Is a 8879 form the same as a 1040? No, 8879 is the e-signature authorization form, and 1040 is the actual tax form.

Full Answer

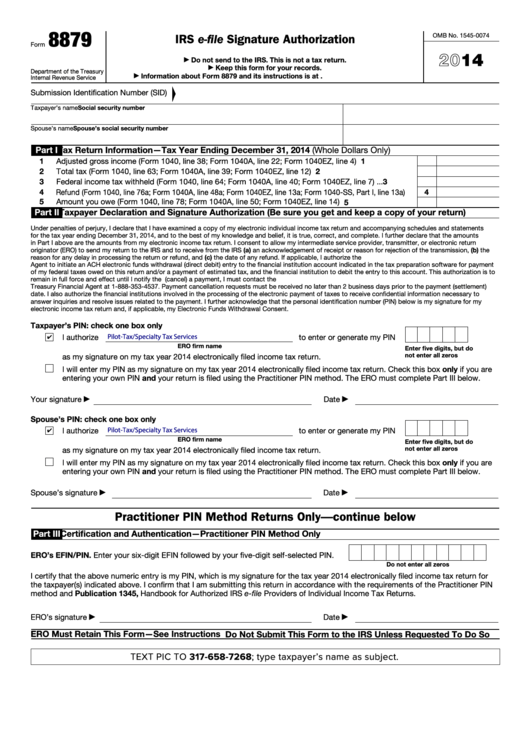

What is form 8879 used for?

Form 8879 is an electronic signature document that is used to authorize e-filing. It is generated by the software using both the taxpayer’s self-selected PIN and the Electronic Return Originator’s (ERO’s) Practitioner PIN. Form 8879 does not need to be mailed to the IRS, but instead is retained by the ERO.

What is a 8879 tax form?

The Form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax return information of the Form 8879 matches the information on the return.

Is your W2 the same as 1040?

Your personal tax return is IRS Form 1040. A W-2 is a report by your employer (to you and to the IRS) of your wages which is to be attached to your personal return. So, yes, a W-2 is different from your personal tax return. * This will flag comments for moderators to take action.

Are You required to file Form 1040?

The vast majority of citizens in the United States will be required to submit the Form 1040, regardless of whether they are self-employed, employed, or rely on investment income. If your filing status was single and you were under the age of 65 at the end of 2019, you must file Form 1040 if your gross income exceeded $12,200.

Is form 8879 and 1040 the same?

What's New. Form 8879 is used to authorize the electronic filing (e-file) of original and amended returns. Use this Form 8879 (Rev. January 2021) to authorize e-file of your Form 1040, 1040-SR, 1040-NR, 1040-SS, or 1040- X, for tax years beginning with 2019.

What is IRS form 8879 so?

Purpose of Form. A corporate officer and an electronic return originator (ERO) use Form 8879-S when the corporate officer wants to use a personal identification number (PIN) to electronically sign an S corporation's electronic income tax return and, if applicable, consent to electronic funds withdrawal.

Is form 8879 Federal or state?

Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO)....Federal Form 8879 Instructions.IF the ERO is . . .THEN . . .Using the Practitioner PIN method and the taxpayer enters his or her own PINComplete Form 8879, Parts I, II, and III.3 more rows

