To ensure the depositors’ funds are safe, the Federal Deposit Insurance Corporation (FDIC) requires deposit-taking financial intermediaries to insure the funds deposited with them. Providing loans Advancing short-term and long-term loans is the core business of financial intermediaries.

Full Answer

What is the purpose of FDIC?

When was the FDIC created?

About this website

FDIC: Understanding Deposit Insurance

Federal deposit insurance goes to the heart of the FDIC’s mission: to promote confidence and stability in the nation’s financial system. FDIC deposit insurance enables consumers to confidently place their money at thousands of FDIC-insured banks across the country, and is backed by the full faith and credit of the United States government.

FDIC: Deposit Insurance FAQs

Q: How can I get deposit insurance? A: Depositors do not need to apply for or purchase FDIC deposit insurance. Coverage is automatic whenever a deposit account is opened at an FDIC-insured bank. If you want your funds insured by the FDIC, simply place your funds in a deposit account at an FDIC-insured bank and make sure that your deposit does not exceed the insurance limit for that ownership ...

What Is FDIC Insurance? It Protects Your Money Should Your Bank Fail

If your bank has FDIC insurance, then your money is protected if your bank closes. You don't have to apply or pay for FDIC insurance.

What Is a Financial Intermediary?

A financial intermediary is an entity that acts as the middleman between two parties in a financial transaction, such as a commercial bank , investment bank , mutual fund, or pension fund. Financial intermediaries offer a number of benefits to the average consumer, including safety, liquidity, and economies of scale involved in banking and asset management. Although in certain areas, such as investing, advances in technology threaten to eliminate the financial intermediary, disintermediation is much less of a threat in other areas of finance, including banking and insurance.

How does a financial intermediary help savers?

Through a financial intermediary, savers can pool their funds, enabling them to make large investments, which in turn benefits the entity in which they are investing. At the same time, financial intermediaries pool risk by spreading funds across a diverse range of investments and loans. Loans benefit households and countries by enabling them to spend more money than they have at the current time.

How do banks connect borrowers and lenders?

Banks connect borrowers and lenders by providing capital from other financial institutions and from the Federal Reserve. Insurance companies collect premiums for policies and provide policy benefits. A pension fund collects funds on behalf of members and distributes payments to pensioners.

What is co-investment facility?

One of the instruments, a co-investment facility, was to provide funding for startups to develop their business models and attract additional financial support through a collective investment plan managed by one main financial intermediary.

What is mutual fund?

Mutual funds provide active management of capital pooled by shareholders. The fund manager connects with shareholders through purchasing stock in companies he anticipates may outperform the market. By doing so, the manager provides shareholders with assets, companies with capital and the market with liquidity.

Is disintermediation a threat to financial institutions?

Although in certain areas, such as investing, advances in technology threaten to eliminate the financial intermediary, disintermediation is much less of a threat in other areas of finance, including banking and insurance.

Do intermediaries accept deposits?

Intermediaries can provide leasing or factoring services, but do not accept deposits from the public. Financial intermediaries offer the benefit of pooling risk, reducing cost, and providing economies of scale, among others.

What is a financial intermediary?

a financial intermediary creates claims on itself when it accepts depositors' funds

Why do banks prefer loans?

in general, banks prefer loans that stress liquidity and safety

What is the major source of loans to individuals?

insurance companies are a major source of loans to individuals

Is M-2 a time deposit?

since M-2 excludes time deposits, M-2 is a less comprehensive measure of the money supply than M-1

How much does FDIC insurance cover?

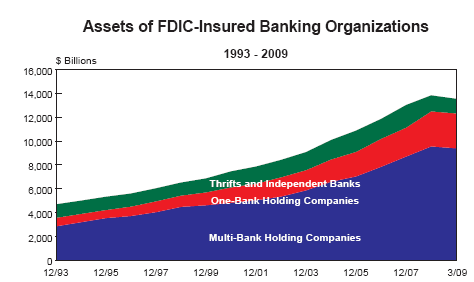

The FDIC provides insurance of up to $250,000 for each depositor at a bank, examines the books of insured banks, and imposes restrictions on assets they can hold. The government employs the following types of regulations in an attempt to ensure the soundness of our financial intermediaries except.

Why do financial intermediaries play a role in matching savers and borrowers?

Financial intermediaries have a role to play in matching savers and borrowers for all of the following reasons except: A. minimizing transaction costs.

What is direct finance?

In direct finance, borrowers borrow funds directly from lenders in financial markets by selling them securities. Let's assume that a carpenter borrowed $2,000 to be paid off in a year to finance a machine that would make him work faster. As a result, he is able to take on more projects and collect $400.

What is securities liability?

C. Securities are liabilities for the firm that issues them and assets for the individual that buys them.

How does secondary market work?

Secondary markets serve two important functions. First, they make it easier and quicker to sell financial instruments to raise cash; that is , they make the financial instruments more liquid . The increased liquidity of these instruments then makes them more desirable and thus easier for the issuing firm to sell in the primary market. Second, they determine the price of the security that the issuing firm sells in the primary market. The investors who buy securities in the primary market will pay the issuing corporation no more than the price they think the secondary market will set for this security. Willingness to pay a particular price will depend on attitudes about the firm's profitability, solvency, and economic environment in which the firm operates.

Why are financial instruments more liquid?

First, they make it easier and quicker to sell financial instruments to raise cash; that is, they make the financial instruments more liquid. The increased liquidity of these instruments then makes them more desirable and thus easier for the issuing firm to sell in the primary market.

Why are financial markets important?

