. Administrative Expenses, Operating Expense, and SG&A

What are stamps costing?

The current price of a first-class Forever stamp is 60 cents, up 3.4 percent from the previous price of 58 cents. A first-class stamp covers the cost to mail a 1-ounce letter. An additional ounce now costs 24 cents, up from 20 cents.

Are stamps considered money?

POST-OFFICE STAMPS AS CURRENCY. It is - The New York Times.

Did the price of stamps go up?

It just got a little more expensive to send mail in Washington state — and across the U.S. As of July 10, the United States Postal Service's first-class mail “forever” stamps — commonly used to mail domestic letters — increased to 60 cents from 58 cents.

Are stamps taxed?

Gross receipts from the sale of U.S. Postal Service stamps sold for the purpose of postage are not subject to tax. The folders or wrappers containing the stamps are "containers." Since the sale of postage stamps for postage is not subject to tax, neither is the sale of containers holding those stamps.

Can you cash in stamps?

Most retailers (including the Post Office) won't allow the return of postage stamps for a cash refund, and typically only offer exchanges. Instead, you can use a postage buying service to get a cash refund for your stamps.

Why do we pay for stamps?

I reflected on the one main purpose of the postage stamp. Yes, it allows your mail to be delivered, but its main purpose is to stick to its letter, postcard or package until its job is complete. The postage stamp never deviates from its purpose.

Do Forever stamps expire?

Forever stamps never expire and always cover the same amount of postage, even as rates change. The Postal Service sells them at the same price as a regular First-Class Mail stamp.

Do postage stamps expire?

No, U.S. postage never expires; you can use existing stamps indefinitely. All postage stamps issued by the United States since 1860 are valid for postage from any point in the United States or from any other place where U.S. Mail service operates.

How much is a postage stamp 2021?

The rate for a First Class Mail Letter (1 oz.) for postage purchased at the Post Office will increase 3 cents to $0.58 from $0.55. Each additional ounce for First Class Mail will cost $0.20, no change from the January through July 2021 period.

What was the purpose of tax stamps?

Essentially, tax stamps are evidence of the payment of tax. Tax stamps have been historically required since excise taxes were first imposed on tobacco products, much like stamps are used on other licenses and products states regulate (e.g., hunting, alcohol sales).

What is a documentary stamp tax?

Documentary stamp tax is an excise tax imposed on certain documents executed, delivered, or recorded in Florida. The most common examples are: Documents that transfer an interest in Florida real property, such as deeds; and. Mortgages and written obligations to pay money, such as promissory notes.

Is it a crime to write on money?

Yes, It's Legal! Many people assume that it's illegal to stamp or write on paper currency, but they're wrong! We're not defacing U.S. currency, we're decorating dollars!

Is it illegal to paint on money?

With that, you could conclude that yes it is, in fact, illegal to "mutilate, cut, deface, disfigure, or perforate, or unite or cement together" any bank bill, draft, note or evidence of debt by a national or federal entity.