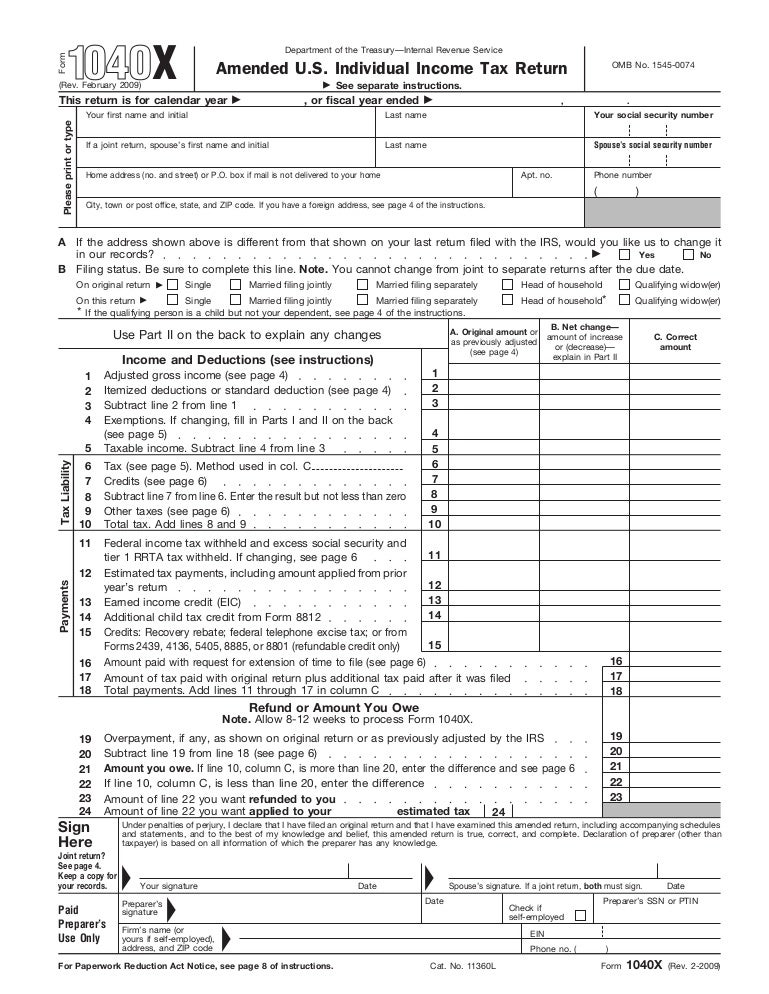

What is a tax form 1040?

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

What states require an e file authorization form?

Which states require their own signature authorization when electronically filing?StateIndividual (1040)Fiduciary (1041)California (CA)XXColorado (CO)XDistrict of Columbia (DC)Georgia (GA)X15 more rows

Does the IRS accept electronic signatures on Form 1040?

Taxpayers, who currently use Forms 8878 or 8879 to sign electronic Forms 1040 federal tax returns or filing extensions, can use an e-signature to sign and electronically submit these forms to their Electronic Return Originator (ERO).

Is 8878 required?

Taxpayers must sign Form 8878 by handwritten signature, or electronic signature if supported by computer software. 5.

How do I get 8879 from TurboTax?

Form 8879 is not included in TurboTax because it is never used when you file your tax return yourself with TurboTax. Form 8879 is used only to authorize a paid tax preparer to file your tax return for you. You don't have to authorize yourself to file your own tax return.

What does Ero mean on tax form?

Electronic Return OriginatorThe Electronic Return Originator (ERO) is the Authorized IRS e-file Provider who originates the electronic submission of a return to the IRS.

How do I find my 1040?

You'll be able to access your most recent 3 tax returns (each of which include your Form 1040—the main tax form—and any supporting forms used that year) when sign into 1040.com and go to the My Account screen. If you filed through a tax preparer or CPA, they can provide a printed or electronic copy of your tax return.

Where do I find my 1040 form?

Get the current filing year's forms, instructions, and publications for free from the Internal Revenue Service (IRS).Download them from IRS.gov.Order by phone at 1-800-TAX-FORM (1-800-829-3676)

How do I get my IRS 1040?

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

What does Ero mean on tax form?

Electronic Return OriginatorThe Electronic Return Originator (ERO) is the Authorized IRS e-file Provider who originates the electronic submission of a return to the IRS.

How do I get form 8879 from TurboTax?

Form 8879 is not included in TurboTax because it is never used when you file your tax return yourself with TurboTax. Form 8879 is used only to authorize a paid tax preparer to file your tax return for you. You don't have to authorize yourself to file your own tax return.

What is a signature authorization form?