These markets are critical for producing an efficient allocation of capital, which contributes to higher production and efficiency for the overall economy.

What does FDIC do?

The FDIC Protects You Against Bank Failure. The FDIC launches into action when an insured financial institution fails. When a bank goes on the fritz and is unable to repay the deposits of its customers, the FDIC does a few things. The first action is to notify the customers and the public of the bank’s closure.

Why was the FDIC created?

(More on this in a minute.) The FDIC was created in 1933 to help foster more trust between consumers and financial institutions. In the aftermath of the stock market crash of 1929, thousands of banks failed.

What does "per insured bank" mean?

The meanings of “per depositor” and “per insured bank” are straightforward enough. The deposit account ownership categories include: Single accounts (owned by one person) Joint accounts (owned by two or more people) Certain retirement accounts. Revocable and irrevocable trusts.

How much is the FDIC insurance for bank failure?

As stated by the FDIC, the standard insurance amount in the event of bank failure is $250,000 per depositor, per insured bank, for each account ownership category.

What does the FDIC logo mean?

You see “Member FDIC” displayed in most banks and accented on banking products. You’ve been told to look out for the FDIC logo as a sign of security. And you know that if you don’t see the logo, your money may be at risk.

How much is the maximum amount of insurance for a checking account?

The $250,000 coverage maximum can apply in different ways. For example, if you have a checking account, a savings account and multiple CDs at one bank, all of which are owned by you as an individual, then they are insured up to $250,000 total because they fall within one ownership category as single accounts.

What is the FDIC consumer assistance?

With consumer protection as its goal, the FDIC’s consumer assistance and information area provides links to government and nonprofit resources on topics ranging from basic personal finance, to cybersecurity, to credit reports.

What is the purpose of FDIC?

The Federal Deposit Insurance Corporation (FDIC) is an independent agency created by Congress to maintain stability and public confidence in the nation's financial system. To accomplish this mission, the FDIC insures deposits; examines and supervises financial institutions for safety, soundness, and consumer protection;

When was the FDIC created?

History of the FDIC. Since its creation in 1933, the FDIC has been an essential part of the American financial system. In the 1920s and early 1930s, a rise in bank failures created a national crisis, wiping out many Americans’ savings.

How Much Deposit Insurance Does FDIC provide?

- The FDIC coverage provides deposit insurance of up to $250,000 per ownership category, as long as the institution is a member. Initially, the agency provided an insurance limit up to $2,500 until the passage of the Dodd-Frank Wall Street Reform recommended raising the insurance limit. The FDIC only insures banks. Insurance for deposit accounts at c...

History of The FDIC

- The Federal Deposit Insurance Corporation was formed in 1933, following the stock marketcrash of 1929 that led to the failure of thousands of banks. Investors who were worried about losing their bank deposits started withdrawing their savings, and this resulted in the collapse of even more banks. Following the crisis, then US President, Franklin Roosevelt, ordered a four-day bank holi…

Board of Directors

- The Board of Directors is the top decision-making body of the Federal Deposit Insurance Corporation. The President of the United States appoints three of the five members of the Board of Directors, and the Senate confirms the appointees. The other two ex-officio members of the Board are the Comptroller of the Currency and the Director of the Consumer Financial Protectio…

Functions of The FDIC

- The Federal Deposit Insurance Corporation directly supervises more than 4,000 banks to ensure they operate within the law and that investors’ funds are secured. The agency also acts as the primary federal regulator of banks chartered by state governments that do not join the Federal Reserve System. It ensures that banks comply with consumer protection laws such as the Fair …

Resolution of Insolvent Banks

- Once a bank has been declared insolvent and closed by either the US Office of the Comptroller of Currency or the state banking department, the Federal Deposit Insurance Corporation is appointed as the receiver. As the receiver, the agency is tasked with protecting investor funds and recovering debts owed to the creditors of the failed institution. The functions performed by the F…

Learn More About Banks

- Thank you for reading CFI’s guide to the FDIC. To learn more about the banking industry, see the following free CFI resources. 1. Banking Career Map 2. Federal Reserve 3. European Central Bank 4. Bank of England

What Is a Financial Intermediary?

- A financial intermediary is an entity that acts as the middleman between two parties in a financia…

Financial intermediaries serve as middlemen for financial transactions, generally between banks or funds. - These intermediaries help create efficient markets and lower the cost of doing business.

Intermediaries can provide leasing or factoring services, but do not accept deposits from the public.

How a Financial Intermediary Works

- A non-bank financial intermediary does not accept deposits from the general public. The interme…

Financial intermediaries move funds from parties with excess capital to parties needing funds. The process creates efficient markets and lowers the cost of conducting business. For example, a financial advisor connects with clients through purchasing insurance, stocks, bonds, real estate, …

Types of Financial Intermediaries

- Mutual funds provide active management of capital pooled by shareholders. The fund manager connects with shareholders through purchasing stock in companies he anticipates may outperform the market. By doing so, the manager provides shareholders with assets, companies with capital, and the market with liquidity.

Benefits of Financial Intermediaries

- Through a financial intermediary, savers can pool their funds, enabling them to make large inves…

Financial intermediaries also provide the benefit of reducing costs on several fronts. For instance, they have access to economies of scale to expertly evaluate the credit profile of potential borrowers and keep records and profiles cost-effectively. Last, they reduce the costs of the man…

Example of a Financial Intermediary

- In July 2016, the European Commission took on two new financial instruments for European Str…

One of the instruments, a co-investment facility, was to provide funding for startups to develop their business models and attract additional financial support through a collective investment plan managed by one main financial intermediary. The European Commission projected the total pub…