/us_treasury_bond-5bfc2f31c9e77c002631087a.jpg)

Which stocks are currently good investments?

The 3 Best Passive-Income Stocks to Buy Now

- Fortis. Fortis (TSX:FTS) (NYSE:FTS) is an obvious stock in any passive-income portfolio. ...

- TC Energy. Energy infrastructure company TC Energy (TSX:TRP) (NYSE:TRP) is another reliable investment for passive-income investors.

- Enbridge. Another reliable bet for passive income is Enbridge (TSX:ENB) (NYSE:ENB). ...

- Bottom line. ...

Are stocks the best long-term investment?

Best Long-Term Stocks to Invest In

- Disney. Disney is an absolute behemoth of a company and one that's shown reliable growth for decades. ...

- FedEx. eCommerce is coming into its heyday. ...

- Johnson & Johnson. All anyone can talk about in 2020 is COVID-19 and the impending vaccine. ...

- McDonalds. ...

- Shopify. ...

- Square. ...

- Walmart. ...

- Waste Management. ...

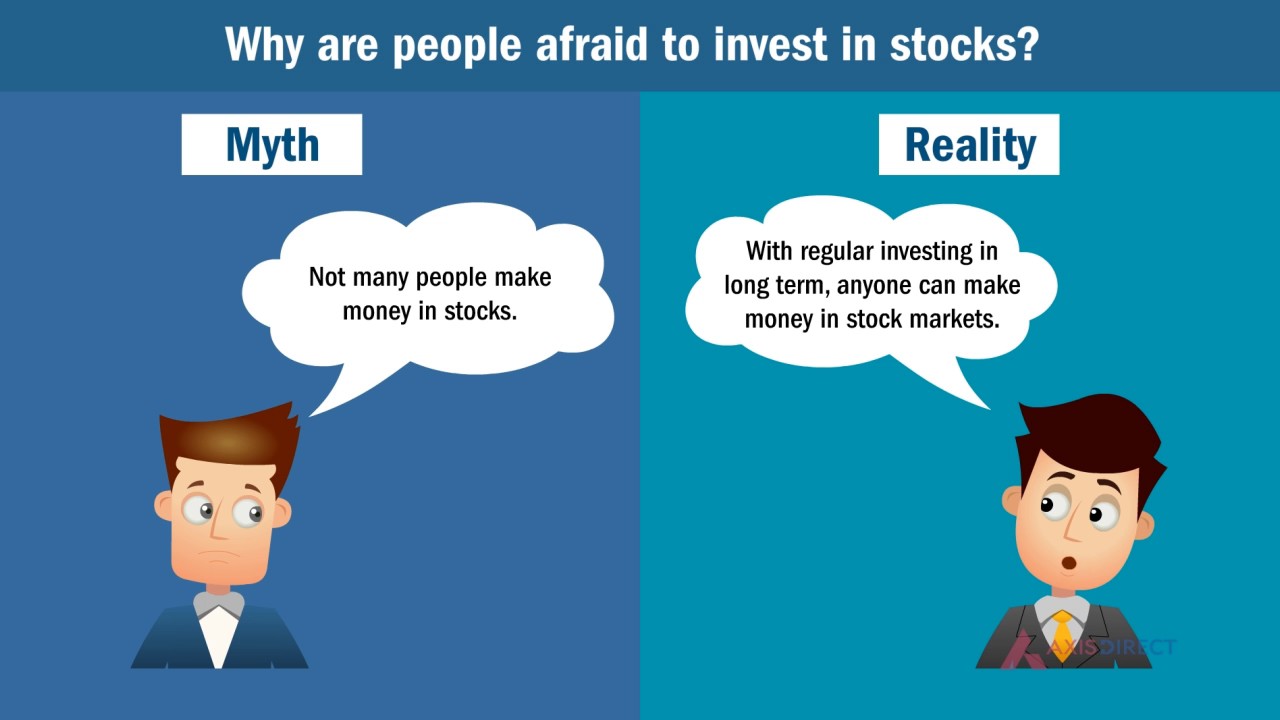

Is investing in stocks good for making money?

The real money in investing is generally made not from buying and selling but from three things:

- Owning and holding securities

- Receiving interest and dividends

- Benefiting from stocks' long-term increase in value

What stocks should I invest in?

Key Points

- AbbVie and Medical Properties Trust are two healthcare stocks that offer juicy dividends.

- Energy stocks Devon and Enterprise Products Partners have especially attractive dividends right now.

- Telecom giant Verizon not only pays a solid dividend but its stock is cheap as well.

