The corporation is the most common form of business ownership. The three major forms of business ownership in the U.S. are sole proprietorships, partnerships, and corporations. The profits of a sole proprietorship are taxed as the personal income of the owner.

What is the most common form of business ownership?

The corporation is the most common form of business ownership. The three major forms of business ownership in the U.S. are sole proprietorships, partnerships, and corporations. Once a business is established, it's almost impossible to change from one form of business ownership to another.

What is the most common form of incorporation?

C Corporation is the most common form of incorporation among businesses and contains almost all of the attributes of a corporation. Owners receive profits and are taxed at the individual level, while the corporation itself is taxed as a business entity.

Can a business be owned by more than one person?

The most common form of business ownership is a partnership. In a sole proprietorship, creditors have a legal claim to the business's assets before the owner. Businesses owned by one person usually have enough funds for emergency situations. A Partnership could be owned by as many as ten or more partners.

How many people can own a corporation?

A Corporation can be owned by as few as one person and as many as thousands of people. To form a corporation, a charter is needed. A Corporation can make contracts and borrow money.

What is the most common form of business ownership?

Sole Proprietorships1. Sole Proprietorship. A type of business entity that is owned and run by one individual – there is no legal distinction between the owner and the business. Sole Proprietorships are the most common form of legal structure for small businesses.

Are corporations the most common form of business?

A sole proprietorship is the most common form of business organization. It's easy to form and offers complete control to the owner.

What is the most common form of corporation?

Limited Liability Companies - This is the most common form of business entity in the United States.

Is it the most common form of business entity in the world?

The most popular form of business entity today is the limited liability company (LLC). Like a corporation, it offers personal liability protection for its owners.

What is the most common form of business ownership quizlet?

A sole proprietorship is a business owned and managed by one individual and is the most popular form of ownership.

Why is a corporation the best form of business?

Corporations offer the strongest protection to its owners from personal liability, but the cost to form a corporation is higher than other structures. Corporations also require more extensive record-keeping, operational processes, and reporting.

Why is corporation the best form of business in the world?

What are the advantages of forming a corporation? There are several advantages to becoming a corporation, including the limited personal liability, easy transfer of ownership, business continuity, better access to capital and (depending on the corporation structure) occasional tax benefits.

What is the least common form of business organization?

EconomicsQuestionAnswerprovides goods and services to members or the community without making profitsnon-profit organizationsleast common form of business organization in the United Statespartnershipsmost common form of business organization in the United Statessole proprietorship31 more rows

Are corporations more common than partnerships?

Today, there are 1.7 million traditional C corporations, compared to 7.4 million partnerships and S corporations, and 23 million sole proprietorships.

What are the 3 most common forms of business organization?

There are three common types of businesses—sole proprietorship, partnership, and corporation—and each comes with its own set of advantages and disadvantages.

What is the most common type of business organization in the United States?

Sole ProprietorshipSole Proprietorship Simplicity of organization-this is the most common form of business organization in the United States because it is the easiest and least expensive to establish.

What is the common form to start a business?

In addition to the three commonly adopted forms of business organization—sole proprietorship, partnership, and regular corporations—some business owners select other forms of organization to meet their particular needs. We'll look at several of these options: Limited liability companies. Cooperatives.

What are the most common forms of business ownership?

The most common corporate forms of business ownership are: Sole proprietorships. Limited liability companies (LLC). Corporations (for-profit or nonprofit). Partnerships . Cooperatives. When you start your business, choosing a legal structure is one of the first and most important decisions you'll have to make.

How many owners does a sole proprietorship have?

A sole proprietorship has just one owner. The positive side of this form of business ownership is that it is the simplest, the easiest to set up, and the least expensive to run. Making decisions in a sole proprietorship is very simple and straightforward.

What is a partnership in business?

Partnerships. A partnership involves two or more partners who maintain personal liability for the debts of the business. Any partner can be held responsible for the actions of the business, and each partner holds decision-making authority.

What is a stockholder in a corporation?

In a corporation, the owners are called stockholders. They have limited liability for the actions of the company, but they also have limited involvement in the day to day operations. This is one of the most complicated forms of business to run in terms of taxes, record keeping accounting, and general paperwork.

Is a limited liability company a corporation?

Limited Liability Company. Limited liability companies (LLCs) are somewhere between a corporation and partnership. However, they are not incorporated, so they are not considered corporations. This form offers the business owner some protection for his or her personal assets.

Is LLP available in every state?

The LLP structure is not available in every state, and regulations vary widely. If you are considering this structure, you'll want to research your local jurisdiction's requirements carefully. In a partnership, the gains and losses the partners realize pass through to the individual tax return.

Is it wise to have a different legal structure for your business?