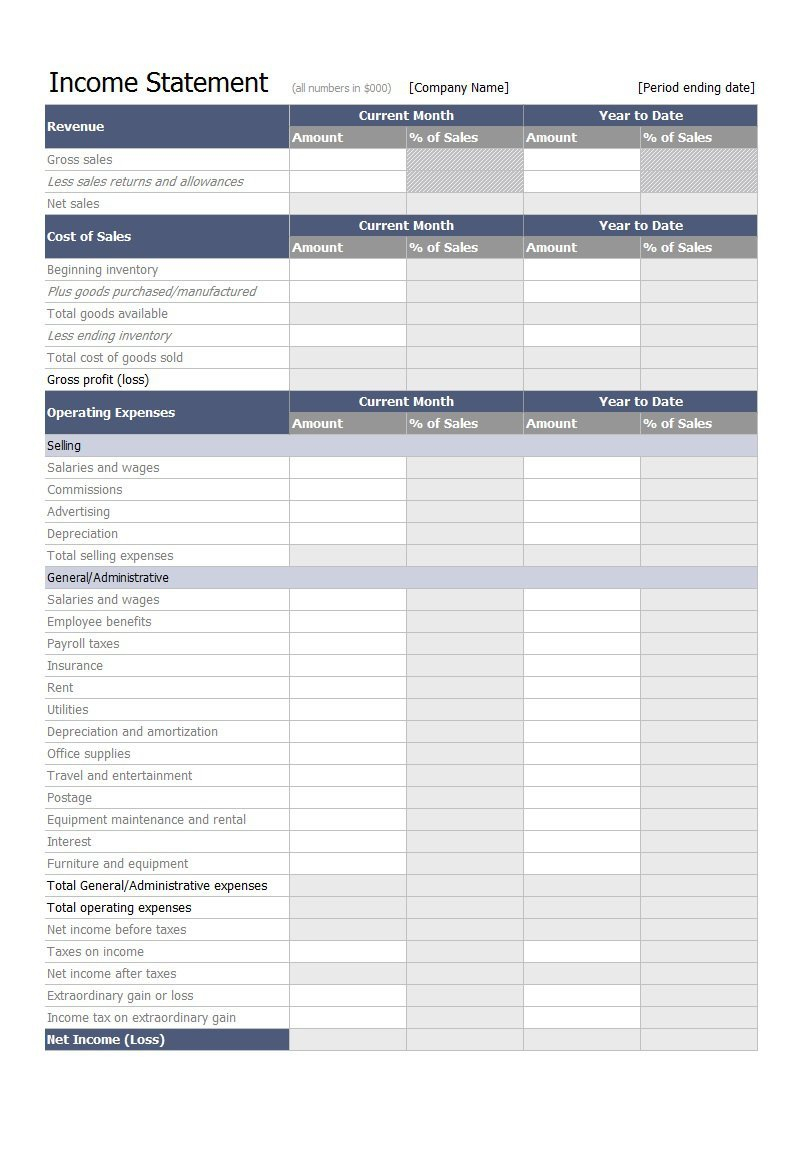

What is administrative cost?

Administrative costs are non-manufacturing costs that include the costs of top administrative functions and various staff departments such as accounting, data processing, and personnel. Executive salaries, clerical salaries, office expenses, office rent, donations, research and development costs, and legal costs are also administrative costs.

Why is operating expense important?

In times of financial difficulty, operating expenses can become an important focus of management when implementing cost controls. Some companies may prefer more discretion when reporting employee salaries, pensions, insurance, and marketing costs.

How does spending affect a company's profitability?

If the company’s expenses are growing, expensing results in greater R&D expense. Facebook is still generating revenue from the R&D they spent to develop their newsfeed and ad-embedding into the newsfeed years ago.

What is R&D expense?

Research and development (R&D) expenses are associated with the research and development of a company’s goods or services. A company generally incurs R&D expenses in the process of finding and creating new products or services. As a type of operating expense, a company may deduct R&D expenses on its tax return.

Is administrative expense incurred regardless of sales?

Like operating expenses, administrative expenses are incurred regardless of the number of sales being generated by the company. Accounting Rules spreads out a couple of stipulations for capitalizing interest cost.

Is SG&A the same as operating expenses?

Typically, the operating expenses and SG &A of a company represent the same costs – those independent of and not included in cost of goods sold. But sometimes, SG&A is listed as a subcategory of operating expenses on the income statement.

Is a business expense expensable?

Most ordinary business costs are either expensable or capitalizable, but some costs could be treated either way, according to the preference of the company. Capitalized interest if applicable is also spread out over the life of the asset.

What is Included in SG&A Expense?

SG&A expenses include most expenses related to running a business outside of COGS. This includes salaries, rent, utilities, advertising, marketing, technology, and supplies not used in manufacturing. Some of the most common expenses that do not fall under SG&A or COGS are interest and research and development (R&D) expenses.

Selling Expenses

Selling expenses are the costs a business incurs in selling, distributing, or marketing a product. These expenses may be direct or indirect.

General and Administrative Expenses

General and administrative expenses include most daily expenses that a business incurs in operations, whether it produces goods and generates revenue or not.

How Does SG&A Appear on the Income Statement?

On the income statement, total revenue is shown and reduced by COGS to arrive at gross profit. This shows how much revenue remains to cover operating expenses and hopefully still leave a profit.

Why is SG&A a Useful Number?

SG&A expenses are an important benchmark as to the company's break-even point. Regardless of sales, a business needs to cover this mostly fixed overhead cost before it can begin to turn a profit, so understanding SG&A is important for management to understand.

Are SG&A Expenses Tax Deductible?

As with any ordinary and necessary business expense, SG&A expenses are deductible in the year that they were incurred.

What are Selling, General, and Administrative Expenses (SG&A)?

Selling, General, and Administrative (SG&A) expenses represent the costs incurred by a company that are not directly tied to generating revenue.

Selling, General and Administrative (SG&A) Definition

SG&A expenses are the indirect costs of operating the business day-to-day.

Examples of SG&A Expenses

In this section, we’ll provide examples of the most common SG&A expenses.

SG&A Ratio Calculation Example

The SG&A ratio is simply the relationship between SG&A and revenue – i.e. SG&A as a % of total sales.

SG&A by Industry

Generally speaking, the lower the SG&A ratio, the better – but the average SG&A ratios varies significantly based on industry.

SG&A vs Operating Expenses

On the income statement, operating expenses and SG&A typically represent the same costs – those that do NOT qualify as COGS.

Operating Expenses

Selling, General, and Administrative Expenses

- Selling, general, and administrative expensesalso consist of a company's operating expenses that are not included in the direct costs of production or cost of goods sold. In other words, SG&A includes all non-production costs. While this is typically synonymous with operating expenses, many times companies list SG&A as a separate line item on the income statement below cost o…

Administrative Expenses, Operating Expense, and SG&A

- The decision to list SG&A and operating expenses separately on the income statement is up to the company's management. Some companies may prefer more discretion when reporting employee salaries, pensions, insurance, and marketing costs. As a result, an aggregate total of all non-production expenses is compiled and reported as a single line item titled SG&A. However, some …

The Bottom Line

- Typically, the operating expenses and SG&A of a company represent the same costs – those independent of and not included in cost of goods sold. But sometimes, SG&A is listed as a subcategory of operating expenses on the income statement. In times of financial difficulty, operating expenses can become an important focus of management when implementing cost c…