Is investing in stocks a good idea?

Stocks can be a valuable part of your investment portfolio. Owning stocks in different companies can help you build your savings, protect your money from inflation and taxes, and maximize income from your investments. It's important to know that there are risks when investing in the stock market.

Do stocks make good money?

The stock market's average return is a cool 10% annually — better than you can find in a bank account or bonds. But many investors fail to earn that 10%, simply because they don't stay invested long enough. They often move in and out of the stock market at the worst possible times, missing out on annual returns.

Do you make money in stocks?

Beginners can make money in the stock market by: Starting early—thanks to the miracle of compounding (when interest is earned on already-accrued interest and earnings), investments grow exponentially. Even a small amount can grow substantially if left untouched.

What are disadvantages of stocks?

Disadvantages of investing in stocks Stocks have some distinct disadvantages of which individual investors should be aware: Stock prices are risky and volatile. Prices can be erratic, rising and declining quickly, often in relation to companies' policies, which individual investors do not influence.

Can you get rich off stocks?

Investing in the stock market is one of the world's best ways to generate wealth. One of the major strengths of the stock market is that there are so many ways that you can profit from it. But with great potential reward also comes great risk, especially if you're looking to get rich quick.

Can you lose money from stocks?

Yes, you can lose any amount of money invested in stocks. A company can lose all its value, which will likely translate into a declining stock price. Stock prices also fluctuate depending on the supply and demand of the stock. If a stock drops to zero, you can lose all the money you've invested.

How do beginners buy stocks?

The easiest way to buy stocks is through an online stockbroker. After opening and funding your account, you can buy stocks through the broker's website in a matter of minutes. Other options include using a full-service stockbroker, or buying stock directly from the company.

How do beginners invest in stocks?

One of the best ways for beginners to get started investing in the stock market is to put money in an online investment account, which can then be used to invest in shares of stock or stock mutual funds. With many brokerage accounts, you can start investing for the price of a single share.

Can you live off stocks?

By investing in quality dividend stocks with rising payouts, both young and old investors can benefit from the stocks' compounding, and historically inflation-beating, distribution growth. All it takes is a little planning, and then investors can live off their dividend payment streams.

Why do people buy stocks?

Stocks offer investors the greatest potential for growth (capital appreciation) over the long haul. Investors willing to stick with stocks over long periods of time, say 15 years, generally have been rewarded with strong, positive returns. But stock prices move down as well as up.

When should you buy stocks?

The upshot: Like early market trading, the hour before market close from 3 p.m. to 4 p.m. ET is one of the best times to buy and sell stock because of significant price movements, higher trading volume and inexperienced investors placing last-minute trades.

When should I invest in stocks?

The period after any correction or crash has historically been a great time for investors to buy at bargain prices. If stock prices are oversold, investors can decide whether they are "on sale" and likely to rise in the future.

Do successful investors have secret passwords?

Successful investors don't have any well-guarded secrets up their sleeves, and there are no secret passwords or handshakes. In truth, there's little standing between you and successful investing, except a bit of research and a solid understanding of the basics.

Is the stock market clueless?

The stock market is clueless regarding you and your plans. It doesn’t have any agenda, and it couldn't care less about yours. Despite what you may have gleaned from late-night infomercials or unsolicited emails, there are no magic formulas for investing success.

What are the benefits of investing in stocks?

There are many benefits to investing in stocks. Seven big ones are: 1 The potential to earn higher returns than alternatives like bank CDs, gold, and government bonds. 2 The ability to protect your wealth from inflation, as the returns often significantly outpace the rate of inflation. 3 The ability to earn regular passive income from dividends. 4 The ability to own a tiny slice of a company whose products or services you love. 5 The ease of buying and selling, which makes stocks a more liquid investment compared to other options like real estate. 6 The ability to diversify a portfolio across many different industries. 7 The ability to start small. Thanks to $0 commissions and the ability to buy fractional shares with many online brokers, investors can begin purchasing stocks with a little bit of money.

Why is it important to hold out for the right time to buy stocks?

Holding out for the right time to buy stocks can be costly, because a large portion of gains come from a small number of days. Meanwhile, stocks tend to recover from corrections -- declines of more than 10% -- in a matter of months.

How often do stocks decline?

On average, the stock market declines 10% from its high roughly every 11 months, 20% about every four years, and more than 30% at least once a decade. Investing in stocks isn't for everyone. Consider these valid reasons not to buy stocks:

Is paying off debt better than buying stocks?