If your personal financial history is not very strong or if you are likely to be sued for the activities of the business, then it's wise to choose a different legal structure to protect your personal assets. Sole proprietors may find some protection in a business insurance policy.

What are the Common Types of Corporations?

A corporate can be formed as a for-profit or a not-for-profit entity.

What is a corporation?

A corporation is a legal entity created by individuals, stockholders. Stockholders Equity Stockholders Equity (also known as Shareholders Equity) is an account on a company's balance sheet that consists of share capital plus. , or shareholders, with the purpose of operating for profit. Corporations are allowed to enter into contracts, ...

How Does a Corporation Dissolve?

The life of a corporate entity lasts until there is a change in its charter or the purpose of its existence has reached its peak. A process called liquidation will serve the transition, facilitated by a liquidator.

How many shareholders are in an S corporation?

An S Corporation consists of up to 100 shareholders and is not taxed as separate – instead, the profits/losses are shouldered by the shareholders on their personal income tax returns. 3. Non-Profit Corporation. Commonly used by charitable, educational, and religious organizations to operate without generating profits.

What are the different types of incorporation?

The three main types of business incorporations are: 1. C Corporation. C Corporation is the most common form of incorporation among businesses and contains almost all of the attributes of a corporation. Owners receive profits and are taxed at the individual level, while the corporation itself is taxed as a business entity. 2.

What is the process of creating a corporation?

The creation of a corporation involves a legal process called incorporation where legal documents containing the primary purpose of the business, name and location, ...

How many votes does a shareholder have to have to be on a board of directors?

Each shareholder is entitled to one vote per share, and they are not required to take part in the day-to-day running of the corporation.

Which is more likely to fail: a partnership or a sole proprietorship?

A recent study showed that partnerships are more likely to fail than sole proprietorships.

Which type of business is the most difficult to establish?

A comparison of the three major forms of business ownership shows that sole proprietorships are usually the most difficult type of business to establish.

What is the responsibility of a business owner for all the debts of the business?

general partnership. a partnership in which all owners share in operating the business and in assuming liability for the business's debts. limited partnership. a partnership with one of more general partners and one or more limited partners.

What is limited liability?

limited liability. the responsibility of a business's owners for losses only up to the amount they invest ; limited partners and share.

What is a limited partnership?

limited partnership. a partnership with one of more general partners and one or more limited partners. general partner. an owner (partner) who has unlimited liability and is active in managing the firm. limited partner.

What is a sole proprietorship?

Terms in this set (113) sole proprietorship. a business that is owned and usually managed by one person. partnership. a legal form of business with two or more owners. corporation. a legal entity with authority to act and have liability apart from its owners. unlimited liability.

Why do people incorporate?

One reason Individuals incorporate is to obtain the advantage of limited liability.

What is the most common form of business ownership?

The most common form of business ownership is a partnership.

What is the top officer of a corporation called?

The top officer of a corporation is referred to as a CFO.

How many partners can a partnership have?

A Partnership could be owned by as many as ten or more partners.

Which sells more goods and services annually than do proprietorships and partnerships combined?

Corporations sell more goods and services annually than do proprietorships and partnerships combined.

Who decides when dividends are distributed?

Stockholders decide when dividends are to be distributed.

Who is legally responsible for a contract?

If a partner enters into a contract against the wishes of the other partners, the other partners are legally responsible for the contract.

Do you need a charter to form a corporation?

To form a corporation, a charter is needed .

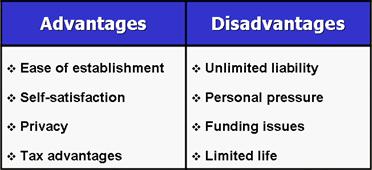

Sole Proprietorships

- A sole proprietorship has just one owner. The positive side of this form of business ownershipis that it is the simplest, the easiest to set up, and the least expensive to run. Making decisions in a sole proprietorship is very simple and straightforward. This may be the best choice if you are the only owner and you have no need to separate the identity of the business from your personal ide…

Limited Liability Company

- Limited liability companies (LLCs) are somewhere between a corporation and partnership. However, they are not incorporated, so they are not considered corporations. This form offers the business owner some protection for his or her personal assets. This structure also gives the owner some protection from personal liability for the activities of the business. However, the ow…

Corporation

- In a corporation, the owners are called stockholders. They have limited liability for the actions of the company, but they also have limited involvement in the day to day operations. This is one of the most complicated forms of businessto run in terms of taxes, record keeping accounting, and general paperwork. Shareholders report the money they ear...

Partnerships

- A partnership involves two or more partners who maintain personal liability for the debts of the business. Any partner can be held responsible for the actions of the business, and each partner holds decision-making authority. One special type of partnership is a limited partnership in which only one partner can make decisions for the company and can be held personally liable. The oth…