The Signature Authorization Form. pdf and Online SA are used to verify signature approval authority that signatures on financial and administrative documents. It is also used as the authorization to grant Fund and Organization access in the Banner financial system which controls institutional access to data.

What is electronic confirmation of e filing?

This electronic filing program is called e-file. You can e-file a return through a qualified third-party provider or directly from your computer. Once you have filed using e-file, you receive a confirmation from the IRS when it has accepted or rejected your filing.

What is a 8879 form?

The Form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax return information of the Form 8879 matches the information on the return. That declaration and signature authorization on Form 8879 gives the ERO permission to electronically submit ...

How long does it take to get a 8879 from the IRS?

The IRS requires the ERO to transmit the return for e - filing within three days of receiving the signed Form 8879. A client may be out of town and unable to receive mail or may not have access to email, or fax or scanning capabilities.

How long do you have to keep 8879?

EROs are required to keep the signed Forms 8879 on file for three years after the date the return was received by the IRS or the due date of the return, whichever is later. If these recordkeeping rules are not complied with, the ERO is subject to IRS sanctions, as mentioned above.

What is the problem number 2 on Form 8879?

Problem No. 2: Failure to obtain signed Form 8879 before submitting the return

Who can sign 8879?

The taxpayer declaration on the Form 8879 series of forms must be signed by a person authorized to sign tax returns for the taxpayer. For a corporation, that would be an officer of the company. For a partnership, it would be a general partner or managing member. For individual returns, the authorization must be given by the taxpayer or by both the taxpayer and spouse if filing a joint return. CPAs may be questioned as to who can sign an authorization, so they should be aware of some special cases in which a taxpayer can sign Form 8879 for someone else.

Can a CPA give verbal instructions?

Often a client will give verbal instructions to the CPA to transmit the returns . While it may be tempting for the practitioner to take the verbal authorization from the client, the practitioner should be aware that this violates the ERO regulations.

Can an ERO be a tax preparer?

Even if the ERO is not considered the tax preparer, the practitioner is at risk for sanctions for violating ERO regulations, as explained below, and could possibly lose the ability to participate in the IRS e - file program. Such sanctions would severely impact the CPA's ability to practice.

What is a 8879 form?

Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO). Complete Form 8879 when the Practitioner PIN method is used or when the taxpayer authorizes the ERO to enter or generate the taxpayer’s personal identification number (PIN) on his or her e-filed individual income tax return.

How long to keep 8879?

Don’t send Form 8879 to the IRS unless requested to do so. Retain the completed Form 8879 for 3 years from the return due date or IRS received date , whichever is later. Form 8879 may be retained electronically in accordance with the recordkeeping guidelines in Rev. Proc. 97-22, which is on page 9 of Internal Revenue Bulletin 1997-13 at

What is a 8879?

Form 8879 is an electronic signature document that is used to authorize e-filing. It is generated by the software using both the taxpayer’s self-selected PIN and the Electronic Return Originator’s (ERO’s) Practitioner PIN. Form 8879 does not need to be mailed to the IRS, but instead is retained by the ERO. Form 8879 instructions direct the ERO to do the following:

How long to keep 8879?

Form 8879 instructions direct the ERO to do the following: "Do not send Form 8879 to the IRS unless requested to do so. Retain the completed Form 8879 for 3 years from the return due date or the date the IRS received the return, whichever is later.

How to change bank account number on 8879?

To change the format of the bank account numbers on Form 8879, complete the following steps: Select the Setup menu from the Home window of the software. Select Options from the drop list. Select the Form & Schedule Options tab. From the Form 8879 bank account options drop list at the bottom left select the option you need.

What line is line 3 on a corrected 1040?

Line 3 from the corrected Form 1040 or 1040-SR, line 25d.

Does Form 8879 flow from Form 1040?

If filing an amended Form 1040 on Form 1040-X, the amounts on Form 8879 flow from the corrected Form 1040 or Form 1040-SR, not from Form 1040-X.