Paying off this debt can often yield higher returns than buying stocks. You don't have an adequate emergency fund. Having enough cash on hand to cover an emergency expense can prevent you from needing to borrow money on a credit card. You don't have the time or desire to research stocks to buy.

Does it matter when you invest in a great company?

As Motley Fool co-founder David Gardner puts it, "It doesn't matter when you invest if you are investing in great companies.". A minority of stocks account for the majority of the market's overall return.

Which stocks carry greater risk?

Small-cap stocks carry greater risk and have greater market fluctuation than large-company stocks. Treasury bills and government bonds are guaranteed by the U.S. government and if held to maturity offer a fixed rate of return and fixed principal value.

Why do stocks increase their dividends?

Stocks that increase their dividends on a regular basis give you a pay raise to help balance the higher costs of living over time. In addition, stocks that provide growing dividends have historically provided a much greater total return to shareholders, as shown below.

How to use dividends?

Dividend income – Many companies choose to pay dividends on a regular basis, most often quarterly. Dividends can be used to supplement one’s income or may be reinvested to buy additional shares: 1 If you’re using this money as a regular income stream, consider staggering your stocks’ dividend payments dates. 2 If you reinvest your dividends and buy additional shares of stock, your money has the potential to grow faster.

Do stocks have higher potential return?

But remember – you need to balance reward with risk. Generally, stocks with higher potential return come with a higher level of risk. Investing in equities involves risks. The value of your shares will fluctuate, and you may lose principal.

Can dividends be reinvested?

Dividends can be used to supplement one’s income or may be reinvested to buy additional shares: If you’re using this money as a regular income stream, consider staggering your stocks’ dividend payments dates. If you reinvest your dividends and buy additional shares of stock, your money has the potential to grow faster.

What happens to the stock market?

Basically what happens overall on the Stock Market is some make a profits, some make a losses. Some people look at it as overall on the Stock Market there is no gain/no loss, only transfer of money from one person to another. This shows both sides. You can win big and you can loose big.

Is inventory a terrible marketplace?

Another terrible of the inventory marketplace is that it calls for endurance. If you count on to make investments into a company's inventory and be a millionaire in a month, you may be very disillusioned. In order to see principal gains, you'll should wait years, or perhaps even a long time for the fee to skyrocket.

Is it a bad day to invest in stocks?

Those are clearly inferior in terms of risk/reward for the average person. You are also implying that for some reason today is a bad day to be investing in stocks. It ’s actually a really good day to be investing in stocks.

Is the stock market volatile?

The stock market is volatile, especially in investing in the stock market worth it short term, and can swing wildly in between extremes. If you’re looking to invest your money in investing in the stock market worth it short term, there are usually much more reliable, low-risk investment strategies available.

What are the best stocks to buy in April 2021?

With that in mind, here are nine of the best stocks to look into in April of 2021: 1. Amazon (NASDAQ: AMZN) The coronavirus pandemic is a horrible thing. More than 184 million people around the world have gotten sick, with more than 3.98 million people losing their lives.

Is all stocks created equal?

Not all stocks are created equal, and with a massive number of retail investors flooding into the market since the new year, it has been a bit of a wild ride. With unprecedented gains being created in the market, many expect a continuation of this recent increase in investment activity.

Is Gevo stock profitable?

Gevo (NASDAQ: GEVO) Gevo isn’t necessarily the type of company you would expect to see on a list like this. The company is anything but profitable, and the stock was still trading in the penny category in late 2020. Nonetheless, Gevo has seen an exceptional rise thus far in 2021.

Is Gevo stock still trading?

Gevo isn’t necessarily the type of company you would expect to see on a list like this. The company is anything but profitable, and the stock was still trading in the penny category in late 2020.

What is an ETF?

ETFs bundle many different stocks together, letting you get exposure to all of them through a single investment. For example, if you were to invest in an S&P 500 ETF, you would have a stake in every company listed in the index.

Is the S&P 500 market cap weighted?

And given the recent market highs, it appears Wall Street isn’t spooked. The S&P 500 is also market cap-weighted, meaning larger companies will have a bigger impact on its performance (see how the S&P 500 works to learn more about this).

Is NerdWallet an investment advisor?

NerdWallet, In c. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice.

Looking for market-beating stocks? These are some of the best companies to consider buying now

Anand is the Editor-in-Chief of Fool.com. He loves pithiness, clever turns of phrase, and helping people simplify their money decisions.

Elevator pitches for each stock and basket

iRobot is one of my favorite stocks because it checks so many of the boxes I like to see in a company.