Can I claim the residential energy credit?

The residential energy credit is based on a percentage of the cost paid for eligible energy-saving home improvements. You must own the residence in order to claim this credit, and leasehold improvements on rentals do not qualify. However, it does not need to be your primary residence. Eligible improvements include: Solar electric panels

Is the solar tax credit refundable?

The solar tax credit is nonrefundable, which means it cannot result in a refund if the individual's tax credit exceeds their liability. Instead, the leftover amount can be carried over to the ...

Is the Solar Credit refundable?

The solar ITC is not a refundable credit – it can only be used against your organization’s U.S. federal income tax liability. However, the solar ITC may be carried back one year and forward up to 20 years for companies that don’t have sufficient tax liability to offset for the tax year their solar energy system was placed in service.

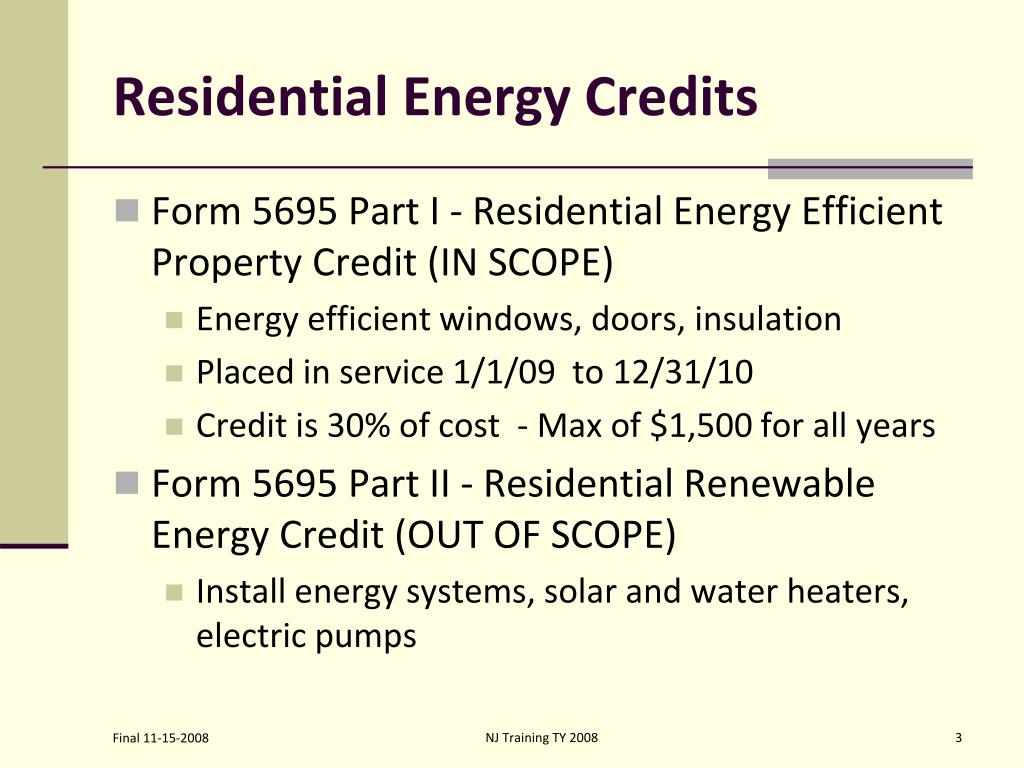

What is Form 5695 residential energy credit?

The residential energy-efficient property credit, best known as the residential energy credit and most commonly claimed by homeowners, is claimed in Part I of Form 5695. The nonbusiness energy property credit is claimed in Part II. The residential energy credit is based on a percentage of the cost paid for eligible energy-saving home improvements.

Are energy-efficient credits refundable?

The energy tax credit isn't a refundable credit that would result in you receiving money. The energy credit is a nonrefundable credit that can only reduce the tax you owe to $0. You won't receive a refund for any remaining credit amount.

How does the energy-efficient tax credit work?

You can claim a tax credit for 10% of the cost of "qualified energy efficiency improvements" and 100% of "residential energy property costs". This credit is worth a maximum of $500 for all years combined, from 2006 to its expiration. Of that combined $500 limit, A maximum of $200 can be for windows.

Is the ITC a refundable credit?

The solar ITC is not a refundable credit – it can only be used against your organization's U.S. federal income tax liability.

How long can you carry forward residential energy credit?

20 yearsCredits for energy efficiency With the Residential Energy Efficient Property Credit, taxpayers can carry forward the unused portion of the credit from the current year's tax return to the next year's tax return. For the Non-Business Energy Property Credit, the carryforward period is 20 years.

How is residential energy credit calculated?

You may be able to take a credit equal to the sum of:10% of the amount paid or incurred for qualified energy efficiency improvements installed during 2020, and.Any residential energy property costs paid or incurred in 2020.

Is there a tax credit for replacing windows in 2021?

2021 Window & Door Tax Credit You may be entitled to a tax credit of up to $500** if you installed energy-efficient windows, skylights, doors or other qualifying items in 2018-2021**. Federal tax credits for certain energy-efficient improvements to existing homes have been extended through December 31, 2021.

What are refundable tax credits?

What Is a Refundable Tax Credit? A refundable tax credit can be used to generate a federal tax refund larger than the amount of tax paid throughout the year. In other words, a refundable tax credit creates the possibility of a negative federal tax liability.

Is there an energy tax credit for 2022?

EV Tax Credit Expansion First and foremost, for EVs placed into service after December 31, 2022, the Inflation Reduction Act extends the up to $7,500 EV tax credit for 10 years—until December 2032.

Are RECs tax deductible?

No. The actual dollars spent on renewable energy are not tax deductible. Are buying RECs a permit to pollute?

Can residential energy credit be carried back?

Also use Form 5695 to take any residential energy efficient property credit carryforward from 2020 or to carry the unused portion of the credit to 2022. You may be able to take the credits if you made energy saving improvements to your home located in the United States in 2021.

How many times can you claim energy tax credit?

You may be able to take these credits if you made energy saving improvements to your principal residence during the taxable year. In 2018, 2019 2020, and 2021 the residential energy property credit is limited to an overall lifetime credit limit of $500 ($200 lifetime limit for windows).

Is a new roof tax deductible in 2022?

Unfortunately, you cannot deduct the cost of a new roof. Installing a new roof is considered a home improvement and home improvement costs are not deductible. However, home improvement costs can increase the basis of your property.

What are refundable tax credits for 2021?

Individual tax filers, including married individuals filing separate returns, can claim a deduction of up to $300 for cash contributions made to qualifying charities during 2021. The maximum deduction is increased to $600 for married couples filing a joint return.

Which tax credits are non refundable?

Examples of Non-Refundable Tax CreditsSaver's credit.Lifetime learning credit (LLC)Adoption credit.Foreign tax credit (FTC)Elderly and disabled credit.Residential energy efficient property credit.General business credit (GBC)Alternative motor vehicle credit.More items...

How do I get a refund from ITC GST?

Step 1: Login to the GST portal, go to 'Services' > 'Refunds' > 'Application for Refund'. Step 2: Select the refund type and choose whether or not to file NIL refund application. Select the refund type as 'Refund on account of ITC accumulated due to inverted tax structure'.

What is ITC tax credit?

The Solar Investment Tax Credit (ITC) is a federal tax credit for those who purchase solar energy systems for residential, commercial or utility scale properties. The credit, which is applied to a homeowner's federal income tax return debt, is equal to a percentage of the cost of eligible equipment.

What is the maximum energy credit for a property?

The maximum allowed credit for all improvements is $500.

Which has the highest efficiency?

Central air conditioner which achieves the highest efficiency: $300. Natural gas, propane, or oil water heater which has either an energy factor of at least 0.82 or a thermal efficiency of at least 90 percent: $300.

Can you claim a tax credit for solar panels?

Taxpayers may be able to claim a tax credit for home improvements which make use of renewable sources of energy, such as: Solar panels. Solar powered hot water heaters. Wind turbines.

When will the non business energy property credit be reinstated?

The Non-Business Energy Property Credit initially expired at the end of 2017, but then it was reinstated through December 31, 2020. The first part of this credit is worth 10% of the cost of qualified energy-saving equipment or items added to a taxpayer’s main home during the year. Energy-efficient exterior windows and doors, certain roofs, ...

When will the tax credit be available for 2022?

22% for property placed in service after December 31, 2020, but before January 1, 2022 2 . The tax credit you're eligible for is a percentage of the cost of alternative energy equipment that's installed on or in a home, including the cost of installation. Solar hot water heaters, solar electric equipment, wind turbines, ...

What is included in the second part of the credit?

The second part of the credit isn't a percentage of the cost, but it does include the installation costs of some high-efficiency heating and air-conditioning systems, water heaters, and biomass fuel stoves. Different types of property have different dollar limits. 7

Can you claim a federal tax credit for solar energy?

Homeowners can claim a federal tax credit for making certain improvements to their homes or installing appliances that are designed to boost energy efficiency . Solar, wind, geothermal, and fuel cell technology are all eligible for the Residential Renewable Energy Tax Credit. 1 The Non-Business Energy Property Credit was reinstated through 2020 as well.

Do you have to be the main residence of a taxpayer for alternative energy equipment?

The property must be located in the United States, but it doesn't have to be the taxpayer’s main residence unless the alternative energy equipment is a qualified fuel cell property. The equipment must be installed in your principal residence in this case.

Is the IRS refundable tax credit?

This tax credit isn't refundable, so the IRS won't be sending you the difference in cash if your credit is more than any tax you owe on your return. The unused portion can be carried over to your following year’s tax return, however, so you won't lose it.

How to apply for residential energy property credit?

To apply for the Residential Energy Property Credit, complete Form 5695 and attach it to your Form 1040.

How does having an energy efficient home help you?

By having an energy efficient home, you will save money on your bills and pay less money in taxes. Learn how you claim home energy tax credits if you qualify.

How many deductions does H&R Block have?

When you file with H&R Block Online they will search over 350 tax deductions and credits to find every tax break you qualify for so you get your maximum refund, guaranteed.